Quick Overview

Ever wondered why your Star Health Insurance premium differs from someone else’s, even with a similar plan? That’s because factors like age, health history, and city affect how premiums are calculated. At Ditto, we break this down simply. In this guide, you’ll learn how to download the premium chart PDF, calculate your premium online, and understand what really drives your cost.

What is the Star Health Insurance Premium Chart?

A health insurance premium chart shows how the cost of a plan changes based on the cover amount you choose, the number of members, their ages, and the pin code. Every insurance company in India must share its premium chart with IRDAI to ensure transparent and fair pricing. It may appear as a table in a brochure or be available through an online premium calculator.

Take Note: Insurers must follow IRDAI’s product pricing rules, which require premiums to be fair and transparent. This means prices should not be too high, too low, or unfairly different for similar customers. The goal is to ensure that health insurance products are priced reasonably and consistently for all policyholders.

How to Download the Star Health Insurance Premium Chart?

- Navigate to Star Health’s official website.

- Scroll down to the ‘Download Section’ under the ‘Resources’ table at the bottom of the page

- Click on the ‘Prospectus’ and ‘Brochures’ option under Health Plans

- Select the desired plan, and you can find the premium charts.

Premiums for Star Health plans like Comprehensive, Star Super Star, and Assure are available through the respective plan links.

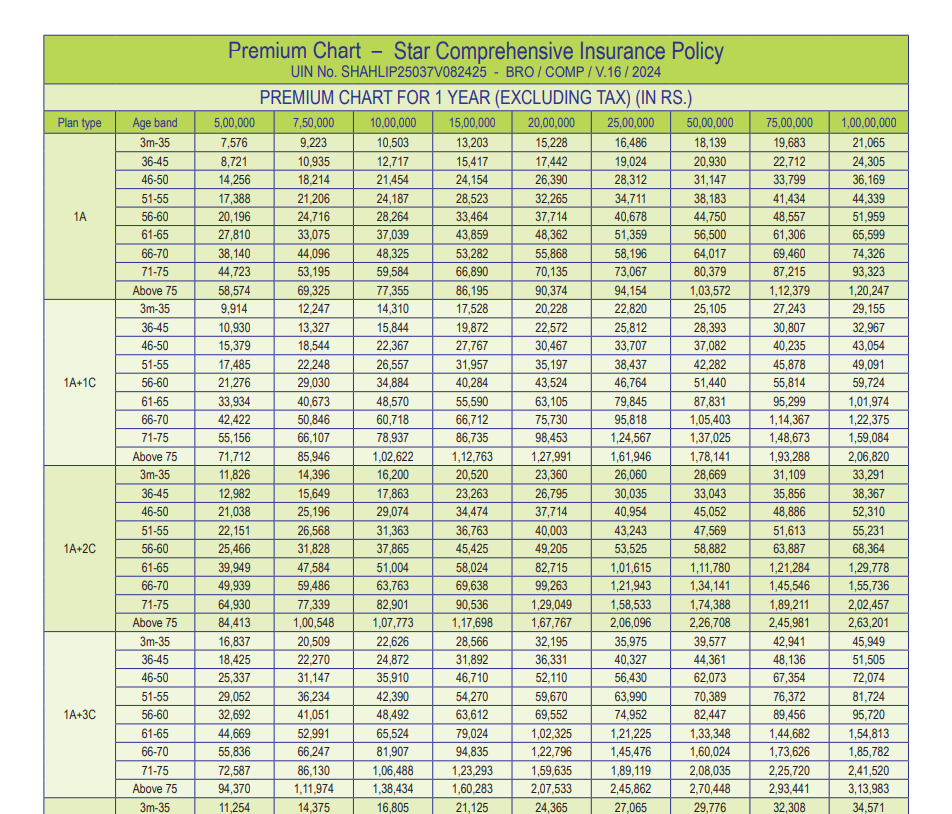

Here’s a snippet of the Star Comprehensive policy premium chart:

Source: Star Comprehensive Brochure

Note: It is always advisable to download the premium chart from the official insurer website, as information on third-party websites can be outdated or inaccurate.

What the Star Health Insurance Premium Chart Shows?

The Star Health Insurance premium chart PDF provides a detailed breakdown of premiums based on key factors such as:

Age bands and sum insured

- Policy type (individual or family floater)

- Tenure discounts (1 year, 2 years, or 3 years)

- Zone-based pricing (if any)

Note: You can calculate your Star Health Insurance premium online by using the premium calculator on the insurer’s website. You need to enter details like your age, sum insured, city, and policy type to get an instant estimate.

Star Health Insurance Plans Covered in the Premium Chart

The Star Health Insurance premium chart PDF usually covers the insurer’s main retail health plans, such as Star Comprehensive and SuperStar, and select specialized policies like Star Cardiac Care.

These charts can be displayed either in the plan Brochure or Prospectus. Some details, like discounts, may not be included, so it’s best to check with the insurer or a trusted agent for the full and correct information.

If you want to estimate your health premium using the chart PDF, here’s a simple method:

- Select your plan type (1A, 2A, 2A+1C, etc.) and locate your age band in the table.

- Choose the column for your required sum insured.

- Start with the base premium shown.

Next, adjust it for:

- Any optional add-ons you plan to include.

- Official discounts mentioned in the brochure or prospectus.

This gives you a close estimate of what your final premium may look like.

Note: These premiums can change based on loadings due to medical history.

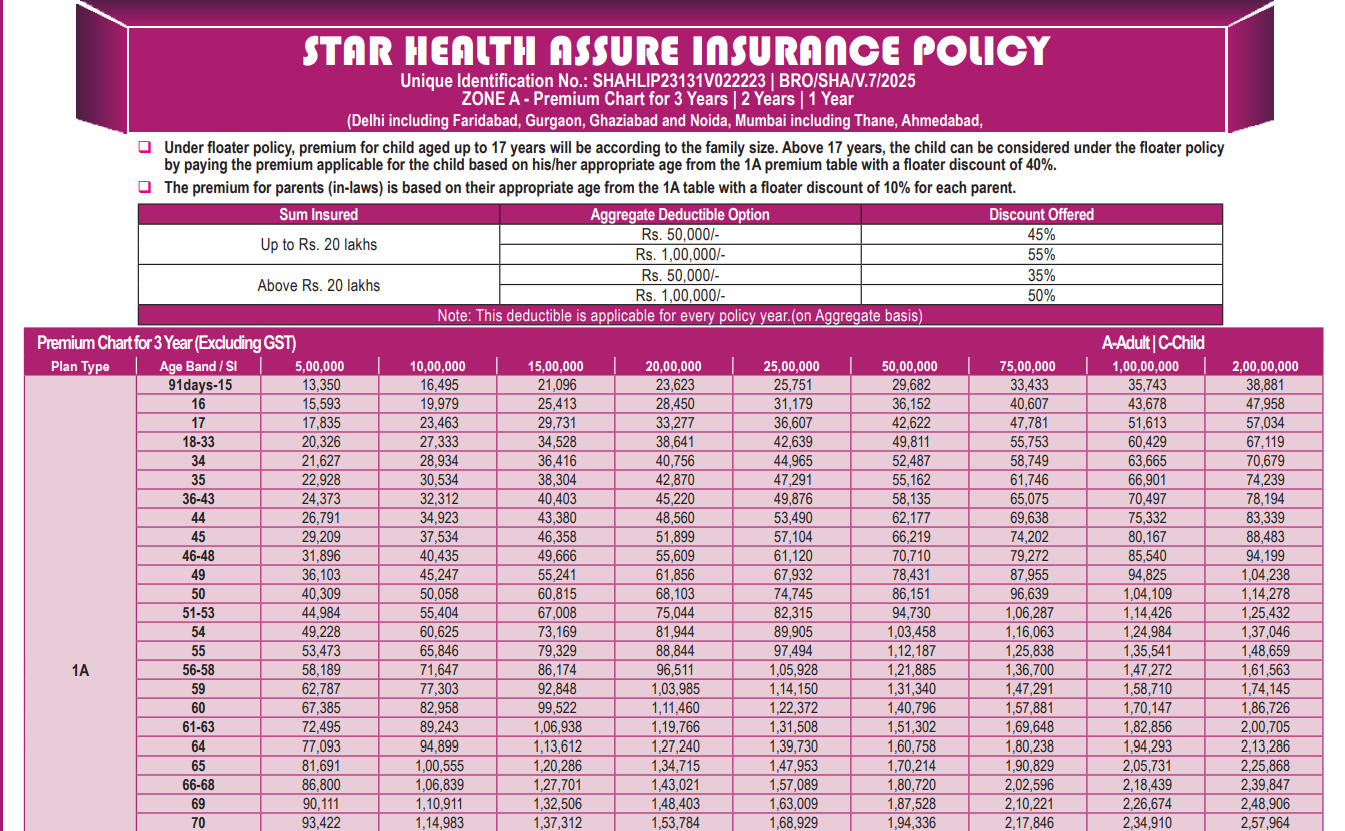

Here’s a snippet of the Star Health Assure Insurance policy premium chart:

Source: Star Health Assure Insurance Brochure

Popular Star Health Insurance Plans With Premium Charts

Note: These annual premiums are calculated for a ₹15 lakh sum insured for a policyholder residing in Delhi. The Super Star premiums include bonus and health check-up add-ons for the first three profiles.

Why Approach Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat with us on WhatsApp now, slots fill up fast!

Star Health Insurance Premium Chart PDF: Ditto’s Take

Downloading the Star Health Insurance premium chart PDF is quick and convenient. It gives you a clear view of how premiums vary by age, sum insured, and policy type. However, the premium should not be the only deciding factor. It is equally important to review the scope of coverage and policy benefits before choosing a plan.

Disclaimer: Star Health is our partner. If you’d like expert advice on plans offered by Star Health, book a call with us. You can also explore our comprehensive health insurance plans for 2026 to compare options and choose what suits you best. Learn more about how we evaluate health insurance plans through Ditto’s Cut.

Frequently Asked Questions

Last updated on: