Quick Overview

Cancelling a term insurance policy sounds simple, but the actual process depends on the type of plan you bought and your reasons for wanting to exit. People usually think cancelling means they get money back or that they can pick the easiest route available.

In reality, term plans have very limited surrender value, strict timelines, and specific procedures that insurers follow. This guide makes these concepts clear and walks you through your cancellation options.

Did You Know?

How to Cancel Your Term Insurance?

You can easily cancel your term plan by adopting any of the following options:

- Cancel During the Free Look Period: If you bought the policy recently, the free look period allows you to cancel within 30 days from the date of receiving the policy document. This is the simplest and most hassle-free option.

Note: You will get a premium refund post the necessary deductions by the insurer. Typical deductions range from ₹4,000 to ₹6,000: around ₹2,000 to ₹3,000 for medicals, plus stamp duty (which depends on the chosen sum assured and is specified in your policy document). - Stop Paying Future Premiums: If your policy is past the free look period and is a plain term plan, you can walk out of it by stopping premium payments. The plan will lapse, and the coverage will end after the grace period.

At Ditto, we do not recommend stopping premium payments without prior notification to your insurer. Failing to do so creates a poor record with insurers, impacts your credit score and makes future policy approvals harder. You may also have to declare and justify the cancellation when you apply for a new policy in the future with any insurer. - Request Surrender for Special Variants: If your term plan has ROP, limited pay, or a zero-cost exit benefit, you can formally surrender it. You may receive a small surrender value, but it builds slowly and is much lower than total premiums, especially in the early years.

When to Cancel Your Term Insurance?

While a term plan is a long-term commitment, there are several valid reasons why a policyholder might choose to cancel it. Here are some of those:

- Misunderstood Policy Features: If the policy doesn’t match your expectations, such as missing riders, confusing exclusions, or a mis-sold ROP plan with high premiums, it’s reasonable to reconsider.

- Affordability Issues: If premiums strain your budget, avoid cancelling the policy immediately. Explore options like reducing the term, lowering the sum assured, or removing non-essential riders to make the policy affordable.

Alternatively, if you choose a limited-pay premium mode, you only need to pay for a fixed number of years. The premium amount costs more, but it gets covered during your earning years. You can also check if your insurer is allowing you to switch to a regular payment term (longer term but lower annual amounts).

You may also opt for term plans with a smart exit option. For example, plans like HDFC Click2Protect Supreme offer this option in any policy year after the 25th year, but cannot be used during the last five policy years. - Switching to a Better Plan: If a new plan suits you better, apply for it. Once approved and active, consider cancelling the old policy to avoid any coverage gap.

There could be other reasons, like changing life goals or reduced financial responsibilities, which may justify lowering or ending coverage. Similarly, persistent service dissatisfaction can also trigger a switch.

Steps to Cancel or Surrender Your Term Insurance Policy

- Contact the Insurer or your Advisor: Reach out to customer support or your insurance advisor. Inform them that you plan to cancel or surrender. They will tell you the specific rules for your policy.

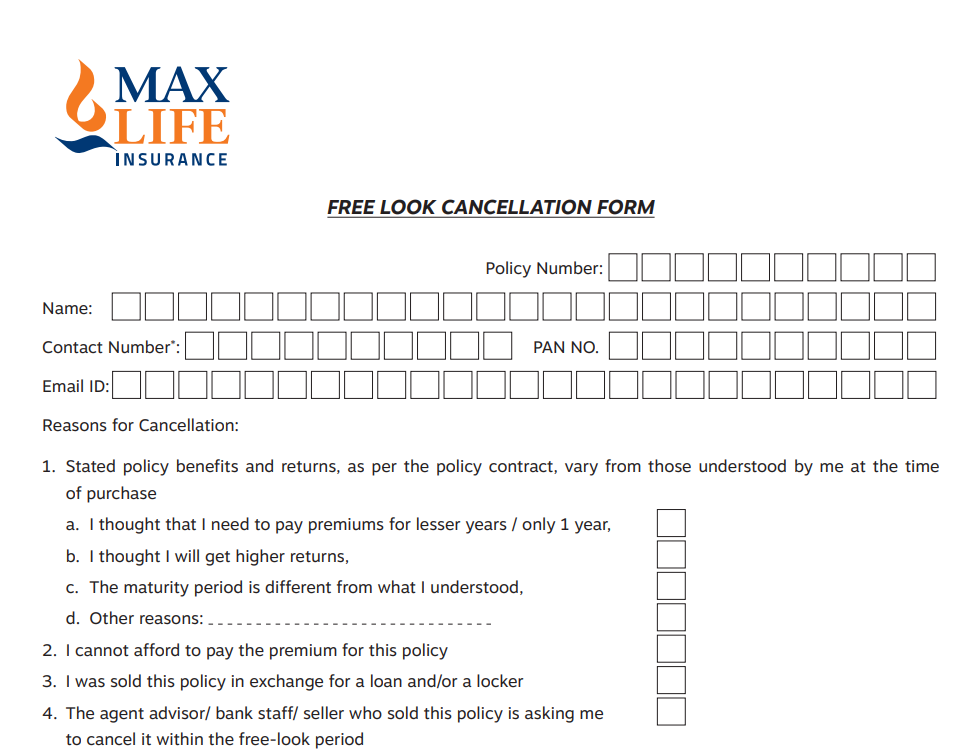

- Submit a Cancellation Request: You may need to fill out a surrender or cancellation form. Some insurers accept requests through email or their customer portal.

Here’s what a cancellation form (within free-look period) looks like from Axis Max Life:

- Provide Required Documents: You usually need the policy document, a valid ID, a cancelled check (for refund, if any), and a simple written request. The insurer may ask for additional forms depending on the variant.

- Wait for the Insurer to Process your Request: The insurer reviews your policy, confirms the cancellation, and shares the final status. If there is a refund or surrender value, they deposit it into your bank account.

- Get a Confirmation: Make sure you receive a written confirmation or email stating that your policy is cancelled or lapsed. Keep this for future reference.

Note: As per IRDAI rules, a request received by the insurer for cancellation of the policy during the free look period should be processed, and the premium shall be refunded within 7 days of receipt of such a request.

Things to Keep in Mind Before Cancelling Your Term Insurance Policy

Free-Look Deadline

If you are still within the 30-day free-look period, this is a safe time to cancel and receive most of your premium back. Refunds are limited or unavailable if you are past this window.

Future Insurability

Frequent cancellations or lapsed policies can raise concerns with insurers when you apply again. This can lead to stricter underwriting, more questions, or higher premiums.

Have a Replacement Plan Ready

Always research and secure approval for a new policy before cancelling your existing one. If you cancel first and apply later, you may be left without coverage. If something happens during that gap, your family will not receive any benefit.

Talk to an Expert

An insurance advisor or financial planner can help you decide whether cancelling is necessary or if adjusting the sum assured, riders, or term is enough.

Keep Documentation

Save copies of all cancellation requests, policy documents, and communication with the insurer. These records help if there is a dispute or if you need clarification later

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why do customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Ditto’s Take on Term Plan Cancellation

If your current policy feels unsuitable and your reasons for cancelling are genuine and logical, you may consider switching as your last resort. At Ditto, we recommend comprehensive plans like Axis Max Life Smart Term Plan Plus and HDFC LIFE Click2protect Supreme. Explore more about how our experts evaluate term plans through Ditto’s cut.

In case you bought a term plan through us, contact us for refund/cancellation queries and let our experts help you out.

Still unsure about cancelling your term plan? Book a free call with us and let our experts guide you to make an informed decision.

Frequently Asked Questions

Last updated on: