What is EDLI in EPFO?

You might not be aware of this. But if your company deducts PF from your salary, you already have life insurance by default. Employees’ Deposit Linked Insurance, or simply EDLI, is EPFO’s no-cost, built-in life cover for all employees who contribute to PF. If an employee passes away while still in service, the EDLI scheme promises to pay a lump sum to the nominee.

EDLI scheme benefits not only apply automatically but the clearing process is also remarkably efficient. Only last year, EPFO cleared 74,576 EDLI death claims (over ₹2,000 crore paid out), averaging 300 families a day!

In this guide, you’ll learn:

- What is EDLI in EPFO?

- Key benefits of EDLI in EPFO

- Eligibility criteria for EDLI in EPFO

- Payout calculation method of EDLI in EPFO

- Required documents for EDLI in EPFO

- How to file an EDLI claim?

What is EDLI In EPFO?

Technically, EDLI is a statutory group life insurance linked with your EPF membership. It calls for no medicals, no premium from employees while employers contribute 0.5% of wages (max ₹75/month) toward this cover.

The rule is simple; if one is covered by EPF and passes away during employment, the nominee gets a one-time payment. So, for a nominee, EDLI is an assured benefit.

However, the amount paid is based on the deceased employee’s wages and recent PF balance (pre-defined floor limits and a ₹7 lakh cap applies). All benefits are embedded in the EDLI Scheme, 1976 and directly administered by EPFO.

Your family will still need more than what EDLI pays for unseen emergencies. And nothing does it better than a personal term insurance. Book your free call with Ditto to map your unique life needs for a desired term cover.

Who Is Eligible for the EDLI Scheme?

All EPF members (including permanent, contractual and casual staff) under a company’s payroll are automatically eligible for the EDLI scheme. There’s no minimum years of service required. The “12 months” timeframe only decides whether the nominee gets a guaranteed minimum of ₹2.5 lakh.

Here’s a nominee’s checklist to confirm eligibility before claiming EDLI.

- Ensure the deceased employee was an active EPF-covered member and the death occurred while in service.

- Check if the PF is run via an exempted trust where EDLI benefits still apply (unless the employer has an EPFO-approved exemption for a better-paying group life plan).

- Mention if the deceased worked part-time for more than one employer and PF was deducted (EDLI will still cover). In such cases, EPFO uses the allowed combined PF/wage figures to calculate the amount.

Also, take into account the 2025 EPFO relaxations that broaden EDLI eligibility.

- An employment break of up to 60 days counts as continuous service for the 12-month mandate (guarantees the ₹2.5L minimum pay).

- EDLI coverage applies even if the death had occurred within 6 months of the last PF contribution while the person was still under the employer’s payroll.

- A ₹50,000 minimum pay is allowed for anyone with a very low PF balance (helpful for new joiners or employees in short tenure).

Remember: A nominee won’t be able to file an EDLI claim if the employee's death had occurred after exit from service, crossing a six-month window. This six-month window ensures coverage only for members who were still on the employer’s rolls or whose death happened shortly after exit, within that grace period.

Also, if the employer has an approved EDLI exemption for a superior group life policy [Section 17 (2A)], all claims will be subject to the terms of the other policy and not the EDLI scheme.

Key Benefits of Employees’ Deposit Linked Insurance

EDLI benefits are applicable across all jobs wherever there’s a PF deduction. From zero sign-ups to fast settlement, EDLI packs multiple benefits.

- Access to automatic life cover: If your employer offers PF, you’re by default covered by the EDLI scheme. However, if a company has an EPFO-approved group life plan with superior benefits than EDLI, they might seek an EPFO exemption.

How to Check if You’re Covered by EDLI or a Group Life Plan (GTL):

- No cost to employees: There’s no extra premium to pay for EDLI, other than standard PF deductions from salary (generally 12% of basic + DA).

- Portable protection: If you switch jobs with a new employer that offers EPF, your EDLI cover will continue. So, have the HR tag your existing UAN and start PF deductions. You won’t lose EDLI coverage if you haven’t moved the old PF balance. However, you must transfer it (via Form 13, online) to consolidate earnings and keep it hassle free during a claim.

- Clear payout range for the nominee: EDLI payout for a nominee ranges between ₹2.5 lakh (minimum) and ₹7 lakh (maximum), provided the deceased employee had at least 12 months of continuous service. Small gaps up to 60 days don’t break continuity.

- Low PF balance is not an obstacle: According to a 2025 amendment of EDLI scheme, a minimum ₹50,000 payout to the nominee is allowed for employees who passed away in service with a very low PF balance.

- Fast track settlement: EPFO is very particular about settling EDLI claims. Any pending claims beyond 20 days without a genuine reason attract a 12% p.a. penal interest.

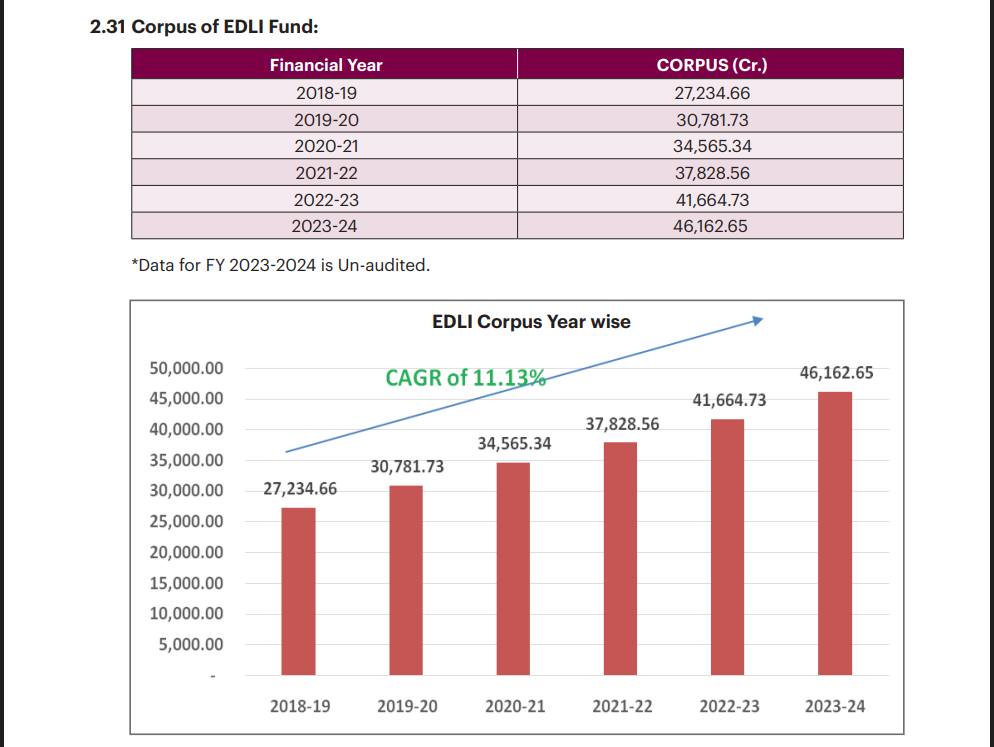

Here’s a snapshot of EDLI fund corpus that rose from ₹27,234.66 cr (2018–19) to ₹46,162.65 cr (2023–24) at 11.13% CAGR.

Source: EPFO Annual Report (FY24 unaudited)

- It’s cause and location-agnostic: It doesn't matter where an employee died, either due to an illness or an accident, in India or abroad. The key factor for an EDLI payout is whether the deceased employee was “in service” under an EPF-covered employer.

How is EDLI Payment Calculated?

EPFO runs its calculations for EDLI payout in two ways, but only one method applies at a time depending on the member’s service continuity and PF balance.

Method 1: Enhanced benefit for 12 months’ of continuous employment

According to Para 22(3) of the EDLI Scheme, this is an enhanced payment option for any deceased employee with at least 12 months of continuous service before death (with 60-days of employment gap allowed). The nominee payout is calculated in parts (wage and PF) according to the following formula:

- Wage part:35 × the average monthly wage of the last 12 months (capped at ₹15,000 if higher)(Max wage part = 35 × ₹15,000 = ₹5,25,000)

- PF part: 50% of the average PF balance over the last 12 months, capped at ₹1,75,000.

- Now both wage and PF parts are added for the final payout and floor/ceiling limits are applied. The minimum floor limit is ₹2,50,000 and maximum ceiling is ₹7,00,000.

Say the monthly wage of the deceased employee was ₹12,000 and the PF balance is ₹2,00,000. Therefore;

Wage Part = 35 × 12,000 = ₹4,20,000

PF part= 50% of 2,00,000= ₹1,00,000 (≤ ₹1,75,000 cap)

Subtotal (Wage+ PF)= ₹5,20,000 (₹4,20,000 + ₹1,00,000)

Final estimated payout = ₹ 5.20 lakh (below ₹ 7 lakh ceiling)

Method 2: Base benefit (for short or discontinuous service)

According to Paras 22(1), 22(1A), and 22(2) of the EDLI Scheme, this track-based payment option applies when the member does not satisfy the 12-month continuity rule. It’s a simple, PF-linked formula that also comes with a 20 % enhancement rule.

So, if the average PF balance is ≤ ₹50,000, the nominee is paid ₹50,000 (as statutory minimum base) + 20% enhancement [(Added under para 22(4)]

Let’s say the average PF balance for an employee (over the last 12 months) is ₹40,000. Since it’s ≤ ₹50,000, the base payout will be ₹50,000. Adding 20% enhancement makes it ₹50,000 × 1.20 = ₹60,000 (final payout)

If average PF balance > ₹50,000, the nominee is paid ₹50,000 + 40% of the amount over ₹50,000 (capped at ₹1,00,000).

If the average PF balance is ₹80,000, we start with a ₹50,000 base payout. Add 40% of (₹80,000 − ₹50,000) = 40% of ₹30,000 = ₹12,000

Add it to base payout = ₹50,000 + ₹12,000 = ₹62,000

Finally, add 20% = ₹62,000 × 1.20 = ₹74,400 (final payout)

Note: Method 1 and Method 2 apply to different eligibility conditions under paras 22 and 22(1A)–22(2).

What Documents Are Required to Claim EDLI Benefits?

As a first step, all EPF members should add or edit their nominees in the UAN portal. Remember, the nominee can’t create or change this after the member’s death. It takes only a few minutes and fast-tracks the claim process later.

When switching jobs, ensure your new employer uses the same UAN and you’ve transferred your previous PF balance to the active account.

How to add/edit your nominee in the UAN portal:

- Log in to the UAN Member e-Sewa portal with your user ID and password.

- Click on “Manage” and choose the E-Nomination option.

- Add family details and assign percentages for each nominee (must be 100% in total).

- Submit/verify (complete Aadhaar-based e-sign if asked).

To file an EDLI claim, you will need the following documents in order:

- EDLI claim form (Form 5IF), filled and attested by the last employer.

- Death certificate of the member

- Nominee’s proof ( nomination on UAN / nomination form copy)

- Nominee’s bank details ( cancelled cheque or first page of passbook in nominee’s name)

- Nominee’s ID/address proof (Aadhaar/other valid ID matching with bank KYC)

- To claim PF/EPS along with EDLI, you need Form 20 (EPF) and Form 10D/10C (pension).

- If the employer is unavailable/business closed, get Form 5IF attested by authorised officials (e.g.,Magistrate, Gazetted Officer, Postmaster, Bank Manager, Village Panchayat Head, MP/MLA, EPF Regional Committee member).

- Ensure the full names (and spellings) mentioned in the documents match across UAN, nomination, and bank account.

What to do if e-nomination isn’t set:

You can still claim EDLI benefits without e-nomination, but it needs extra paperwork to prove legal heir/succession rights. For minor nominees, proof of guardianship, birth certificates, and a declaration are needed. This is a time-consuming process, as besides standard ID proof, one needs several supporting documents as per the local authority and scheme definitions.

Find out more about how a minor can be a nominee in a life insurance policy.

How To Claim Benefits Under EDLI

If the deceased EPF member already had an e-nomination on the UAN portal, a nominee can easily file an EDLI claim. This is by far the fastest way to settle the claim. In case there’s no nomination or any vital documents requiring attestation, you’ve to go with offline submission.

Steps to file EDLI claim online:

- Log in to the UAN Member e-Sewa portal.

- Click on Online Claims, and select the Death Claim workflow.

- Upload Form 20 for EPF, Form 10D/10C for pension, and Form 5IF for EDLI along with other documents like death certificate, nominee ID/bank proof.

- Click Submit to confirm.

- Track status on the portal and respond promptly to any query from EPFO.

Steps to file EDLI claim offline:

- Fill all required forms (Form 51F, Form 20, Form 10D/10C (EPS), death certificate, claimant’s ID, bank proof, and guardianship papers for a minor nominee)

- Get attested copies from authorized officials for organizations that are unavailable or closed.

- Submit all documents to the regional EPF office.

Keep the acknowledgement copies and track progress.

What should you do next as an employee under EPF:

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

The Bottom Line

Most people are clueless about choosing the right life cover. They seldom understand that EPFO-backed options like EDLI are largely employer-dependent with multiple caveats. In the long run, it can seldom cover life’s unique challenges, such as loss of income, disability, or a serious illness.

Instead, opting for pure protection can pay the debts, help reuse funds, and keep things running long after you’re gone. So, quit depending on an option like EDLI for the future. Make a smart move and get the right-sized term insurance plan now. Book a 30-minute free call with Ditto to get started!

Key Takeaways:

FAQs:

Is there a minimum service period to avail of coverage under EDLI?

There is no fixed “tenure” to be covered under the EDLI scheme. What matters is the death of an employee while in service. For the minimum of ₹2.5 lakh to apply, the member should have 12 months’ continuous service (with up to 60 days’ gap allowed). Alternatively, the low balance of ₹50,000 floor under sub-para (1)/(1A) applies.

Can an employee opt for a higher insurance coverage amount under the EDLI?

An employee cannot opt for a higher insurance coverage amount under EDLI. The maximum cap is ₹7 lakh. However, one can always complement it by buying a term insurance plan with riders and stay better protected.

Does EDLI pay for deaths outside India?

Yes, because EDLI benefits are location-agnostic (not geographically restricted). The key factor is death while in service under an EPF-covered establishment.

How long does EDLI claim settlement take?

EPFO has strict instructions in place to settle all EDLI claims in 20 days. If there’s unexplained delay, a 12% p.a. penal interest may be levied and recoverable from the Commissioner’s salary.

What if my employer is not available or business closed and can’t attest to the form?

If your employer is unavailable or the business is closed, EPFO allows attestation by specified authorities, such as a Magistrate, Gazetted Officer, Postmaster, Bank Manager, Village Panchayat Head, MP/MLA, and an EPF Regional Committee member.

Am I covered by EDLI if I change jobs?

Yes, as long as your new employer offers EPF, EDLI coverage will follow.

What if my employer has an approved alternative life policy?

If your employer has an EPFO-approved exemption for a superior group life plan, all claims will be under that policy instead of EDLI.

Can my family claim EDLI if my PF contributions stopped recently?

Yes, a family can claim EDLI if the death occurs within 6 months of the last PF deposit and the person remained on the employer’s payroll.

What documents are needed to file an EDLI claim?

The common documents required to file an EDLI claim are Form 5IF, death certificate, nominee proof, nominee’s bank proof, and ID. Add Form 20 and Form 10D or 10C if also claiming EPF or pension.

Last updated on: