Quick Overview

Looking for a ₹20 lakh term insurance plan can feel confusing, especially when most well-known policies seem to begin at much higher cover amounts.

While options are limited, a ₹20 lakh cover is still possible through a specific category of plans designed to keep insurance accessible for first-time and lower-income buyers, most notably, Saral Jeevan Bima.

Why a ₹20 Lakh Term Insurance Plan Isn’t a Good Idea

₹20 lakh may seem like a reasonable safety net, but it offers very limited financial cushioning. If the nominee invests the ₹20 lakh payout in a fixed deposit with an interest rate of approximately 7%, the expected returns would be as follows:

An Example Calculation

₹11,600 per month can handle essentials like groceries and basic utilities, but it won’t sustain rent, EMIs, school fees, medical costs, or long-term family needs.

This is why financial experts often recommend life cover worth 10–15 times your annual income (at least ₹ 50 lakh to ₹1 crore or more for most working individuals).

Pricing is another important consideration. While Saral Jeevan Bima may appear affordable overall, its cost per lakh is higher because insurers still incur fixed expenses such as medical examinations, underwriting, and operational overheads regardless of the sum assured.

Let’s compare the difference below for a 30-year-old non-smoking male seeking cover till age 65:

A Detailed Comparison

For an additional ₹300–₹400 in premium, it is possible to secure nearly 2.5 times the life cover, making a ₹50 lakh policy a far more efficient and future-ready choice.

Many insurers also permit a ₹50 lakh sum assured for individuals earning around ₹3–₹5 lakh annually, subject to underwriting norms.

While a ₹20 lakh policy can serve as an entry-level or interim solution, it should not be considered sufficient long-term protection for a family.

Alternatives to Buying a ₹20 Lakh Term Insurance Plan

Who Should Buy a ₹20 Lakh Term Insurance Plan?

- Suitable for people with low or irregular income who may not qualify for higher cover amounts.

- Works well for those with low or informal income proof, like small shop owners, gig workers, freelancers, or daily wage earners who can’t show strong ITRs or salary slips.

- Ideal for early-stage earners with an annual income of around ₹1.5–3 lakh, where income-based eligibility often limits coverage to ₹20–₹30 lakh.

- Can be taken as temporary protection until income increases and you upgrade to ₹50 lakh–₹1 crore later.

- Useful for specific needs, such as credit-linked loan protection, though such plans mainly cover the loan amount rather than broader family needs.

Note: If you are comfortable increasing coverage slightly, some offline/basic plans such as LIC New Jeevan Amar allow a minimum sum assured of ₹25 lakh, which may be a better alternative than stopping at ₹20 lakh.

Documents Required to Purchase a ₹20 Lakh Term Insurance Plan

Income Proof

Identity & Address Proof

Age Proof

Medical Reports

Note: Income proof may not always be required to purchase a ₹20 lakh term insurance plan because the insurer may waive it.

Factors to Consider Before Buying a ₹20 Lakh Term Plan

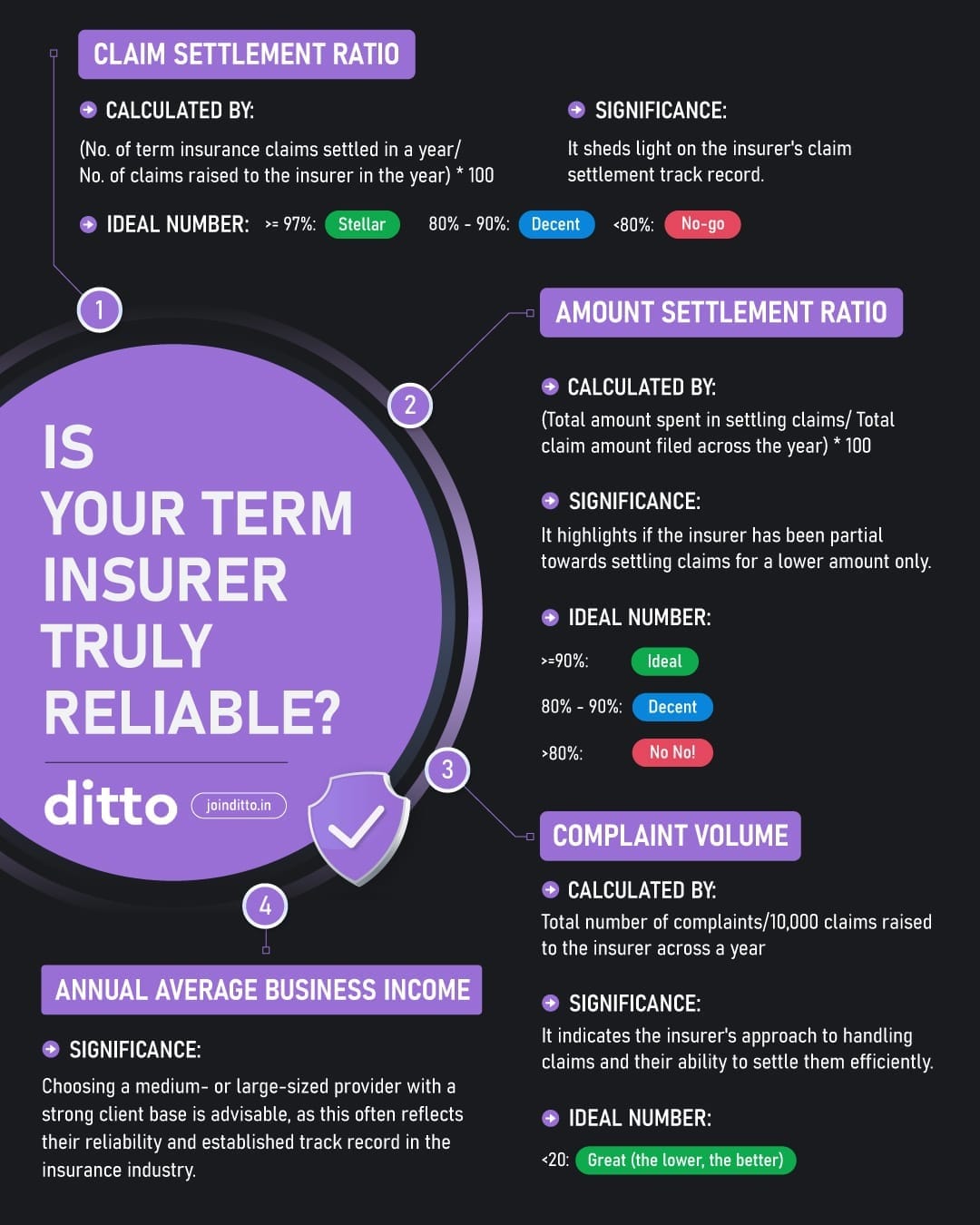

The most crucial factor in choosing a term insurance plan is the insurer's reliability. The following infographic tells you which metrics matter the most when it comes to that:

The other factors to be taken into consideration are as follows:

- Claim experience & brand reliability

- Premium affordability

- Policy term (ideally till age 60–70)

- Riders like Accidental Disability Cover / Waiver of Premium / Critical illness

- Income eligibility requirements

- Medical requirements (depends on insurer)

- Whether you will upgrade your coverage later

Why Choose Ditto for Term Insurance

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right term insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Conclusion

While a ₹20 lakh term insurance plan is an accessible entry-level option, it is not enough for long-term family protection in most cases.

If budget or eligibility is a constraint, start with ₹20 lakhs, but aim to scale up to ₹50 lakhs– ₹1Cr as income rises. The goal isn’t just buying insurance, but ensuring your family is actually secure.

To figure out your ideal cover, use our term insurance cover calculator.

Frequently Asked Questions

Last updated on: