What is the ICICI Term Insurance Calculator?

The ICICI term insurance calculator is a free, online tool to find the premium amount before buying a term insurance policy.

With a few basics (like your age, income, tobacco consumption status, gender, occupation, desired sum assured, preferred policy term), the calculator instantly generates the estimated premium (quote), payable either monthly, half-yearly, or annually. The quote can be customized in real-time by changing the tenure, sum assured, and adding/removing riders.

Introduction

Calculating the premium before buying term insurance can be tricky. But ICICI’s term insurance calculator makes it easy. In under a minute, the ICICI term insurance calculator analyzes your unique needs, health risks, budget, and shows what a typical ₹1–2 crore cover (and above) actually costs.

Here’s everything you need to know about the ICICI term insurance calculator and how to use it.

Heads up! We know that life insurance can be overwhelming – but it doesn’t have to be! Our IRDAI-certified advisors at Ditto assess your requirements and can help you pick the right policy. And the best part? We don’t spam or pressure you to buy. So book a free call now.

ICICI Term Insurance Calculator: Overview

ICICI term insurance calculator is a dedicated term premium calculation tool built around their flagship term plan iProtect Smart. Once you enter your basic details, it instantly estimates the premium. From there, you can tweak the cover amount, payment terms, and add-ons, and the quote updates in real time.

Benefits Of Using The ICICI Term Insurance Calculator

Faster Calculation

Get instant premium estimates based on your inputs.

Seamless Customization

Test different options for sum assured, term tenure, and riders matching your budget and goals.

Better Clarity

Check how changing riders or tenure affect the premium before you actually buy.

Unmatched Convenience

Get your term insurance quote in minutes minus any paperwork, branch visits or lengthy phone calls.

Effective Planning

Align your desired term cover matching your income and liabilities.

Personalized Quote

Get a realistic quote tailored on key factors like your smoking status, occupation, and age.

Transparent Options

See the premium change real-time as you add/remove riders, change term plan, and sum insured.

What Information Is Required To Use The ICICI Term Insurance Calculator?

Before you use the ICICI term insurance calculator, keep the following information handy.

- Date of Birth & Gender: It helps assess the mortality risk (considering the life premium amount is usually 10-15% more for males compared to females)

- Smoking/tobacco Consumption Status: It directly affects your premium bands.

- Occupation & Annual Income: It determines the eligibility and reasonable cover for an individual.

- Desired Sum Assured & Policy Term: These are core factors that affect the final term premium quote.

- Add-on Riders: Term insurance riders are optional add-ons that enhance protection but also increase the premium.

How To Use The ICICI Term Insurance Calculator?

Here’s a step-by-step walkthrough (with screenshots) to use the ICICI term insurance calculator.

Step 1: Go to the official website of ICICIPrulife and click “Term Insurance”.

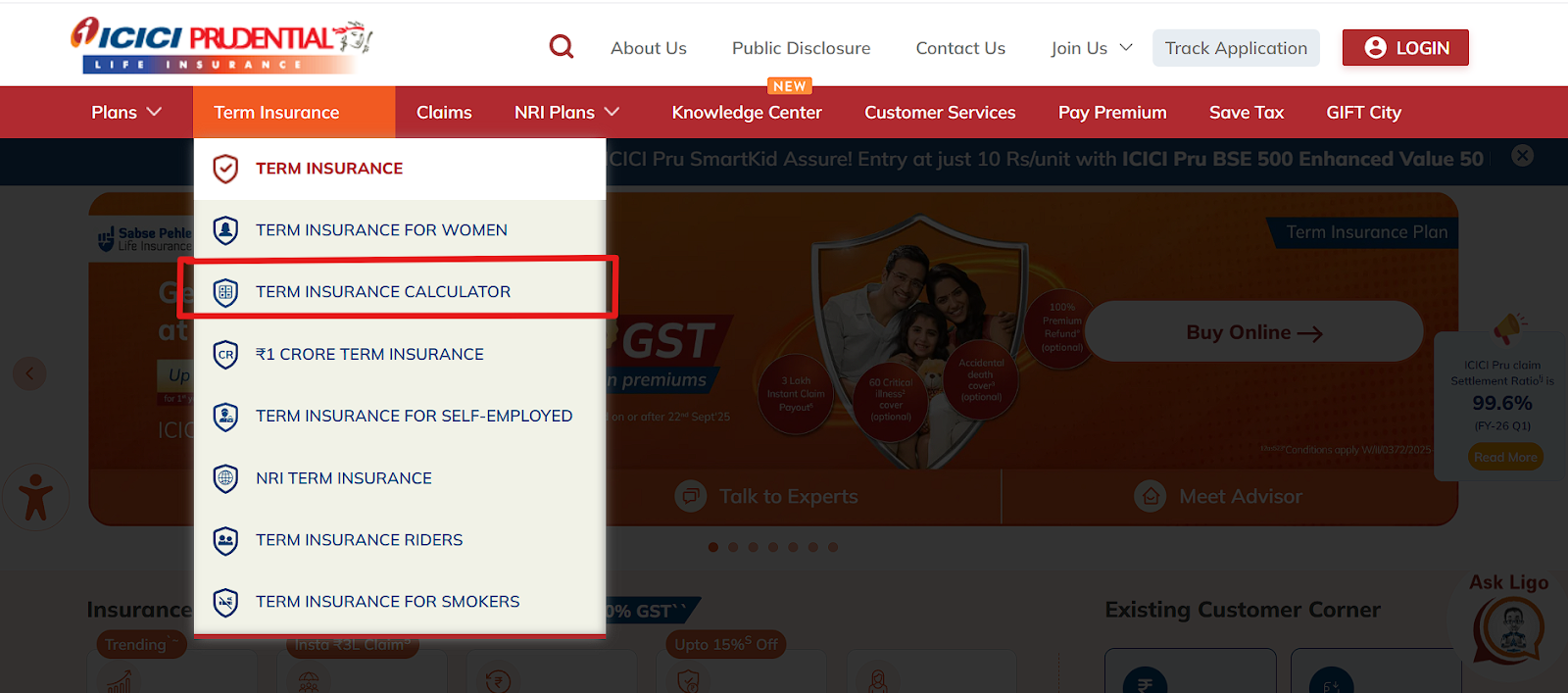

Step 2: From the drop down menu of Term Insurance, choose and click “Term Insurance Calculator”.

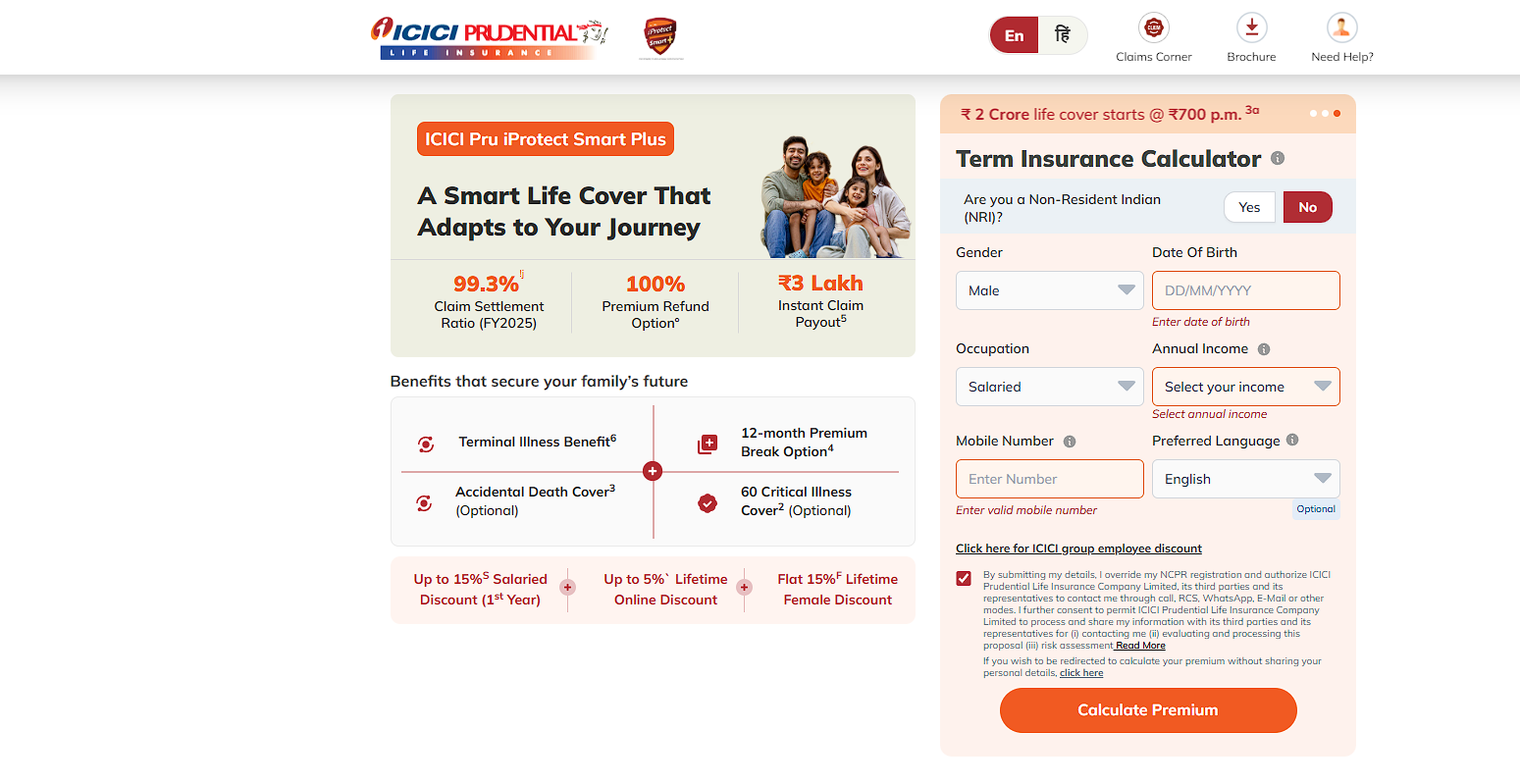

Step 3: Once the Term Insurance page loads, enter your basic details, like:

- Gender

- Date of Birth (in DD/MM/YYY format)

- Occupation

- Annual Income

- Mobile Number

- Preferred Language

Note: If you’re an NRI, change the option from default “No” to “Yes” and proceed. Once done, click the "Calculate Premium” button to proceed.

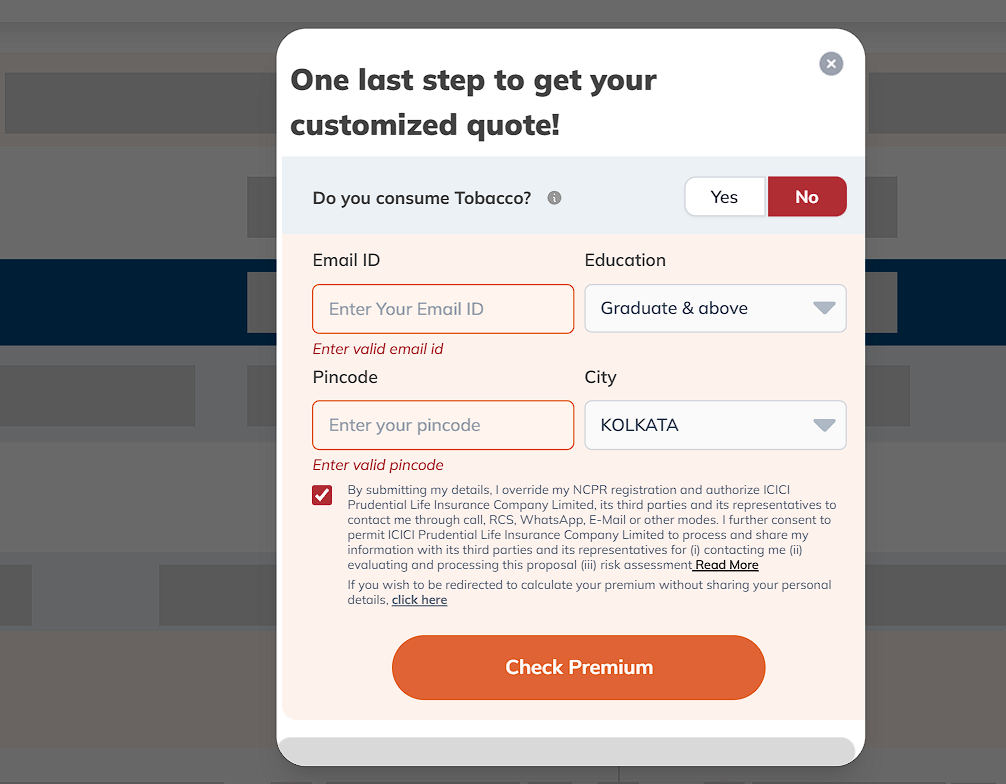

Step 4: On the next screen, you will see a pop-up asking for some additional info, like:

- Tobacco consumption status (Select Yes/No)

- Email ID

- Educational Qualification

- City and Pincode

Once done, click the “Check Premium” button to continue.

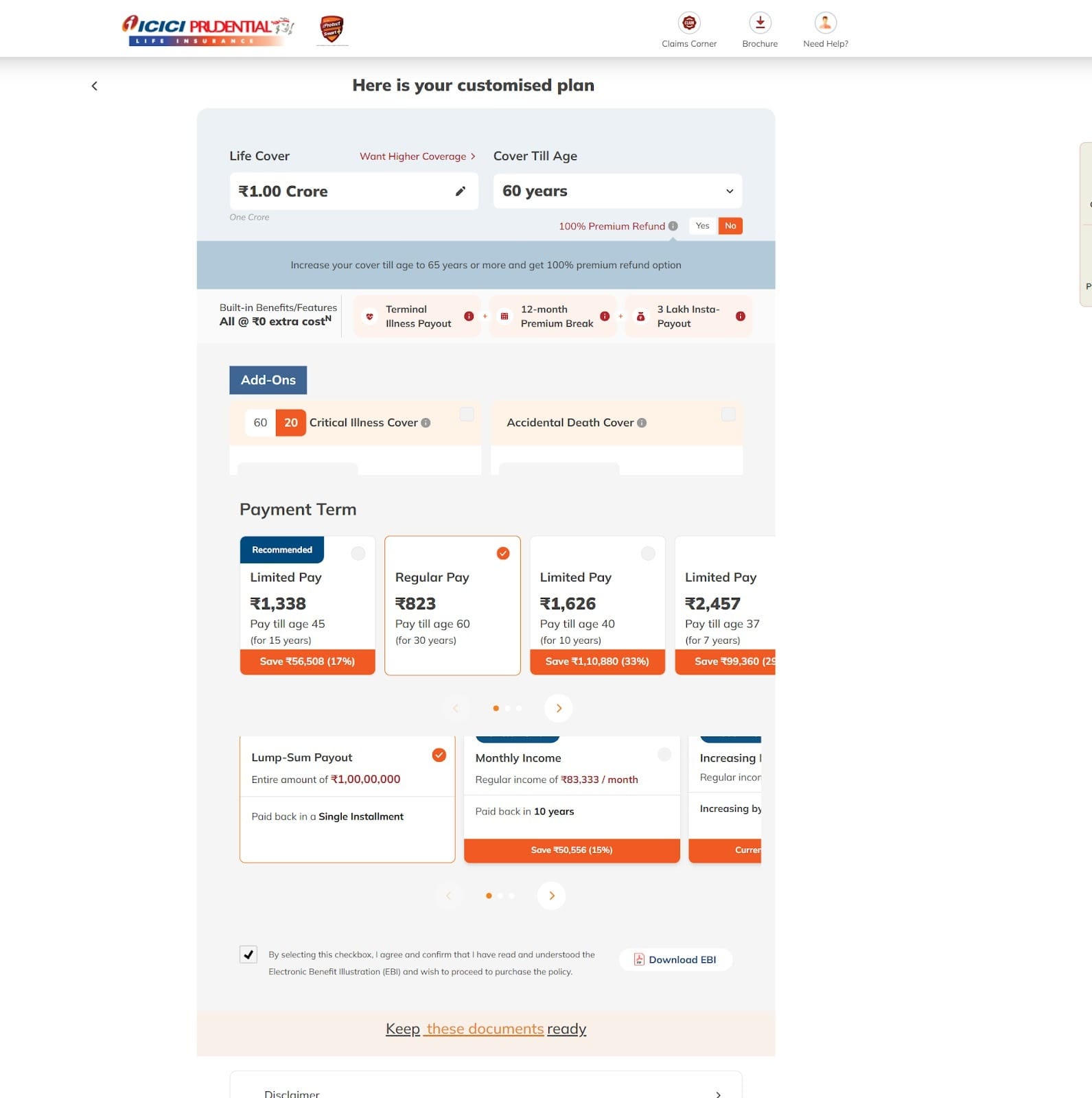

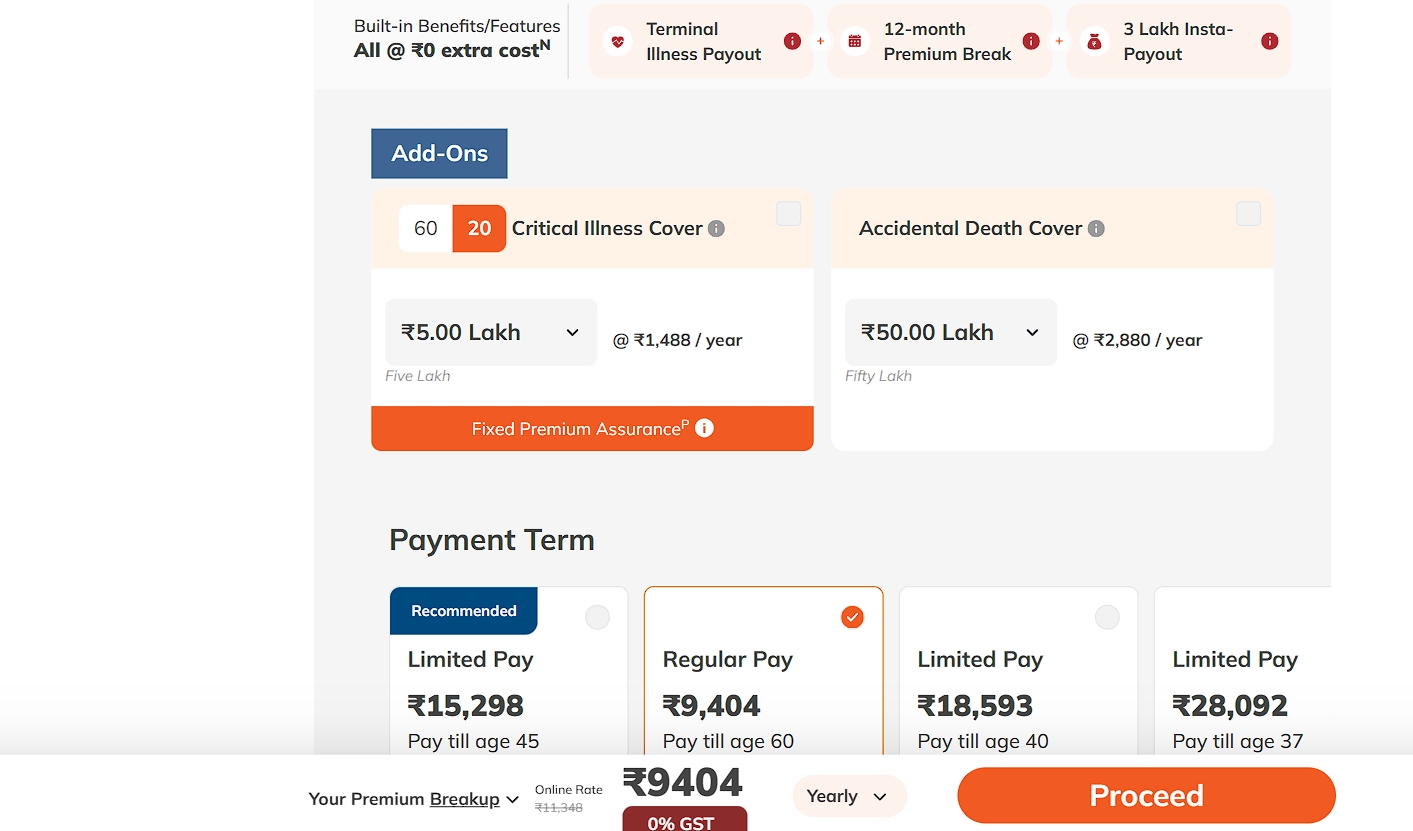

Step 5: Next, you will have your customized term insurance quote ready with option to choose/remove “Add-ons” (Riders), change payment term, and an estimated nominee payout.

Step 6: As you scroll down, the premium breakup is displayed at the bottom of the screen. You can toggle between “Yearly”, “Monthly” and "Half Yearly” payment options to reflect price changes. Once you’re done choosing your option, click the “Proceed” button to confirm and pay online to buy your term insurance policy.

Pro Tips to Use the ICICI Term Insurance Calculator

Always Be Accurate

Choose a Realistic Cover

Match the Tenure to Your Dependents' Needs

Review the Term Riders

ICICI term Insurance Calculator: Ditto’s Take

ICICI Prudential is one of Ditto’s partner insurers, and we often recommend its plans for obvious reasons—comprehensive cover, good hospital network, and a positive claim settlement ratio. ICICI’s term insurance calculator follows the same logic; it’s fast, accurate, and allows you to test your options before paying.

Why Choose Ditto For Your Term Insurance?

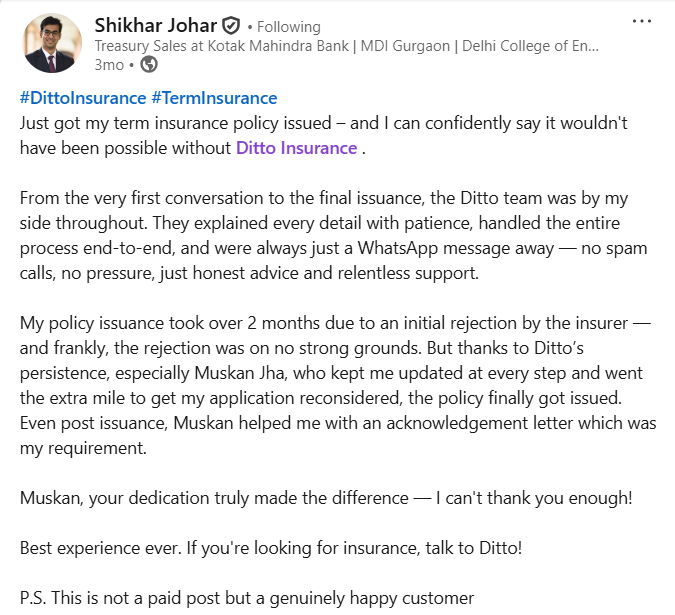

At Ditto, we’ve guided 8,00,000+ customers to buy the right insurance policy, and there’s more than one reason why customers like Shikar trust us.

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

✅Personalized recommendations

✅Real-time claim support

Final Thoughts

ICICI’s term insurance premium calculator is highly recommended for a quick, accurate premium estimate before buying a term policy. All you have to do is input your personal details, size the right cover, and add only those riders you actually need.

If you feel stuck or unsure, you can always book a free call with our IRDAI-certified advisors.

Frequently Asked Questions

Where do I find the official ICICI term insurance calculator?

You can find the official ICICI term insurance calculator on ICICI Prudential’s site.

What are the factors that change my premium?

Factors like age, tobacco consumption, cover amount, and policy tenure are some of the key factors that directly affect and change your premium.

Can NRIs use ICICI’s term insurance calculator?

Yes! ICICI’s term insurance calculator has an option to declare yourself as a NRI and get your premium estimate.

Does the calculator lock my premium?

ICICI’s term insurance calculator offers a near-accurate estimate for your term insurance premium. However, the final charges typically depend on the underwriting, which in turn is based on one’s medical conditions and disclosures.

Last updated on: