Quick Review

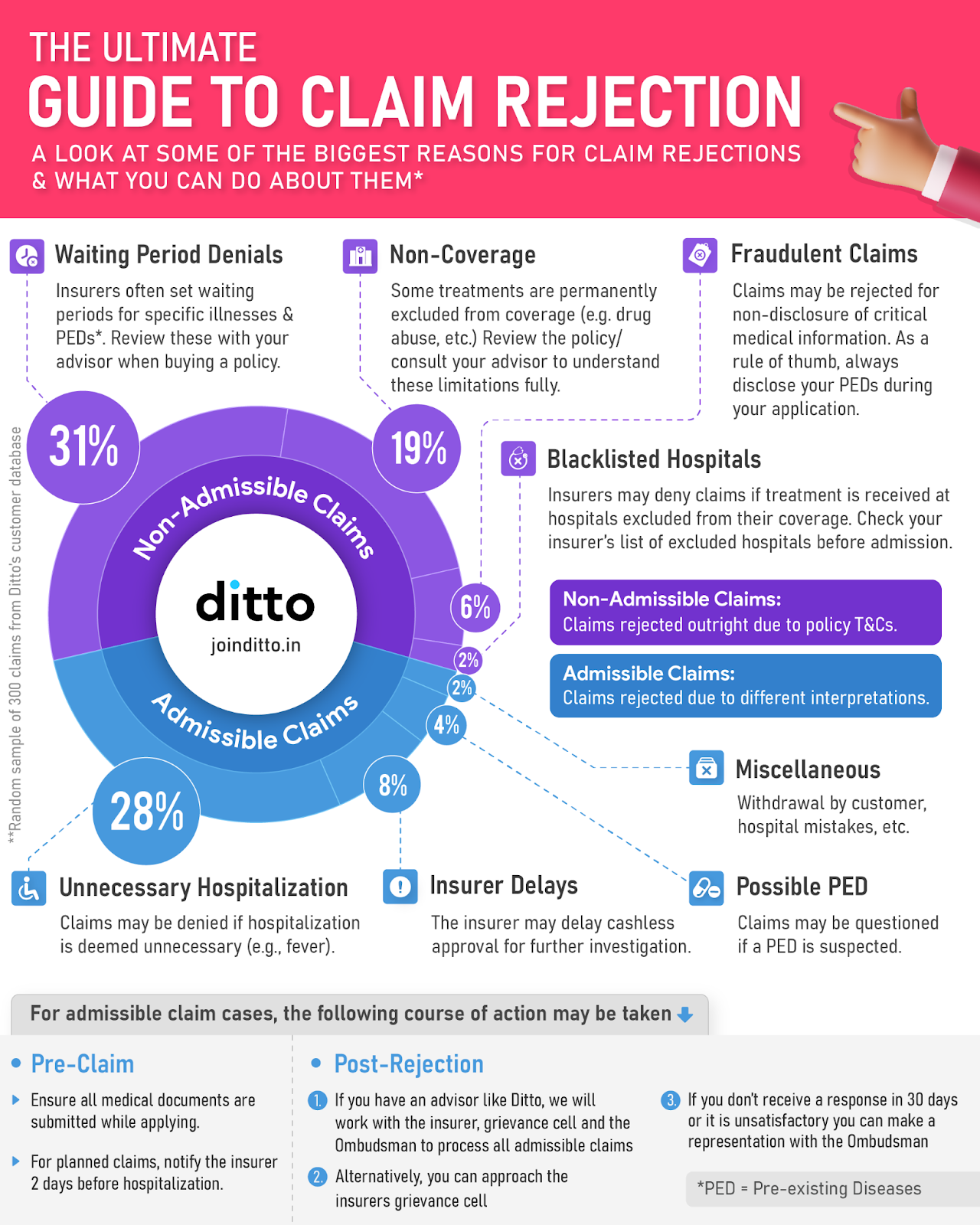

Health insurance claim rejections often don’t happen because insurers “refuse to pay,” but because policyholders miss small yet critical details. Non-disclosure of medical history, claims made during waiting periods, excluded treatments, and room rent limits are among the most common reasons claims get reduced or denied. This is why understanding your health insurance policy details is crucial as it determines when, how, and how much your insurer will pay during a medical emergency.

In this guide, we explain the key health insurance policy details you need to check and understand so you can avoid claim rejections and protect your savings.

What are the Key Health Insurance Policy Details?

- Types of Plans: Understand the various health insurance plans available, like individual plans, family floater plans, and senior citizen plans, each designed to meet different needs and budgets.

You should also know the difference between top-up and super top-up plans, group cover vs retail policies, and benefit-based policies (like hospital cash or critical illness) versus indemnity-based policies (policies where only the actual medical expenses incurred are paid by the insurer, up to the sum insured). - Sum Insured: The sum insured is the maximum amount your insurer will pay in a single policy year. You should choose it based on your age, city, family size, medical history, lifestyle, and rising healthcare costs. If you live in a metro city, a higher sum insured is recommended.

- Waiting Periods: Waiting periods define when certain treatments become claimable. Most policies have a 30-day initial waiting period for illnesses, while accidental claims are covered from day 1. Specific diseases like cataract or hernia usually have a waiting period of up to 2 years. Pre-existing diseases such as diabetes or blood pressure are covered only after 2–3 years. Maternity benefits also come with a waiting period ranging from 9 months to 4 years.

- Inclusions (What the Policy Covers): Inclusions explain what medical expenses your policy will pay for. These usually include in-patient hospitalization, day care procedures, pre- and post-hospitalization expenses, AYUSH treatments, domiciliary hospitalization, ambulance charges, and organ donor expenses. You should always check coverage limits and conditions for each inclusion.

- Exclusions (What the Policy Does Not Cover): Exclusions list treatments and situations where claims will not be paid. There are some permanent exclusions that no policy covers. Temporary exclusions apply due to waiting periods or specific policy clauses. Carefully review and understand the exclusions section well to avoid claim rejections.

- Policy Clauses That Affect Claims: Certain clauses directly impact your final payout. A co-payment clause requires you to pay a fixed percentage of the bill. Disease-wise sub-limits cap the payout for specific illnesses. Room rent caps restrict the room category you can choose and may reduce the overall claim amount if exceeded.

- Renewal, Portability, and Migration Rules: Most health insurance policies offer lifelong renewability, provided you renew on time. Portability allows you to switch insurers without losing waiting period benefits, while migration lets you move to another plan within the same insurer.

Note: Always disclose your complete medical history when buying a policy. Hiding a pre-existing condition or illness can lead to claim rejection later.

In FY 2024–25, health insurers in India rejected 7.92% of health insurance claims and did not pay nearly 14% of the total claim amount, adding up to over ₹29,000 crore, according to the latest IRDAI report.

Check out the infographic below to see the biggest reasons behind claim rejections and how you can avoid them.

Health Insurance Claims Process and Documentation

Understanding the claim process is as important as knowing your coverage.

- Documents Required: You must check document requirements carefully at the time of purchase and during claims. Buying a policy requires KYC, age proof, and medical disclosures. Cashless and reimbursement claims need specific hospital documents. Missing or incorrect paperwork often causes claim delays or rejections.

- Claim Process (Cashless and Reimbursement): Cashless claims are available at network hospitals where the insurer settles the bill directly after approval. Reimbursement claims require you to pay first and submit documents later. Knowing the timelines and procedures for both is a crucial part of health insurance policy details.

Health Insurance Premiums, Benefits, and Add-Ons

These factors affect the cost of your policy and the value you receive.

- Factors That Affect Premiums: Your premium depends on your age, medical history, family size (for family floaters), sum insured, add-ons selected, city of residence, and medical inflation. Premiums generally increase with age, but choosing the right health plan can help control long-term costs.

- In-built Features That Benefit Policyholders: Modern health insurance plans offer features like restoration benefits, no claim bonus, free annual health check-ups, wellness programs, etc. These features significantly increase the overall value of your policy.

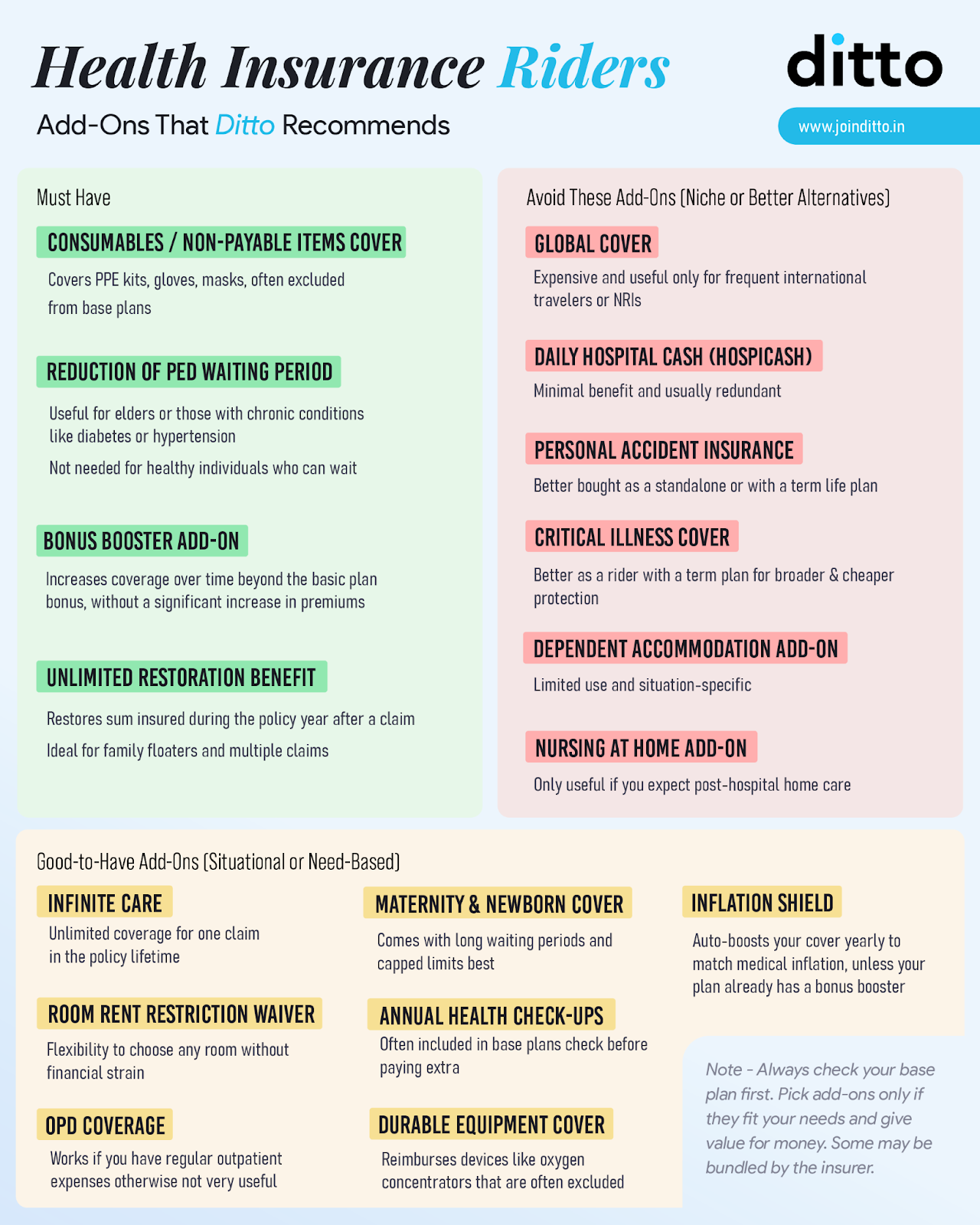

- Add-ons to Consider Based on Your Needs: Add-ons help you customize coverage for specific needs. Choose add-ons based on your life stage and health risks. Find the health insurance riders recommended by Ditto experts, in the infographic below.

Insurer Performance Metrics to Check Before Buying Health Insurance

Before you finalize a plan based on health insurance policy details, you must check the company's track record. These metrics are of utmost importance before purchasing a policy.

Key Performance Metrics of a Health Insurer

Claim Settlement Ratio (CSR)

This shows the percentage of claims the company pays out. Aim for an insurer with CSR above 90%.

Incurred Claim Ratio (ICR)

This shows how much the company spends on claims versus premiums collected. A healthy ICR is between 50% and 80%.

Network Hospitals

A larger network ensures easier access to cashless treatment. An ideal network would cover 10,000+ hospitals. Always check if network hospitals are located near you.

Complaint Volume

Check how many complaints users file per 10,000 claims in a financial year. Lower is always better.

Annual Business Volume

A high volume suggests a stable company that can handle large payouts.

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Here’s why customers like Abhinav love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

Health insurance policy details are the roadmap to your financial and medical security. From sum insured and waiting periods to inclusions, exclusions, and claim processes, every section matters. Read them carefully, check insurer metrics, and consider add-ons or in-built features to ensure you select a policy that works when you need it most.

Note: This list of health insurance policy details is not exhaustive, but it highlights the essential points you should review before purchasing and during the free-look period. If you notice any errors or omissions in the document after the policy is issued, contact your insurer immediately to have them corrected without delay.

Frequently Asked Questions

Last updated on: