What is the TATA AIG Premium Rate Chart?

Each insurance company in India is required to submit a premium chart to IRDAI for transparency in pricing models and public accountability. The chart displays age bands, sum insured slabs, location/zones, and other policy specifications.

Similarly, TATA AIG also publishes its premium rates for health coverage to provide clarity and support informed decision-making for its customers.

Introduction

Ever wondered how your health insurance premiums differ from someone else’s, even for the same policy? That’s because several key factors, like age or city of residence, play a significant role in determining the final premium you pay for your health coverage.

Full disclaimer: TATA AIG is not a partner company with Ditto. At Ditto, we help customers understand premium differences and help them make informed choices for the best coverage.

This guide helps you understand how TATA AIG

- Calculates premiums.

- Covers age bands, sum insured slabs, and zonal classifications.

- Simplifies complex terms for easy understanding.

Did you know? Choosing the wrong insurance plan could cost you a lot in the long run! But our IRDAI-certified advisors offer free consultations to help you pick the right policy! Book a call now – no pressure, no spam, just honest insurance advice.

TATA AIG Premium Rate Chart: Age Bands and Sum Insured Slabs

Here’s a snippet from the TATA AIG policy wording where you can find the Rate chart:

Age Bands and Sum Insured Slabs provide standardized categories for risk assessment and premium calculation. Age bands group policyholders by age ranges, while sum insured slabs define coverage levels. Such classifications are required because age affects health risk, life expectancy, and the likelihood of claims, while the sum insured indicates potential payout exposure.

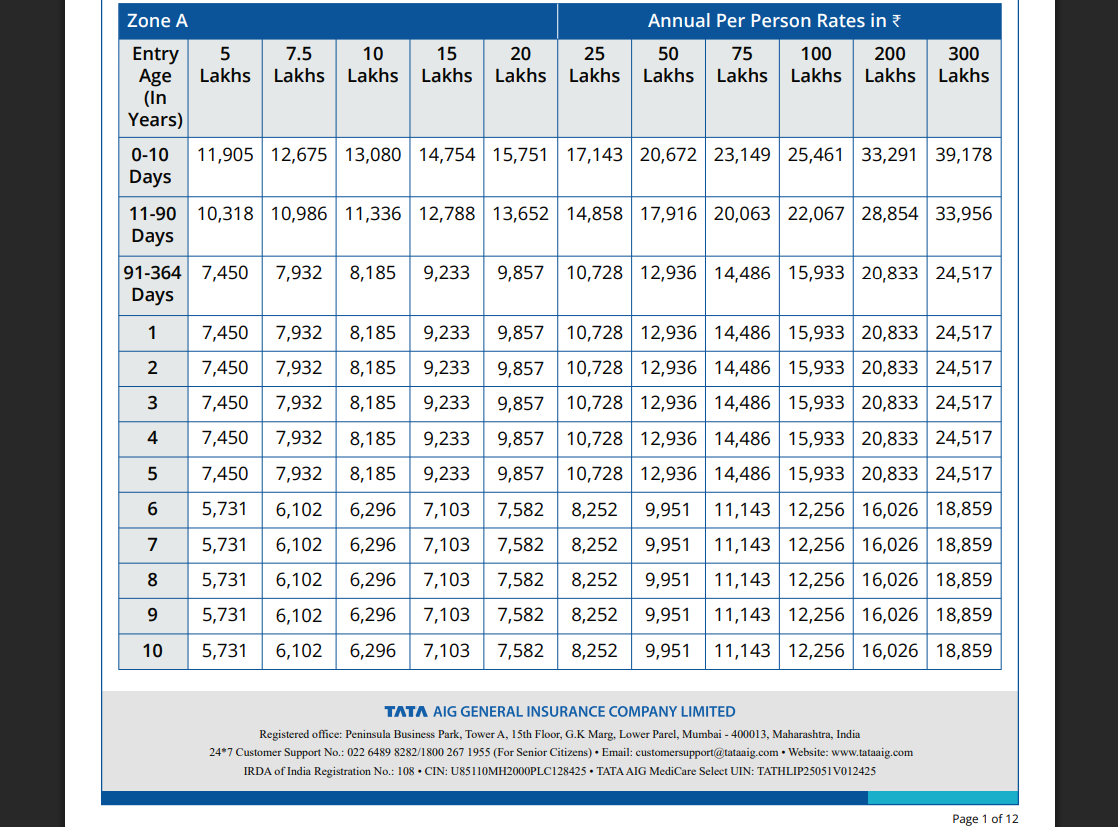

Here’s a snippet from TATA AIG’s MediCare Select:

How do TATA AIG Health Premium Prices Differ by City or Zone?

In India, health insurers use zonal classifications to price premiums more accurately based on medical costs, lifestyle risks, and healthcare infrastructure in different regions. It's a common practice to ensure that residents or those from non-metro/tier cities are not penalized for higher treatment costs in metro cities.

For example, if a 25-year-old male purchases a TATA AIG Medicare Premier with a sum insured of Rs 15 lakh, he needs to pay an annual premium of ₹14,536 if he resides in Delhi, while he needs to pay ₹11,397 if he resides in Patna.

TATA AIG offers zonal classification for its health products depending on the following zones:

TATA AIG Health Premium Prices

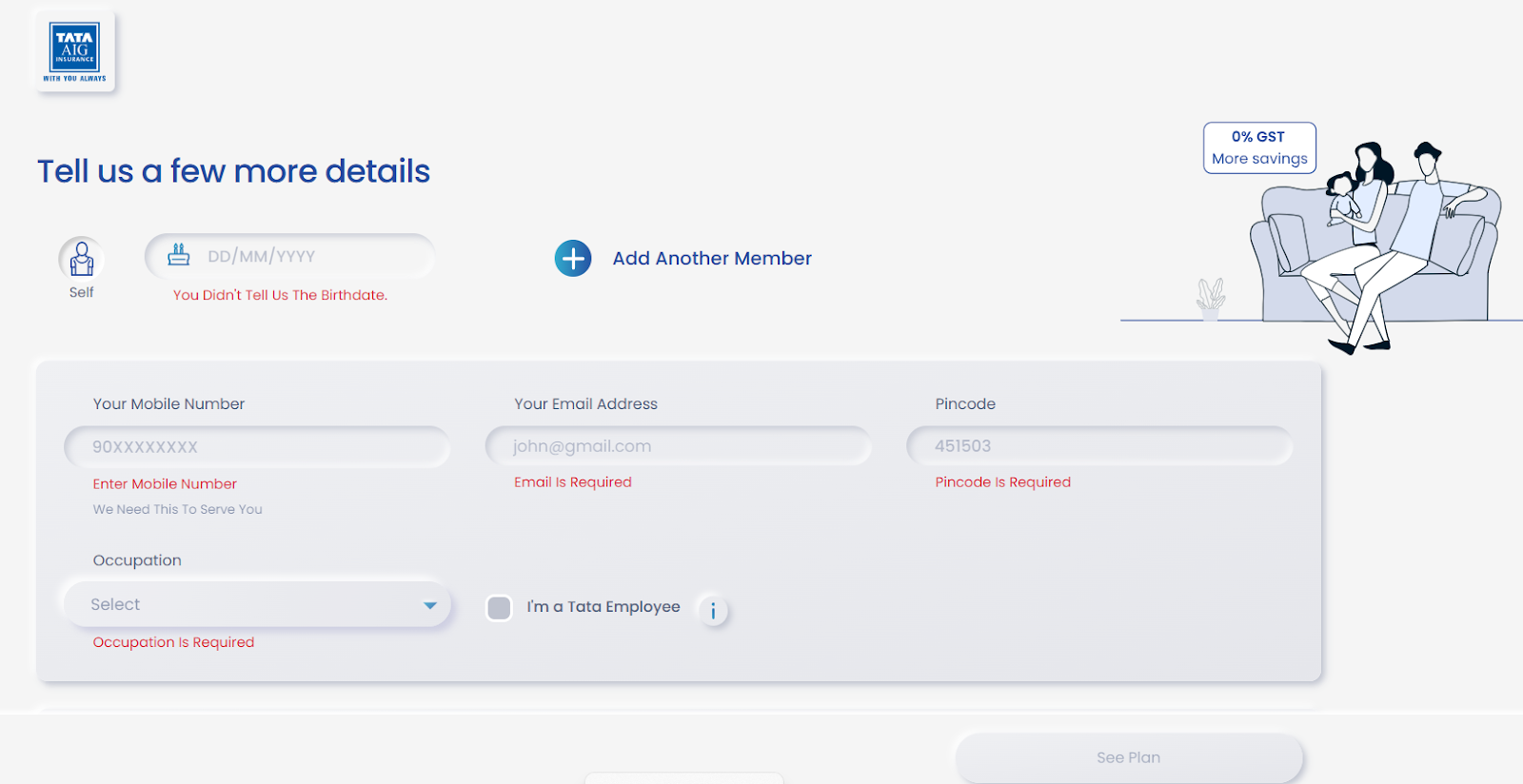

How to Calculate TATA AIG Health Insurance Premium Online?

You can calculate your insurance premium through the TATA AIG online calculator. Here’s how it works:

Step 1: Know Your Age

Premiums under the TATA AIG Policy are listed by age. The older you are, the higher the premium, since health risks rise with age. At Ditto, we recommend that our customers buy a comprehensive health plan when they are young and healthy.

Step 2: Choose the Sum Insured

Decide the total coverage amount you need (for example, ₹5 lakh, or ₹15 lakh). A higher sum insured offers better protection but comes with a slightly higher premium.

For example, if a 25-year-old male (non-smoker, residing in Delhi) purchases a TATA AIG Medicare Select with a sum insured of Rs 10 lakh, he needs to pay an annual premium of ₹6,717, while he needs to pay ₹8,083 if the sum insured is Rs 20 lakh. Thus, the premium increases by a slight margin for double the coverage.

Step 3: Check Your Zone

Premiums also vary based on where you live. TATA AIG classifies India into zones to reflect medical costs.

At Ditto, we recommend checking for zonal restrictions, such as co-payments. If your budget allows, consider choosing Zone 1/Tier-1 premiums, even if you live in lower zones, to ensure coverage for treatments in major cities without incurring extra costs.

Step 4: Add Optional Covers

You can enhance your base policy with add-ons such as consumable benefit or unlimited restoration.

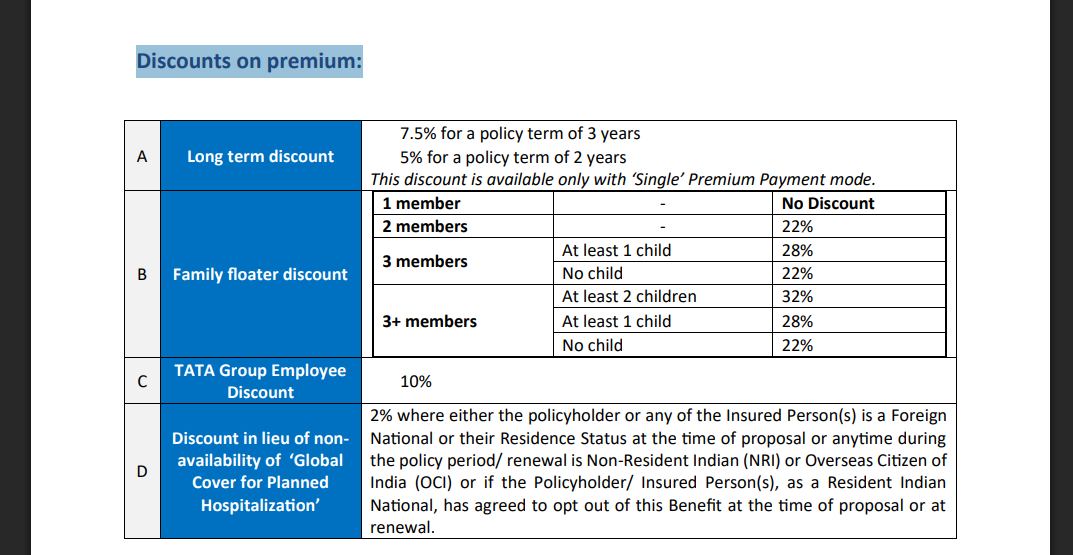

Step 5: Apply Available discounts

For instance, TATA AIG products offer several discount options. Here’s a snippet of how discounts work for the MediCare Premier Care policy:

Quick Note:

Your final premium depends on how the insurer reviews your medical history. Loading charges( due to increased BMI or smoking/drinking) increase costs to balance overall risk. PED rules limit coverage for pre-existing conditions. Together, they help keep insurance affordable and fair for both the insurer and the policyholder.

How Are Premiums for Family Floater Plans Calculated?

Under a family floater policy, the total premium is calculated on the basis of the age of the eldest member. When you add more members, a small additional amount is added to the premium.

Let’s take a quick look at the premiums( including consumable cover add-on) for TATA AIG Medicare Select for different family compositions, opting for a sum insured of ₹15L, residing in Delhi:

Premiums for Family Floaters

Why Talk to Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

TATA AIG’s premium rates change based on your age, city, and coverage. It is a trusted insurer that offers a variety of plans and dependable customer support.

Frequently Asked Questions

Are premium charts mandatory?

Yes. Health insurance regulations require insurers to publish product details, including policy wordings, prospectuses, and premium rates, on their websites.

Does my premium increase every year?

Premiums may increase when you move to a higher age band, add additional covers, or when insurers revise rates under IRDAI-approved guidelines due to medical inflation.

Can I reduce my TATA AIG health insurance premium amount?

Yes. You can opt for a deductible, buy a multi-year policy, or avoid unnecessary add-ons to lower your premium.

Why is my premium different from someone else’s?

Premiums depend on age, sum insured, zone (city category), and optional add-on covers. Even with the same plan, variations in age, health, or city can result in different premiums.

How can I quickly find my premium in the rate chart?

Check your age band, zone, and sum insured in the TATA AIG premium rate chart to ensure accuracy. The corresponding row shows your annual premium.

Last updated on: