Quick Overview

Edelweiss Term Insurance offers a limited range of comprehensive plans and focuses on simple life cover with flexible payout options and features. This guide walks you through its top plans, premiums, eligibility rules, riders, claim process, and whether Edelweiss suits your long-term protection needs.

Edelweiss Tokio Life is relatively young with a smaller business scale but is growing steadily in India. Compared to established players like ICICI or HDFC Life, it has lower brand visibility.

Performance Metrics of Edelweiss Life Insurance

Note: CSR stands for claim settlement ratio, while ASR refers to amount settlement ratio

What Are the Top Term Insurance Plans by Edelweiss?

Edelweiss Tokio Life offers two major term plans:

- Edelweiss Zindagi Protect Plus

Zindagi Protect Plus is the flagship plan from Edelweiss Life and has no limit to the maximum sum assured (subjected to underwriting). It comes with comprehensive coverage like:

- Life Cover or Return of Premium options

- Coverage up to age 100 years

- Add-ons like Better Half, Child's Future Protect, Premium Break

- Special Exit Benefit (under certain conditions)

- Multiple premium payment options

- Riders available such as Critical Illness, waiver of premium & Accidental Total and Permanent Disability

- Saral Jeevan Bima

Saral Jeevan Bima is a simple life insurance plan designed to provide basic financial protection for your family. It is easy to understand and suits people looking for straightforward coverage without complexity. Here are some of the features:

- Life cover from ₹5 Lakhs to ₹25 Lakhs

- Coverage up to age 70

- Flexible payment terms, including single payment

Some of the major drawbacks of this plan is it offers no riders and only death due to an accident is covered during the initial waiting period (45 days).

Did You Know?

Let’s see how premiums for Edelweiss Zindagi Protect Plus vary for a sum assured of ₹2 crore. The annual premiums below are for non-smoker male of different ages, with coverage up to age 70 and without 1st year discounts.

How Do Edelweiss Term Insurance Premiums Compare vs Other Term Plans?

Key Insight: Between ages 25 and 45, Edelweiss is usually among the two costliest term plans, priced close to HDFC Life. From age 35 onward, it is clearly more expensive than ICICI, Axis, and Bajaj.

Benefits of Edelweiss Term Insurance

Affordable Premiums

Fixed Tenure

Multiple Payout Options

Tax Benefits

What Are the Eligibility Criteria for Edelweiss Term Insurance?

- Age: Minimum entry age is 18 years and maximum entry age is up to 65 years, depending on the plan option and premium-payment term chosen.

- Financial Eligibility: You may need to submit income proof (salary slips/ITR, etc.) to justify the cover amount; a fixed minimum income isn’t publicly specified in the brochure, and approvals are underwriting-based.

- Underwriting Inputs: Your smoking status, medical history, existing personal life insurance and occupation can affect acceptance, required medicals, and premium.

What Riders Are Available with Edelweiss Term Insurance?

- Accidental Death Benefit Rider: Extra payout to your nominees if death occurs due to an accident.

- Critical Illness Rider: Lump-sum benefit on diagnosis of 12 listed illnesses including heart attack, cancer or kidney failure.

- Accidental Total and Permanent Disability Rider: Helps protect income if you become disabled. It comes into effect after 180 days after you present your condition to your insurer.

- Waiver of Premium Rider: Future premiums are waived if you face disability or a serious illness. This feature gets activated upon first diagnosis of critical illness or due to accidental total and permanent disability during the term.

What Are the Documents Required for Buying Edelweiss Term Insurance?

- ID proof like a PAN card or passport

- Address proof such as Aadhaar or a driving license

- A recent photograph

- Income proof like ITRs, Form 26AS, or salary documents

- Bank details such as a cancelled check or bank statement

- Medical reports may be required if asked by the insurer

How To Claim Edelweiss Term Insurance?

Here is how you can file your claim:

- Inform the insurer through their website or visit their nearest branch.

- Submit documents, such as the claim form, death certificate, medical records, and other required documents.

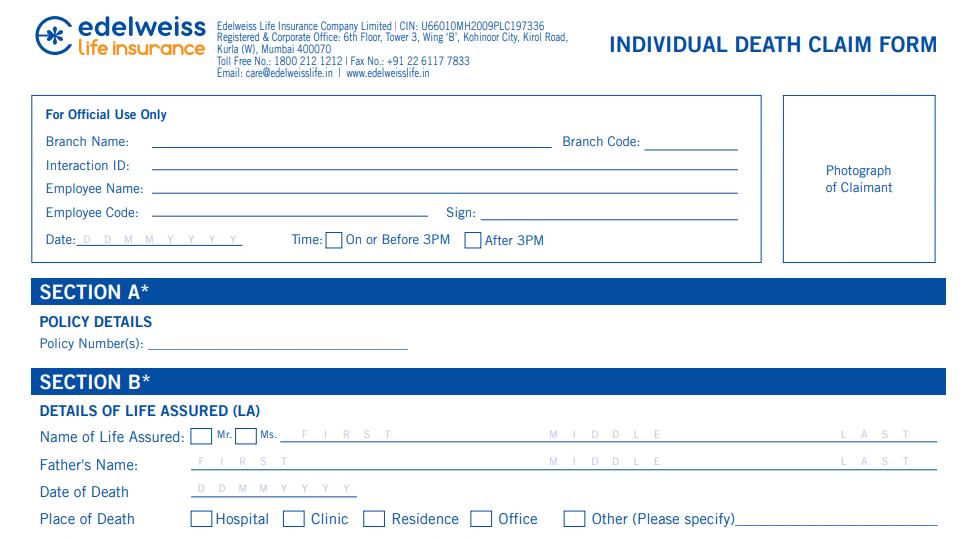

Note: Here’s what an Edelweiss Life individual death claim form looks like:

- The insurer reviews the claim and may ask for additional papers if needed.

- Claim is settled directly to the nominee’s bank account once everything is verified.

Alternatively, you can call at their toll free 1800-212-1212 or drop an email at claims@edelweisslife.in.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why do customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Ditto’s Take on Edelweiss Term Insurance

Though the insurer had a high CSR during FY 2024-25, it faces several challenges, including high complaint volumes though declining over the years, and service inconsistencies. You may still consider Edelweiss Term Insurance if you want affordable plans with straightforward coverage.

However, if you are looking for a comprehensive term plan from insurers with established track record, we recommend plans like Axis Max Life Smart Term Plan Plus or HDFC LIFE Click2protect Supreme. Explore more about how our experts evaluate term plans through Ditto’s cut.

Note: Ditto is not a partner of Edelweiss Tokio Life Insurance. All information in this article is based on details available on Edelweiss Life’s official website and other publicly available sources.

Frequently Asked Questions

Last updated on: