Can We Port Term Insurance?

Imagine this. You already have a term plan, and then someone tells you there is another, cheaper plan with better riders and comes from a “stronger” brand. Your first thought is simple: “Can I port my term plan like health insurance?”

Unfortunately no. If you want a better plan, you need to apply for a new policy with fresh medical checks and underwriting. The premium will be higher based on your current age.

In this article, we will walk you through what portability means in insurance, why term insurance cannot be ported, and what your real options are if you are unhappy with your policy.

What Is Portability In Insurance?

Portability in insurance means you can switch your policy from one insurer to another without losing the benefits you’ve already built up. This is mainly available in health insurance (not term insurance), and it protects things like waiting and moratorium period credits, so there is no break in cover.

Let’s say you’ve completed a 2-year waiting period for pre-existing diseases (out of a total of 3) under Care Supreme. Then, if you decide to port to HDFC ERGO Optima Secure, you don’t have to restart that waiting period, as it is already carried forward.

Now, let’s see why this idea does not work for term insurance.

Why Is It Not Possible To Port Term Insurance?

No Regulatory Framework For Term Portability

IRDAI has clear guidelines for health insurance portability, but there is no framework for term insurance. No rule forces an insurer to accept your old term policy, medical history, and pricing as a package.

Term Plans Have Fixed Premiums And No Waiting Periods

You usually buy a term plan when you are young and healthy, and the insurer fixes a level premium for the entire policy term after analyzing the risks. There are no waiting periods, bonuses, or loyalty benefits. Hence, there is nothing meaningful to carry forward if you “port” the plan.

Pricing Issues

Insurance actuaries use age, health, lifestyle habits, and other data to estimate the likelihood of living a long and healthy life during the policy term. Based on these factors, they decide your premium at the time of purchase.

If insurers had to take older customers at the same low premiums set years ago by another company, new insurers would have almost no reason to offer them a policy.

Why Would Someone Want To Port Term Insurance?

Mis-selling And Realizing It Late

Imagine you are 25, just started working, and someone sells you an expensive TROP plan with too many riders and a long term without explaining the trade-offs. Later, you realize that a standard term plan would have been much cheaper and that you are paying for add-ons you do not really need. This prompts you to consider another plan.

Newer Plans With Better Features

Over time, insurers launch new plans like ICICI Prudential’s iProtect Smart Plus and new riders like cover continuance benefit or instant payout on claims. These can look more attractive than your old plan.

Lower Premiums For Same Or Higher Cover

Sometimes, a new insurer may keep pricing low for your age group. So, you might get a higher sum assured at a similar premium, or the same sum assured at a lower premium. On paper, that looks like a “better deal.”

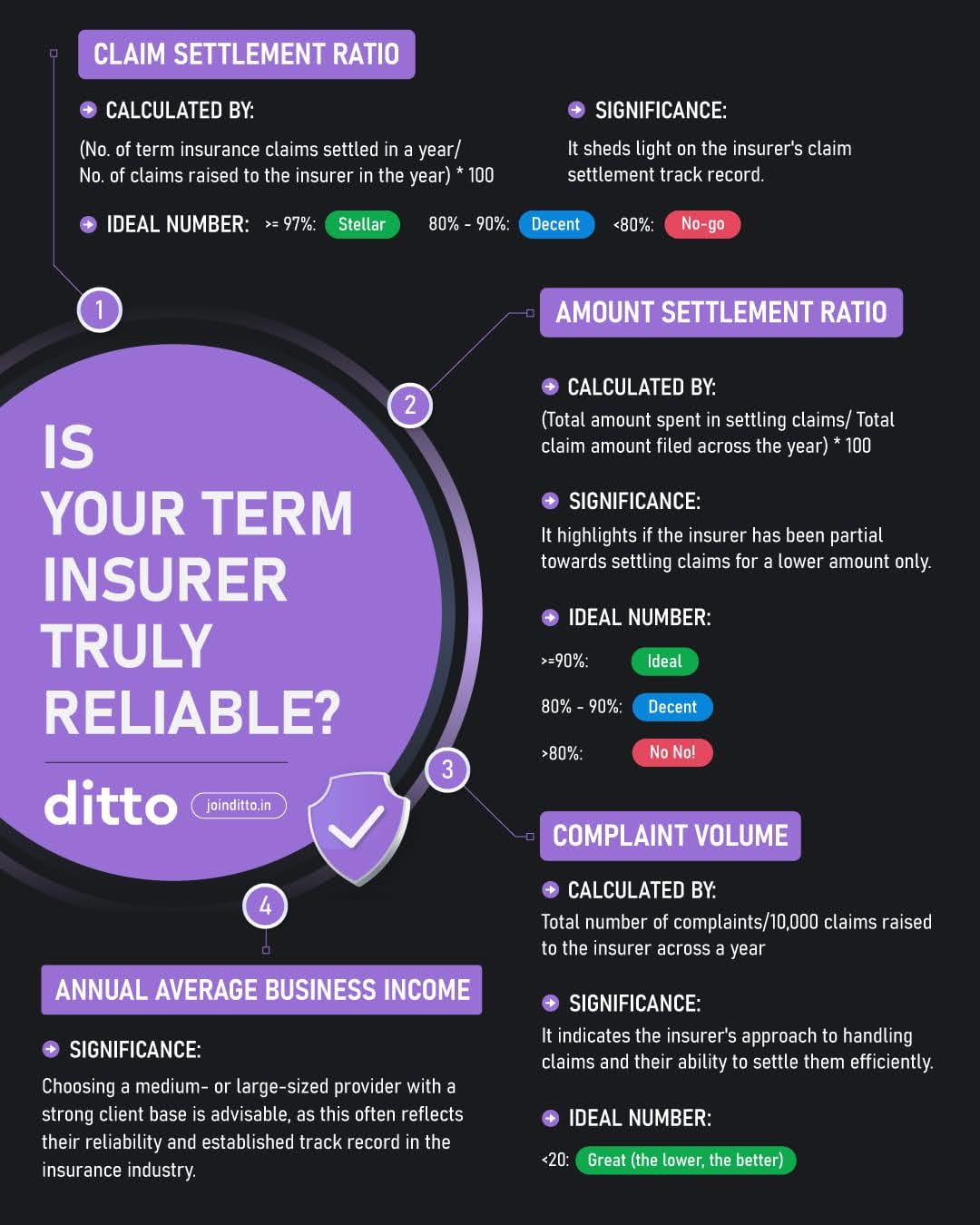

Poor Service Or Trust Issues

You might feel unhappy with the claim stories you read online or slow customer service. A brand that feels “small” or less visible can trigger the urge to switch to a more “reputable” company.

Too Many Policies And Confusion

You might have picked multiple term plans over time and start thinking, “I just want one clean, simple policy. Should I move everything to one insurer?” Doing this can give you peace of mind and clear a lot of confusion.

Unhappy With Your Term Plan? What You Can Do

Step 1: See Where You Are In The Policy Timeline

1) Within Free Look Period (30 days)

- If the plan feels mis-sold or you simply don’t want it, cancel within the free look period.

- You’ll get your premium back after deducting stamp duty, risk premium for days covered, and medical costs (if any).

- If you catch the issue this early, exiting and choosing a better plan is usually the smartest move.

2) Within the First 1–2 Years

- Pure term: if you stop paying, the policy lapses, and you usually don’t get anything back.

- TROP / limited pay: There may be a small surrender value after a minimum period, but in the early years, it’s usually not much. So your main loss is the premiums already paid.

Before switching, ask:

- Has your health changed since you bought the plan?

- Will you still qualify for a new plan at a similar or reasonable premium?

If health is good, switching is easier. If it has worsened, giving up your existing cover can be risky.

3) After 3+ Years

- You’ve already locked in a premium at a younger age.

- You’ve spent a few years inside the policy and likely Section 45, which makes the policy harder to question later.

At this stage, for many people, continuing the plan often makes more sense than trying to replace it.

Step 2: Know Your Practical Options

1) Buy A New Policy First, Then Tweak The Old One

- Apply for a new term plan that actually fits your needs today.

- Complete medicals and underwriting, and wait till the new policy is issued and active.

Only then think about reducing the old cover or letting the old policy go.

This way, you’re never left without cover if the new insurer rejects you, increases the premium sharply, or adds major exclusions.

2) Use Reduced Paid-Up (RPU) in Some TROP Plans

In some TROP policies, you can stop paying premiums and convert to a reduced paid-up. The policy continues with a lower sum assured, in proportion to the premiums already paid.

Example:

- Original: ₹2 crore sum assured, ₹8 lakh total premium over 20 years.

- You’ve paid ₹4 lakh (50%).

- New sum assured ≈ ₹1 crore (about 50%).

3) Surrender the Policy

Some products, like limited pay TROP or zero-cost term plans, allow you to surrender during specific ages/years. You can get back the base premiums minus the rider costs, depending on the product rules.

The exact surrender value is shown in your benefit illustration or policy schedule. Always check this before deciding.

Why Choose Ditto For Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Ditto’s Take On Porting Term Insurance

Our simple view is that most people are better off keeping their existing term plan and adding more cover if needed. Never cancel your existing plan blindly.

You can always check how much life cover you really need using our term cover calculator. Then, apply for any new plan and wait for it to be issued and get active.

Later, you can easily think about reducing or cancelling the old policy. Remember, once you lose a well-priced old plan, you may not get the same benefits again, especially if your health has changed.

All life insurers are regulated by IRDAI, which sets solvency rules and can step in to protect policyholders. So, the fear of a “small brand” by itself should not push you into an expensive mistake.

If you are unsure what to do with your current policy, you can speak to a Ditto advisor for free and get a simple keep, add, or change recommendation tailored to your income, loans, and family responsibilities.

Frequently Asked Questions

Last updated on: