| How to Appeal for a Rejected Health Insurance? Review the claim rejection letter from your insurer. According to IRDAI guidelines, all insurers must clearly state the reason for rejection, along with the relevant policy clause. If your cashless claim was denied, you can submit a reimbursement claim by providing all necessary documents after treatment. If your claim continues to be rejected or remains unresolved, escalate directly to the Grievance Redressal Officer (GRO), IRDAI’s Bima Bharosa, and then the Insurance Ombudsman with consumer courts as a final escalation step. |

Everyone wants their claim settlement process to be smooth. Except sometimes, your insurer may come back with a cold response stating that your claim has been denied. Whether it’s a cashless or reimbursement claim denial, missing paperwork, or a vague reason like ‘medically unnecessary,’ the system can leave you disappointed.

The positive part is that you have the right to reverse your insurer’s decision through the escalation paths provided by IRDAI.

At Ditto, we guide more than 500 policyholders through claims, appeals, and even Ombudsman cases every month.

In this guide, we will break down why health insurance claims get denied, what immediate steps you should take, how to strengthen your appeal, and the official IRDAI rules that work in your favor.

Bought a policy through Ditto? Reach out to our claims team for further assistance

What are the Different Ways to Appeal for a Rejected Health Insurance?

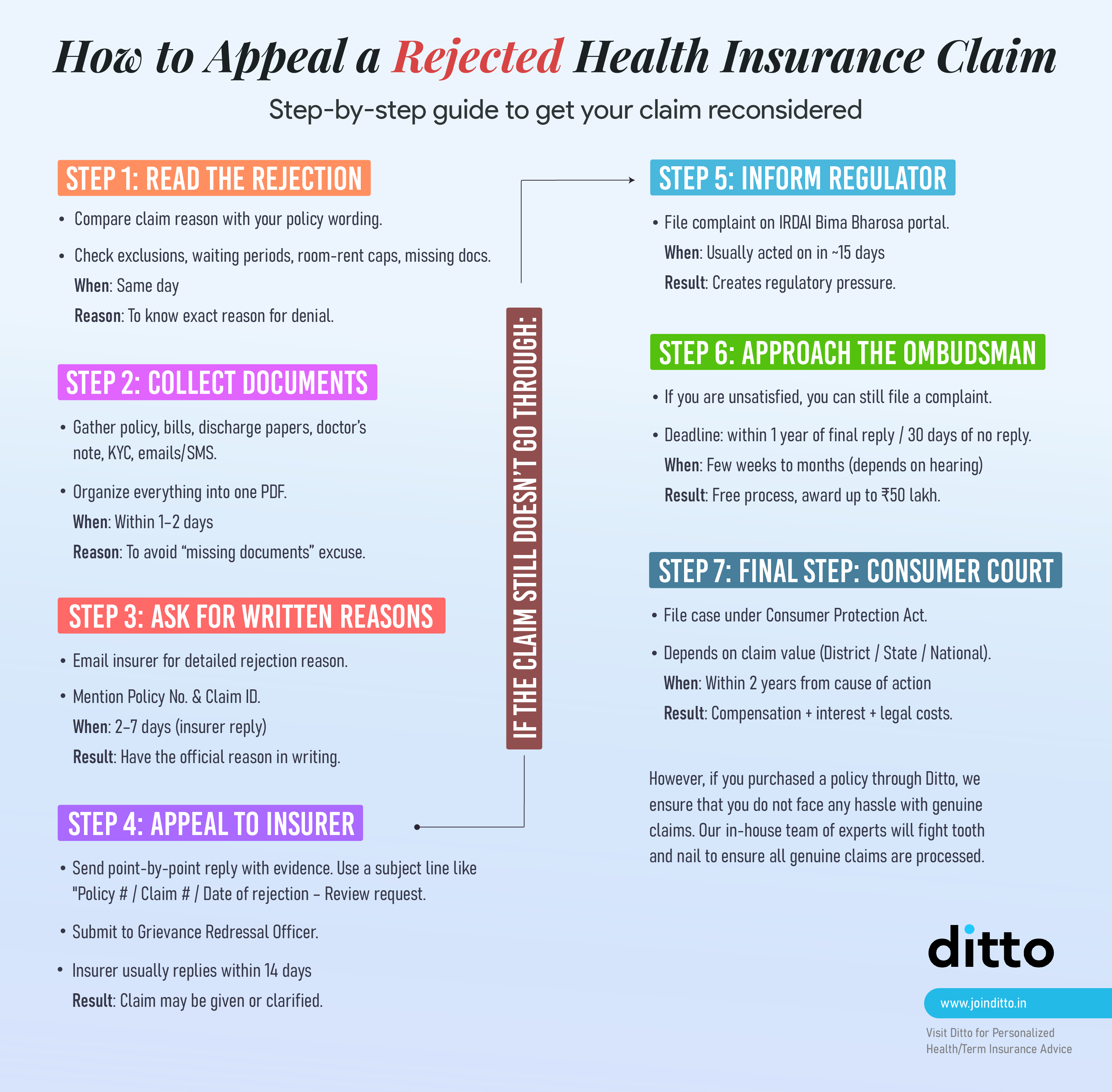

The health insurance claim appeal process is designed in a way that you get ample opportunities to reverse the insurer’s decision. Here’s how to go about the process in different ways once you review the claim rejection letter from your insurer:

1) Re-read the Rejection

Match the insurer’s cited clause to your policy wording. Then, check waiting periods, exclusions, sub-limits, room-rent cap, pre-/post-hospitalization windows, and other missing documentation.

2) Build your Dossier

Collect a complete set of documents, including the policy, claim form, hospital bills, discharge summary, diagnostics, treating doctor’s note on medical necessity, KYC, and all email/SMS trails.

3) Re-submit as a Reimbursement Claim

In case the insurer denies your cashless claim, you can apply for reimbursement by providing all the required documentation after treatment. Include prescriptions, investigation reports, discharge summary bills, ID proof, and your bank details.

Remember: The insurer may also reject reimbursement claims if any documentation is missing, if intimation is not done within stipulated time limits, or if the medical justification is weak.

4) Escalate to the Grievance Redressal Officer (GRO)

If the insurer continues to deny your claim or it remains unresolved, escalate the matter directly to the GRO of the company. You can send them an email with details of your health insurance policy and claim details, why you believe the claim is valid, and other supporting documents and medical justifications.

Most insurers list their GRO details on the official websites. Check out their consolidated list for further information.

Note: GROs must respond within 15-30 days of receiving your claim appeal. However, if you do not receive any satisfactory response, move to the next step.

Here’s the grievance redressal contact details HDFC ERGO provides to policy buyers:

5) Register a Complaint on IRDAI’s Bima Bharosa Platform

If the insurer’s GRO is not able to resolve your claim settlement issue, escalate it to IRDAI’s Integrated Grievance Management System (IGMS), also called the Bima Bharosa Platform.

You can register complaints, get token numbers, and track the status of your complaint easily on this platform. Insurers are mandated to check any complaints registered through the IGMS and the IRDAI may take enforcement action, such as monetary penalties or orders for regulatory non-compliance, including breaches of claim-settlement timelines.

You can take advantage of this facility if your insurer misses claim settlement timelines, denies it without any valid explanation, or ignores your grievance completely.

6) Contact the Insurance Ombudsman

If the insurer doesn’t resolve your claim settlement issue within the stipulated time (around 15 days), even after receiving Bima Bharosa’s intimation, you can move to the Insurance Ombudsman. The independent authority resolves disputes between insurers and customers at zero cost to either party.

The timeline for resolving the matter is generally 2-6 months, depending on the location and complexity of your case.

| Did You Know? If the Insurance Ombudsman rules in your favor: 1) The insurer must comply within 30 days of receiving the award. 2) If they don’t, they must pay you ₹5,000 per day for each day of delay. 3) This penalty is in addition to any penal interest under the Insurance Ombudsman Rules, 2017. Exception: If the insurer appeals within 30 days, the penalty doesn’t apply—but they must inform you about the appeal. |

Ditto’s Tip: Include relevant documents, correspondence with the insurer, and GRO complaint details for faster resolution. Here is a specimen complaint form.

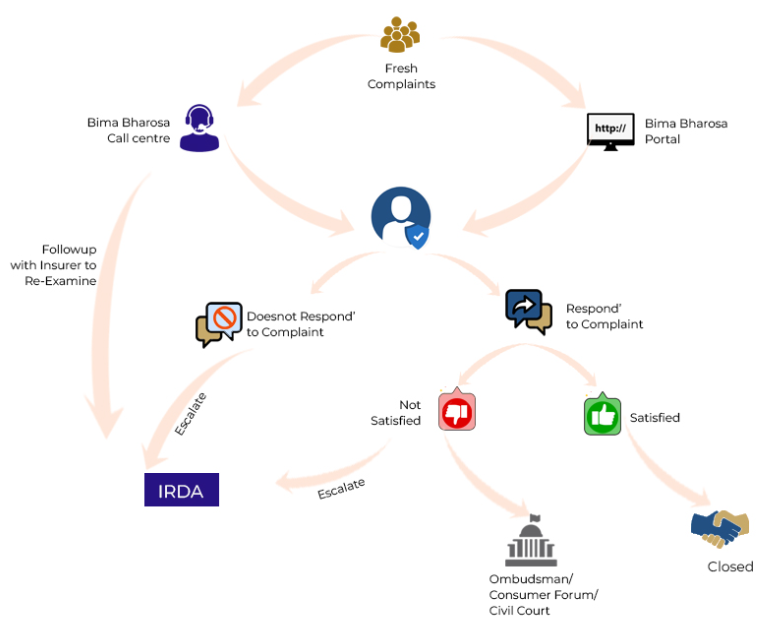

Source: https://bimabharosa.irdai.gov.in/Home/OurProcess

| IRDAI’s Take on Health Insurance Claim Rejections The IRDAI has laid out clear timelines and transparency guidelines for insurers, especially for claim settlement processes: a) All claims must be processed within 30 days of receiving the last required document b) If further investigation is needed, insurers usually get up to 45 days c) Delays often attract interest at 2% above the bank rate d) All denials must be explained clearly in rejection letters, citing the exact policy clause e) Grievances should be resolved within 15 days, and any unresolved case can be escalated on Bima Bharosa (IGMS) and then to the Insurance Ombudsman. f) Policyholders can easily register and track complaints online on IRDAI’s Bima Bharosa (IGMS) portal. Knowing these rules in insurance gives you leverage during appeals and escalations. |

How to Appeal for Rejected Health Insurance Through Different Platforms?

| Forum | When to use | Caps / Powers | Cost | Key deadline(s) | Typical pros |

| Insurer GRO | First appeal after rejection | N/A | Free | Act promptly; keep all within a few days of rejection | Fastest fix if it’s a documentation/interpretation issue |

| IRDAI “Bima Bharosa” | If GRO isn’t responsive or you want regulator visibility | Regulator follow-up with insurer | Free | Register as soon as you file with GRO | Creates a case ID; improves responsiveness |

| Insurance Ombudsman (CIO) | After insurer response is unsatisfactory or 30 days pass with no reply | Can award up to ₹50 lakh | Free | File within 1 year of insurer’s final reply (or after 30 days of silence) | Quick, document-light, consumer-centric |

| Consumer Court/Commissions | For higher compensation/interest or complex disputes | District ≤₹50L; State >₹50L–₹2Cr; National >₹2Cr | Court fee (modest) | 2 years limitation (condonable for sufficient cause) | Binding orders; broader reliefs |

What If the Claim Appeal Is Still Denied?

In the rarest of rare cases where the insurer and even the insurance ombudsman don’t rule in your favor, but you are sure your claim is correct, you have one more option.

Under the Consumer Protection Act, 2019, health insurance falls under the category of “services,” which means that unfair claim denials can be legally challenged. Consumer courts (District, State, or National Commissions, depending on the claim amount) can direct insurers to honor valid claims and pay compensation for delays. They may even impose penalties for deficiency of service in some cases.

However, litigation can be time-consuming and effort-intensive, but it remains the last resort when all other escalation mechanisms have failed.

How to Avoid Claim Rejections in the Future?

Nobody likes dealing with paperwork, especially during a medical emergency. This is why we recommend a list of simple habits that can go a long way in ensuring your future claims proceed smoothly.

Here’s what you can do:

1) Get Pre-authorization for Planned Treatments

Always check if your insurer requires pre-approval for surgeries or non-emergency hospitalizations. It’s one of the most common reasons for health insurance claim rejections.

2) Consider Only Network Hospitals

Choosing a network hospital can make cashless claims much smoother and also lower the chance of disputes later.

Store Every Document

Save all medical documentation, even the ones that seem minor, such as the doctor’s prescriptions, hospital bills, test results, and discharge summaries. Having complete documentation can make your claim stronger and is less likely to be denied.

3) Understand Your Policy

Read your policy document to learn what’s covered, what’s excluded, and if you have to serve any waiting periods.

4) Inform your Insurer About Any New Diagnoses or Ailments

If you’re ever diagnosed with something, immediately inform your insurer so that you can get an acknowledgment proof. This helps you avoid hassles during potential future claims.

How Long Does the Review Take for the Appeal?

- IRDAI generally mandates a maximum of 30 days for insurer-level claim resolution after they receive all documents.

- External review by the Ombudsman may often take up to 45–60 days, depending on the case complexity.

- The total appeal duration can usually range from 1 to 2 months in most cases, if the documentation is complete.

This process ensures insurance companies act promptly and fairly, but the applicant must be proactive in meeting documents and appeal deadlines to avoid delays.

Ditto’s Take on Health Insurance Claim Rejections

A weak appeal may often lead to another rejection. According to Akshat, our Claims Manager, here’s how you can make your appeal as strong as possible:

1) Get a Medical Justification

Ask your doctor to write a letter explaining why the treatment was deemed medically necessary. This helps you prove that it wasn’t optional or cosmetic in nature.

For instance, claims for hospitalization due to fever, dengue, or malaria may be denied with the reasoning that it was not medically required. In such cases, you can get a treating doctor’s certificate (TDC) to explain the necessity of admission.

Conversely, if your past medical records are unavailable, your doctor can provide a certificate stating when the condition was first diagnosed and how long it existed. This helps establish the necessity for treatment and prove your medical history.

2) Submit Complete Documentation

Include all relevant records such as medical test reports, doctor’s prescriptions, indoor case papers, discharge summaries, and hospital bills, among other things. A few people may miss paperwork even at this stage, which is one of the top reasons appeals get rejected.

3) Be Specific and To the Point

You should explain clearly what the treatment was, why it was needed, and why you believe your claim should be approved in your appeal letter or the email sent to the GRO.

Pro Tip: Always avoid vague or emotional language and focus on facts and timelines.

4) Stay Organized and Follow Up

Track your dates of communication, names of people you spoke to, and reference numbers to expedite your claim appeal. Follow up regularly and get everything in writing.

Note: If the reply from the insurer is unsatisfactory or they do not respond within the prescribed time, you may approach the Insurance Ombudsman under the 2017 rules.

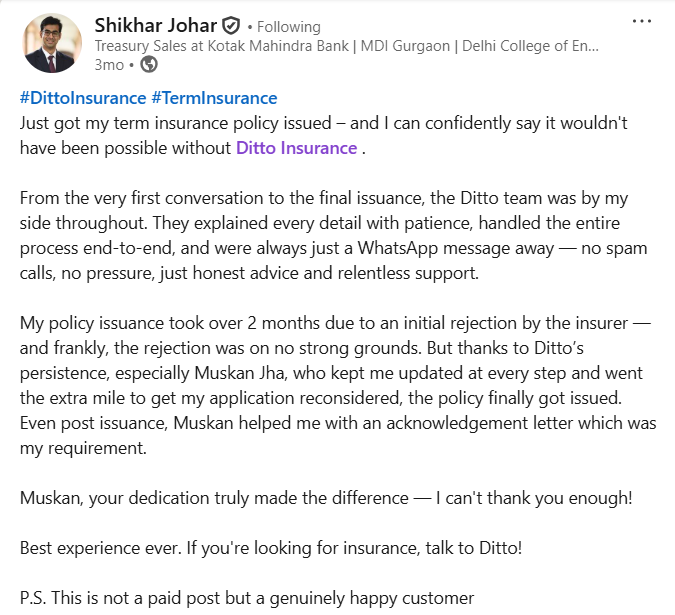

Why Choose Ditto for Health Insurance

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Shikhar below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation here. Slots are running out, so make sure you book a call now.

How to Appeal for a Rejected Health Insurance: Final Thoughts

A denied claim isn’t a final decision; it’s just a hurdle. With medical justification, proper paperwork, and awareness of IRDAI timelines, you can get the rejections reversed. Even if your insurer won’t budge, you still have other escalation routes, such as the Ombudsman and IRDAI’s grievance system.

So don’t give up at the first “no” from your insurer. Instead, consider it as the beginning of the process. And if you’d rather not handle the issues alone, chat with a Ditto advisor, and we’ll help you with the appeal and documentation. Please note that this applies only if you’ve chosen us as your registered intermediary in the transaction.

FAQs

What are two primary reasons for claim rejections in health insurance?

The two most common reasons are:

- Incorrect or incomplete documentation (such as missing signatures, forms, or bills)

- Policy-related issues, such as the treatment not being covered (e.g, filing for a maternity claim when the insurance plan does not cover it)

Which health insurer denies the most claims?

Claim denial rates can vary from year to year and are publicly reported by IRDAI and mentioned in the insurer’s public disclosures (NL 37 Form). For the most recent data on insurer claim ratios and denial rates, we recommend consulting the IRDAI Annual Report or seeking guidance from a Ditto advisor based on updated insights.

Can I appeal a rejected claim after the deadline has passed?

Yes, while it is crucial to submit an appeal within the insurer's specified deadline, some insurers may allow late appeals if there are strong, genuine reasons for the delay. It is always best to immediately contact the insurance company to discuss the situation and check if the appeal can still be considered. Remaining proactive and providing all relevant documents increases the chances of acceptance.

Last updated on: