How to Use the Axis Term Insurance Calculator?

Powered by Axis Max Life Insurance, this free online calculator allows you to enter basic details such as your age, coverage amount, and smoking status to get a clear idea of your premium instantly.

It is beneficial if you want to:

- Choose the right sum assured and policy term.

- See how your premium changes with various add-ons or riders.

It helps you plan your family’s financial protection conveniently, with no paperwork or sales calls, just quick and transparent numbers.

Introduction

What if you could check your term insurance premium in just a few clicks, without filling out forms or waiting for an agent to call? That’s exactly what the Axis Term Insurance Calculator is built for. This online tool provides you with instant, transparent premium estimates based on simple inputs, such as your age, coverage amount, and lifestyle choices.

At Ditto, we know how the right tools can make insurance planning smoother and more confident. Every financial situation is unique, so your coverage should be carefully tailored to meet your specific needs.

Before you make a decision, feel free to speak with Ditto’s expert advisors. We will help you explore your options, compare Axis Max Life’s term plans with others, and find the one that fits you best. There are no spam calls or hidden charges, just honest advice.

Details You’ll Need to Use the Axis Term Insurance Calculator

To get an accurate premium quote using the Axis Term Insurance Calculator, you’ll need to enter the following details:

- Date of Birth: Age directly affects your premium; younger applicants usually pay less.

- Gender: Premiums may vary slightly for men and women.

- Smoking Habit: Smokers often pay higher premiums due to higher health risks.

- Occupation or Income: Helps determine your eligible coverage amount.

- Sum Assured & Policy Term: Decide how much life cover you need and for how long.

- Payment Frequency: Choose yearly, half-yearly, or monthly payments.

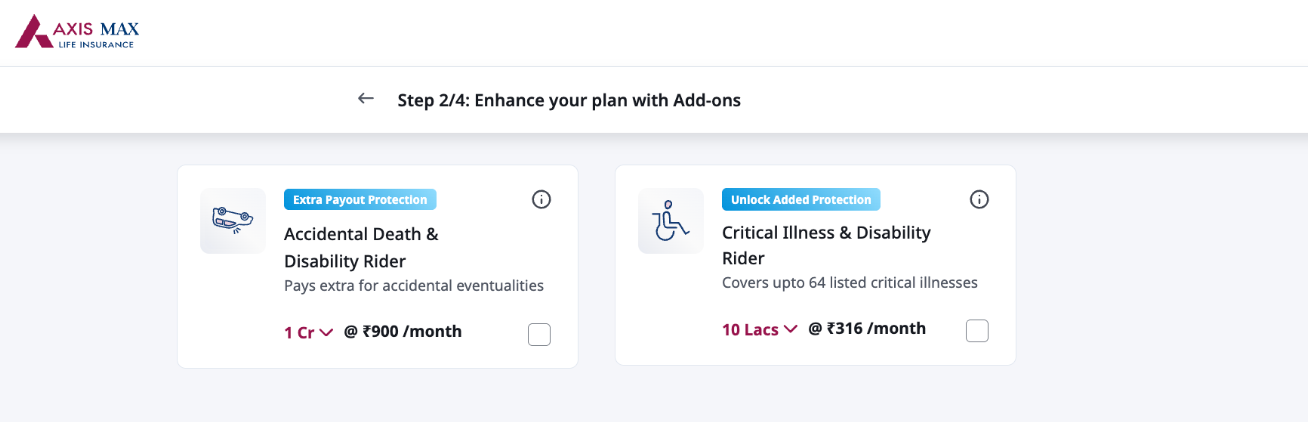

- Add-on Riders (Optional): You can include benefits such as Critical Illness or Accidental Death Cover for extra protection. If you’re a male policyholder, you can also opt for a Spouse Cover to extend protection to your partner under the same plan.

Note: The final premium may vary slightly based on health declarations and underwriting.

How to Use the Axis Term Insurance Calculator?

Here’s a quick step-by-step guide to using the Axis Term Insurance Calculator:

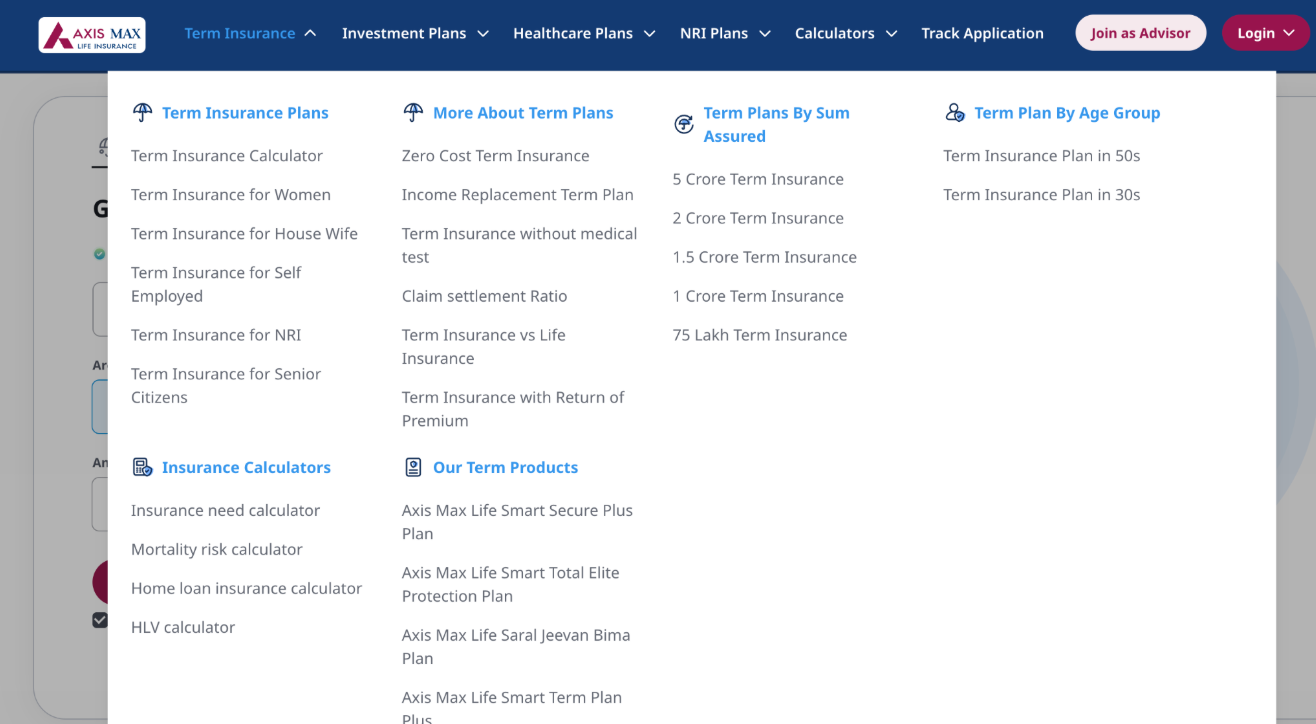

Step 1. Go to Axis Max Life’s official website.

Step 2. Locate the Term Insurance section: On the homepage, find the ‘Term Insurance Calculator’ tab under the “Term Insurance Plans” list and click on it.

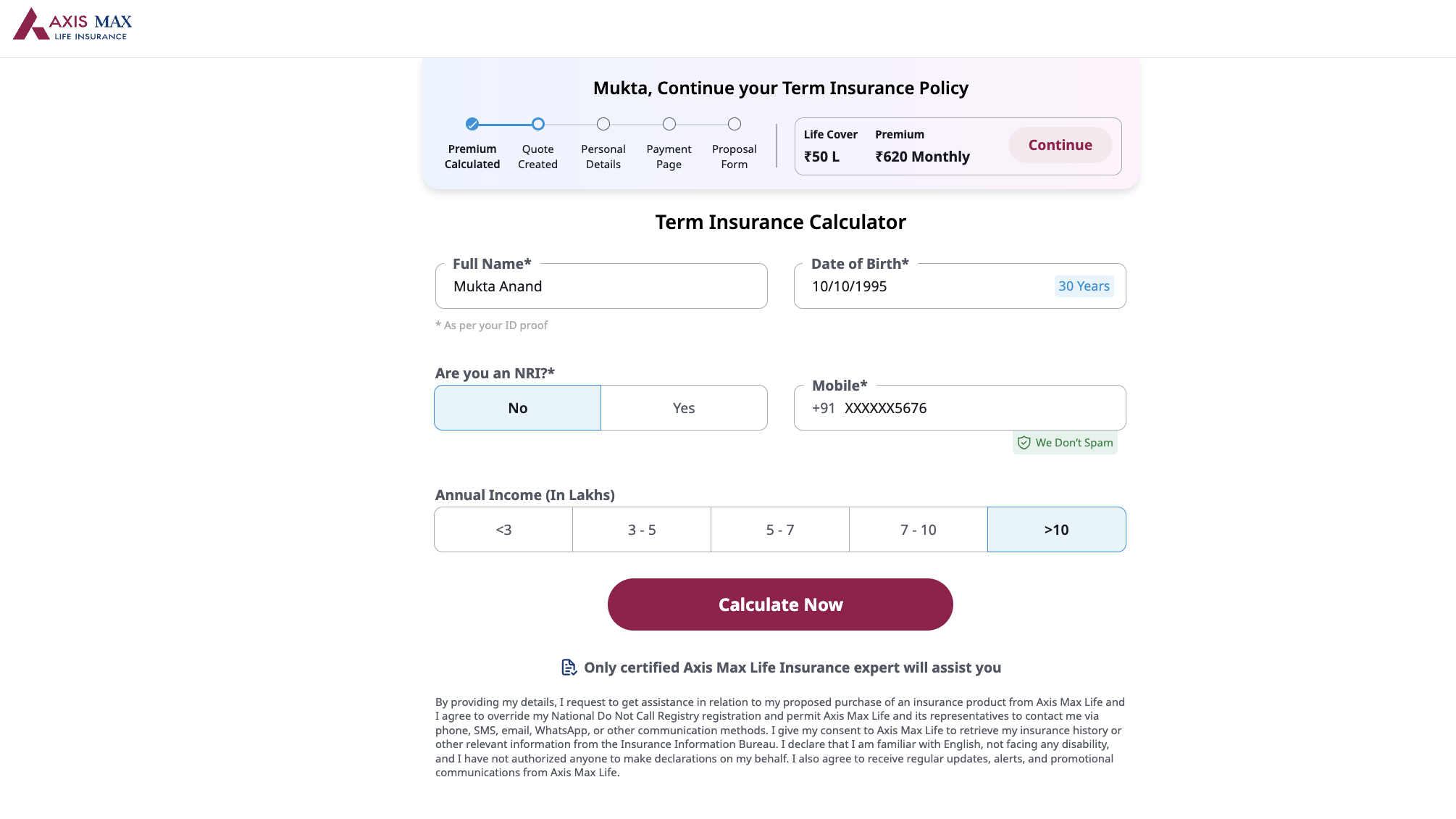

Step 3. Enter your basic details: Fill in your name, date of birth, nationality, and annual income to get started.

Step 4. Click on the calculator: Click on ‘Calculate Now’ to launch the Axis Term Insurance Calculator.

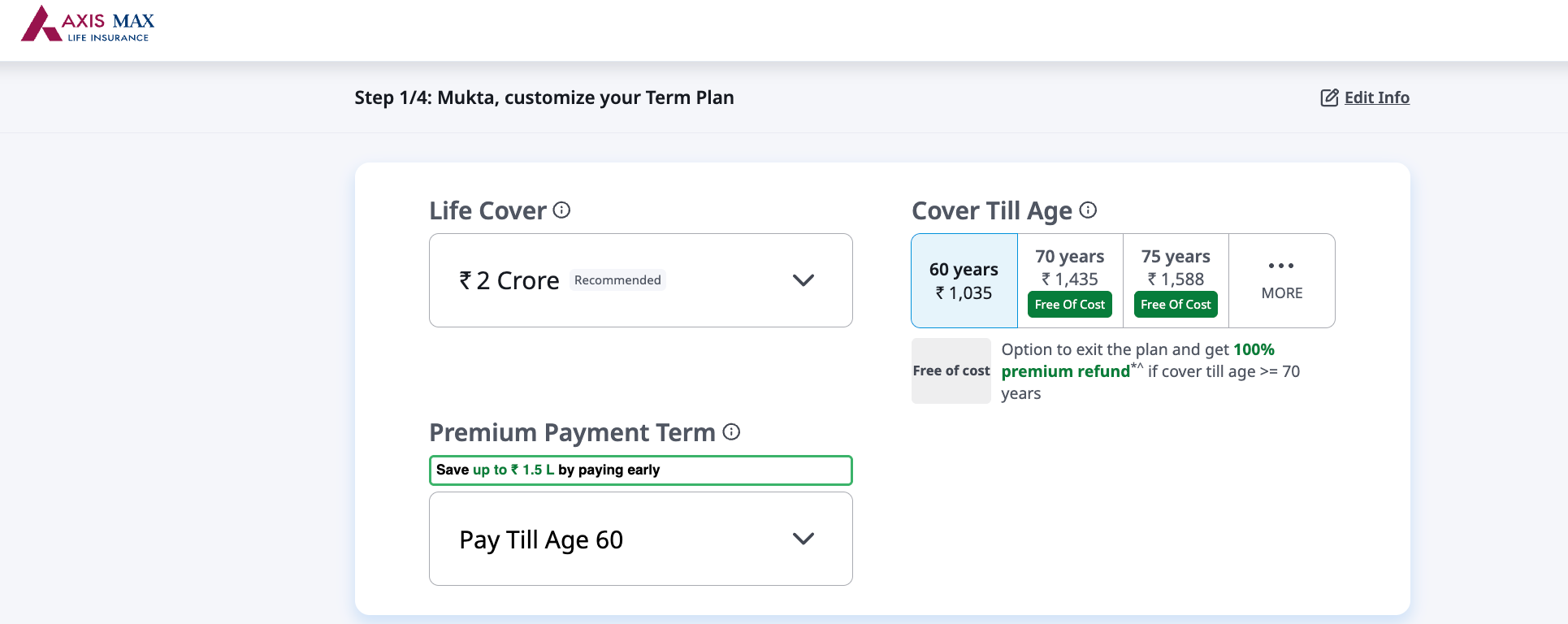

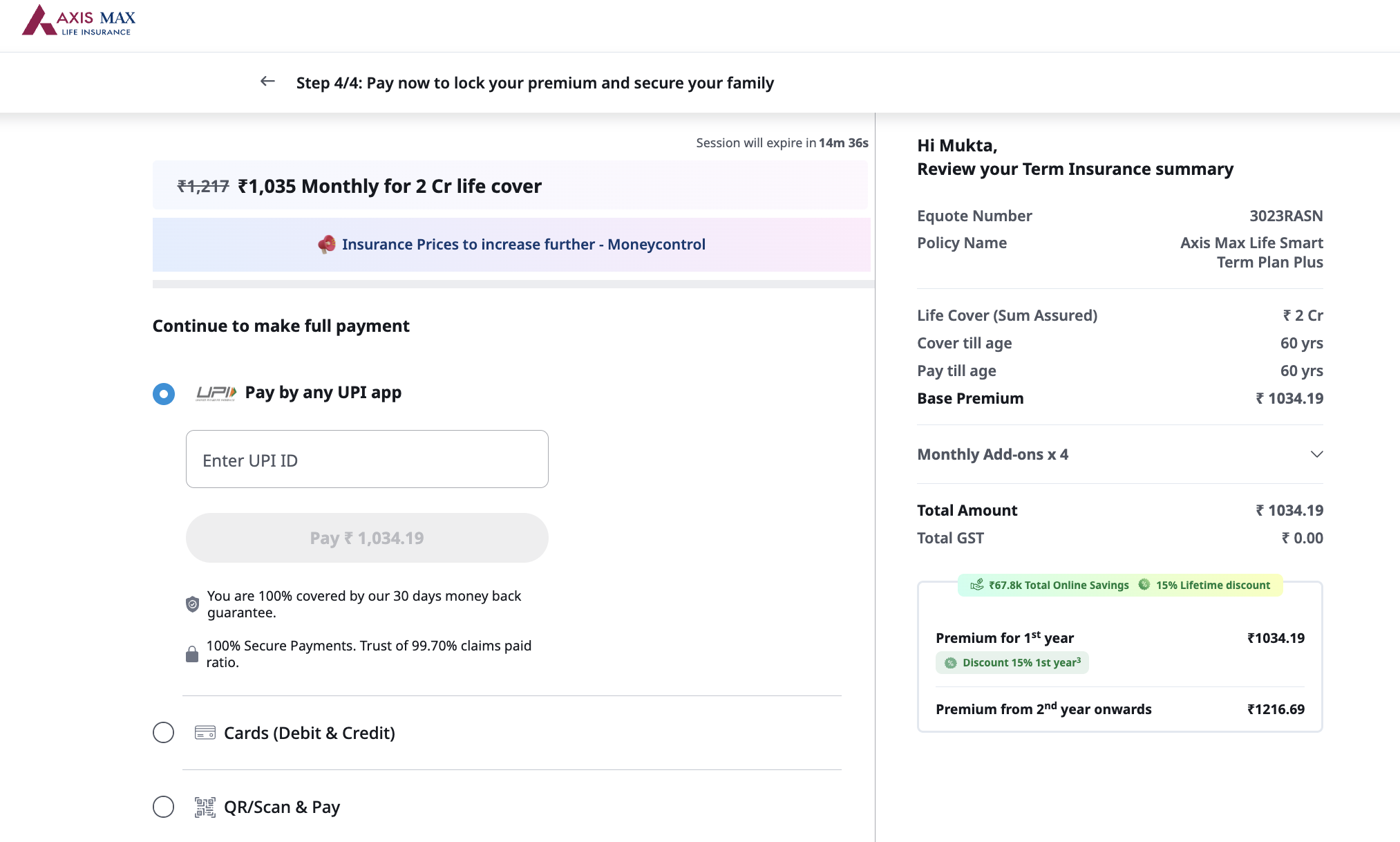

Step 5. View your premium quote: The calculator instantly displays your estimated premium on the screen, usually at the bottom left corner. Do check both the first-year and second-year premiums carefully, as prices may change after the initial year.

Step 6. Modify and finalize: You can adjust your coverage amount, policy term, or rider options to see how each change affects your premium by clicking on the Edit Info button on the top-right corner of the screen.

You’ve completed most of the important steps already; your premium has been calculated, your quote created, and your personal details submitted.

Once you complete the payment and proposal form, your Axis Max Life term plan will be processed for activation. Your plan will activate soon to support your family when needed.

Key Benefits of Using the Axis Term Insurance Calculator

Customizable Coverage

You can easily adjust your sum assured and policy term to find the right balance between affordability and protection.

Accurate Estimates

The calculator provides instant, automated premium results, removing the guesswork and human errors that come with manual calculations.

Easy Comparison

You can evaluate different Axis Max Life term plans and rider options side by side, helping you identify which combination offers the best value.

Affordable Choices

By trying different coverage amounts or terms, you can find a plan that aligns with your budget without compromising on essential benefits.

Tax Advantages

Premiums paid for Axis Max Life term plans may qualify for tax deductions under Section 80C (under the old regime) and Section 10(10D) of the Income Tax Act.

Why Talk to Ditto for Your Term Insurance?

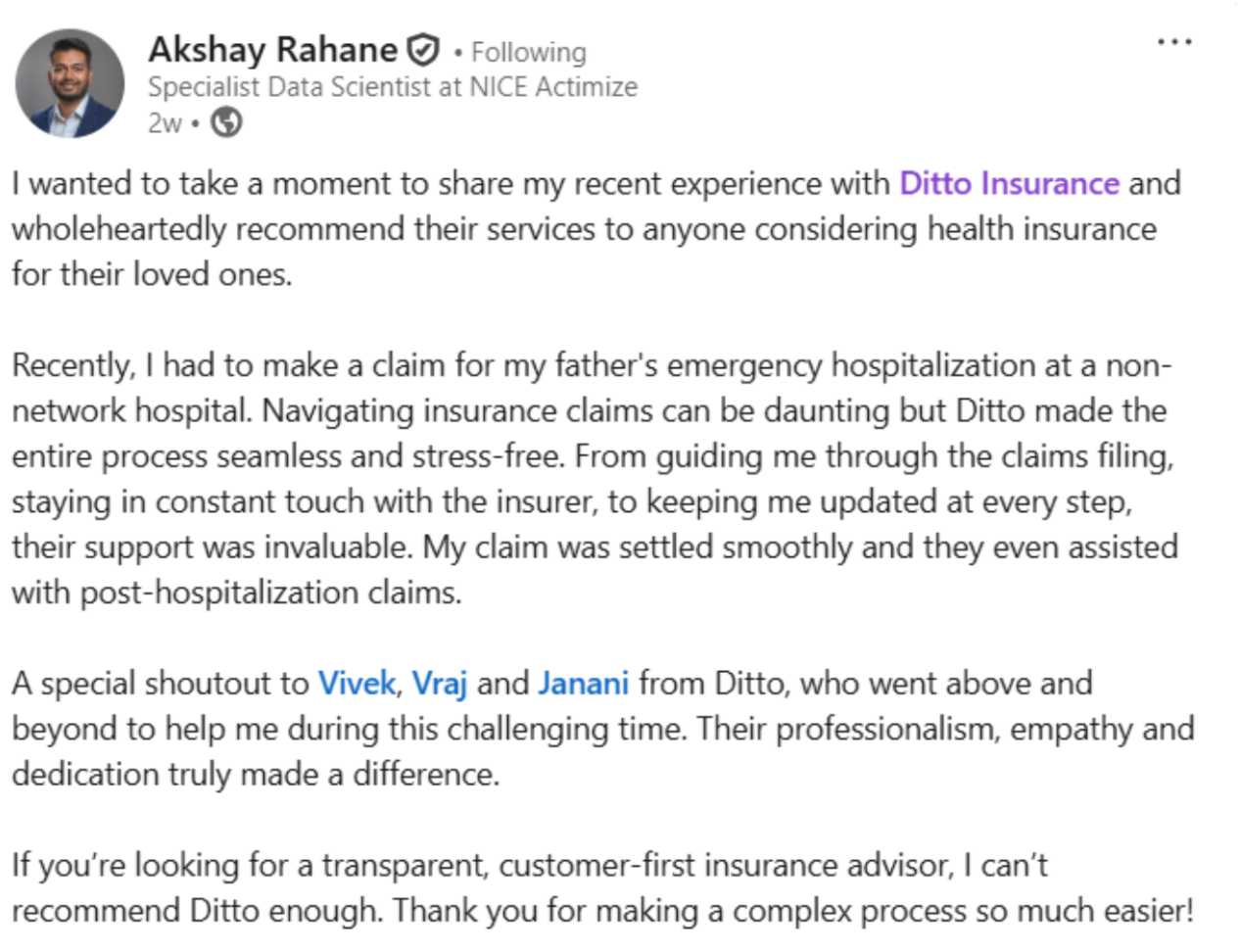

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right health insurance policy. Here’s why customers like Akshay love us:

✅ No Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅ Dedicated Claim Support Team

✅ 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

When using the Axis Term Insurance Calculator, keep these points in mind to make the most informed decision.

- Calculator results provide an indicative premium; the final quote may vary due to health conditions or lifestyle factors.

- Adding riders enhances your protection but will increase your premium.

- Longer policy terms and higher coverage amounts lead to higher premiums.

- Always enter accurate information for the best estimate.

This approach ensures you understand the calculator’s limitations while leveraging its convenience for smart insurance planning.

FAQs

What features does the Axis term insurance calculator offer?

The calculator provides instant premium quotes, allows input customization, and offers accurate, transparent estimates.

Can I use the Axis term insurance calculator for all Axis Max Life term plans?

Yes, the calculator mainly covers the primary Axis Max Life Term Plan, as it usually has a single variant.

Does the calculator show GST-inclusive premiums?

No, since GST has been removed on term and health insurance, the premiums shown are exclusive of GST.

Can I buy the plan directly after using the calculator?

Once you generate a quote, you can proceed to buy your chosen plan online instantly.

Is it necessary to add riders while calculating the premium?

No, adding riders is optional; however, some free add-ons are automatically included to enhance your coverage.

Last updated on: