IndiaFirst Life Insurance is a joint venture backed by Bank of Baroda, Union Bank of India, and Carmel Point Investments. Established in 2009, the insurer has gradually expanded across over 1,000 towns and cities, driven largely by bancassurance partnerships.

While IndiaFirst offers a broad portfolio of life insurance products, choosing a term insurance provider ultimately comes down to how reliably the insurer performs at the time of claim. Understanding both strengths and limitations is therefore essential before making a decision.

How Does IndiaFirst Term Insurance Work?

IndiaFirst does not outsource its risk evaluation or claim decisions. The insurer is solely responsible for underwriting the policy, communicating acceptance or rejection, and settling claims within the prescribed timelines.

The distributor or advisor can coordinate paperwork, but the final decision always rests with the insurer.

The portfolio is broad, but when choosing a term insurance provider, what matters is whether the insurer can deliver at the time of claim. That requires examining both the strengths and weaknesses.

What Does IndiaFirst Term Insurance Offer?

Flexible Coverage Options

Long-Term Coverage

Rider Add-ons

Straightforward Onboarding

IndiaFirst Life Term Insurance Plan Comparison

The table below captures IndiaFirst’s 3-year record on claim settlements, payout reliability, complaint volume, business scale, and solvency, giving you a clear view of its overall stability and service quality.

Performance Metrics of IndiaFirst Life Insurance (A 3-Year Overview)

Note: IndiaFirst shows decent claim reliability with a solid CSR and improving ASR. However, its higher complaint volume highlights service and documentation gaps that may affect the overall experience, particularly for customers who prioritise strong digital and post-sale support.

The figures above reflect the insurer’s overall performance across all life insurance products and are not limited to its term insurance segment.

Estimated Annual Premiums for IndiaFirst Term Plans

Profile: Male, non-smoker seeking a ₹2 crore term cover until the age of 70, without first year discounts.

Note: IndiaFirst is competitive at younger ages but gets costlier over time, while insurers like Axis Max Life and ICICI Prudential remain cheaper across age bands.

Documents Required to Buy IndiaFirst Term Insurance

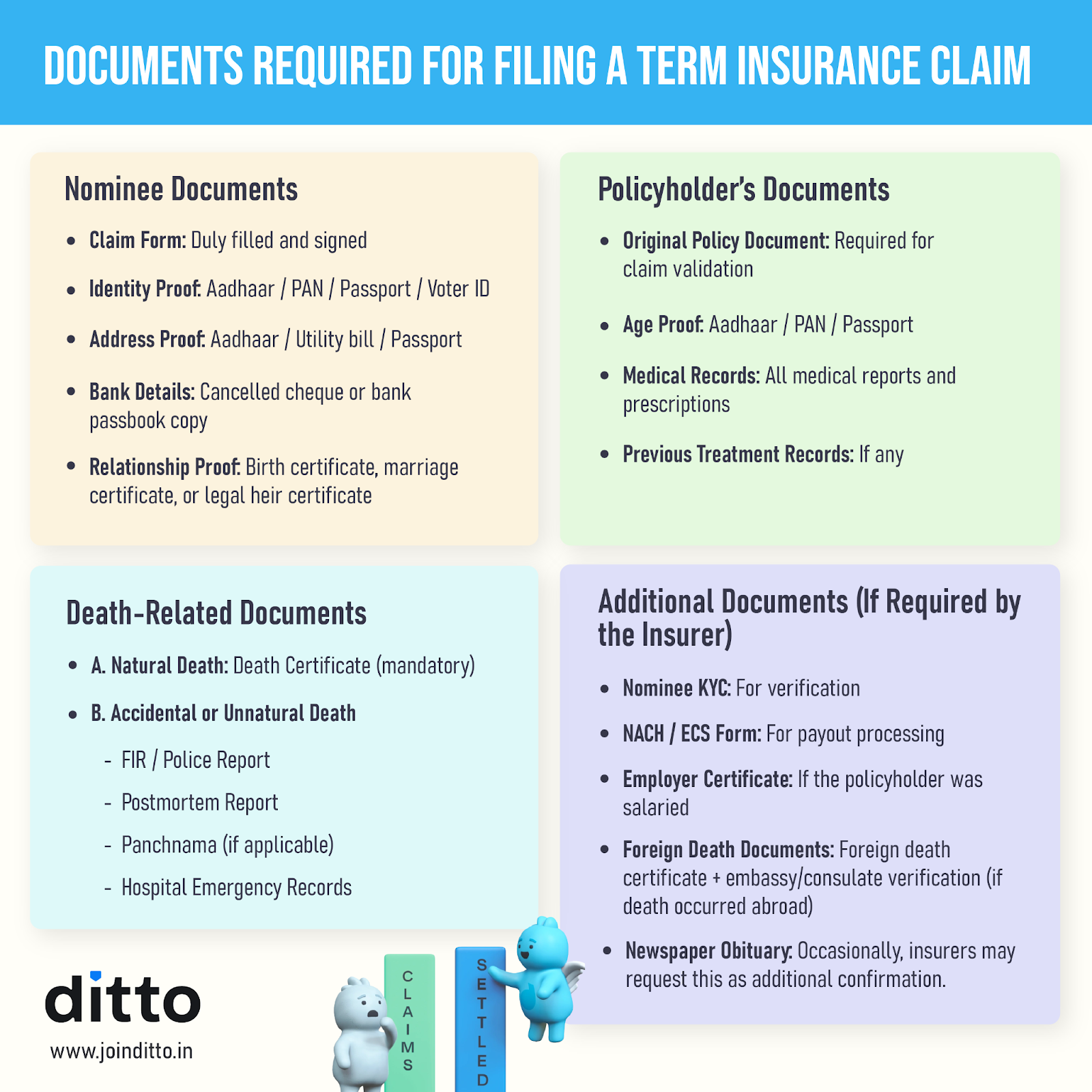

Use the infographic below as a ready checklist of the documents required for buying an Aviva policy (which is the same across most standard term plans). Verify your details carefully to avoid delays during underwriting.

Claim Settlement Process of IndiaFirst Life Insurance

For a complete step-by-step guide, check here for more details. The process broadly follows the standard claim procedures used across most term insurance plans.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now.

Ditto’s Take on IndiaFirst Life Insurance

IndiaFirst can be a reasonable choice if you value PSU-backed assurance, prefer buying through Bank of Baroda or Union Bank, or want features such as joint-life cover, premium waivers, or return-of-premium options.

It also suits buyers who prioritize claim reliability, with IndiaFirst posting a strong 3-year average CSR of 97.98 % and an ASR of 92.4 percent.

However, IndiaFirst may not be ideal if you expect a seamless digital experience, faster servicing, or minimal paperwork.

Its higher complaint volume, smaller business scale of ₹2,969 crores, and limited digital capabilities suggest a service experience that may feel less smooth compared to larger private insurers like HDFC Life, Axis Max Life, or ICICI Prudential.

Disclaimer

Frequently Asked Questions

Last updated on: