Understand Your Term Insurance Policy

Understand what your policy has to offer. Read terms and conditions in plain English. And discover the good, the bad, and the lacking features in your term plan.

What is a term insurance policy?

A term insurance policy pays out a large sum of money in the event the policyholder passes away. The money is paid out to the nominees and usually, the payout is only made in the event of death. Unlike regular life insurance policies (endowments and ULIPs), term insurance policies don't offer any additional return. So you can only use it for risk protection and not to generate investment returns.

Heads Up: It takes an average person up to 5 hours to read & analyse a policy, and 10 hours or more to compare different plans and make a decision. This is why we propose a better alternative - taking a 30-minute FREE consultation with Ditto's certified advisors.

We have a spam-free guarantee, and we'll never push you to buy a plan. Don't delay this - we have limited slots every day, so before they run out.

Limited slots! Book today!

Key benefits of having a term plan

- Low premiums: When compared to endowment policies you will see that term insurance products sell for a fraction of the premiums. This is partly due to the fact that term insurance products don't offer an additional return on maturity, and also because the fee structure is much more simplified.

- Your premiums won't increase with time: Once you buy a policy and lock in your premiums, you'll have to keep paying the same sum until the policy expires. So you won't have to deal with any nasty surprises.

- Pretty much guaranteed claim payouts: After 3 years, the insurer cannot reject the claim for any reason. Which means once you buy a policy and hold it for 3 years, you will almost certainly get the claim paid out.

- Tax benefits: You can also claim deductions under Section 80C if you are buying a term insurance plan. There's also the fact that the cover paid out to the nominees in the case of the policyholder's death is also tax-free.

Ideal coverage for a term insurance plan

The simplest way to calculate your term cover is to multiply your income by a certain multiple - say 10x or 15x. But this is not a good way to calculate what your family will really need since every individual will have a different expense structure. So instead, a better way to calculate your ideal cover is to calculate your total expenses. Be very thorough in your description because you don't want to miss out on any obvious items. Once you do this, assume a certain inflation percentage and project those expenses into the future. For example, if you are currently spending ₹1 lakh a month and assume an inflation of 6%, then you're assuming your expenses will grow 6% every year. You can also add other expenses on top if you feel like you need more protection. But the ultimate objective is very simple. You're trying to evaluate what your family will need in your absence to continue with their lifestyle. And you assume that they'll need this money until you would have theoretically retired (this could be at 60 or 65). So from your current age, you need to project your expenses into the future until retirement and see what cover you will need to make sure that the money extends enough leeway for your family to keep living the same way they are right now.

If you want a more elaborate explanation and you want to simply choose what cover you need, we have a Term Insurance calculator and an accompanying explanation.

Talk to an expert today and

find the right insurance

for you.

Best Riders for a term insurance plan

While a term insurance policy only pays out money if the policyholder passes away, you may also want to have some extra protection by way of adding riders that could make your policy more comprehensive. And if you are buying a term insurance policy here are a few riders that you should consider:

Critical Illness Rider: If you're ever diagnosed with a debilitating illness, you would want your insurance policy to pay a fixed sum so that you can deal with any monetary obligations you may have. A good critical illness rider should offer comprehensive coverage. It should have low waiting periods, and the payouts should be made the moment the diagnosis is confirmed.

Increasing cover: Some policies will boost your cover by a margin of inflation so that you will always have enough protection irrespective of what happens outside. And while we usually urge consumers to factor in inflation while buying a cover the first time around, it is still a nice benefit to have.

Top-Up: Once you pick a cover you seldom have the option of increasing it anytime you like. However, some policies offer you a rider that lets you increase your cover by a certain sum. This is a very useful option for someone whose financial position may change substantially in the future.

Terminal Illness: Some policies pay out the sum insured when you're alive if you are ever diagnosed with a terminal illness. This is a nice option to have especially if you want to pursue medical treatments that may give you some shot at a future

Waiver of premiums: If you're not in a position to pay your premiums either after suffering a critical illness or a disability, then you should have the provision to suspend payments and still hold your term plan. This option is called the waiver of premium option.

Premium Payment Options

Regular Pay: If you are paying your premiums every year until the term policy expires, then you're opting for a regular payment term. For instance, if you buy a policy that lasts until 65, then you'll be expected to pay your premiums every year until that time.

Limited Pay: Limited Pay options allow you to pay all your premiums ahead of time. The payment term are further subdivided into 10 pay, 5 pay and 1 pay - with each option listing out the time during which you are expected to pay off all your premium obligations. For instance, if you pick the 5-pay option you will be expected to pay all your premiums in just 5 years. The benefit of such limited pay options is that you get a discount when you make such payments and you don't have to worry about your ability to pay off your premiums in the future. You can wrap all of it in a short span of time. The downside is that you do lock in a fair share of your capital and it can become overly expensive for some people.

Read our Regular Vs Limited Pay article to understand the difference in detail.

Monthly Payment Options: Some insurance companies also offer you the provision to pay your premiums on a monthly basis. You may have to pay something extra to avail this option in most cases. However some companies do let you pay the premiums on a monthly basis without asking you to pay any extra. The biggest downside of the monthly payment option is that your policy could lapse pretty quickly if you miss a single payment. This isn't ideal.

Talk to an expert

today and

find

the right

insurance for you.

How to choose the best term insurance policy?

Most companies have very limited options when it comes to term insurance plans. Most companies sell a single product while some insurers may choose to list 2 options at most. And as a consequence, it is essential that you choose the insurer before you pick the term plan. Because you don't get a lot of options afterwards.

So how do you choose the right insurer when you are picking a term plan?

Well, you have to look at a few operational factors:

The first thing you have to look at is scale. If an insurance company is underwriting hundreds of thousands of policies each year, then conventional wisdom dictates that this insurer is very popular with the masses. This is generally true. So if you are shortlisting an insurer, then it's best to consider the total policies sold in any given year and the new business premium generated. The total policy count will give you an idea about the size of the customer base and the new business premium generated will tell you about the kind of money people are willing to pay. If you have a company that is selling atleast 5,000 policies while generating new business premiums of over ₹5,000 crores, then you can likely shortlist them.

The second thing you do is look at whether the insurer is private or government owned. Now in our experience, government-owned insurers aren't the most proactive while dealing with your application. Small mistakes can take forever to fix. Communication is slow. And when things go wrong with your medicals, the explanations can seem a bit underwhelming. So while there is a general level of belief amongst people that government-owned insurers are "safe" and "more reliable", there is little truth to these statements, atleast in our experience. Select private insurers on the other hand have been far more reliable in their communication and proactiveness while dealing with our application. So we generally prefer a private life insurer over a government-owned institution.

Why Should You Buy 1 Crore Term Insurance Through Ditto?

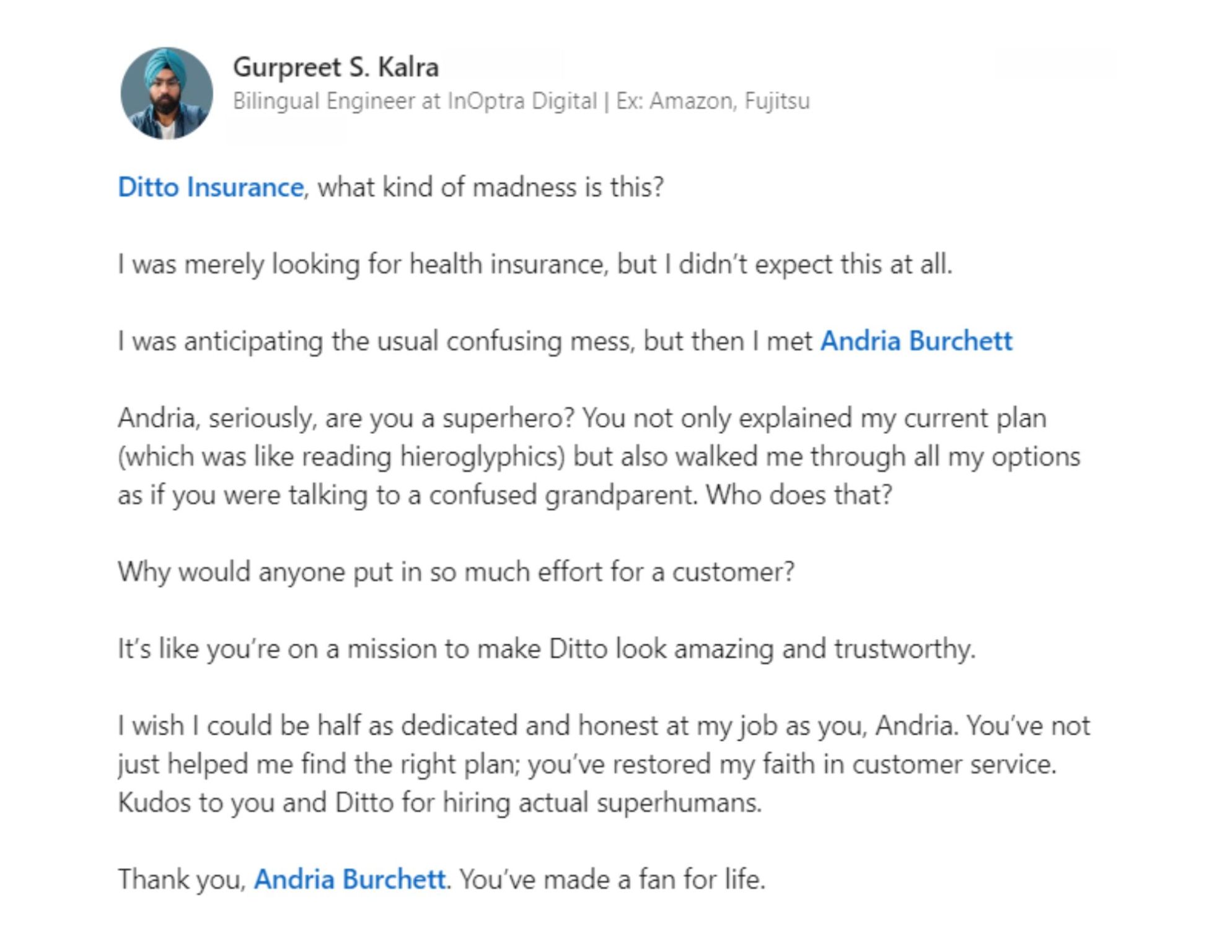

At Ditto, we've assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Gurpreet below love us:

No-Spam & No Salesmen

Rated 4.9/5 on Google Reviews by 10,000+ happy customers

Backed by Zerodha

100% Free Consultation

You can with our team. Slots are running out, so make sure you book a call now!

The final thing you look for is the objective metrics that tell you how well companies deal with claims and complaints.

Claim Settlement Ratio: Claims settlement ratio stands for the total number of claims settled as a proportion of the total claims received. You ideally want your insurer to have a claim settlement ratio of 97%+ averaged over three years.

Amount Settlement Ratio: Some insurers pay out the smaller claims while refusing to pay out the high-value claims in a bid to improve their claim settlement ratio. So you will need to look at the total amount settled as a percentage of the total amount claimed. Ideally, you want your insurer to have an average amount settlement ratio of greater than 87% averaged over 3 years.

Volume of complaints: You don't want to be seeing a lot of complaints when you are picking a term insurance company. In general, if your company has less than 50 complaints for every 10,000 claims registered, then it's a safe bet.

Once you are through shortlisting a good term insurance company, you can see if the products they offer meet your criteria. In general, a good term insurance plan should have:

- A simplified flow: You don't want to fill out an application and wait forever to have your policy issued. Ideally, you want to have your policy issued in under 10 days after filling out the application. You can to know more about this aspect.

- Offer all the popular add-ons: You want your insurance company to offer all the important add-ons we've listed above. This includes riders like critical illness, waiver of premiums, top-ups etc.

- A good price: It makes no sense to buy a term insurance product by paying a substantial premium when every company pretty much does the same thing. So considering term insurance plans are commodities, it's best if you seek a good price before you buy a term plan

Talk to an expert

today and

find

the right

insurance for you.