SBI cashless health insurance: Overview

SBI cashless health insurance allows one to avail treatment at a network hospital without paying a significant amount upfront. The eligible costs are settled between the hospital and the insurer as per the policy terms.

For planned treatment, pre-authorization is needed and for emergencies one must intimate the insurer promptly. SBI’s cashless health insurance also acknowledges India’s “Cashless Everywhere” initiative by expanding cashless access beyond network hospitals. However, real-time adoption varies by hospital, so always confirm before admission.

Introduction

Cashless health insurance is preferred for predictable hospital bills and low out-of-pocket expenses. But where it differs across insurers is the speed, reliability, and coverage. With an extensive hospital network and speedy claim approvals, SBI cashless health insurance can be a good option.

This article explains :

- What does SBI cashless insurance offer

- The key benefits of SBI cashless insurance

- The eligibility criteria for SBI cashless insurance

- List of SBI cashless insurance plans

- Inclusions and exclusions of SBI cashless health insurance

- How to buy a SBI cashless health insurance

Pro tip: The health insurance market can be a labyrinth. Instead of spending hours navigating through the hundreds of policies out there, why not book a free call with our expert IRDAI-certified advisors? We don’t spam or pressure you to buy. Just honest insurance advice.

What Does SBI Cashless Health Insurance Offer?

All major SBI General retail health plans (like Health Edge, Super Health, Arogya Supreme, and Arogya Sanjeevani) have cashless options. However, always check SBI’s network hospitals and confirm cashless availability with the hospital insurance desk. (The list of network hospitals is updated periodically).

Key Benefits Of SBI Cashless Health Insurance

No large upfront payment at network hospitals

Bills are settled between hospital and insurer as per policy terms.

Hassle-free hospital admission

Pre-authorization for planned procedures ensures critical care, faster discharge, and billing.

Comprehensive & transparent coverage

Get cover for inpatient care, domiciliary hospitalization, ambulance charges, post-hospitalization expenses, day-care procedures, and AYUSH treatments with the right room rent.

The “Cashless Everywhere”option

Cashless may be possible even at some non-network hospitals with advance intimation and insurer approval.

Access to an extensive hospital network

SBI’s extensive empaneled hospital list (16,000+) covers prominent metros, tier-2, and tier-3 cities.

Attractive tax savings

Premiums qualify for deductions under Section 80D of the Income Tax Act (only under the old tax regime).

No mandatory medical tests

Medical check-ups during policy purchase under 45 years are not needed for many plans.

Free annual health check-ups

Some SBI cashless health plans offer free yearly health check-ups for customers.

Eligibility Criteria for SBI Cashless Health Insurance

To buy SBI cashless health insurance plans, one must be:

- Between 18 to 65 years with some plans extending up to 99 years (for adults). For dependent children, they should be between 91 days up to 25 years.

- An Indian resident with valid identity, age and address proof

- Ready to disclose all pre-existing diseases

- Willing to undergo medical tests for a higher sum insured or when buying at an advanced age

List of SBI Cashless Insurance Plans

Explore SBI’s cashless health insurance plans with diverse coverage needs (from ₹1 lakh to ₹4 crore).

Note: By design, Top-up/Super Top-up plans are reimbursement-based health plans (above deductible). For planned cashless treatment at a network hospital, confirm pre-authorization cover with the insurer and hospital.)

Did You Know:

To make cashless claims quicker and fairer, IRDAI has set clear timelines that every insurer must follow:

- Insurers must approve or reject a cashless hospitalization request within one hour of receiving it.

- Once the final bill is sent, the insurer must issue discharge within 3 hours. If delayed, the insurer, not the policyholder, must bear the extra hospital charges.

- Insurers are also expected to work toward 100% cashless settlements across their network hospitals.

Inclusions and Exclusions of SBI Cashless Health Insurance

SBI cashless health insurance plans cover a range of medical expenses, except certain specified treatments and conditions. Here’s what to watch out for.

Common inclusions:

- In-patient hospitalization and day-care procedures

- Pre and post-hospitalization expenses

- Ambulance and organ donor expenses

- AYUSH treatments (Ayurveda, Yoga, Unani, Siddha, Homeopathy)

- Wellness check-ups and consumables cover (Claims Shield) on select plans

- OPD, maternity/newborn care, and specified global treatment add-ons

- Waiting periods apply for initial, listed illnesses, and pre-existing conditions

Common Exclusions:

- Self-inflicted injuries, war-related injuries, and breach of law

- Cosmetic treatments, weight management, infertility, surrogacy unless covered

- Experimental or unproven treatments

- Other permanent exclusions listed in the policy

How to Buy SBI Cashless Health Insurance?

Besides offline purchase, one can also buy SBI cashless health insurance plans digitally in a few steps :

- Visit SBI General Insurance website.

- Put your name (as it appears on PAN Card) mobile number, and email id to proceed.

- Choose your plan and sum insured based on your needs.

- Fill out your personal and health details.

- Upload necessary documents.

- Customize the health plan with add-ons (riders) if needed.

- Pay the premium online or choose the auto-debit option (if you’re an existing SBI bank account holder).

- Receive your policy document and digital health card.

Why Choose Ditto For Health Insurance?

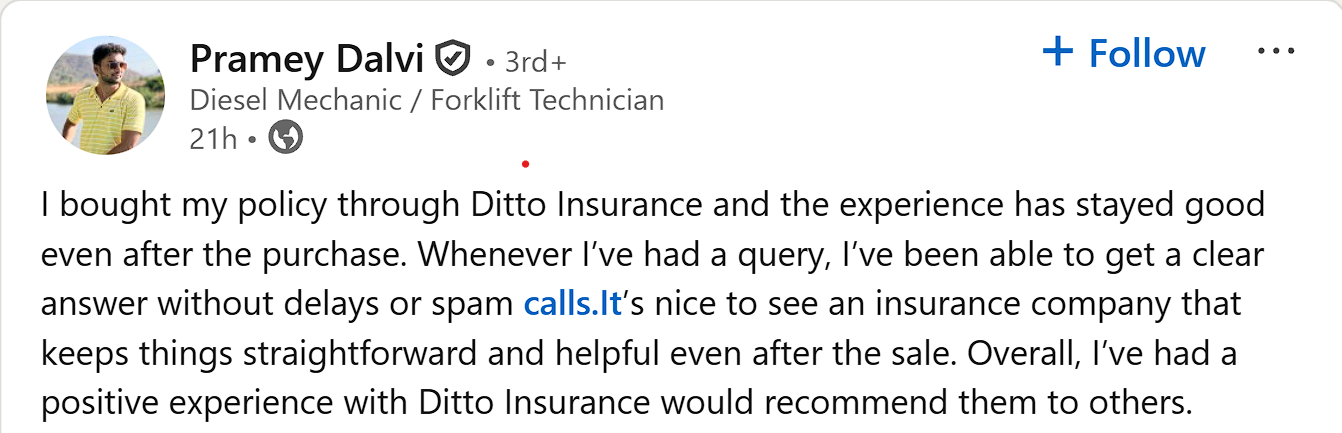

At Ditto, we’ve helped 7,00,000+ customers become smart insurance buyers by matching their unique needs to the right health insurance policy. That’s why customers like Pramey trust Ditto and recommend us to others.

✅ Honest advice – no sales pitches, no commission-driven recommendations

✅ 12,000+ 5-star reviews (Rated 4.9 on Google)

✅ Real claim experience – we've helped customers through actual claims

✅ Backed by Zerodha and other leading fintech companies

Get More From Your SBI Cashless Health Insurance: Ditto's Take

Here's a 7-point checklist by Ditto to help you get more from your SBI cashless health insurance.

- Ensure your preferred hospital is on SBI General’s network of hospitals.

- Choose a room category that's allowed in your plan.

- Send pre-authorization notice to the hospital for planned procedures in advance (48-72 hrs. early). For emergencies, intimate the insurer/TPA ASAP.

- Get claim shield add-on to save out of pocket expenses on non-medical items.

- A refundable deposit (usually ₹5,000–₹50,000) may be needed at admission to cover non-admissible items or delays.

- At discharge, the insurer pays the approved amount directly to the hospital. You may pay extra for expenses exceeding insurer limits or policy sub-limits (like room rent or co-payments).

- Pre-authorization from the insurer, handled by the hospital and TPA, is required for treatment approval.

To know more about the claim process in detail, refer to our comprehensive guide on How to claim health insurance.

Conclusion

Good cover, affordable pricing, positive claim experience; that’s SBI’s Cashless Health Insurance for you. But, don’t buy a plan blindly. Book a free call with Ditto where our IRDAI-certified experts can match your needs, budget, and health risks to the right plan.

FAQs

Are there any sub-limits applicable to SBI Health Insurance?

Yes, there are sub-limits and room/ICU category rules that apply for some plans and chosen add-ons. Check your policy wordings or brochure before purchase to prevent proportionate deductions and partial cashless approvals.

How do I find SBI’s network hospitals for cashless treatment?

Visit the official website of SBI General Insurance and use the official network hospital finder. Search by city/TPA and call the hospital desk to confirm the cashless process.

Does cashless work at non-network hospitals now?

Under the “Cashless Everywhere” initiative, cashless facilities may work in some non-network hospitals. However, it needs insurer approval and prior intimation.

What are the timelines for claim settlement if I get reimbursement instead of cashless?

According to the IRDAI rules, all insurers must settle or reject claims within 30 days of receiving the necessary documents. Any unexplained delay attracts a penalty. delays attract interest.

Last updated on: