How to Claim Your Aditya Birla Health Insurance?

Aditya Birla lets you file both cashless and reimbursement claims. For cashless treatment, inform your insurer through email or the website. If the hospitalization is planned, notify them 3 to 5 days before admission. For emergencies, inform them within 24 hours of getting admitted or before discharge (for daycare treatments).

If you choose a non-network hospital, you must file a reimbursement claim. Pay the bills yourself, collect all documents, and submit them within a week after discharge.

Aditya Birla’s average claim settlement ratio from 2022 to 2025 is 96%, which reflects that your claims will be settled in time without delays.

Introduction

Finding it hard to understand how to claim your Aditya Birla Health Insurance? Many people feel unsure about opting for cashless treatment or filing a reimbursement claim. At Ditto, we explain every step easily so you know what to do when you or your family needs medical help.

This guide helps you understand:

- How to claim your Aditya Birla health insurance on a cashless basis

- How to claim Aditya Birla health insurance on a reimbursement basis

- Documents required for your claim procedure and crucial tips

Need help purchasing a health insurance policy? Book a free consultation call with us, and our expert advisors will help you out.

Did You Know?

As per IRDAI Guidelines, if your claims are not settled within 45 days after document submission, your insurance company must pay interest at 2% above the bank rate from the date the last required document is received.

How to Claim Your Aditya Birla Health Insurance on a Cashless Basis?

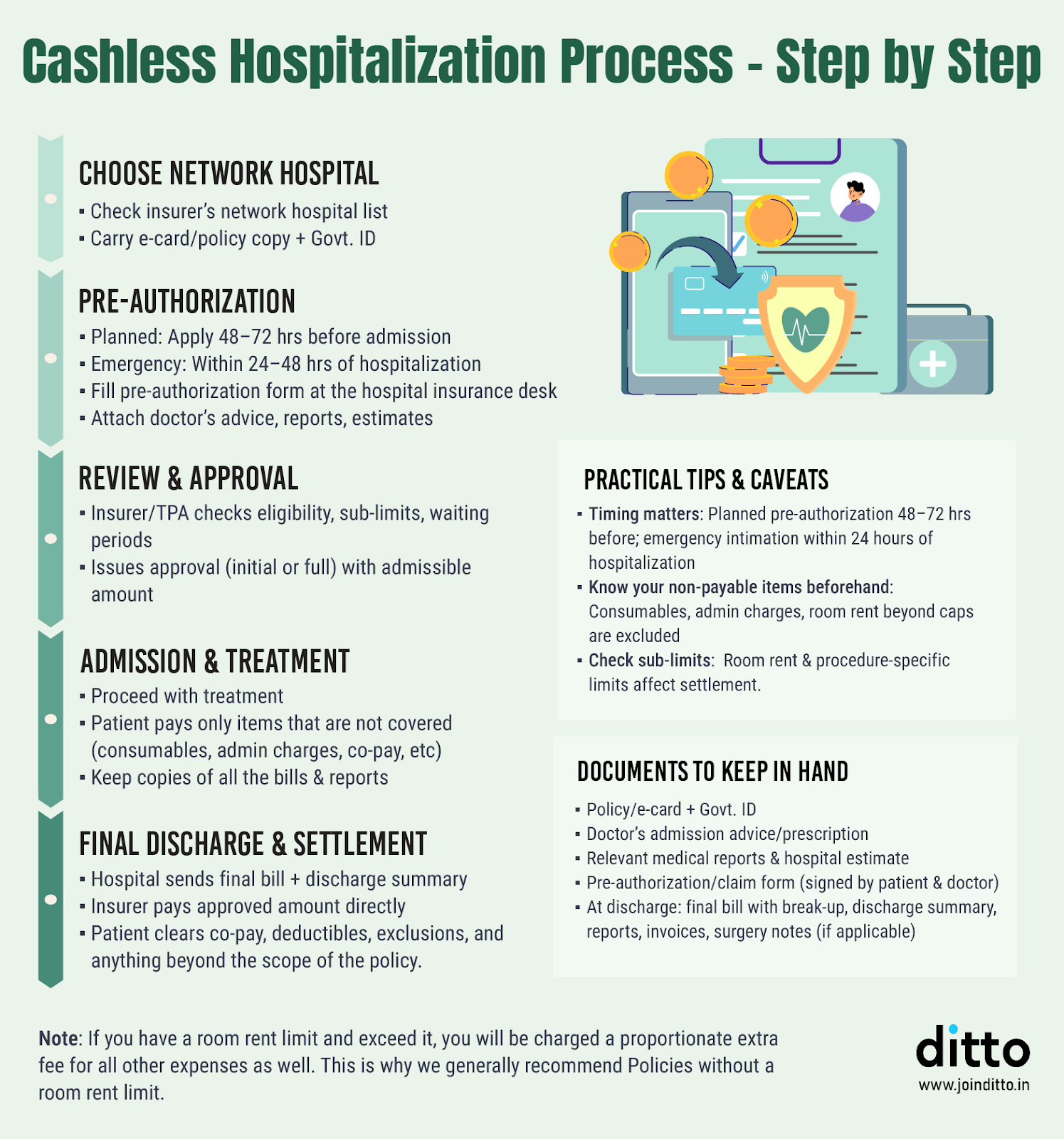

As discussed in the infographic below, a cashless claim allows the hospital to settle bills directly with the insurer. You avoid any major upfront payment. Here is the step-by-step process:

- Select a Network Hospital: Pick a hospital from Aditya Birla’s network. Locate the nearest one from over 12,000 hospitals.

- Show your Health Card: Present your Aditya Birla e-card or policy number at the help desk to verify patient details. Next, ask for a pre-authorization form and fill it carefully. Here’s what it looks like.

- Submit the Pre-authorization Form: The hospital sends this form to Aditya Birla for approval.

- Wait for Approval: The insurer checks the request and sends a decision within one hour.

Let’s take a look at some examples of how offline and online procedures differ in cashless claims:

- Online: A patient is scheduled for a knee replacement. They upload their reports and pre-authorization form through the Aditya Birla app before admission. They check the approval status online. Once approved, the hospital receives confirmation, and the treatment starts.

- Offline: A customer has sudden abdominal pain and needs an appendectomy. They fill out the pre-authorization form at the hospital desk and submit the reports. The hospital sends the papers to the insurer and gets cashless approval for the surgery.

Take Note: Since Aditya Birla Health Insurance is one of Ditto’s trusted partner insurers, we make the process simple for you. If you brought your health plan through us, get in touch with our experts for claim assistance.

How to Claim Your Aditya Birla Health Insurance on a Reimbursement Basis?

You file a reimbursement claim when you receive treatment at a non-network hospital or when the hospital refuses cashless support. Here is the simple flow:

- Inform your health insurer about the hospitalization, preferably before getting admitted or at the most within 24 hours of being hospitalized.

- Collect all the invoices generated by your hospital and pay the final bill from your own pocket.

- Post-discharge, fill the claim settlement form and submit it to your insurer.

- Once the insurer reaches out to you, within 15 working days, submit the documents.

Let’s take a look at some examples of how offline and online procedures differ in reimbursement claims:

- Online: A patient is treated for pneumonia at a hospital outside the network. After discharge, they scan their bills, prescriptions, and discharge papers. They upload everything to the Aditya Birla portal and submit the claim. They track the claim online until it is settled.

- Offline: A person fractures their arm and gets treated at a non-network hospital. After recovery, they visit an Aditya Birla branch with all original documents. They submit the form, bills, X-rays, and discharge summary. The insurer verifies the papers and credits the approved amount.

How to Download Your Aditya Birla Health Insurance Claim Form?

You can download the claim form through one of these routes:

- Visit the official Aditya Birla Health Insurance website and select the claim section.

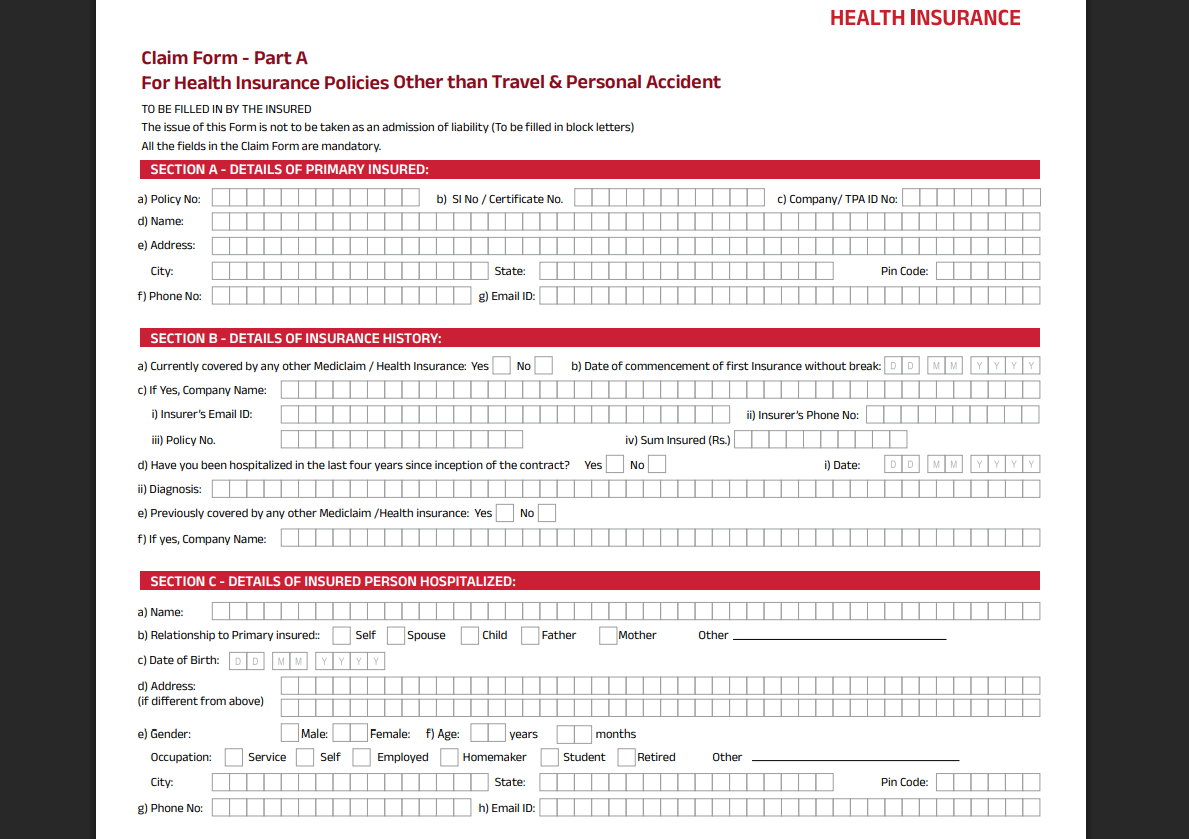

Here’s a snippet from Aditya Birla's health claim form:

- Use the customer portal or mobile app. Log in to ABHI Platform (ABHI Website/Active Health app) using your registered mobile number or send “Hi” to their WhatsApp number, 8828800035.

- Request the form through the toll-free customer care number at 1800-270-7000.

What Documents Are Required to File an Aditya Birla Health Insurance Claim?

Note: In case of an accident, for both types of claims, you need to submit a FIR or Medico-Legal Certificate (MLC).

Ditto’s Take on Claim Process

Good preparation makes your claim faster and easier. Here’s what you need to do:

- Save your insurer's or TPA helpline number and inform your insurer as soon as you are hospitalized.

- Keep scanned copies of your bills, reports, and discharge papers ready.

- Send your reimbursement claim early and read your policy terms for the exact timelines.

Why Talk to Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Rajan below love us:

- No Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

If your Aditya Birla health claim is rejected, talk to your insurer and ask if you can submit it again. Collect any missing papers and reapply. If that still doesn’t work, you can reach out to the Ombudsman for help.

Still unsure how to file your health claims? Book a free call with us and let our experts help you file your claim.