Many life insurance products promise the best of both worlds, i.e. protection for your family as well as a return on investment. While in most term insurance plans, it is called Return of Premium, Unit Linked Insurance Plans (ULIPs) take this to the next level.

ULIPs bundle a life insurance policy with an investment component in market-linked funds. While ULIPs sound enticing because you get “double benefits” in one plan, they also come with numerous conditions and additional costs.

In this guide, we will break down exactly what ULIPs really are, how they work, their features, and whether you’re better off with something else instead.

An Overview of ULIPs

A ULIP is a type of life insurance policy that combines investment and insurance. When you pay premiums, the insurer splits your money into two parts.

One portion goes toward providing a life insurance cover (the sum assured), and the other portion is invested in market-linked funds (such as equity, debt, or a mix) of your choice.

Since there is an investment component, your ULIP’s returns aren’t fixed, they depend on how the chosen investment funds perform. If the fund does well, the value of your investment grows; if it performs poorly, your fund value can decline.

At the same time, the policy provides a life insurance cover. If the worst happens to you, your nominee will receive a benefit from the insurer. This death benefit is usually at least the sum assured (the insurance portion) or the fund value, whichever is higher.

Think of a ULIP as having two pockets, one for insurance and one for investment. Let’s say you invest ₹1,00,000 per year in a ULIP policy. Here’s what happens:

How Does a ULIP Work?

Premium Allocation

The insurer deducts some charges (more on these later) from your premium and then splits the remainder between insurance and investment. For example, assume that out of ₹1,00,000, about ₹20,000 might go towards securing your life cover (the insurance component) and related charges, and the remaining ₹80,000 is put into investment funds. This allocation can vary by policy, but the idea is that part of your money funds the insurance benefit, and the rest is invested.

Investment in Funds

The ₹80,000 investment portion buys “units” of the fund(s) you choose. ULIPs offer a range of fund options, where you could put your money in an equity fund (stocks), a debt fund (bonds), or a balanced fund, depending on your risk appetite. Each fund has a Net Asset Value (NAV) that fluctuates daily. So, if you invest in an equity fund and it grows 10% in a year, the amount of ₹80,000 could increase in value. Conversely, if the fund drops by 5%, your investment portion would shrink accordingly.

Life Insurance Coverage

Meanwhile, the ₹20,000 allocated for insurance provides a life cover (say the policy offers a sum assured of ₹10 lakh, which is minimum of 10 times your annual premium for several ULIPs). If you pass away during the policy term, the insurer will pay your nominee the promised death benefit. This is the higher of the sum assured or the investment fund value at that time. If your ULIP’s fund value grew substantially above the sum assured, your family would get that higher fund value. If the fund underperformed, they would at least get the sum assured.

Maturity Benefit

If you survive the policy term (e.g., a ULIP term might be 10-20 years), you receive the maturity value, which is the fund value of your investments at that time. The amount you get at maturity depends on market performance after all fees (which is quite high). However, there is no guaranteed return, and it is subject to market risk. Some ULIPs might add bonuses at maturity, but the payout ultimately equals your fund’s NAV and number of units on that date.

Note: Some ULIPs also allow you to switch between funds if you want to rebalance your investments later.

Your ULIP cover amount must be at least 10x the premiums you have paid to claim tax benefits under the old tax regime. This rule was introduced to prevent people from purchasing primarily for investment purposes, and then claiming the tax benefit u/s 10(10D).

Key Features of ULIPs

ULIPs come with their own set of features and jargon. Understanding these basics will help you make sense of how ULIPs operate:

1) Life Cover (Sum Assured)

Every ULIP provides a life insurance sum assured, a guaranteed amount paid to your nominee if you pass away during the policy term. By regulation, ULIPs must offer a minimum sum assured relative to your premium. For regular-premium ULIPs, it’s often 10 times your annual premium.

For example, a ₹1 lakh/year ULIP might have a minimum ₹10 lakh cover amount. Some ULIPs are Type 1 (death benefit = higher of sum assured or fund value), while Type 2 ULIPs pay sum assured plus fund value on death, giving a bigger payout but usually charging higher premiums.

2) Investment Funds and Units

The portion of premium not used for insurance is invested in segregated funds. You can easily choose from equity funds (stocks), debt funds (bonds), or hybrid/balanced funds.

The amount you pay buys units in these funds, and each fund has a changing Net Asset Value (NAV). This means:

The number of units you get = (investment amount after charges)/(NAV at purchase).

For instance, if ₹50,000 is invested and the NAV is ₹10, you get 5,000 units. It generally changes based on market performance.

When the fund’s underlying investments rise in value, the NAV goes up and your units become more valuable. When the market declines, the NAV falls and your unit value drops as well. This is the “unit-linked” part of ULIPs.

3) Lock-In Period

ULIPs come with a mandatory lock-in of 5 years. This means you cannot withdraw or surrender the policy during the first five years (except in case of the insured person’s death).

If you try to exit earlier, your fund value is moved to a discontinued policy fund (which earns only a minimal interest, e.g. 4-5% per annum) and paid out after the 5-year lock-in is over.

Fun Fact

Talk to an expert

today and

find

the right

insurance for you.

4) Premium Payment Options

ULIPs offer flexibility in how you pay premiums. You can opt for regular premium (pay every year, or semi-annually, etc.), or single premium (one large upfront payment). Some plans allow limited pay, where you pay premiums only for a fixed number of years (say 5 or 7 years) while coverage continues for a longer term.

5) Fund Switching

If your ULIP offers multiple funds (such as an equity growth fund, a debt fund, a balanced fund, etc.), you can redirect future premiums or even shift past investments from one fund to another.

Switching funds helps you adapt to market conditions or life changes without exiting the ULIP or incurring tax. It is unlike selling one mutual fund to buy another.

This feature gives ULIPs a degree of investment flexibility that pure traditional plans lack (though it requires you to actively manage the fund allocation).

6) Top-Ups

Many ULIPs give you the option to top up your investment by adding an extra premium over and above your regular premiums. If you have surplus money in a particular year, you can inject it into the ULIP as a one-time top-up premium, which goes directly into the investment component (after minimal charges) and increases your fund units.

7) Policy Term and Maturity

ULIPs generally have long terms (10-20 years or more). You can easily choose a policy term at inception. If you outlive it, the policy “matures” and you get the maturity benefit, which is the fund value (including any bonuses added).

Important Note

Bottom Line: These features highlight that ULIPs are more complex than standard term insurance or mutual funds. They often bundle a life cover, investments, flexibility options, and fees, into one product.

What are the Costs Associated with ULIPs?

ULIPs have a number of fees and charges associated with them, which also affect your returns. In brief, there are premium allocation charges, policy admin charges, fund management fees, mortality charges, and more. The insurer generally deducts these charges either upfront from your premiums or periodically from your fund value.

Over time, these charges can considerably reduce the net return you get from the ULIP. However, modern ULIPs are more transparent about fees, and regulators like IRDAI have capped many of them for fairness.

Yet, it’s important to know what you’ll be paying for when you invest in a ULIP. Here are the charges commonly associated with these plans:

1) Premium Allocation Charge (PAC)

This is an upfront fee deducted from your premium before the rest is invested. It’s usually a percentage of each premium.

2) Policy Administration Charge

This is a monthly fee for maintaining your policy, covering paperwork, record-keeping, customer service, and more. It can either be a flat fee or a percentage of premium/fund value, deducted by canceling units from your fund every month.

Regulation: IRDAI has set that policy administration charges can be at most a predetermined inflation-linked rate or a flat cap. In many ULIPs, this charge might start small and increase annually up to a limit. It’s usually a small charge, but it can add up over time. Some newer ULIPs even waive separate administration fees altogether.

3) Fund Management Charge (FMC)

This is the fee for managing your investments, similar to a mutual fund’s expense ratio. It’s charged as a percentage of the fund’s value and is typically deducted daily from the NAV of the fund. ULIP fund management charges cover the fund manager’s services and fund administration, to name a few.

Regulation: IRDAI caps the FMC at 1.35% per annum for any ULIP fund (except for the discontinued policy fund which is capped at 0.5%). In practice, many ULIP equity funds charge 1.35%, and debt funds a bit lower. So, if your fund value is ₹5 lakh, up to ₹6,750/year could go toward FMC (deducted in tiny portions daily).

For comparison, many direct plan mutual funds have expense ratios between 0.5–1.0% for equity funds. ULIPs are also in a similar range due to the cap. Yet, a ratio of 1.35% yearly can considerably drag growth over time.

4) Mortality Charge

This is essentially the cost of insurance, the fee the insurer takes for providing you life cover. It’s charged regularly by cancelling units from your fund. The mortality charge depends on your age, the sum at risk (sum assured minus current fund value), and the insurer’s mortality rates. Younger policyholders pay less, and the charges increase with age.

Regulation: There’s no fixed cap on mortality charges, but insurers must decide it based on standard mortality tables and disclose the rates upfront.

Note: If your fund value becomes higher than the sum assured, the mortality charge can effectively drop to zero because the insurer no longer carries any risk liability.

5) Surrender/Discontinuance Charge

If you terminate the policy early, the insurer levies a surrender charge. ULIPs are designed as long-term products, so exiting in the first few years can cost you more. For instance, if you stop paying premiums or withdraw in the second, a certain amount (perhaps a percentage of fund value or premiums) is taken as a penalty.

Regulation: Surrender charges are regulated by IRDAI, capped within set limits (usually a few thousand rupees), and generally reduced to zero after the fifth policy year.

6) Switching Charge

Most ULIPs offer a limited number of free fund switches each year, but if you exceed that limit, additional switches may attract a fee. Many plans charge less or nothing at all to encourage flexibility.

7) Other Minor Charges

Depending on the ULIP, there could be policy rider charges (if you add riders, such as critical illness or waiver of premium, their cost is deducted), premium redirection fee (if you change how future premiums are allocated among funds), or partial withdrawal fee (though many waive it).

Moreover, administrative fees like GST on charges will apply. These are usually not deal-breakers but make sure to read the policy brochure for the full list. Many ULIPs today streamline their fee structure, keeping only the core charges mentioned above.

Despite the costs and complexities, ULIPs still attract investors because they promise a mix of insurance and market-linked returns. While these benefits look appealing on paper, it’s worth examining how they hold up in practice.

What Are the Benefits of ULIP Plans?

Insurance and Investment in One Place

The biggest selling point of ULIPs is the dual benefit: life cover and investment under a single plan. For someone who doesn’t want to juggle separate products, this might seem convenient. You pay one premium, get insured, and invest at the same time. However, this convenience often comes at the cost of flexibility. In reality, keeping insurance and investment separate gives you more control, transparency, and potentially better value over time.

Tax Advantages

ULIPs do enjoy tax benefits under Sections 80C and 10(10D). Premiums qualify for deductions, and maturity proceeds can be tax-free if specific conditions are met. That said, new rules introduced in 2021 have narrowed these advantages, especially for policies with annual premiums exceeding ₹2.5 lakh. While fund switches inside a ULIP aren’t taxed, these perks shouldn’t be the primary reason to invest.

Market-Linked Growth and Flexibility

Since ULIPs invest in equity and debt funds, they can potentially earn better returns than traditional savings plans. Investors can even switch between funds without tax implications, which sounds great for managing risk. The caveat? These switches work best for those who actively monitor markets and understand asset allocation. For most long-term investors, a simple mutual fund SIP paired with term insurance could achieve the same goal, with fewer moving parts.

Long-Term Discipline

One could argue that ULIPs encourage disciplined investing. The 5-year lock-in ensures you stay invested for the long haul. But that same lock-in also limits liquidity. You can’t access your money freely if your plans change. In other words, what’s marketed as “forced savings” might feel restrictive when life throws a curveball.

What are the Drawbacks and Risks Associated with ULIP Plans?

ULIPs aren’t without significant downsides. In fact, they have been controversial in the past due to mis-selling and poor returns relative to simpler options. Here are the main drawbacks and risks of ULIPs you should consider:

1) Complexity and Lack of Transparency

ULIPs are multi-layered and hard to understand. There’s a lot of fine print, various charges, conditions on withdrawals, fund options, etc.

Many policyholders buy ULIPs without grasping all these details, sometimes due to aggressive sales pitches. The complexity can lead to mis-selling, where an agent might highlight only the high returns (assuming best-case markets) and tax benefits, but gloss over the costs and lock-in.

Historically, ULIPs earned a bad reputation because of this: people bought thinking they’re great investments, only to realize later that returns were low due to heavy charges, or that they couldn’t exit without losing money.

In short, ULIPs are not as straightforward as a mutual fund or a pure insurance plan, so the opaqueness itself is a risk, you have to trust that you understand what you’re getting into (and many don’t until it’s too late).

2) High Charges Can Erode Returns

Although charges are capped now, ULIPs can still be expensive. Particularly in the initial years, fees like premium allocation and policy administration charges mean a chunk of your premium doesn’t get invested. Even later, the fund management and mortality charges continually nibble away at your corpus. The result is that your net returns may be significantly lower than the gross market returns.

For example, if the underlying fund earns 10% but ULIP charges total 2-3% per year (when averaged out, including the effect of early PAC, etc.), you might end up with only 7% effective growth.

Financial planners often note that ULIPs underperform a combination of mutual funds + term insurance largely due to these extra costs.

In the past (pre-2010 ULIP reforms), charges were even higher, often blatantly front-loaded, leading to abysmal early cash values. Even with improvements, if you’re someone who values cost-efficiency, this is a major drawback.

Instead, low-cost index funds or term insurance are far cheaper alternatives in comparison. Essentially, ULIPs make you pay for the convenience of bundling insurance and investment.

3) Market Risk and No Guaranteed Returns

With ULIPs, you bear the investment risk. There is no guarantee on the investment portion. If the markets perform poorly (say there’s a recession or a prolonged downturn), your ULIP fund can yield negative or very low returns, just like any mutual fund would.

However, unlike some traditional policies, there’s usually no capital guarantee or minimum return guarantee on maturity.

You could even end up with less money than you paid if you surrender at a bad time or if the charges and poor performance combined erode the value. The only guarantee is on the death benefit (at least sum assured or 105% of premiums), but if you survive, you fully participate in market volatility. So, ULIP returns are volatile by nature, especially if you choose equity-heavy funds.

Investors must have the risk appetite for this. If you are risk-averse or absolutely need a certain amount for a goal, a ULIP’s variability is a risk.

It’s worth noting that some people assume insurance products always give steady returns, not true for ULIP. A ULIP in 2008 market crash would have seen its fund value plummet, for instance.

So, treat a ULIP as an investment with no guarantees (unless explicitly stated by some guaranteed ULIP variant).

4) 5-Year Lock-in and Liquidity Constraints

ULIPs lock-in your money for 5 years minimum. You cannot access your funds during this period (except via policy loan in some cases, or critical illness benefits if any rider, etc., but generally no direct withdrawals).

This lack of liquidity is a drawback if you encounter a financial emergency early on. Moreover, even after 5 years, many ULIPs are designed for much longer terms, so if you withdraw or surrender too soon, you might not realize much gain or could suffer surrender penalties (if within the early years).

In contrast, most mutual funds (except ELSS) can be redeemed anytime without such a long lock. Even PPF (15-year span) allows some partial withdrawals from year 7. ULIP’s lock-in is stricter, effectively tying your hands. This can be a pro for discipline, but it’s a risk if you might need flexibility.

Remember that if you stop premiums before 5 years, the policy is discontinued and money paid only after lock-in ends, sitting in a low-return fund in the interim. Liquidity is a significant risk, so you should not commit money to a ULIP that you might need in the near term.

The product penalizes or prevents early exit, which could hurt if your financial situation changes.

5) Need for Ongoing Premium Commitment

With ULIPs, especially regular premium ones, you’re usually expected to keep paying premiums each year for the full premium paying term (or at least the first 5 years). If you fail to pay (say you have a cash crunch and can’t pay the premium in year 3), the policy can lapse or become “paid-up” with reduced benefits.

In ULIPs, if you discontinue premiums within the lock-in, the policy goes into a discontinued fund and effectively stops providing insurance, and your money is stuck till year 5 with nominal interest. Even after lock-in, not paying could stop the insurance cover unless you have built enough fund value to cover charges.

This rigidity is a drawback compared to, say, mutual fund SIPs which you can pause anytime without losing your invested money (or a term plan which you can stop if you don’t need cover, without losing investment because there was none).

ULIPs don’t offer that flexibility, you stand to lose benefits if you don’t/can’t continue as planned. It’s essentially a commitment for the long term. If your income is unstable or you foresee difficulty in sustaining contributions, a ULIP can be risky.

(Some ULIPs allow reducing premium or making policy paid-up after 5 years, but your sum assured might drop and charges still deduct).

6) Relatively Low Insurance Cover for the Premium

ULIPs are first and foremost investment products with a bit of insurance, not the other way around. The life cover (sum assured) you get is limited by formula, often 10× annual premium is the maximum if you want tax benefits.

This means if you are paying ₹50,000/year, you might get a ₹5 lakh coverage. Even if the insurer allows higher cover, the more cover you add, the more mortality charge eats into your premium, defeating the purpose of investment.

Practically, ULIPs do not give you large insurance coverage relative to what you pay. For the same ₹50k/year, a pure term plan could give you ₹1 crore in coverage (because term premiums are low).

This is a fundamental drawback, ULIPs can compromise on the insurance aspect. If your primary goal is protecting your family’s financial future, a ULIP’s sum assured might be inadequate.

You may end up having to buy additional term insurance anyway, which means you’re paying for insurance twice (once via ULIP, once via term). Many financial advisors argue that ULIPs “over-insure your investments and under-insure your life.”

In other words, you’re spending a lot, but not getting an optimal amount of either insurance or investment returns.

7) Possibility of Lower Returns than Separate Investments

When comparing ULIPs to a strategy of “Term Insurance + Mutual Funds”, ULIPs often come out behind in terms of final corpus. The higher charges and insurer’s fund choices can lead to a lower net yield.

Studies and calculations have shown that over long periods, a combo of a cheap term plan and investing the rest in mutual funds can yield a higher corpus (by tens of thousands or a few lakhs) than an equivalent ULIP.

We’ll delve into a comparison example later, but in essence, you might be sacrificing return on investment for the convenience of bundling. If the market does very well, ULIPs do well too, but then so would your mutual fund. If the market does poorly, both suffer, but ULIP additionally has charges.

From a purely investment perspective, ULIPs carry an opportunity cost: the money that went to fees could have been earning returns elsewhere. This is a drawback if maximizing returns is your goal.

It’s not uncommon to see ULIP holders disappointed that after 10 years their policy grew at (say) 6% per annum, whereas a simple mutual fund could have done 10%, the difference largely being cost leakage.

Talk to an expert today and

find the right insurance

for you.

What Are The Types of ULIPs?

ULIPs are not one-size-fits-all, insurers have created various types of ULIP plans to cater to different needs. You can categorize ULIPs in several ways:

1) Based on Death Benefit Structure: As touched on earlier, ULIPs mainly come in two categories here:

Type 1 ULIPs

These pay either the sum assured or the fund value (whichever is higher) to the nominee if the insured dies during the term. For example, if the sum assured is ₹10 lakh and the fund value at death is ₹8 lakh, they pay ₹10 lakh. If the fund value has grown to ₹12 lakh, they pay ₹12 lakh. Type 1 is more common and slightly less costly, because the insurer’s risk decreases as your fund grows (if your fund outperforms, they don’t have to pay extra from their pocket beyond the fund).

Type 2 ULIPs

These pay sum assured plus fund value on death. Now, let’s use the same example. If you die when the fund value is ₹12 lakh and sum assured is ₹10 lakh, the nominee gets ₹22 lakh. This provides extra protection but at a higher cost, because the insurer must always pay the full sum assured on top of whatever is in the fund. Mortality charges in Type 2 plans are higher, and premiums can be a bit expensive too for the same cover.

Final Verdict:

Type 2 ULIPs are suitable if you want to maximize family payout (e.g., you’re the sole breadwinner and want to leave both the savings and insurance amount). Type 1 ULIPs are chosen by those who prefer lower cost and assume the investments will grow over time to give a good payout.

Some ULIPs offer a choice between Type 1 and Type 2 at inception. Always decide carefully - although Type 2 gives more security, it will reduce your investment’s growth slightly due to higher insurance cost.

2) Based on Investment Fund Type: ULIPs can be classified by the type of funds they invest in:

Equity Fund ULIPs

These involve investing predominantly in stocks/equities. They also have a high-risk, high-return potential. The idea is to generate growth by participating in the stock market. For example, a ULIP might have a “Growth Fund” or "Large Cap Equity Fund" option which puts 80-100% in equities. These are suitable for long-term goals and for investors with a higher risk appetite.

Debt Fund ULIPs

These invest in fixed-income instruments, such as government bonds, corporate bonds, or money market instruments. They aim for stable returns with lower volatility. A ULIP “Income Fund” or “Bond Fund” falls under this category. These funds come with a lower risk than equity ULIPs, but typically yield moderate returns.

Balanced or Hybrid ULIPs

These funds mix equity and debt to balance risk. For instance, a “Balanced Fund” ULIP might keep 40-60% in equities and rest in debt. It always offers a middle path of growth and stability.

Cash or Liquid Fund ULIPs

Some ULIPs offer a low-risk fund that parks money in cash, bank deposits, or very short-term instruments. For example, a “Liquid Fund” ULIP, which might be used when you want to temporarily shield your gains or are nearing maturity (this is not in every ULIP, but some have it).

Emerging/Theme-based ULIPs

Nowadays, insurers may have multiple equity funds, large cap, mid cap, or opportunities fund, under the ULIP. For instance, a single ULIP fund might focus on large-cap stocks, another on mid-caps, giving granular choice similar to mutual fund categories. Most ULIPs allow you to switch among these fund types.

Note: The “type” of ULIP in terms of funds is essentially what asset allocation you choose. Some people refer to it as an “Equity ULIP,” the one where they invest fully in the equity fund option, versus a “Debt ULIP” where they stick to the debt fund. ULIPs usually provide all these options in one product, and you select the one based on your risk profile.

3) Based on Premium Payment Method: ULIPs can be:

Single Premium ULIPs

You pay one lump sum at the start (or sometimes you’re allowed to add another large premium later as top-up, but essentially one main premium). Then, the policy provides coverage and invests that amount for the rest of the term. Single premium ULIPs often have a minimum sum assured of 1.25× to 1.10× the single premium (as per regulation). These ULIPs are useful if you have a large amount to invest at once and want insurance along with it. They avoid the hassle of yearly payments, but also you lock in a big amount.

Regular Premium ULIPs

You commit to pay annually (or quarterly, etc.) through the premium paying term. This is like an annual investment habit. Many ULIPs require 5 years of premium at minimum, while some require a full term. Limited pay variants also work this way: you pay premiums for a shorter period (for example, seven years) while the policy coverage continues for the full term. The choice affects convenience and coverage (single pay ULIPs have lower sum assured multiples). Regular premium ULIPs are more common for long-term goals since they align with yearly savings.

4) Based on Financial Goals/Purpose: Insurers often market ULIPs tailored to specific goals:

Wealth ULIPs

Generic ULIPs aimed at wealth creation, where you invest for the long term and get maturity value. Most ULIPs fall under this category by default.

Child ULIPs (Child Plans)

These ULIPs are positioned for saving for your child’s future (education/marriage). They usually have features like waiver of premium on parent’s death (if the parent dies, future premiums are waived but policy continues for the child’s benefit). Then, the investment portion pays out on a target date, roughly when the child enters college.

Retirement ULIPs (Pension Plans)

These ULIPs aim at building a retirement corpus. However, they are often taken early and mature when you retire. Some offer an option to convert the maturity amount into an annuity (pension). After 2010, pure pension ULIPs were somewhat restricted by IRDAI, but some ULIPs still serve this goal by letting you take the maturity benefit and buy an annuity.

Essentially, goal-based ULIPs are just branding. The underlying mechanism is still about insurance + investment. However, the policy might be structured (or riders attached) to suit that goal better. For example, a child ULIP might ensure money comes when the minor turns 18.

5) New-Age ULIPs (4G ULIPs): A recent category often dubbed “4G ULIPs” or “zero-cost ULIPs” has emerged.

These are ULIPs with minimal charges and added features, introduced to change the negative perception of ULIPs. They eliminate premium allocation charge and policy admin charge, cap at FMC lower rates, and include benefits like Return of Mortality charges and loyalty additions. Essentially, they try to match mutual funds in cost while giving insurance.

Some are whole-life ULIPs (covering till age 99) with flexibility to withdraw after 5 years and so on. They might advertise “zero premium allocation, zero mortality charge (with RoMC), zero admin fee”, effectively only charging the fund management fee and perhaps a small mortality that gets refunded.

For example, plans like ICICI Pru Signature or HDFC Click2Invest are known for low charges and high transparency.

These ULIPs are more investor-friendly than the older ones, aimed at tech-savvy or fee-conscious customers.

If you are considering a ULIP, these new-age ones are worth a look, as they directly address many cost-related drawbacks.

How to Choose the Best ULIP Plan in India? (Ditto’s Take)

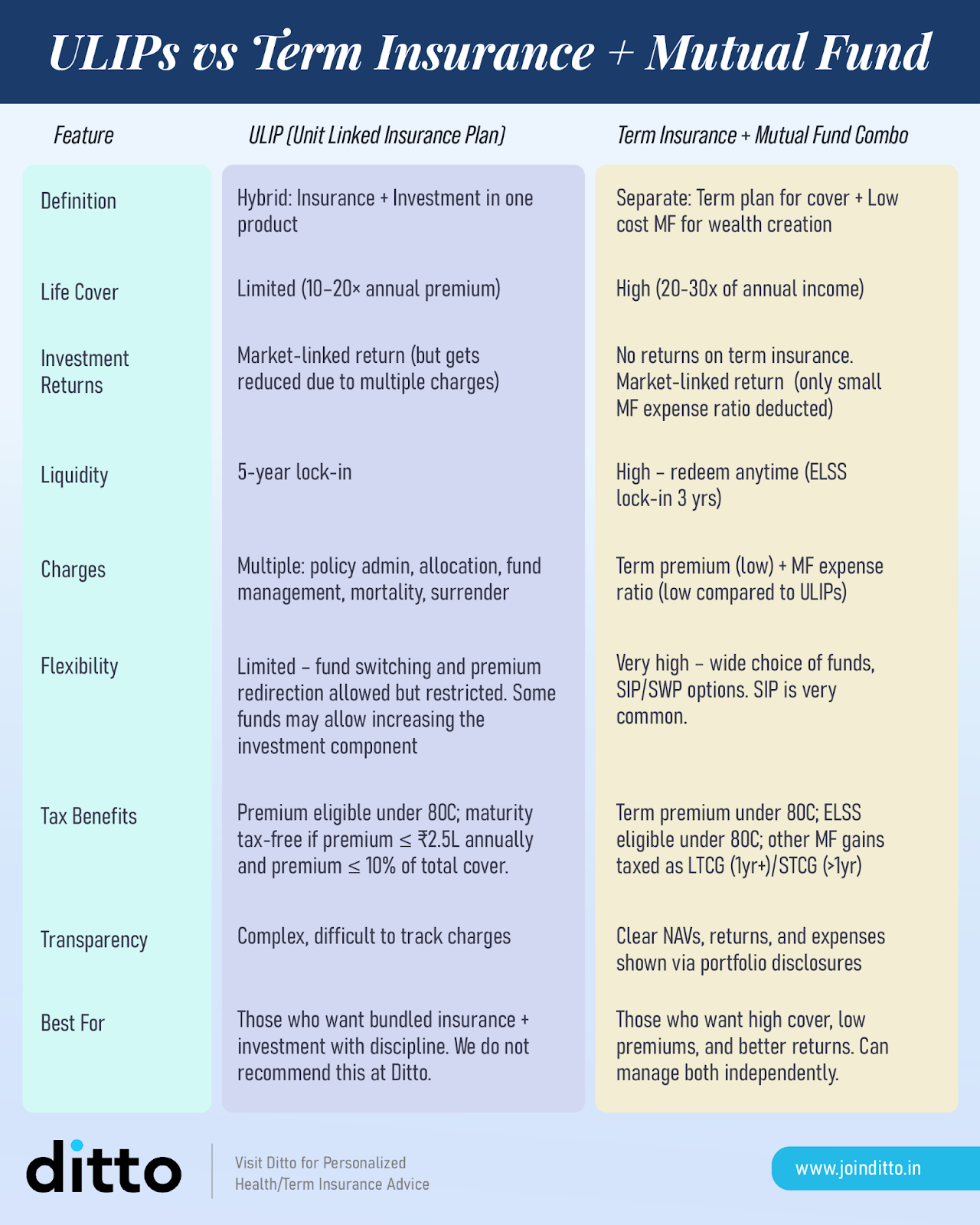

ULIPs vs Term Insurance + Mutual Fund (Ditto’s Advice)

One of the most common debates in personal finance is whether you should buy a ULIP for investment and insurance, or buy a term plan and invest the rest separately?

Ditto’s stance is generally in favor of the latter (term + MF). Let’s break it down with a detailed comparison and examples to justify our take.

Approach 1: Invest via a ULIP

Suppose you have a budget of ₹1 lakh per year for protecting your family and growing wealth. You choose a ULIP and put the entire ₹1,00,000 into it annually.

Perhaps, ₹10,000 of each year goes towards insurance charges for a sum assured of around ₹10 lakh (10× premium), and ₹90,000 gets invested in market funds (minus other charges).

Over 20 years, assume that the ULIP’s funds earn 8% annually on average, but after all the additional charges, your net return might be effectively around 6-7%.

Your overall life cover is ₹10 lakh (flat or reducing if fund value overtakes it in a Type 1 ULIP).

By the end of the 20-year-period, your ULIP might accumulate a corpus. For illustration, let’s say it reaches around ₹40–50 lakh (hypothetical value). This would be tax-free on maturity (since ULIP premiums = ₹1L <2.5L limit, conditions satisfied).

Your family stayed protected for ₹10 lakh throughout the policy term, and they would have received that amount if you had passed away during those years.

Approach 2: Term + Mutual Fund (MF)

You decide to buy a pure term insurance policy and invest the remainder in a mutual fund SIP. For example, a ₹1 crore term life cover (far greater protection) for a 30-year-old costs only around ₹10,000 per year (even less for a younger person).

From the ₹1 lakh budget, you pay ₹10,000 for term insurance and accumulate the remaining ₹90,000 to invest per year. You put this ₹90k annually into a mutual fund (let’s assume an equity index fund or balanced fund) expecting similar market returns (8% over long term). Mutual funds have lower expense ratios (often <1% for index funds).

Over the next 20 years, your ₹90,000/year investment could grow to an amount equal or higher than the ULIP’s corpus. That’s because more of your finances are working (no insurance charges are coming from it).

Even after paying tax on mutual fund gains (10 percent on long-term gains above ₹1 lakh), you still end up ahead overall. Meanwhile, your life cover was ₹1 crore throughout, providing vastly superior protection to your family if something happened to you.

Note: Several reports reveal that the term + MF strategy can leave you with a ₹1 lakh higher corpus over 20 years than a comparable ULIP. This involves assuming similar investment amounts and market returns for both, and the difference is mainly due to ULIP costs. Modern ULIPs have narrowed this gap, but the fundamental advantage of term + MF remains the same: cost efficiency and flexibility.

Let’s consider a concrete real-life example to illustrate the difference:

A person, say X, 35, invests in a ULIP, premium ₹50,000/year, sum assured ₹5 lakh (10×). He plans to pay for 15 years and hold it till 20 years. The ULIP invests in a balanced fund. Assuming 8% gross return, and factoring charges, the ULIP might yield 6-7% net. In 20 years, X’s fund value might be roughly (hypothetically) ₹20–25 lakh. If they die during the term, their family gets at least ₹5 lakh (maybe more if the fund grows beyond that).

Another person, Y, also 35, takes a ₹50 lakh term insurance (which costs perhaps ₹5,000/year at her age). They invest ₹45,000/year in an equity mutual fund via SIP.

If we assume 8% return and minimal fees, their MF might grow to a similar or slightly higher ₹20–25+ lakh range (actually potentially more, since nearly the full ₹45k/year is compounding at market returns without heavy insurance charges) in 20 years.

Y also pays 10% tax on the gains, but that might reduce their corpus by a small fraction. Their family, however, had ₹50 lakh protection throughout in case of Y’s untimely demise, far more than X’s ULIP cover.

In the above example, the person Y likely ends up with more money (or at least not less), and unquestionably had better insurance coverage.

This encapsulates why many advisors recommend keeping insurance and investments separate.

A term plan offers high coverage at a low cost, and mutual funds offer high flexibility and potentially higher net returns due to lower fees.

ULIPs, in contrast, force a trade-off: you get modest insurance and investment in one category, but pay more for it and get less of each than taking them separately.

ULIP vs Term Insurance: Which is Better?

The answer depends on your personal goals, financial discipline, and what you value.

A ULIP might be right for you if:

- You are in a high tax bracket and have already utilized other tax-saving avenues. This also applies if you value the tax-free maturity aspect of ULIPs. (Remember to keep premiums ≤ ₹2.5L/year for tax exemption on returns).

- You find a modern ULIP with very low charges and good features, essentially a product that addresses many of the traditional ULIP downsides. Certain new ULIPs are quite competitive. For example, if you’re getting almost mutually-fund-like cost structure plus insurance, it could be a reasonable choice for a portion of your portfolio.

- You have a specific use-case in which ULIPs look more appealing.

A ULIP is likely not the right plan if:

- Your primary goal is maximizing the life insurance cover for your family at an affordable cost. So, term insurance is an excellent choice in this case.

- You seek highest investment returns or the lowest cost. In this case, you would lean towards mutual funds (or other investments) rather than ULIPs. Especially if you are financially savvy, you might resent the lower transparency and higher fees of ULIPs over time.

- You require flexibility or might need liquidity. If your life situation is such that you might need to pause investments (job uncertainty, potential big expenses upcoming) or dip into your savings on short notice, a ULIP’s rigid structure can be a hindrance. Term+MF provides far more flexibility to adjust to these life changes.

- You don’t fully understand ULIPs or are not comfortable with the market risk and rules. If terms like NAV, fund switches, and yield reduction sound confusing and you prefer simpler products, a ULIP may cause stress. You might be better off with a combination of term insurance + PPF/FDs or simpler balanced funds if taking risk is a concern.

- You are considering ULIP purely because an agent or bank is pushing it, or because it’s marketed as “best of both worlds.” Remember, ULIPs are often sold, not bought. If, after an objective analysis (like we did above), you feel a term plan plus an investment would accomplish the same or better, then the ULIP is not the right choice for you.

Ditto’s Perspective

Final Verdict: If you want simplicity, maximum cover, and highest probability of good returns, go for a solid term life insurance (for protection) and invest your money in diversified, low-cost instruments like mutual funds, ETFs, or other plans suitable for your goals.

This combination often outperforms ULIPs in both coverage and returns. On the other hand, if you value the ULIP’s integrated approach and will stick to it long-term, and you choose a high-quality ULIP product.

Why Choose Ditto for Your Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Here’s why customers like Abhinav love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 5,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation with us. Slots are filling up quickly, so be sure to book a call now!

Conclusion

ULIPs can be seen as a double-edged sword. On one hand, they promise the convenience of an investment-cum-insurance product with tax benefits and the potential for market-linked returns. On the other hand, they come with strings attached: multiple fees, a five-year lock-in, and often lower insurance coverage for the price.

Over the past decade, ULIPs have improved in transparency and cost-efficiency, but they remain complex products that aren’t universally suitable.

For many individuals, a term life insurance (for robust, low-cost protection) combined with separate investments (like mutual funds, PPF, etc.) can be a more effective and flexible approach. Ultimately, that choice depends on your needs.

Frequently Asked Questions

Why People Trust Ditto

Last updated on: