Best ₹3 Crore Term Insurance Plan

Confused about what should be the ideal cover for your term plan? With rising costs and growing financial goals, many people now wonder if a ₹3 crore term plan is the right fit for their needs.

This guide walks you through the benefits of a ₹3 crore term plan, who should opt for such a plan and factors to consider while choosing a ₹3 crore term plan.

How Does a ₹3 Crore Term Insurance Plan Work?

When you buy a ₹3 crore term plan:

- You pay fixed premiums regularly (monthly, quarterly, half yearly or annually) during the policy term.

- If you pass away during the term, the insurer pays ₹3 crore to your nominee (family).

- If you survive the term, there is no payout (unless you opted for a return‑of‑premium variant, where premiums are much higher (50-100%) than regular term plans).

Note: You can add optional riders like waiver of premium or a critical illness benefit to boost protection.

What Are the Best ₹3 Crore Term Insurance Plans in India?

Before we discuss the list, we assess the plans through our 6-point evaluation framework to ensure strong coverage, clear features, and long-term value.

Features:

- Accidental Death Benefit,

- Critical Illness Cover (up to 64 illnesses)

- Regular or Smart Cover (1.5X coverage for first 15 years)

- Waiver of Premium on Disability or Critical Illness

- Terminal Illness Benefit (up to ₹1 crore)

- Additional features like Zero-Cost Exit Option and Women's Perks (Lifeline Plus & Discounts)

Features:

- Accidental Death Terminal Illness Benefit

- Disability & Critical Illness Premium Waiver

- Income benefit on Accidental Disability

- Inflation-linked cover

- Critical Illness Cover (60 illnesses)

- Life Stage Increase Option

- Terminal illness cover (up to ₹ 2 crores)

Features:

- Accidental Death Benefit

- Life Stage Benefit (increased coverage after marriage/childbirth)

- Critical Illness Coverage (60 illnesses)

- Waiver of Premium on Accidental Total & Permanent Disability

- Terminal Illness cover and Zero Cost Option

Features:

- Accidental Death Benefit

- Life Stage Benefit (increased coverage after milestones like marriage/childbirth/home loan)

- Terminal Illness Payout (Entire base cover)

- Critical Illness Cover (60 illnesses)

- Zero Cost Option

Features:

- Accelerated Critical Illness Benefit

- Waiver of premium on Accidental Total & Permanent Disability

- Life Stage Flexibility and Terminal Illness payout

- Cover Continuance (premium deferment up to 12 months)

- Early Exit Value (specific age/tenure bands)

How Much Do ₹3 Crore Term Insurance Premiums Cost for Top Plans?

The annual premiums above are for male non-smokers of different ages, with coverage up to age 70.

Ditto’s Take: Axis STPP offers strong features at an affordable price for a ₹3 crore cover, earning it a solid overall rating. Whereas, Bajaj eTouch II offers the most affordable premiums across age groups, while others remain competitive with only moderate variations.

Check out this infographic to understand the essential term plan add-ons you can choose during purchase:

Who Should Opt for a ₹3 Crore Term Insurance Plan?

A ₹3 crore term plan is ideal if you earn well or expect your income to grow, have major financial responsibilities like loans, or support dependents such as your spouse, children, or parents. It also fits those who want pure protection without mixing insurance and savings.

This higher coverage also prepares families for rising education costs, as MBA, engineering, or medical degrees may reach ₹50 to ₹80 lakh in the coming years. It is especially useful for those in metro cities, where daily expenses and long-term financial commitments are much higher.

Note: You can easily estimate your ideal cover using the online cover calculator. It factors in your age, expenses, and liabilities to suggest the right protection for your family.

How do Premiums Vary for Different Sum Assured Amounts and Age?

Take a look at how the premiums for a non-smoker male vary with sum assured and age. These premiums are for Axis Max Smart Term Plan Plus with coverage up to age 70, without discounts.

Key insights:

- Premiums do not increase at the same pace as coverage. A ₹3 crore cover usually costs only about 2.5 to 2.8 times a ₹1 crore cover, so higher sums assured offer better value.

- Premiums rise fast with age. A 45-year-old pays more for a ₹1 crore plan than a 25-year-old pays for a ₹3 crore plan. Therefore , it is advisable to buy early to keep lock-in low premiums and coverage high.

Factors to Consider Before Buying the Best Term Insurance Plan for ₹3 Crore?

Here’s the checklist you should look for before buying a ₹3 crore term plan:

- Your Annual Income: Insurers estimate your maximum cover by multiplying your income and considering your age at purchase. For example, for a ₹3cr term cover, you would need an annual income of 12LPA+.

- Existing Liabilities: Home, education, or personal loans influence your cover requirement so your family can stay debt-free if something happens to you.

Always declare any existing life insurance policies in your name. Insurers subtract your current coverage from your maximum eligible sum assured, which affects how much additional term cover you can buy. - Current Lifestyle: Smokers pay higher premiums due to lower life expectancy.

- Age & Medical History: Higher age or pre-existing conditions generally increase premiums. Medical tests for a term plan are recommended by the underwriter based on your profile, and the cost is covered by the insurer.

- Insurer’s Track Record: Check your insurer’s claim settlement ratio, amount settlement ratio, complaint levels, and available riders before choosing.

- Policy Term & Payout Mode: The ideal duration depends on when your dependents become financially independent. Insurers offer single, regular, and limited premium payment options.

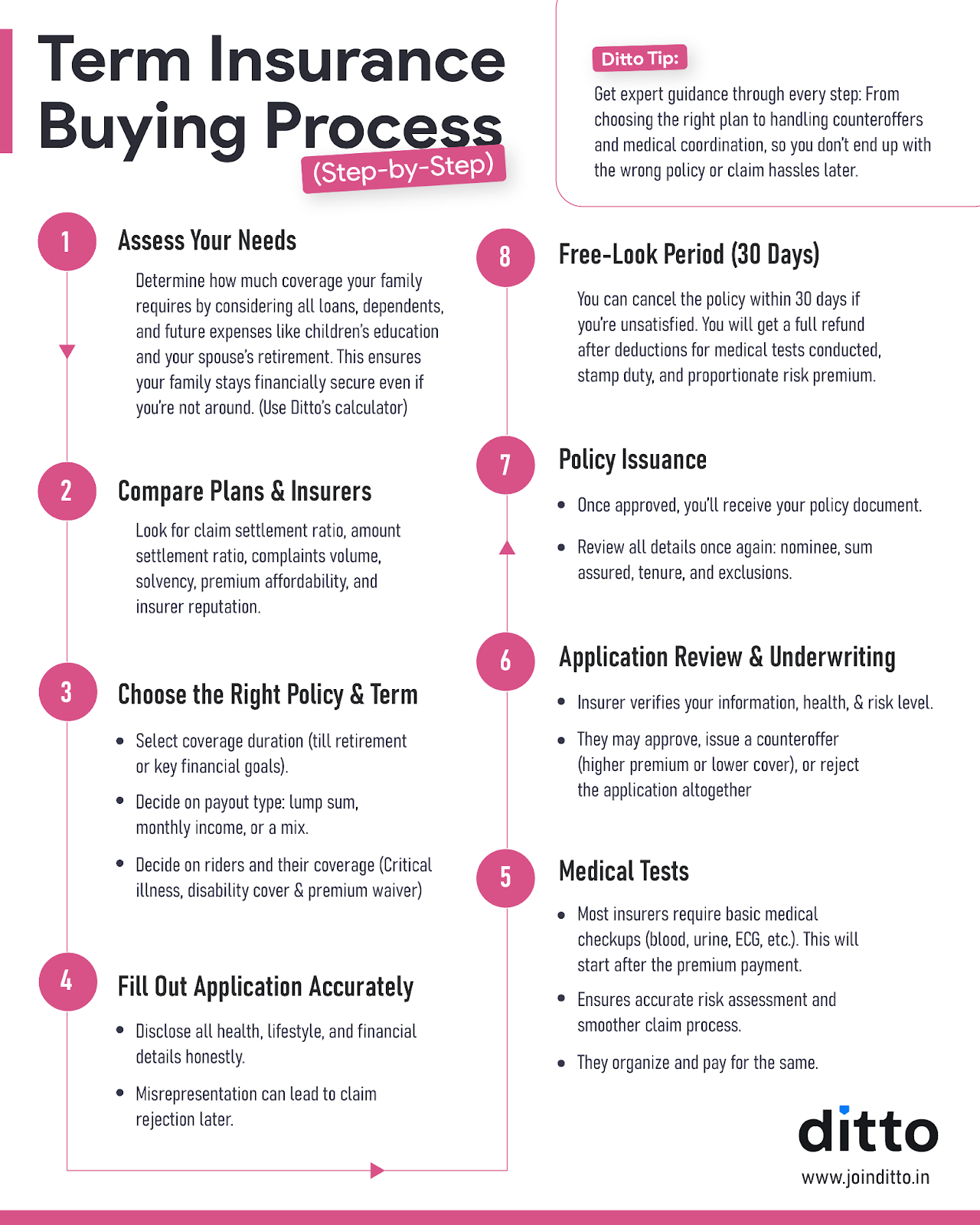

Take a look at the infographic which helps you with a term plan purchase process:

Ditto’s Take on a ₹3 crore Term Insurance Plan

There’s no fixed perfect cover for everyone, but a ₹3 crore plan makes sense if your income is growing, you have a young family, or you expect big future expenses. For people earning ₹15 lakh or more annually , a ₹1 crore or ₹2 crore may fall short over time. A ₹3 crore cover offers stronger long-term protection without a big jump in premium.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

A ₹3 crore term plan offers strong, affordable protection when your income and responsibilities justify higher cover. All you need to do is plan wisely: align the sum assured with real goals and choose a credible insurer with essential features.

Still unsure about purchasing a term plan? Book a free call with us and let our experts guide you to make an informed decision.

Frequently Asked Questions

Last updated on: