Compare Health Insurance Policies

Compare Insurance Policies from top-rated insurance companies

Select Insurer

Let us know your insurer to compare plans.

Aditya Birla

Bajaj Allianz

Care

Digit

HDFC Ergo

ICICI Lombard

Iffco Tokio

Manipal Cigna

Niva Bupa

National Insurance

New India Assurance

Oriental Insurance

Royal Sundaram

SBI

Star Health

TATA AIG

United India

Universal Sompo

Zuno (erstwhile Edelweiss)

How to compare health insurance policies?

Quick Take: You can compare health insurance policies along two verticals. First, you compare the insurer – their operational performance, claim settlement figures, business scale and Net Promoter Score. Next, you compare the policy itself. You look at the policy features, the price point at which they’re selling, and the specific use cases they try to address. You take into account every metric and then make a qualified choice on what product you want to buy.

However, if you do not intend to do this yourself, we’ve churned out comparisons for most health insurance policies out there. Just plug in what policies you want to compare and we will have a full-blown comparison chart and an extended explanation alongside it. Including a recommendation on what policy best suits you.

Friendly reminder: It’s easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalised insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts.

Introduction

Most people are used to a simplistic comparison model. Take for instance a rating method involving stars. Every product is rated along a 5-star scale and you can tell what’s better by seeing who gets a higher star rating. However, this system doesn’t work well when you are comparing two health insurance policies. You could be comparing a policy specifically meant for a heart patient with a policy marketed for the general public. The star rating will have you convinced that the heart policy is a poor alternative since these products usually come with many restrictions. The reality however is that the “general policy” may not be made available to you since your present a specific heart condition. In which case your only alternative is the heart policy. And a star rating may mislead you into buying the “general policy” and you’ll likely waste a lot of time in the process.

So instead of simply assigning a star rating based on your subjective assessment. It’s better to evaluate every policy along two verticals.

Company Specific Comparison

This is where you evaluate the insurer. You look at the company’s track record, its claim settlement numbers, operational efficiencies, network hospitals and general customer satisfaction. If at any point you find that an insurer is deficient in this department, you’d be better off buying a sub-par policy from a different insurer as opposed to buying a top-tier policy from this insurance company.

Policy Specific Features

You look at different policy features i.e. compare restrictions on room rent, sub-limits, co-payment clause, no-claim bonus extended, restoration policy and other benefits including maternity, dental and international treatments and wrap it up with a use-case comparison. Once you go through each line item, you can then make an assessment if a policy is best suited for you.

So let’s look at how you compare two different insurance companies first.

Talk to IRDAI-certified experts

If you want help with selecting the best health policy tailored to your needs, book a FREE call with our experts today by clicking here.

Comparing Insurers - How to decide which insurance company is better?

Track Record

Network Hospitals

Claim Settlement Ratio

The figure is calculated using the formula: Claims settled / (Claims booked + Claims outstanding at the beginning - Claims outstanding at the end)

| Company | CLAIM SETTLEMENT RATIO (avg. of last 3 years) |

|---|---|

| New India Assurance | 99% |

| HDFC Ergo | 98% |

| SBI | 97% |

| Digit | 97% |

| Oriental Insurance | 96% |

| TATA AIG | 96% |

| Acko | 96% |

| Iffco Tokio | 95% |

| Aditya Birla | 95% |

| Universal Sompo | 95% |

| Bajaj Allianz | 95% |

| United India | 94% |

| Royal Sundaram | 94% |

| National Insurance | 93% |

| Zuno (erstwhile Edelweiss) | 92% |

| Niva Bupa (erstwhile Max Bupa) | 91% |

| Manipal Cigna | 90% |

| Care | 90% |

| Reliance | 89% |

| ICICI Lombard | 85% |

| Bharti Axa | 85% |

| Star Health | 83% |

| Navi | 64% |

Operational Efficiencies

Talk to IRDAI-certified experts

If you want help with selecting the best health policy tailored to your needs, book a FREE call with our experts today by clicking here.

Comparing policy features: How to tell which policy has better features

Price

The first metric is always the same – Price. You want to be able to buy a policy that’s relatively affordable with decent features. What’s a good price point for a policy you ask? Well, there’s no easy answer. It depends on your age, your health conditions, your location and the features you pick. Ideally, you want to buy a policy that offers value for money i.e you want something that isn’t overly expensive but isn’t very basic in structure. You can use our comparison tool to tell which policies offer.

Co-payment

With a co-payment clause, the insurer will mandate that you pay a part of the bill. So if the bill adds up to Rs. 2,00,000 and the co-payment is set at 20% then you could be asked to pay Rs. 40,000 from the bill. Ideally, you want to buy a policy that doesn’t impose a co-payment clause.

Room Rent Restrictions

If the policy does impose room rent restrictions then the insurer may only let you stay in a room of a certain specification or impose a cap on the total room rent. If you were to breach either criterion then the insurance company may ask you to pay a portion of all the expenses you incurred while staying in the room. Once again, the best approach is to pick a policy that doesn’t impose any restrictions on this front. However, if you have to settle for something less, you probably could go with a policy that extends a single private room with AC.

Ayush Benefit

Most policies only cover treatments administered in a registered medical facility. However, on some occasions, you may want to pursue alternative treatments including homoeopathy, Ayurveda, Unani and Siddha. These treatments are collectively categorized as Ayush treatments. If you had to pick between two products, you’d probably be best advised to pick a policy that extends Ayush Benefits as well.

Waiting Periods

If you’re suffering from a lifestyle condition or if you’ve had surgery in the past, or if you’re dealing with an acute or chronic illness at the time of buying the policy, then the insurer may classify this as a pre-existing disease. And they may tell you that they will only cover these illnesses after some time. This cooling period is referred to as the Pre-existing-disease waiting period.

No-claim Bonus

Some policies will tell you that they will incentivize you for not making a claim in any given year. And they offer such incentives by offering extra cover on top of the existing sum insured. This extra cover is categorized as a no-claim bonus. Ideally, a 50% no-claim bonus every year is the gold standard. A 20% no-claim bonus is doable. But anything less than that is just insignificant.

Maternity Benefit

If you’re hospitalized during childbirth, then you may have to incur significant costs during delivery of your newborn, child care and other related matters during the course of the hospitalization. These costs are collectively termed maternity costs. And while it’s always better to prioritize a policy that extends maternity benefits, know that this usually pushes the price of the product much higher. So you may have to take that into consideration too.

Outpatient consultation

Doctor visits and regular consultations are categorized as Outpatient consultations (or OPD treatments). And just like maternity benefits, it’s a nice-to-have feature, but know that it comes at a significant cost.

Use Case Recommendations

Finally, see if the policy is marketed for a very specific use case i.e. a diabetic-specific policy will usually waive off waiting periods for all diabetic-related matters. Similarly, a heart care policy will likely extend policies to “heart-patients” when others may reject their application altogether. If you fall in this bucket, maybe you should prioritize this feature above all else.

Why Talk to Ditto for Your Health Insurance?

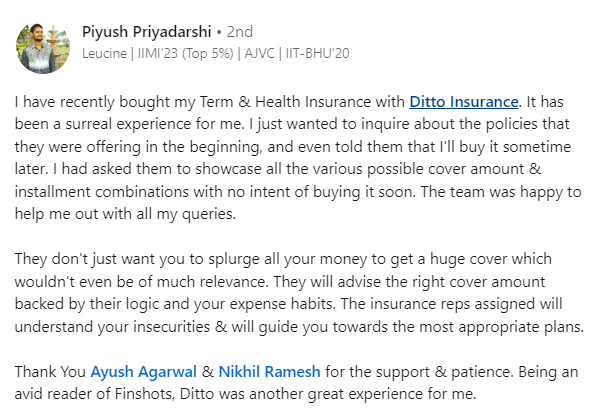

At Ditto, we’ve assisted over 3,00,000 customers with choosing the right insurance policy. Why customers like Piyush below love us:

No-Spam & No Salesmen

Rated 4.9/5 on Google Reviews by 10,000+ happy customers

Backed by Zerodha

100% Free Consultation

You can with our team. Slots are running out, so make sure you book a call now!

Conclusion

Ultimately, comparing policies isn’t as easy as just looking at the features. You have to look at the insurers, their antecedents, the price at which they market their policy and the use case. Only after you take stock of these factors, can you actually compare the policy.

Once again, if you do not intend to do this yourself, we’ve churned out comparisons for most health insurance policies out there. You can just use the comparison tool to know what best suits your use case.

Select the best plan with our help!

Get in touch to find out what plan works best for you. Zero fuss. Zero spam. Zero charges. Book a call now. Limited slots available!