Quick Overview

Renewing your HDFC Life term insurance policy is one of the simplest ways to ensure your family’s financial protection stays uninterrupted. HDFC Life offers multiple flexible renewal options to suit every policyholder, regardless of whether they prefer online or offline methods. The best part? The entire process takes just a few minutes when you know exactly where to go and what to do.

In this blog, we’ll walk you through everything you need to know about HDFC Life term insurance renewal to keep your policy active without any hassle.

About HDFC Life Insurance

HDFC Life Insurance: Official Contact Details

How to Complete HDFC Life Term Insurance Renewal Online

Renewing your HDFC Life Term Insurance policy online is the quickest and most hassle-free way to keep your coverage active.

1. Official Website

To renew your HDFC Life Term Insurance policy through the official website, visit www.hdfclife.com and click on the “Pay Premium” or “Login” option available at the top-right corner.

- You can sign in using your Policy Number and Date of Birth, which may be followed by OTP verification.

- Once logged in, navigate to the “Pay Premium / Renewal” section, select the policy due for renewal, and complete the payment using Net Banking, UPI, Debit Card, or Credit Card.

- After the payment is successful, you can instantly download your premium renewal receipt. A copy is also automatically shared with your registered email ID and mobile number.

2. Mobile App

You can also renew your policy through the HDFC Life Mobile App, available on both Android and iOS:

- Once you download the app, log in using your registered mobile number or policy details.

- Select the term insurance policy due for renewal, choose your preferred payment method, and complete the transaction within minutes.

- The digital receipt is generated instantly and stored within the app for future reference.

If you purchased your HDFC Life term plan through Ditto, you can easily reach out to our team for help. We’ll guide you through every step of the renewal process since HDFC Life is one of our partner insurers.

How to Complete HDFC Life Term Insurance Renewal Offline

If you prefer face-to-face support or need assistance while renewing, HDFC Life also offers simple offline renewal options:

1. Renew at the Nearest HDFC Life Branch

- You can walk into any nearby HDFC Life branch to renew in person.

- A customer service representative will help you review your policy details, clarify benefits, and answer any questions you may have about your term plan or riders.

- You can make the renewal payment using cash, cheque, demand draft, or card.

- Once the payment is processed, the branch will provide a printed acknowledgement/receipt confirming that your HDFC Life term insurance renewal has been completed successfully.

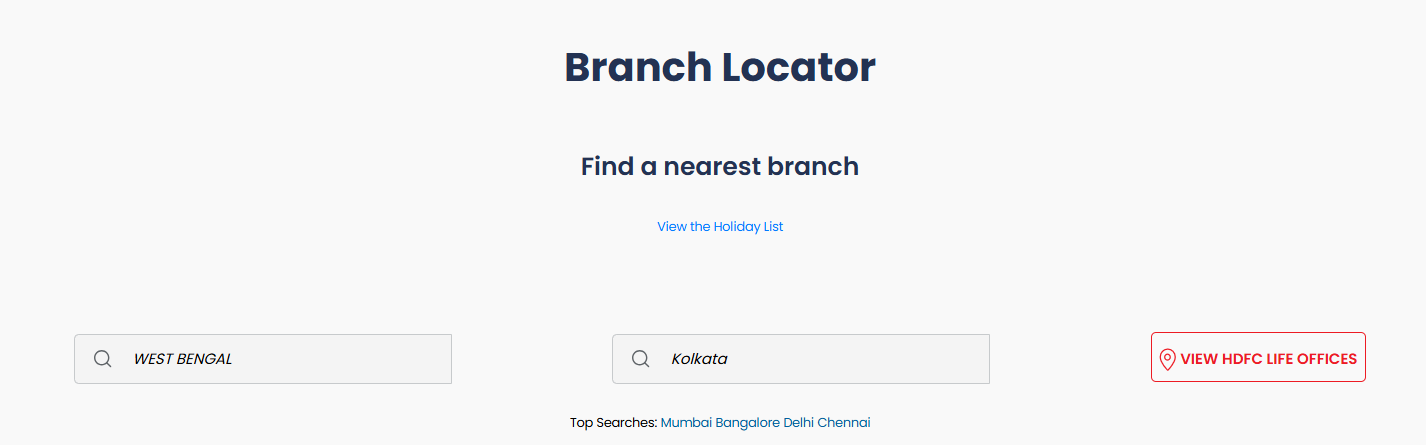

To find the nearest branch, visit the official contact page and scroll down to the ‘Branch Locator’ section.

2. Renew Through Customer Support

If you prefer remote assistance, you can reach out to HDFC Life’s customer care team via their toll-free helpline or email.

- Keep your policy number, date of birth, and registered mobile number/email ID ready for quick verification.

- The support executive will walk you through the renewal steps, explain payment options, and guide you through completing your HDFC Life term insurance renewal without visiting a branch.

Pro Tip: Consider Setting Up Auto-Debit

HDFC Life Term Insurance Renewal Grace Period

If you miss your premium due date, HDFC Life provides a grace period, an additional window of time during which you can pay your premium without losing your policy benefits. Your coverage stays active throughout this period, and you can renew your policy without any late fees or penalties.

The duration of the grace period depends on your payment frequency:

Important Reminder: Your life cover remains in force during the grace period. If a claim arises, HDFC Life will still pay the death benefit to the nominee after deducting any outstanding premiums. However, if you fail to make the payment before the grace period ends, your term insurance policy will lapse, and coverage will stop.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

HDFC Life term insurance renewal is a simple yet crucial step to keep your family’s financial protection uninterrupted. Since different policyholders are comfortable with different types of payment methods, HDFC Life offers multiple renewal options to suit your convenience. Make sure to pay your premium within the grace period to avoid any break in coverage. If you purchased your policy through Ditto, our team is always available to guide you through every process.

Frequently Asked Questions

Last updated on: