What is Long-Term Care Insurance?

Long-term care insurance covers the costs of extended care for individuals who need assistance with daily living activities (such as bathing, eating, dressing, or supervision due to cognitive impairment) because of age, illness, or disability.

Abroad, these policies pay cash or reimburse care at home, assisted living, or nursing facilities, typically triggered when you can’t do at least 2 of 6 “activities of daily living” (ADLs) or have severe cognitive impairment.

But in India, long-term care insurance isn’t yet a standalone retail product. Instead, families rely on a mix of health insurance with home-care or domiciliary benefits, public schemes like PM-JAY, and personal savings to fund long-term support.

Introduction

Long-term care insurance covers costs for assistance with daily activities like bathing, eating, or mobility. It’s mainly available in countries such as the US, Japan, Germany, and Singapore, but not as a standalone product in India.

In India, coverage for such ongoing custodial care, which refers to long-term daily assistance without active medical treatment, is typically limited or excluded from standard health insurance policies, which focus more on short-term, event-based care such as hospitalization, critical illness, or accidents.

Still unsure about how to plan for long-term care costs or which health policy best fits your family’s needs? Chat with a Ditto advisor for a personalized consultation. Book a call now.

Benefits of Long-Term Care Insurance

Long-term care insurance helps cover expenses for assisted living, home nursing, or caregiving support in old age. While more common abroad, it’s less relevant in India due to limited availability and family-based care systems. Instead, Indians can focus on health or senior citizen plans that offer hospitalization and medical expense coverage.

How Does a Long-Term Care Rider in Term Insurance Work?

In India, there isn’t a pure “long-term care insurance” product, but certain term insurance riders offer similar protection.

These include Critical Illness Riders, Accelerated Terminal Illness Riders, and Waiver of Premium on Disability Riders, which are designed to provide financial support when a serious illness or loss of independence affects your ability to earn or care for yourself.

These riders usually come at an additional cost, which varies depending on the insurer, rider type, and the policyholder’s age and health profile. Generally, adding such riders increases the overall premium moderately but can offer valuable financial protection during serious illness or disability.

However, they provide limited financial help compared to standalone long-term care policies abroad, as payouts are one-time or capped benefits rather than ongoing support.

Short-Term vs Long-Term Care Insurance

Inclusions and Exclusions of Long-Term Care Insurance

- Inclusions (in countries where LTC policies exist):

- Care at home, in assisted-living, or in nursing facilities

- Support for day-to-day tasks like bathing, dressing, eating, toileting, continence, and transferring

- Supervision for cognitive impairment (e.g., dementia)

- Medical equipment, mobility aids, and nurse visits

- Exclusions (Indian context):

- Custodial care (non-medical daily assistance), typically excluded under Indian health plans

- Rest cure, rehabilitation, or respite care are listed under exclusions in policies like HDFC ERGO Optima Secure

- Non-prescribed home care or services outside authorised providers

- General aging or frailty without active treatment

In India, insurers cover domiciliary hospitalization only if home treatment substitutes a hospital stay for a covered illness, not for long-term caregiving or day-to-day help.

Popular Indian Term Insurance Policies with LTC Features

Popular term insurance plans with long-term care features include HDFC Life Click 2 Protect Super, ICICI Prudential iProtect Smart, Bajaj Allianz Smart Protect Goal, and Tata AIA Sampoorna Raksha Promise.

These plans offer coverage for multiple critical illnesses and lump sum payouts on diagnosis, often including provisions related to the inability to perform day-to-day activities. Features like waiver of premium on critical illness and payout acceleration on terminal illness make these term plans suitable for LTC-like protection in India.

Why Choose Ditto for Your Term Insurance?

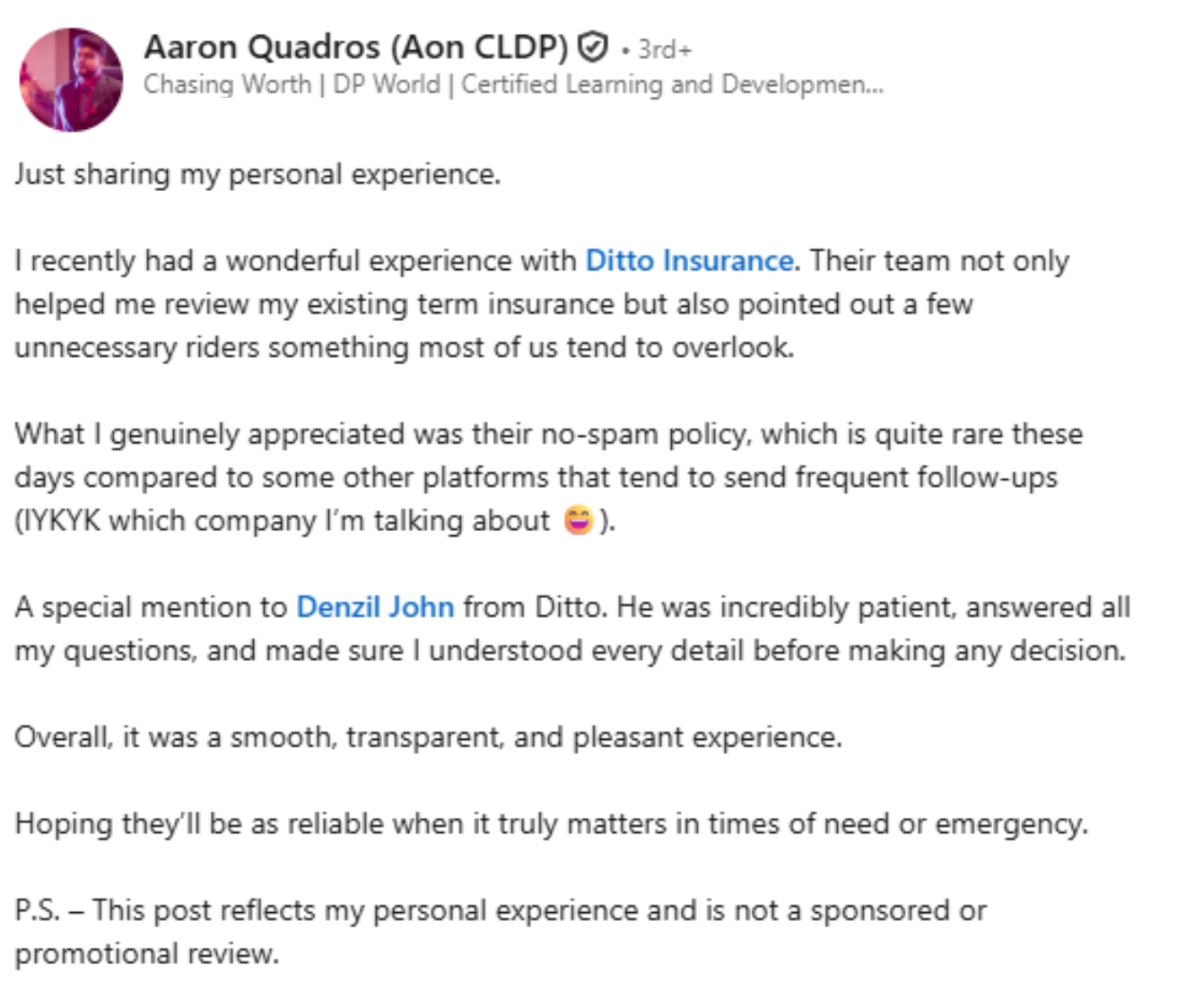

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron love us:

✅ No Spam & No Salesmen

✅ Rated 4.9/5 on Google Reviews by 12,000+ happy customers

✅ Backed by Zerodha

✅ 100% Free Consultation

Ditto’s Take on Long-Term Care Insurance

At Ditto, we understand that long-term care options in India are limited, but there are practical ways to plan ahead. Here’s our approach:

- Evaluate your actual need: Start by assessing whether long-term care coverage makes sense for you, given the limited options in India. For most people, a strong health plan with some home-care features is the more realistic approach.

- Prioritize comprehensive health insurance: Choose a policy with a high sum insured and built-in benefits like domiciliary hospitalization or home health care, wherever available.

- Understand Home Health Care Coverage: Check if it is protocol-based, requires pre-authorization, or works only on a cashless basis. Most insurers exclude long-term custodial or nursing care, so cross-check these details before buying.

- Get Quotes from Local Care Providers: Get quotes from multiple home-care providers in your city. Compare prices for live-in caregivers, nurses, or shift-based support.

- Build a Dedicated Care Fund: Set aside savings or a steady income source specifically for long-term care expenses. Treat it as a dedicated “care fund” to cover future home-care or support costs.

- Keep proper documentation: Maintain updated records of your Activities of Daily Living (ADL) assessments and any cognitive evaluations. Insurers often require this evidence to process home-care or domiciliary claims.

Not sure what coverage you need or how much to set aside for care? Chat with a Ditto advisor for a free review of your options. We’ll help you map a plan suited to your health, family, and budget. Book a call now.

Frequently Asked Questions (FAQs)

What does “long-term care” mean in insurance?

Long-term care refers to help with basic daily activities, like bathing, dressing, eating, or supervision, due to cognitive issues or chronic health problems.

Is retail long-term care insurance available in India?

No. India lacks dedicated long-term care insurance; policies focus on hospital and acute medical needs, not ongoing custodial care.

What’s the difference between domiciliary hospitalisation and long-term care?

Domiciliary hospitalisation covers home treatment for acute medical episodes when hospital admission isn’t possible; it doesn’t fund ongoing daily living help.

How much does home caregiving cost in Indian metros?

Live-in non-medical attendants: ₹30,000–₹36,000/month; professional nursing is higher and varies by needs and city.

Last updated on: