Quick Overview

Imagine you bought your health insurance policy a few years ago. Back then, it felt okay for your needs. But now hospital bills have shot up, your coverage feels too low, there are way too many conditions in the fine print, and every time you raise a claim, the support feels underwhelming at best.

This is what prompts you into thinking whether you should move to a better health insurance plan. Now, the question is: do you start applying for a fresh policy or shift the existing one?

This is where you need to know the term ‘health insurance portability’ which we will discuss in this guide.

What is Health Insurance Portability?

Health insurance portability is like porting your mobile number. When you switch from one telecom company to another, you keep the same number; you just change the network. Similarly, when you port your health policy, you move to a new insurer but carry forward benefits you have already built, such as waiting period credits, no claim bonus, and moratorium years.

For example, say you have a Care Supreme policy that you have held for a few years, and you now port to HDFC Ergo Optima Secure. The years already completed under Care Supreme are counted towards waiting periods up to your old sum insured plus eligible bonus.

Steps To Port Your Health Insurance Policy

Step 1: Check Your Renewal Date

Porting is allowed only at renewal, not in the middle of the year or during the grace period. Contact the new insurer 45 to 60 days before your policy expires.

Step 2: Shortlist New Plan

Compare the new plan with your current one. Look at the sum insured and policy benefits, exclusions, and waiting periods, the hospital network, and the insurer’s track record.

Step 3: Apply To The New Insurer

Inform the new insurer that you want to port an existing policy. You will need to fill out a proposal form, a portability form, and share basic details of your current policy.

Step 4: Submit Documents

The new insurer reviews your application and asks for supporting documents. Medical tests can happen, based on your age, sum insured, and health history. We’ll list the full document set in the next section.

Step 5: Application Review & Data Sharing

Once you apply, your old insurer shares your policy and claim history with the new insurer through the IRDAI Insurance Information Bureau (IIB) portal. The new insurer then underwrites your case and can accept the application as it is, accept with conditions like loading, exclusions, or co-pays, or reject the request.

Step 6: Approval & Issuance

If everything checks out, the new insurer issues your policy effective from your renewal date, and all continuity benefits like waiting periods, no-claim bonus credits, and moratorium years are carried forward. If the new insurer declines your port request, you can continue by renewing your existing policy.

What Documents are Required for Porting?

- Current policy document (and latest renewal notice)

- Last 2-3 Years Policy Documents

- Endorsement letters, if you’ve added members, increased coverage, or made changes over the years

- Claim history (if you’ve claimed before)

- Recent medical reports

- ID and address proof - Aadhaar, PAN

- Filled proposal and portability forms from the new insurer

Note: Additional documents may be requested on a case-by-case basis.

IRDAI Rules for Porting Your Health Insurance

- Individual and family floater indemnity policies from general or standalone health insurers are eligible for portability.

- You can only port at renewal. The window opens 45–60 days before expiry. Even though some insurers accept requests even 1–2 weeks before renewal, applying early gives them enough time to evaluate and reduces the risk of a lapse.

- If the new insurer approves the request, your waiting periods, moratorium period, and bonus are carried forward.

- Portability is subject to underwriting, so the new insurer can accept, modify, or decline your proposal based on its own risk rules.

For a full breakdown of timelines, eligibility, and rights, you can read our detailed article on health insurance portability rules by IRDAI.

Things to Check Before You Port

Is The New Plan Better?

Compare features, not just price. A slightly lower premium with stricter room rent limits or heavy co-pays can hurt you more during claims.

Where Are You In Your Moratorium Journey?

If you’ve already spent 5+ continuous years with your current policy and haven’t had serious issues, you already enjoy strong protection. Port only if there’s a clear coverage or service problem.

How Is Your Health History?

Multiple pre-existing diseases, recent major surgery, or frequent claims can make porting harder. In some cases, it may be safer to improve coverage within the same insurer instead of porting out.

Any Planned Hospitalizations?

If a planned surgery is around the corner, switching insurers right now can complicate claims. It’s better to get through the treatment and then revisit porting at the next renewal.

Too Close To Renewal?

If there are fewer than 15 days left for renewal, it is safer to renew your current plan. Porting at the last minute can lead to a break in coverage if the new insurer cannot underwrite your case in time.

Why Choose Ditto for Insurance?

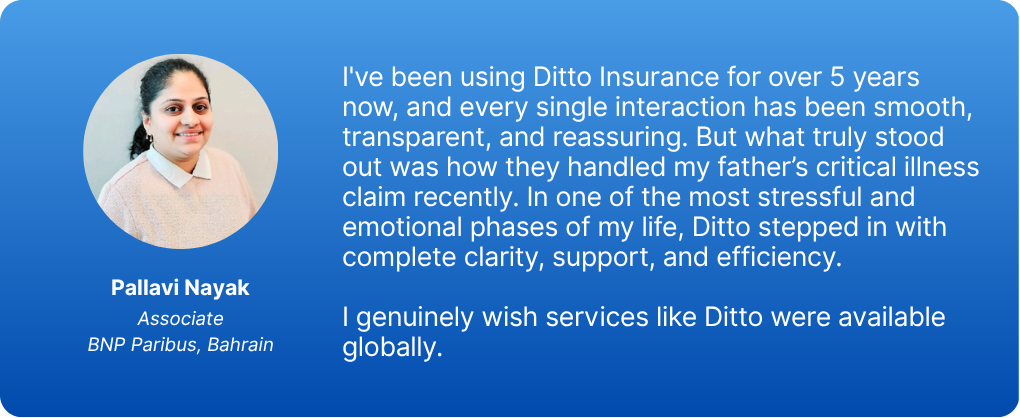

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Ditto’s Take on Porting

The porting process works best when you move in a clear order: first select the new plan carefully, then give the new insurer everything they need in one go, and only after the new policy is issued for the same start date, can you let the old one end.

Starting early gives the new insurer enough time to collect data from your old insurer, ask for medical tests if needed, and issue the policy without any gap. Keeping your old policy copies, claim history, and medical reports ready cuts down most back and forth. Finally, before you pay, read the new policy schedule and confirm what continuity benefits you are getting from day one.

Frequently Asked Questions

Last updated on: