Bandhan Life Term Insurance Renewal: Quick Overview

Worried about missing your Bandhan Life term insurance renewal date? A delay can mean losing policy benefits and paying more than you should. At Ditto, we simplify this process so you can stay protected and don’t miss important renewal deadlines.

This guide explains the benefits of renewing your Bandhan Life term insurance on time, how to renew it online or offline, and what the grace period means for your policy.

Note: Ditto is not a partner of Bandhan Life. All information in this article is based on details available on Bandhan Life’s official website and other publicly available sources.

Did You Know?

How to Renew Your Bandhan Life Term Insurance Policy Online?

For an online renewal, follow these steps:

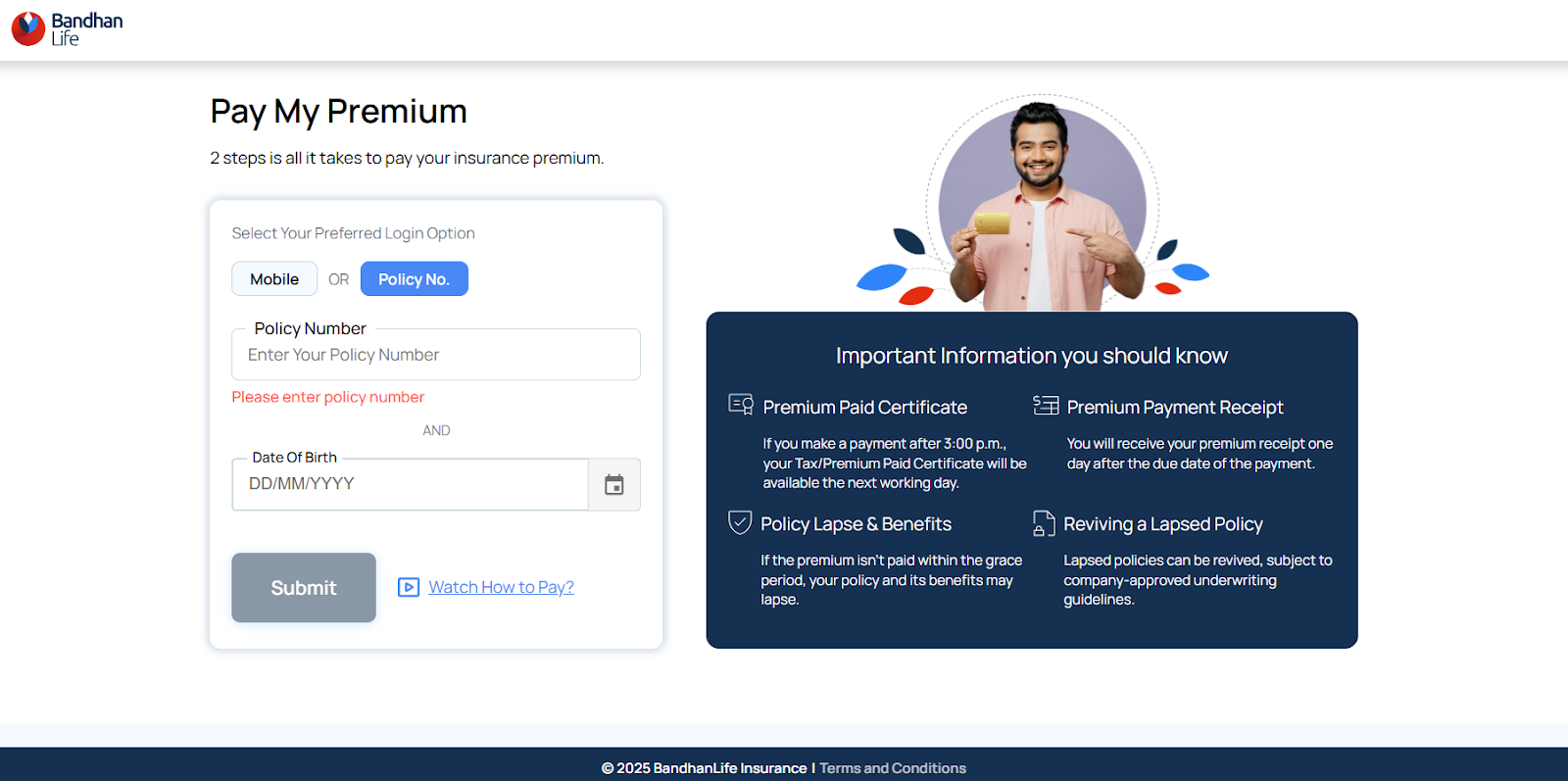

1) Go to the website. Next, click “Support” and then “Pay Premium” from the drop-down options.

2) Choose your preferred login option:

- In case you choose mobile, enter your registered 10-digit mobile number and click submit.

- In case you choose Policy no, input your existing policy number and date of birth to retrieve your policy information, and click submit.

3) Confirm that your name, contact number, and address are correct. You can also modify coverage or add riders if available.

4) Choose your preferred payment mode (debit card, credit card, UPI, or net banking) and pay the renewal premium.

5) Once payment is successful, you can instantly download the payment receipt and receive an email confirmation.

Alternatively, you can also renew your policy through:

- Any UPI app. Open your app, go to the billers or payment section, and search for “Bandhan Life Insurance.” Enter your policy details, confirm the biller, and follow the on-screen steps to pay your premium.

- Your iAssist customer portal. Log in with your mobile number and OTP, and follow the on-screen instructions to complete the renewal process.

How to Renew Your Bandhan Life Term Insurance Policy Offline?

If you prefer in-person assistance, you can renew your policy offline through any of the following ways:

- Visit the Nearest Bandhan Life Service Center: Carry your existing policy documents and ID proof. The representative will verify the details and help you complete the renewal payment. Locate your nearest branch.

- Speak to a Bandhan Life Term Insurance Agent or Advisor: If you bought your policy through an agent, contact them for renewal. They can collect the payment and issue a confirmation receipt.

You can call them at 1800-209-9090 or drop an email at customer.care@bandhanlife.com.

Benefits of Renewing a Bandhan Life Term Insurance Policy

Uninterrupted Financial Protection

Avoidance of High Revival Costs

No New Underwriting Hassles

Continuity of Original Premium Rate

What is the Bandhan Life Term Insurance Policy Grace Period?

In case you miss the renewal date, Bandhan Life provides a grace period to make the payment and maintain your policy coverage. The grace period is 15 days for monthly premiums and 30 days for yearly, half-yearly, and quarterly premium payments.

Term and life insurance policies generally continue coverage during the grace period. If a claim arises during this time, the insurer typically deducts the pending premium from the final payout.

Note: You can change your premium payment mode during your annual renewal by raising a request through a Bandhan Life branch, customer care, or your portal. The update applies from the next policy anniversary with revised premiums.

Ditto’s Take on Term Plan Renewal

If you renew your life term plan on time, it keeps you worry-free. Set renewal reminders and update your contact details so you never miss important alerts. Use online payments for faster and smoother renewals.

To make things easier, set a reminder a month before your renewal date. You can also pick a limited payment life insurance to stay covered for longer and skip the hassle of renewing every year.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

If you miss your Bandhan Life term insurance renewal, including the grace period, contact your insurer for late renewal options. If unavailable, buy a new policy to maintain continuous life coverage.

Still unsure how to go about renewing your term policy? Book a call with us, and let our experts guide you through the process.

Frequently Asked Questions

Last updated on: