What Is Term Life Insurance?

Term life insurance is a simple plan that protects your family in the event of your unfortunate death. It offers coverage for a fixed period, ranging from a minimum of 10 years to a maximum of 80 years or 100 years. If you pass away during the policy period, your nominee gets the payout.

Introduction

Choosing the correct term life insurance can seem tricky with so many plans and features. But don’t worry, at Ditto, we make it simple. From explaining plan types to helping you find the right coverage, we guide you every step of the way so you can make a confident, worry-free choice.

This guide helps you understand:

- What a term life insurance plan is and its types

- What are its benefits and factors that affects its premiums

- How much coverage is enough and how to calculate it

Confused about which type of term insurance plan works best for you? Book a call with our IRDAI-certified experts and get clear, spam-free advice today.

What Are the Types of Term Life Insurance?

Different types of term life insurance plans cater to various financial needs. Here are the main ones to know:

- Level Term Plan: Gives fixed cover and premium for the full term. If you survive, there’s no payout.

- Return of Premium Plan: Returns all premiums if you live through the term, but costs much more.

- Increasing Cover Plan: Cover grows every year (around 5–10%) to handle rising costs.

- Decreasing Cover Plan: Cover reduces over time, suitable for loans or short-term needs.

- Joint Life Plan: Covers both spouses in one plan but often offers limited benefits.

- Housewife Plan: Offers basic coverage to homemakers, although with a limited sum assured.

- NRI Term Plan: Made for NRIs; stays active even after moving back to India.

- No-Income-Proof Plan: Helps freelancers or small business owners without salary slips.

- Corporate Term Plan: Employer-provided cover that ends when you leave the job.

How Term Life Insurance Premiums Increase with Age?

Let’s take a quick look at how the costs of a ₹1 crore term plan for HDFC Life Click 2 Protect Supreme (till age 70, for a non-smoker person) increase with age:

What Are the Features and Benefits of Term Life Insurance Plans?

High Coverage, Low Cost

You get a large coverage area at an affordable premium.

Flexible Payments

You can pay monthly, quarterly, or annually, whatever suits you best.

Tax Savings

Premiums are tax-deductible under Section 80C (old tax regime), and payouts are tax-free under Section 10(10D).

Extra Protection

Consider adding riders such as Critical Illness, Accidental Death, or Waiver of Premium for enhanced coverage.

Financial Security

Your family gets financial support to manage expenses and loans if you’re not around.

How Does Term Life Insurance Work?

Term insurance is easy to understand. You pay a fixed premium on a regular basis throughout the chosen payment term. The policy lasts for a set number of years, which can range from 5 to 82 years, based on your age and need.

If you pass away during this period, your nominee receives the full cover amount. However, if you outlive the policy term, it will end without any payout, unless you’ve chosen extra benefits, such as whole-life coverage or riders.

Learn more about how term life insurance works.

Example:

If you buy a 30-year term plan with ₹1 crore coverage at age 30 and pass away at age 45, your family receives ₹1 crore. But if you live till 60, the plan ends without a payout.

What Are the Factors That Affect the Term Insurance Premium?

Several factors decide how much you’ll pay for term insurance:

- Age: Buying insurance at a young age helps you get cheaper premiums.

- Gender: Women usually pay less due to longer life expectancy.

- Health: Good health means lower costs, while illnesses raise premiums.

- Lifestyle: Smoking or drinking (both past and present) increases your premium.

- Policy Term: Longer coverage often costs a higher premium.

- Sum Assured: Higher coverage means higher premium.

- Riders: Adding riders for extra protection increases the total cost.

How Much Term Insurance Coverage Do I Need? Ditto’s Take

There’s no fixed number that works for everyone. Your ideal cover depends on income, lifestyle, loans, and goals. Here’s a simple way to figure it out:

There’s no fixed number that works for everyone. Your ideal cover depends on income, lifestyle, loans, and goals. Here’s a simple way to figure it out:

- Income Method: Multiply your yearly income by the number of years left till retirement.

- Expense Method (Ditto’s Pick): Add your family’s future expenses and outstanding loans.

- Quick Rule: Take a cover worth 10–25 times your annual income.

Learn more to more about the term coverage you would need.

What are the Top Term Life Insurers in 2025?

Before we discuss the list, here’s how we decide what plans to feature.

At Ditto, every health plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars.

You can learn more about how we evaluate term insurance plans here.

How to Calculate Your Term Insurance Cover?

There’s no fixed amount that fits everyone. The right cover depends on your income, lifestyle, family goals, and loans. Term insurance primarily replaces your income, allowing your family to meet their needs in the event of your passing.

You can find your ideal cover in two simple ways:

- Consult with an expert who can recommend the appropriate amount tailored to your specific situation.

- Alternatively, use Ditto’s online calculator to enter your age, income, expenses, and liabilities, and instantly receive an estimate.

Why Talk to Ditto for Your Term Insurance?

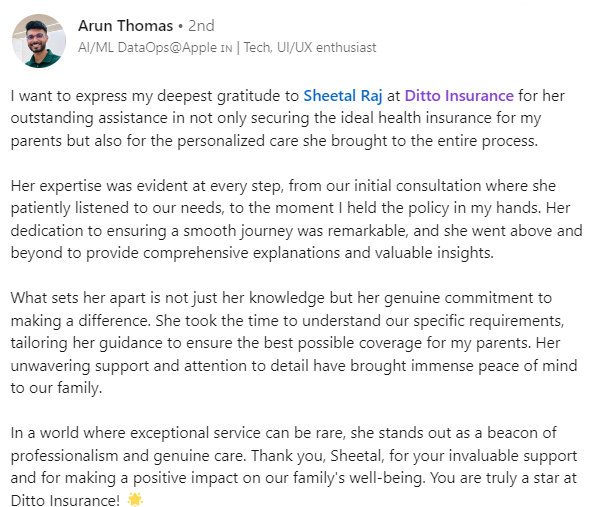

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Arun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

Choosing the correct term life insurance doesn’t have to be confusing. Understanding your needs, comparing plans, and getting expert advice can make the process simple and stress-free.

FAQs

Who can buy term insurance?

Anyone aged between 18 and 65 with a steady income can buy a term plan. You’ll need to share basic income and health details.

Can I buy term insurance for my spouse?

Yes. You can get a joint plan or two separate ones. However, individual plans often give better flexibility and higher coverage.

Should I buy term or health insurance first?

Start with health insurance, as medical costs can arise at any time. Then go for term insurance to protect your family’s future.

Can I buy a term plan for my child?

No, term plans are for earning adults. Choose a child health plan instead.

Why buy a term plan early?

Buying early can offer lower premiums and easier approval. It also ensures long-term financial protection for your family.

Last updated on: