Quick Overview

Renewing your term insurance policy is more than a mere routine payment. Bajaj Allianz term insurance renewal is a simple way to keep your long-term financial safety net intact. With multiple renewal methods available, you can pay your premium from anywhere, whether you prefer quick digital payments or an in-person visit nearby.

In this guide, we’ll break down all renewal options, grace period rules, step-by-step instructions, tips to avoid policy lapse, and where to renew instantly, so you never miss the crucial due date.

Bajaj Life Insurance: An Overview

Bajaj Life Insurance (formerly Bajaj Allianz Life Insurance), was established in 2001 as a joint venture between Bajaj Finserv and Allianz SE. It became a 100% Bajaj owned company in 2025. Headquartered in Pune, it is now one of India’s fastest-growing private life insurers with ₹1,30,733 crore AUM, a 3.6x solvency margin, and a 99.32% claim settlement ratio (CSR) for FY 2024–25. With 597+ branches, 1.6 lakh+ agents, and strong bancassurance partnerships, the company serves over 3.85 crore policyholders across India.

Offering a diverse range of products, from term insurance, ULIPs (including zero allocation charge ULIPs), savings & child plans to retirement and NRI solutions, Bajaj Life focuses on long-term wealth and protection goals backed by technology-led service, competitive pricing and customer-first design.

Bajaj Life Insurance: Official Contact Details

How to Complete Bajaj Life Term Insurance Renewal Online

Renewing your Bajaj Life Term Insurance policy online is the quickest and most hassle-free way to keep your coverage active.

1. Official Website

- Visit https://www.bajajlifeinsurance.com and click on the “Renew Policy” option available at the top of the screen.

- You will be taken to the policy renewal page, where you can choose your preferred payment method.

- Pick a payment method from the available options, including net banking, UPI, EMIs from selected banks, debit card, or credit card.

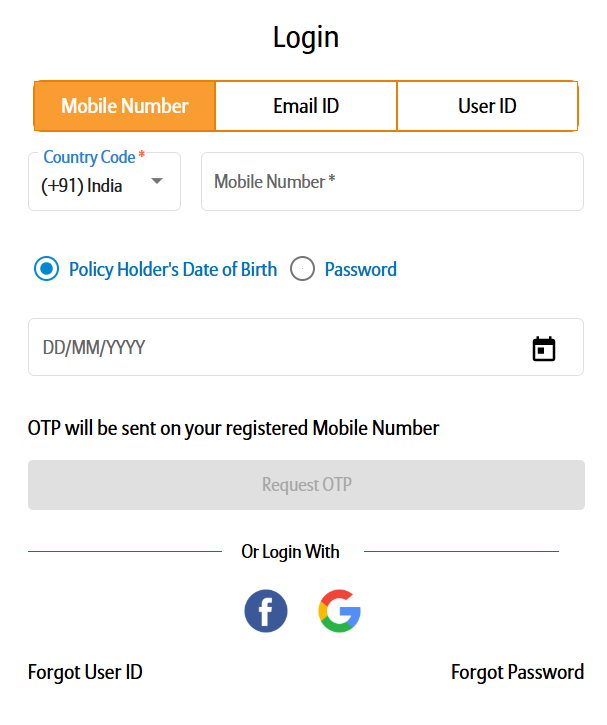

- Then, click on the “Pay Now” button. You will see the following Login screen pop up:

- After the payment is successful, you can instantly download your premium renewal receipt.

- A copy is also automatically shared with your registered email ID and mobile number.

2. Mobile App

You can also renew your policy through the Bajaj Life Mobile App, available on both Android and iOS.

- Log in using your registered mobile number or policy details.

- Select the term insurance policy due for renewal, choose your preferred payment method, and complete the transaction within minutes.

- The digital receipt is generated instantly and stored within the app for future reference.

If you purchased your Bajaj Life term plan through Ditto, you can easily reach out to our team for help. We’ll guide you through every step of the renewal process since Bajaj Life is one of our partner insurers.

Bajaj Life Term Insurance Renewal Offline Mode

If you prefer face-to-face support or need assistance while renewing, Bajaj Life also offers simple offline renewal options:

1. Renew at the Nearest Bajaj Life Branch

- You can walk into any nearby Bajaj Life branch for an in-person renewal.

- A customer service representative will help you review your policy details, clarify benefits, and answer any questions you may have about your term plan or riders.

- You can make the renewal payment using cash, cheque, demand draft, or card.

- Once the payment is processed, the branch will provide a printed acknowledgement/receipt confirming that your Bajaj Life Term Insurance renewal has been completed successfully.

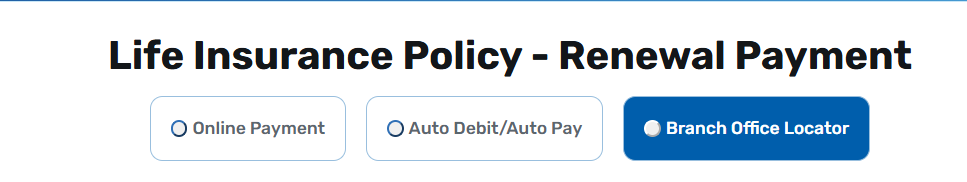

To find the nearest branch, visit the Renew Policy page and scroll down to the ‘Branch Locator’ section.

2. Renew Through Customer Support

- If you prefer remote assistance, you can reach out to Bajaj Life’s customer care team via their toll-free helpline or email.

- Keep your policy number, date of birth, and registered mobile number/email ID ready for quick verification.

- The support executive will walk you through the renewal steps, explain payment options, and guide you on how to complete your Bajaj Life Term Insurance renewal without visiting a branch.

3. Renew Your Policy at SBI Bank Branches

- You can also pay your Bajaj Life term insurance renewal premium at any SBI branch across India.

- Simply provide your policy number and policyholder DOB at the counter, make the payment through cash (up to ₹49,999), cheque, or demand draft, and collect the printed acknowledgement receipt.

- This facility is available for active and lapsed policies (within 180 days) during branch working hours.

4. Renew Through Axis Bank ATMs

Axis Bank customers can renew their Bajaj Life policy directly at an ATM, with no form-filling required.

- Insert your card, go to Special Services, then to Insurance, and then to Bajaj Life Insurance.

- Enter your 10-digit policy number (pad with zeros at the beginning if your policy number is shorter), verify policy details displayed on screen, and confirm payment.

- The premium will be debited instantly, and you'll receive a printed acknowledgement slip with policy number, receipt number, and amount paid.

5. Renew via Common Service Centres (CSC)

- For quick, cash-based renewals without visiting a branch, you can pay your Bajaj Life premium at any CSC e-Governance centre.

- Share your policy number and date of birth, pay the premium in cash (up to ₹49,999), and collect the printed receipt as proof of successful renewal.

- It is accepted for individual and group policies that are active or have lapsed within 180 days; this method is operational during standard CSC operating hours.

Ditto’s Tip: Consider Setting Up Auto-Debit

Bajaj Life Term Insurance Renewal Grace Period

If you miss your premium due date, Bajaj Life provides a grace period, an additional window of time during which you can pay your premium without losing your policy benefits. Your coverage stays active throughout this period, and you can renew your policy without any late fees or penalties.

The duration of the grace period depends on your payment frequency:

Important Reminder: Your life cover remains in force during the grace period. If a claim arises, Bajaj Life will still pay the death benefit to the nominee after deducting any premiums that were due. However, if you fail to make the payment before the grace period ends, your term insurance policy will lapse, and coverage will stop.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Renewing your Bajaj Allianz (now Bajaj Life) Term Insurance is straightforward, flexible, and accessible through multiple online and offline channels. You can complete your renewal in minutes, as long as you stay within the grace period. Consistent renewal keeps your life cover active, ensuring your family’s financial protection stays uninterrupted. And if you ever need help choosing the right plan or navigating renewals, Ditto is just a call away; free, unbiased, and hassle-free.

Frequently Asked Questions

Last updated on: