Best Term Plans in India

There are 26 life insurance companies in India that market at-least one term insurance plan. So picking out the best plan can be challenging. This is why we put together this list to help you shortlist the best term insurance policies for 2024.

Best Term Insurance Plans in India 2024

| Top Term Plans | Insurer Rating | Product Feature rating | Affordability | Final Rating |

|---|---|---|---|---|

| Max Life Smart Secure Plus | 4.1 | 4.5 | 4.5 | 4.3 |

| ICICI Prudential iProtect Smart | 4 | 4.3 | 4.3 | 4.15 |

| Bajaj Allianz Smart Protect Goal | 3.9 | 4.1 | 4.6 | 4.1 |

| HDFC Life Click2Protect Super | 3.8 | 4.4 | 3.9 | 4 |

| Tata AIA Maha Raksha Supreme | 3.9 | 3.8 | 4.4 | 3.97 |

A Quick Word: Did you know that going through insurance policy wordings means simultaneously scanning a financial, medical, and legal document? And well, that sounds taxing!

Here’s what we suggest—leave that part to us! with us and get solid insurance advice from IRDAI-certified advisors! No spam, no cold calls - just a conversation for your customised policy!

Limited slots! Book today!

Our Methodology

We compiled this list using two broad criteria

The first one is our assessment of the insurance company marketing a given policy. Ultimately, term insurance is a commodity. If the policyholder passes away, the insurance company is obligated to pay the sum promised to the nominees. And it’s rarely a matter of debate. So there isn’t a lot separating term insurance policies in general. The difference ultimately boils down to the quality of the insurance company selling a certain product. As a consequence, it’s important to look at the insurer’s claim settlement and complaint numbers while picking the best term insurance plan.

We then look at the price and Riders or Add-ons. A good term insurance policy should offer meaningful add-ons at a competitive price. If a policy is covering your life while also extending added protection for critical illnesses, terminal illnesses, disabilities etc., then that policy is preferable to a regular policy with no extra riders.

Best Term Insurance Plans

Max Life Smart Secure Plus

Max Life’s Smart Secure Plus takes the top rank this year. It’s an affordable term insurance plan that extends pretty much every add-on you can currently think of – zero cost option, return of premium plan, disability benefit, accidental death benefit and a provision to increase your term cover sometime in the future. And considering the number of term policies they’ve been selling in the recent past, it shouldn’t come as a surprise that this is our top recommendation.

Insurer Rating

Product Feature Rating

Affordability

Final Rating

Why Max Life Smart Secure tops our list

As we already noted, one of the primary reasons why we’ve ranked the product so high on our list is because it offers compelling features at a very attractive price point. Some of the features include

- Good Critical Illness Benefit: Smart Secure Plus extends really robust critical illness protection and pays up to ₹30 Lakhs so long as you are diagnosed with 64 illnesses listed in the policy brochure. But that’s not all. The payouts will be made immediately after the critical illness is diagnosed and you can choose whether you want the payout to be made from the total cover or if you want it to be paid out on top of your Sum Assured.

- Voluntary Top-Up Option: Most insurers won’t let you increase your total cover after you buy the policy. However, Max Life offers the provision for you to top up the policy by a certain margin at some later date.

- Increase your cover with inflation: Smart Secure Plus also offers an add-on that lets your cover grow alongside inflation.

While the product features are great, Max Life truly shines when you look at the insurer-specific numbers. Here’s comparing some key metrics of Max Life with other top insurers on this list:

| Claim Settlement Ratio | Amount Settlement Ratio | Complaints for every 10,000 claims | Business Score | |

|---|---|---|---|---|

| Max Life | 99.4% | 95.5% | 7 | 7.5 |

| ICICI Prudential | 97.09% | 92.1% | 14.3 | 10 |

| Bajaj Allianz | 98.85% | 93% | 5 | 7.5 |

| HDFC Life | 98.69% | 87.3% | 2.7 | 10 |

Note: All the numbers noted above have been averaged over three years. And the Business Score is calculated after taking into account a company’s scale, operational efficiencies, customer satisfaction, and brand recognition.

Drawbacks to Consider: Even though Max Life has posted really good claim settlement numbers, it is in all likelihood not the most recognized brand on our top 5 list. So if you prefer a more popular brand, it makes sense to look at other alternatives.

ICICI Prudential iProtect Smart

ICICI’s iProtect Smart doesn’t excel in any one department. Instead, it does well enough in every department to warrant the 2nd spot. On the insurer front, ICICI Prudential has pretty decent claim settlement numbers. They offer most add-ons you’d expect from a good term insurance plan. And they’re not overly expensive. All in all, a solid pick.

Insurer Rating

Product Feature Rating

Affordability

Final Rating

Why iProtect Smart takes the 2nd spot this year

Unlike Max Life, ICICI operates at a much larger scale and it’s a brand that most people recognize. Beyond this, the product features some very interesting benefits.

- Inbuilt Life Stage Benefit: While most insurers may not extend the option of increasing your cover after you buy a policy, iProtect Smart will let you increase your Sum Assured by a certain margin during significant life events. And you don’t have to pay extra to add this benefit to your plan.

- Very Good Critical Illness Benefit: iProtect Smart extends best-in-class critical illness protection by paying up to ₹1 Crore if you are ever diagnosed with any of the 34 illnesses listed in the policy brochure. And the payouts will be made as soon as your diagnosis is confirmed.

Talk to IRDAI-certified experts

If you’re looking to choose the right term life insurance with the best coverage, then book a FREE call with our experts here. Limited slots available!

Bajaj Allianz Smart Protect Goal

Bajaj Allianz is a new entrant in this list and we are ranking them at no. 3 because of how aggressively they’ve grown in the recent past. Their product is pretty decent. Their premiums are extremely competitive. And in many ways, Bajaj Allianz could have been much higher up this list if their claim settlement numbers were slightly better.

Insurer Rating

Product Feature Rating

Affordability

Final Rating

Why Smart Protect Goal takes the 3rd spot

One of the biggest reasons why this plan is high up our list is - the premiums. When you compare premiums for Smart Protect Goal against other similar products, you will see why they’re gaining market share.

Note: HDFC 1st Year 5% Discount

- Inbuilt Life Stage Benefit: While most insurers may not extend the option of increasing your cover after you buy a policy, Smart Protect Goal will let you increase your Sum Assured by a certain margin during significant life events. And you don’t have to pay extra to add this benefit to your plan.

- Very Good Critical Illness Benefit: Smart Protect Goal extends best-in-class critical illness protection by paying up to ₹1 Crore if you are ever diagnosed with any of the 34 illnesses listed in the policy brochure. And the payouts will be made as soon as your diagnosis is confirmed.

Also, one other thing about Smart Protect Goal is that the premiums for non-smokers are considerably lower than those of similar plans on the market. This is how Smart Protect Goal compares against other top insurers:

| Age | Gender | Cover Amount | Smoker status | Premiums for Bajaj Smart Protect Goal | Premiums for Max Life Smart Secure Plus | Premiums for ICICI Pru iProtect Smart |

|---|---|---|---|---|---|---|

| 25 years | Male | ₹1 Crore | Non smoker | ₹10,567 | ₹11,621 | ₹14,058 |

| 30 years | Male | ₹1 Crore | Non smoker | ₹12,634 | ₹14,650 | ₹16,287 |

| 35 years | Male | ₹1 Crore | Non smoker | ₹16,588 | ₹19,433 | ₹20,134 |

| 25 years | Female | ₹1 Crore | Non smoker | ₹9,459 | ₹10,046 | ₹12,730 |

| 30 years | Female | ₹1 Crore | Non smoker | ₹10,980 | ₹12,288 | ₹14,366 |

| 35 years | Female | ₹1 Crore | Non smoker | ₹13,495 | ₹15,952 | ₹17,489 |

Drawbacks to Consider: Smart Protect Goal does not offer the Zero Cost Option while most plans on this list do extend this benefit. Here’s what this means - Some people may want to buy a term plan and hold it for a few years and then forego their policy when they no longer need the protection. In such cases, the Zero Cost Option can come in handy because with this option, you can forego your policy and get all your premiums back. And you don’t have to pay extra to access this benefit. Unfortunately, Smart Protect Goal doesn’t offer this option just yet.

HDFC Life Click2Protect Super

Click2Protect Super is a “Super” product. It offers a lot of customization options. It comes from HDFC Life’s stable - a brand that’s extremely popular. And the insurer is very proactive on the operational front while dealing with applications and claims. Unfortunately, the product is expensive for most profiles we’ve evaluated so far and there is nothing here that justifies the higher price. So that explains why we’ve put HDFC Life Click2Protect Smart at No. 4 and not No. 1.

Insurer Rating

Product Feature Rating

Affordability

Final Rating

Why HDFC Life Click2Protect Super makes our top 5 list

One of the biggest reasons why HDFC Life is still one of our recommended plans is the degree of customization the policy offers. Here’s a list of all the add-ons the policy offers.

- Accidental Death Benefit: Added cover for accidental deaths.

- Zero Cost Option: You get all your premiums back if you forego your policy during a specific period.

- Critical Illness Benefit: Added payouts if you are ever diagnosed with a critical illness.

- Total Permanent Disability Benefit: A monthly income or a large lumpsum in the event you are disabled totally for life.

- Inflation Protection: Your cover will increase in line with inflation.

| Cover Amount | Gender | Smoker status | Age | Premiums for C2P Super | Premiums for Bajaj Smart Protect Goal | |

|---|---|---|---|---|---|---|

| ₹1 Crore | Male | Non smoker | 30 years | ₹15,499 | ₹12,771 | |

| ₹2 Crore | Male | Non smoker | 30 years | ₹26,839 | ₹23,346 | |

| ₹3 Crore | Male | Non smoker | 30 years | ₹37,944 | ₹33,608 | |

| ₹1 Crore | Female | Non smoker | 30 years | ₹13,174 | ₹11,106 | |

| ₹2 Crore | Female | Non smoker | 30 years | ₹22,813 | ₹20,041 | |

| ₹3 Crore | Female | Non smoker | 30 years | ₹32,252 | ₹28,665 | |

Drawbacks to Consider: It’s expensive. Compared to similar plans on the market, HDFC Life C2P Super is relatively pricey. This becomes all the more apparent when you compare the premiums to Bajaj Smart Protect Goal.

Tata AIA Maha Raksha Supreme

Tata AIA Maha Raksha Supreme is an affordable term plan that offers pretty much most things you want in a good term plan. It does the basics well, offers a few novel benefits and it has the TATA brand name alongside pretty decent claim settlement figures. The only problem with the Maha Raksha Plan is that the plan is made available to people earning more than ₹15 Lakh per annum who choose a cover higher than ₹2 Crores. So we couldn’t the rank the plan higher.

Insurer Rating

Product Feature Rating

Affordability

Final Rating

Why Tata AIA Maha Raksha Supreme makes our top 5 list

If you want a brand name like Tata and you don’t want to spend a lot of money buying a term plan, then this is the perfect option. Besides this the product features aren’t half bad. It offers accidental death benefit, life stage benefit (like iProtect Smart), good critical illness benefit and additional payouts in the event of total permanent disability.

Drawbacks to Consider: As we already noted, the plan is only made available to people earning more than ₹15 Lakh per annum who choose a cover higher than ₹2 Crores. And if you don’t fit the profile, then you have to go with the more expensive Sampoorna Raksha Supreme which may not be all too desirable.

Why Should You Buy 1 Crore Term Insurance Through Ditto?

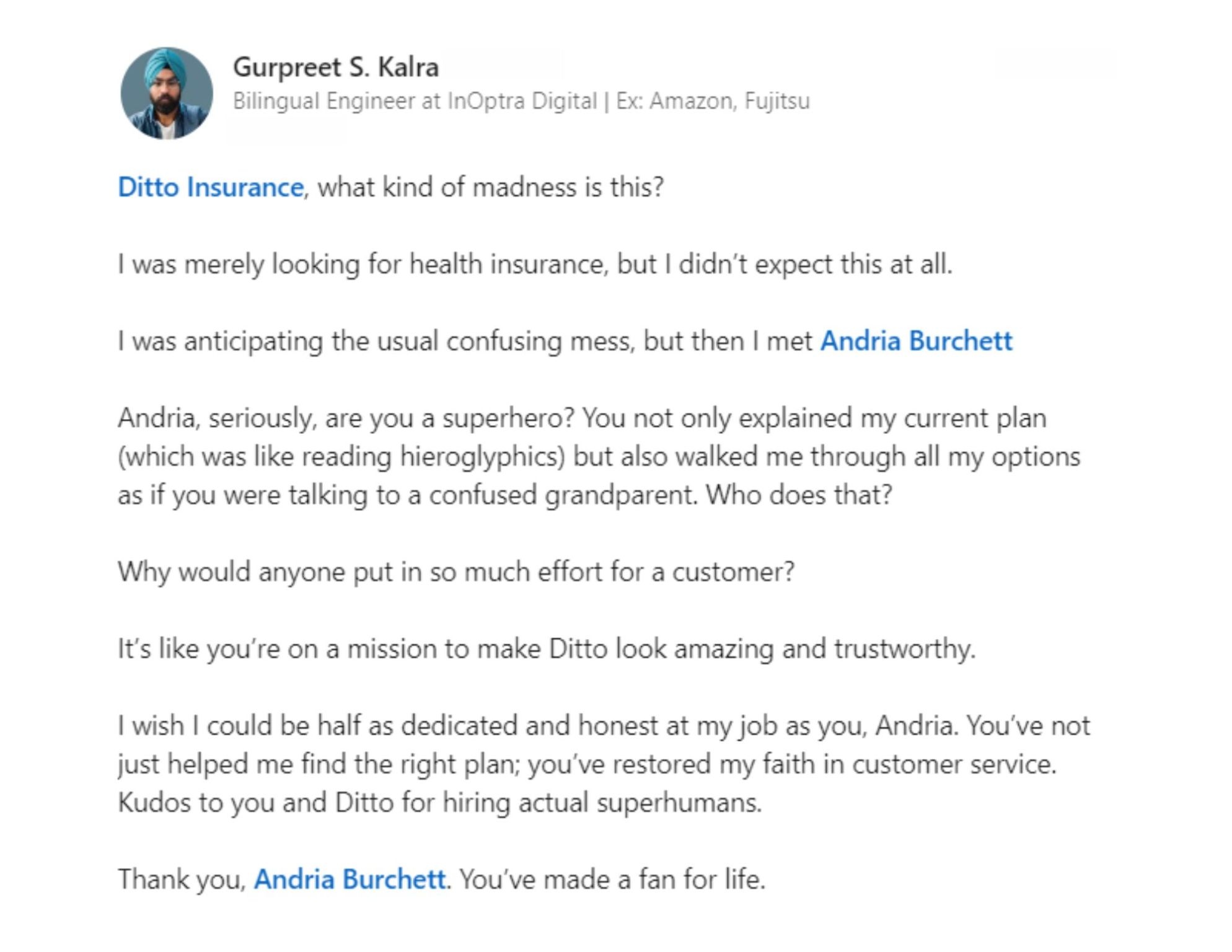

At Ditto, we’ve assisted over 3,00,000 customers with choosing the right insurance policy. Why customers like Gurpreet below love us:

No-Spam & No Salesmen

Rated 4.9/5 on Google Reviews by 7,000+ happy customers

Backed by Zerodha

100% Free Consultation

You can with our team. Slots are running out, so make sure you book a call now!

Outside of the top 5 we also have a few honorable mentions including:

- Aegon iterm Comfort

- Bajaj Allianz eTouch

- TATA AIA Sampoorna Raksha Supreme

- Kotak E Term Plan

- Aditya Birla Digishield Plan

Don't forget to share this Guide on WhatsApp, LinkedIn and Twitter.