Quick Overview

Health insurance plays a critical role in protecting individuals and families from the financial impact of medical emergencies. Yet many people delay buying health insurance thinking they won’t fall sick enough to be hospitalized. Some believe their corporate insurance is enough. Others feel it’s not worth investing in a policy they may never use.

But imagine getting hospitalized due to an accident or a critical illness that results in a massive bill. It hits hard because you are forced to either dip into your hard-earned savings or, worse, borrow money. By paying a small annual premium you transfer the major financial risk to the insurer.

By doing this, you not only save lakhs in hospital bills, but protect your long-term savings, and most importantly, secure your peace of mind. In this article, we delve into the key reasons to get health insurance coverage.

Why Should You Get Health Insurance?

Many people delay buying a policy, only realizing the importance of health insurance when a medical emergency strikes. Here are the key reasons that explain why health insurance is important today.

1) Financial Protection During Medical Emergencies

Medical emergencies like accidents, surgeries, or ICU admissions can happen without warning and often come with massive bills. For example, a heart bypass surgery in a private hospital can cost ₹3–7 lakhs. Paying this out of pocket can drain years of savings. Health insurance cushions this financial shock and helps you handle medical crises without panic or draining your finances.

2) Rising Medical Costs and Healthcare Inflation

Healthcare costs in India are projected to rise around 11–12% in 2026, significantly outpacing general inflation and increasing the cost of medical care year on year. A treatment that costs ₹5 lakhs today could easily cost double in a few years. Even routine procedures have become more expensive, while advanced treatments like cancer care or prolonged ICU stays can cross ₹10–15 lakhs.

Health insurance protects you against these rising costs by ensuring adequate coverage before premiums move to higher age bands. Some plans, such as Niva Bupa Reassure 2.0 and Reassure 3.0, offer premium lock-in benefits for a defined period (until you make the first claim), shielding you from age-based hikes.

However, premiums still increase every 2–3 years to account for medical inflation, even with the age-lock feature. Insurers like HDFC ERGO, Aditya Birla, Care Health, and Niva Bupa offer multi-year policies for 2–3 years, where the premium remains fixed for the chosen term. During this period, any increase due to medical inflation does not affect your premium, and you may also get upfront payment discounts.

Note: The amount of health insurance you need depends on where you live, your age, medical conditions and history, family structure. Given the higher cost of treatment in metro cities, opting for a base cover between ₹15–25 lakhs makes practical sense.

3) Access to Quality Healthcare Without Cash Stress

One of the biggest importance of health insurance is the guaranteed access to quality healthcare without worrying about immediate cash payments. Health insurance plans offer cashless treatment at network hospitals, where the insurer settles bills directly with the hospital. This helps you focus on your treatment and recovery rather than finances. Network hospitals are usually vetted by insurers for quality standards, infrastructure, and service levels, ensuring care from trusted providers.

Note: Cashless hospitalization is a feature, not a guarantee. Out-of-pocket costs may still arise, and it’s wise to be prepared for reimbursements in certain situations.

4) Coverage Beyond Hospital Bills

Health insurance today goes beyond hospital bills. It offers all-around protection that highlights the importance of health insurance in overall wellness. Comprehensive plans cover pre- and post-hospitalization, daycare procedures, modern treatments, domiciliary treatments, annual check-ups, mental health support, ambulance charges, consumables, and even home care. Features like restoration of sum insured and no-claim bonuses enhance your coverage. Note that the benefits vary by plan, some features are in-built, others available as add-ons, so always check the policy terms carefully.

5) Corporate Health Insurance Is Not Sufficient

Relying only on employer-provided insurance is risky. Corporate plans offer limited coverage, often ₹2–5 lakhs, which may not be enough for a single major hospitalization. This gap highlights the importance of health insurance in India. Employers control the policy, they set the sum insured and features, and coverage ends when you retire or resign, leaving you unprotected. Having your own health insurance plan keeps you covered no matter what by giving you flexibility, continuous protection, and peace of mind for life.

6) Income Tax Benefits Under Section 80D

Under Section 80D (old regime), individuals can claim up to ₹25,000 for self/family and ₹25,000 for parents. If both the primary taxpayer and their parents are aged 60 or above (60+), the limit increases to ₹50,000 each, totaling a maximum deduction of ₹1,00,000 annually. These limits include a sub-limit of ₹5,000 for preventive health check-ups.

7) Peace of Mind and Emotional Security

Beyond numbers and benefits, the true importance of health insurance lies in peace of mind. During a health crisis, the last thing you should worry about is money. Knowing that quality treatment is accessible without compromise brings emotional security, especially for breadwinners and caregivers. When you have insurance, you are not just protecting yourself, you are making sure your family doesn’t suffer in your absence. It is therefore recommended to buy health insurance early, so waiting periods run during your healthiest years and your coverage is fully active when you need it most.

Use our policy comparison tool to easily compare plans and find the plan that’s right for you.

Why Approach Ditto for Health Insurance?

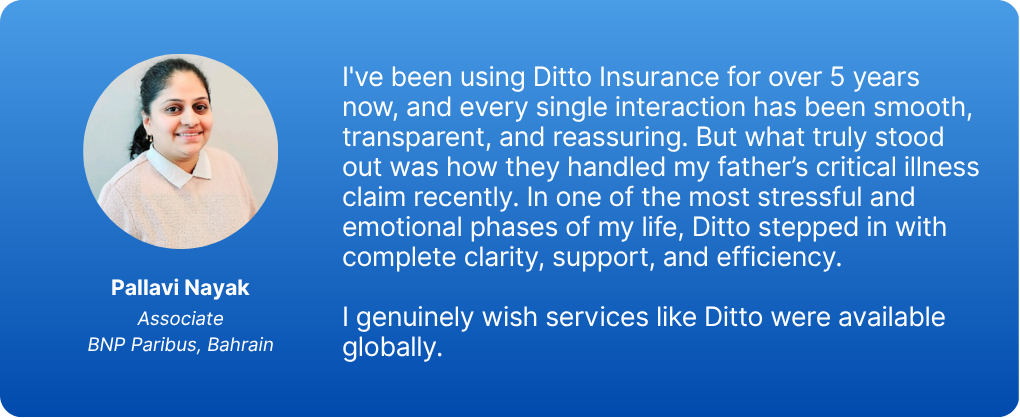

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now or WhatsApp us slots fill up fast!

Conclusion

Health insurance is one of the most important tools to safeguard your health and finances, especially when life takes an unexpected turn. Beyond tax benefits, it ensures access to quality care and support during emergencies. With rising medical costs, unpredictable illnesses, and evolving lifestyles, the question isn’t if you need health insurance, but how soon you can secure it for a safer future.

Frequently Asked Questions

Last updated on: