Quick Overview

Missing a premium payment might seem like a small mistake, but it can instantly disrupt your policy coverage, and in some cases, cause a lapse. With several policyholders in India now preferring digital payment methods, understanding how to make your Axis Max Life Term Insurance payment correctly has never been more critical.

At Ditto, we’ve helped thousands of customers manage their term insurance policies with the right guidance on coverage and premium payments.

By the end of this guide, you’ll know:

- How to make your Axis Max Life Term Insurance payment online or offline

- Track the payment status

- Important tips to ensure your payment is safe and secure

Benefits of Using Axis Max Life Term Insurance Payment

Multiple Payment Options

You can choose from a variety of payment options available as per your suitability (e.g., NEFT, NACH/ECS, direct debit, or UPI).

Branch Drop Facility

You can also drop the cheque at the nearest branch of Axis Max Life or at the bank branch specified for paying your premiums.

Facility of Cheque Pick Up

If you are not able to make a payment online or drop a cheque, then the insurer also provides you with a pick-up service at your convenience.

Secure

Axis Max Life provides you with a secure gateway to pay premiums online, with measures to ensure that every payment you make is safe and secure.

Reminders and Auto-Pay Facility

You can easily set up Axis Max Life Term Insurance premium payment reminders or choose auto-debit instructions without the risk of policy lapse.

Information Required to Make Axis Max Life Term Insurance Payment

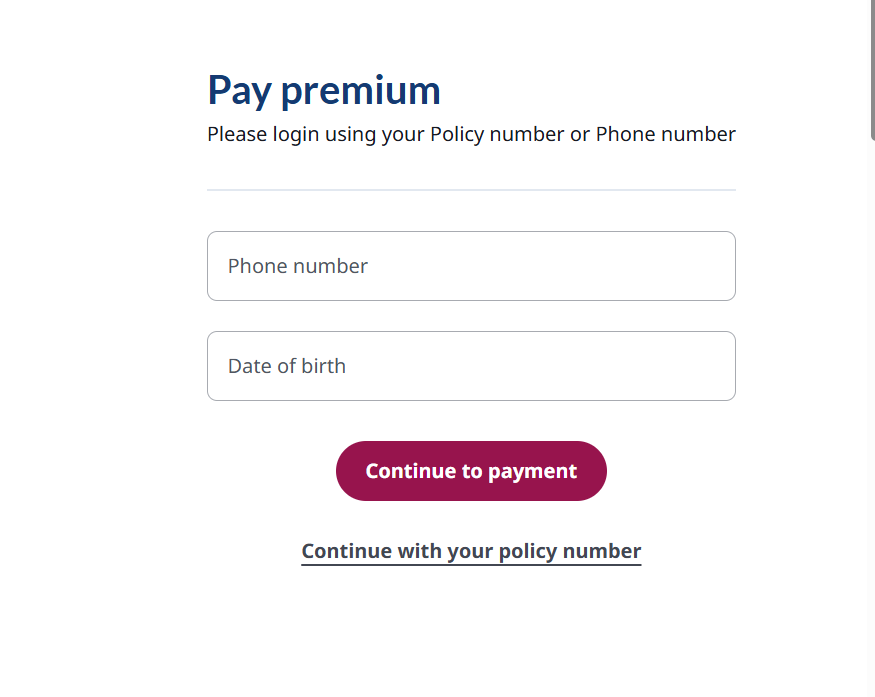

You need to provide your registered mobile number, policy number, or date of birth to pay your premiums on the official website of Axis Max Life.

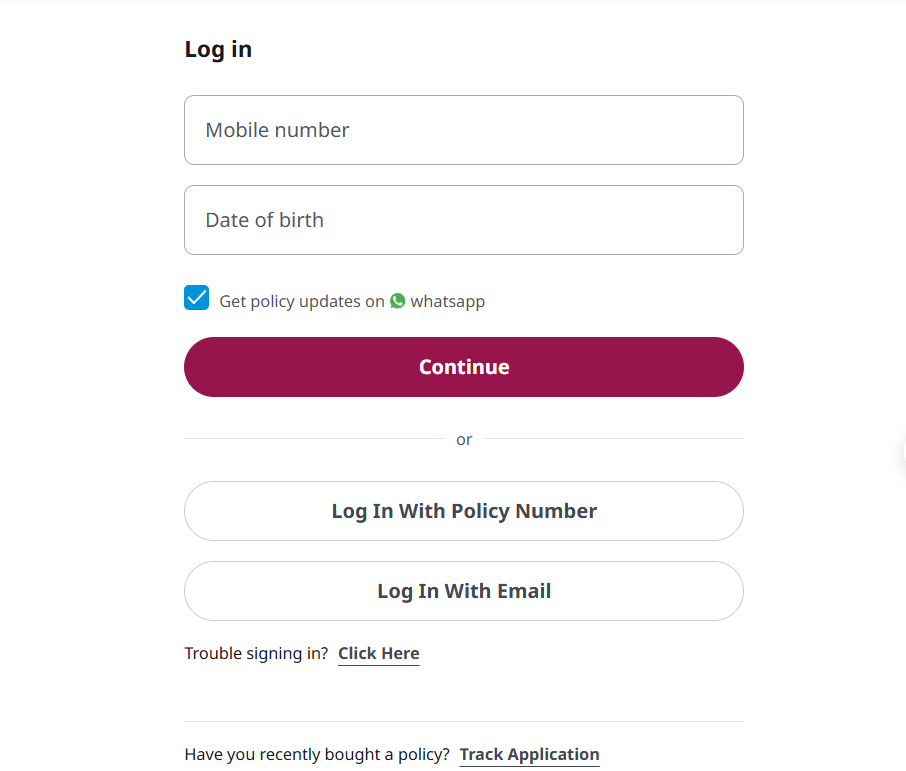

If you are a new user, you must register and log in to your account before proceeding with the payment options. The information that you must provide during this time includes:

- Your policy number

- Registered 10-digit mobile number

- Registered email address

- Your date of birth

Steps to Make a Axis Max Life Term Insurance Payment

From April 1, 2024, the IRDAI has mandated that new insurance policies, irrespective of their type, must be issued in electronic format. Every policyholder will get access to an e-Insurance Account (eIA) to manage these policies digitally. This means you can make all your payments online without the hassle of visiting a branch.

Here are the steps to make an Axis Max Life Term Insurance payment online:

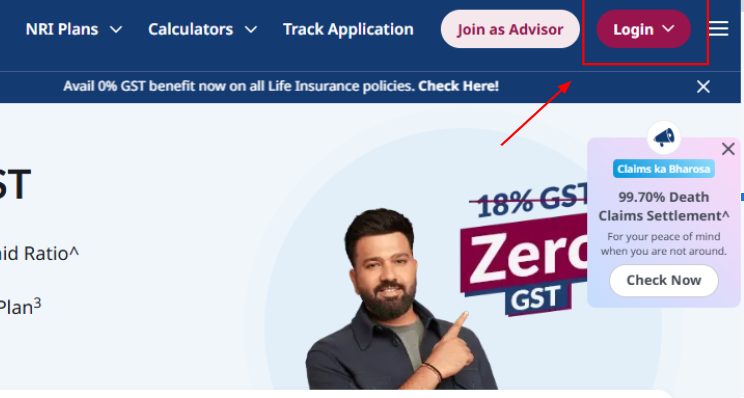

Step 1: Visit the official website of Axis Max Life Insurance.

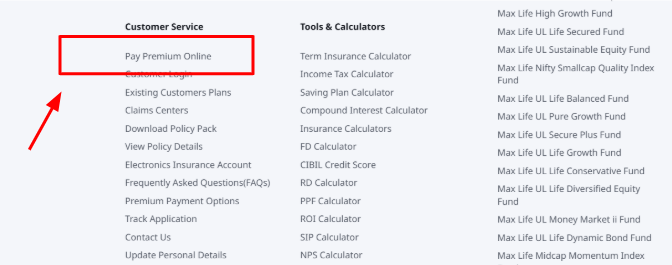

Step 2: Scroll down to the bottom and click on ‘Pay Premiums Online.’

Step 3: Enter your mobile number and date of birth, or click on ‘Continue With Your Policy Number.’

Step 4: After confirming all the details, choose any of the Axis Max Term Insurance payment options and proceed to pay the amount.

Quick Note: You can also pay your premiums offline by visiting your nearest branch or asking the insurer’s agents to collect the cheque from your home or office. Alternatively, you can use the Axis Max Life Insurance app to download all policy documents.

Steps to Check the Status of Axis Max Term Insurance Payment Online

You can check the status of your payment online by following these simple steps:

Step 1: Sign in to your customer account by visiting https://www.axismaxlife.com/cs/login.

Step 2: Enter your registered mobile number, email address, date of birth, or policy number and click on ‘Continue’ to view the status of your transactions.

Note: You can also view the status of your application on the same page if you have bought a policy recently.

Ditto’s Take on Axis Max Term Insurance Payment Options

The Axis Max term insurance payment process is relatively easy for any policyholder. However, you must understand every feature of the policy before purchasing it. That’s the first step you should take, even before making your premium payment.

Then comes the question of your coverage, which is important for determining whether the insurance policy fits your needs best. You can use our term insurance calculator to estimate the coverage and tenure based on your age, policy duration, monthly expenses, and outstanding loans.

Since Axis Max Life is one of Ditto’s trusted partner insurers, we can easily help you with the process. If you have bought your Axis Max term plan through us and need any additional support, contact your advisor or get in touch with our team.

Why Choose Ditto for Your Term Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Aaron love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 12,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call or chat with us now!

Final Thoughts on Axis Max Life Term Insurance Payment

Follow these powerful tips to ensure your axis max term insurance payment is safe and secure:

- Always pay premiums through the official Axis Max Life Insurance website or its authorized mobile app.

- Keep your online account credentials confidential by using strong passwords and avoid sharing OTPs or passwords with anyone.

- Use reputed payment options like net banking, credit/debit cards from major banks, UPI apps (Google Pay, PhonePe), or authorized wallets.

- Frequently check your premium payment and policy status online through the official customer portal.

Frequently Asked Questions

What happens if I miss the Axis Max Term Insurance Payment?

If you miss your term insurance payments, it may lead to policy lapse and directly impact your coverage and benefits. The best thing to do is to set up reminders or auto-debit to avoid missing payments.

Can I change my payment frequency later?

Yes, the insurer allows policyholders to modify their Axis Max Term Insurance payment frequency at renewal or according to policy terms. You can choose to pay your premiums monthly, quarterly, half-yearly, or annually based on your financial budget.

How can I contact customer service for payment assistance?

You can also call the customer service of Axis Max Life Insurance at 18601205577 or send an SMS to receive further updates. You can also reach out to them through service.helpdesk@axismaxlife.com or their online helpline number at 0124 648 8900 (9:00 am to 9:00 pm).

What if I forgot my login ID?

There is no specific password for the Axis Max term insurance login page. You can access your portal directly via the registered mobile number, email, or policy number, along with OTP verification.

Can I revive my Axis Max Term Insurance policy after it lapses?

Yes, you can revive your policy within the grace period or as per the insurer’s revival terms by paying the pending premiums along with any applicable interest. However, reinstatement is subject to the insurer’s approval and may require a health declaration or medical check-up.

Last updated on: