A recent HSBC analysis shows a sharp rise in self-employment in India, jumping from 239 million workers in FY18 to nearly 358 million in FY24. This significant 7% annual growth shows how quickly India is moving toward independent work.

For salaried individuals, employer-backed benefits such as EPF, NPS, and group term and health cover offer some cushioning during unfortunate events. But for the self-employed, there are no employer benefits, and income depends entirely on their own skills, health and reputation. With business loans often tied to them personally, a death or disability can cause the entire income stream to collapse overnight.

This is why term insurance becomes even more important for self-employed people. This guide walks you through the best plans for self-employed individuals, how much coverage to choose, how income proof works, and much more.

How Does a Term Plan Work for the Self-Employed?

It works similarly to any other pure-protection term plan:

- You pay fixed premiums regularly (monthly, quarterly, half-yearly or annually) during the policy term.

- If you pass away during the term, the insurer pays the sum assured to your nominee (family).

- If you survive the term, there is no payout (unless you opted for a return‑of‑premium variant, where premiums are much higher (50-100%) than regular term plans).

Note: You can add optional riders, such as a waiver of premium or a critical illness benefit, to boost protection.

What Are the Leading Term Plans for the Self-Employed?

Before we discuss the list, we assess the plans through our 6-point evaluation framework to ensure strong coverage, clear features, and long-term value.

Axis Max Life Smart Term Plan Plus

HDFC Life Click 2 Protect Supreme

ICICI Prudential iProtect Smart Plus

Bajaj Life eTouch II

Aditya Birla Sun Life Super Term Plan

Key Metrics of the 5 Term Plans

Let’s compare the cost of the top plans with a ₹1 crore cover. The annual premiums below are for males (non-smokers of different ages), with coverage up to age 70 and without 1st year discounts.

How Much Do ₹1 Crore Term Insurance Premiums Cost for Top Plans?

Ditto’s Take: Axis STPP offers strong features at an affordable price for a ₹1 crore cover, earning it a solid overall rating.

What Documents Are Required for the Purchase of a Term Plan?

Here’s a list of documents you will need to apply for a term plan:

- ID Proofs such as PAN Card or Passport

- Photograph

- Address Proof, e.g., Aadhaar Card, Passport, Voter ID, Driving Licence

- Income Proof – ITR and CA-certified computation of income for the last 2-3 years (depending on the insurer). Only income from “Business/Profession” is considered; capital gains, F&O Income, commission-based, or interest income won’t count towards eligibility.

- Existing policy details, if any

- Bank/NEFT Details, e.g., Cancelled cheque or bank statement with account holder name, MICR, IFSC, and account number (depending on the insurer)

- Medical history details and reports (if any)

How Much Coverage Should a Self-Employed Person Choose?

At Ditto, we use the expense and liabilities replacement method to estimate the term cover you require. To get a better understanding, use this online calculator to find the ideal cover for you.

Why Should a Self-Employed Person Purchase a Term Plan?

Protection from Income Fluctuations

Security for Long-Term Goals

Shield for Personal Assets and Debts

High Coverage at Low Cost

What Riders Are Most Important for Self-Employed Individuals?

Term riders add valuable protection at a small extra cost. The most useful riders for self-employed people are:

- Premium Waiver Rider: If you face a disability or a serious illness, this rider waives future premiums while keeping your policy active.

- Critical Illness Rider: This rider pays a lump sum if you are diagnosed with a major illness. Self-employed people often do not have sufficient emergency funds or a steady income during treatment, so this rider helps maintain cash flow.

- Disability Cover (Accidental Total & Permanent Disability): This rider pays a benefit if you permanently lose the ability to work. Unlike the base term plan, you cannot choose your payout format.

The insurer decides whether the benefit is paid as a lump sum or monthly, and you must purchase the rider from the same insurer as your base policy.

For example, HDFC Click2Protect Supreme’s Income Benefit Rider replaces regular earnings to support your family’s ongoing expenses.

Check out this infographic to understand the essential term plan add-ons you can choose during purchase:

Which Premium Paying Term Works Best for Self-Employed?

Self-employed people often try to finish payments early when income is steady or when business is doing well. If you receive bonuses, seasonal profits or large one-time payments, a limited pay option can work better. You can go with any of the following options:

- Limited Pay: You pay premiums for a shorter duration, like 5, 10, or 15 years, but stay covered for the full term. Many self-employed people prefer this because they want to finish commitments early rather than pay for decades.

- Regular Pay: If your income is stable most of the year and you do not want high yearly payments, regular pay works fine. You pay a smaller amount every year until the end of the policy term.

At Ditto, we recommend limited pay for self-employed people as it ensures you finish payments during your best earning years and removes the risk of your policy lapsing later in life.

Can a Self-Employed Person Buy a Term Plan Without Income Proof?

Buying a term plan without income proof is possible, but with conditions. Insurers need to ensure that the coverage amount matches your financial profile.

If you do not have ITRs, salary slips, GST reports or bank statements, the insurer may cap the sum assured or ask for alternate documents like business invoices or accountant-certified financials.

Read more about how you can buy term insurance without income proof.

Take Note

How Long Should Your Term Insurance Cover Last?

Your policy term should last only until your family truly depends on your income and your major loans are cleared. For the self-employed, this period is usually longer than for salaried individuals, because income often continues well past 60 through consulting, practice, or business ownership.

A practical way to choose the term is to match it with your work span and key milestones. Here’s what you should consider:

- Age 25 to 35: If you’re 30 today, choosing a 35–40-year term means your cover runs till 65–70, matching the longer working life most self-employed people have.

- Age 36 to 45: If you’re 40, a 20–30-year term (till 60–65) usually aligns with your kid’s education and loan timelines.

- Age 46 to 55: If you’re 50, a 10–20-year term gives protection till 60–70, based on how long you realistically expect to work and support dependents.

Avoid extremely short terms that leave you uninsured in mid-life, and extremely long ones (till 80–85) that add cost without real dependency. For most self-employed individuals, a cover lasting till 65–70 strikes the right balance.

Insurers check self-employed applicants more carefully because income is harder to verify. You can improve approval chances by following four key steps.

Ditto’s Take on Term Plans for Self-Employed

Maintain Proper Income Proofs

File Accurate ITRs

Keep Business Documents Ready

Seek Expert Guidance

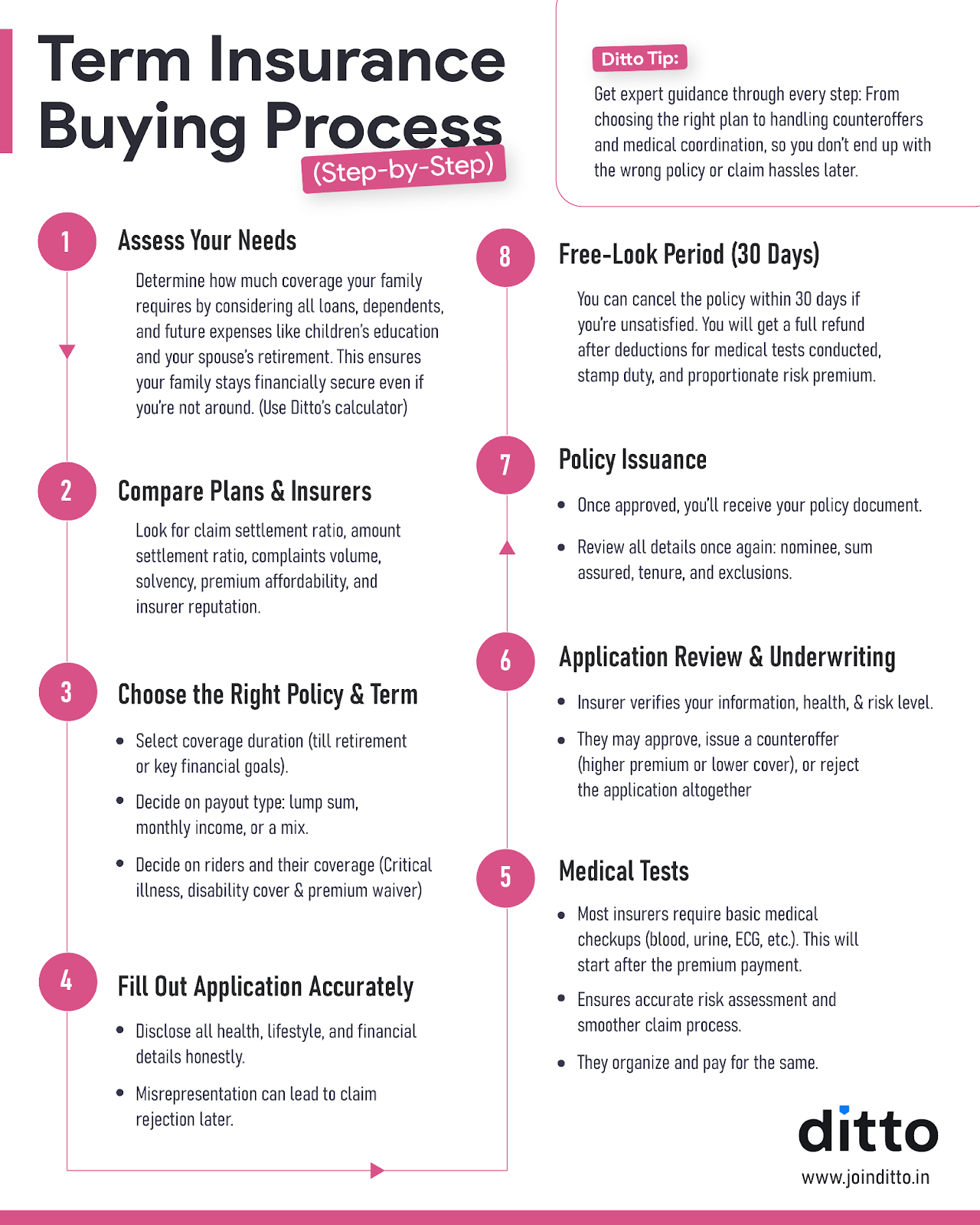

Check out the infographic, which helps you with your term plan purchase process:

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why do customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

If your income fluctuates, make your premium payments foolproof, and choose annual or half-yearly premium payment modes. Furthermore, you can maintain a separate protection-focused bank account with 1–2 years of premiums and enable auto-debit only from that account. Add calendar reminders and alerts for an extra safety layer.

In case you move from a self-employed to a salaried person or vice versa, you need not worry. Your term insurance cover stays the same. If you plan to start a business and expect your income to fluctuate, it is wiser to lock in a higher cover now while your income proof is stronger and easier to verify.

Quick Note

Frequently Asked Questions

Why People Trust Ditto

Last updated on: