Quick Overview

HDFC Life Insurance, founded in 2000 as a joint venture between HDFC and Standard Life (now Abrdn), is India’s leading private-sector life insurer and a publicly listed company with HDFC Bank as the majority stakeholder. This guide walks you through the plans offered by HDFC Life and its features.

Performance Metrics of HDFC Life

Term Plans Offered by HDFC Life

1. HDFC Life Click 2 Protect Supreme (Flagship): Click 2 Protect Supreme is a comprehensive term policy offering flexible smart exit, wellness benefits, and health management services via the Life Rewards app.

Some of its features are:

- Offers three variants: Life, Life Plus, and Life Goal. The third option is for a decreasing term cover option.

- Provides terminal illness cover up to ₹2 crore (Accelerated), payable if two doctors certify in writing that the insured has less than six months to live.

- Instant Payout on Claim Intimation, where a portion of the death benefit is paid to the nominee within one working day after the claim is intimated. For an SA of ₹1–2 crore, ₹2 lakh is paid instantly on claim intimation. For covers above ₹2 crore, ₹5 lakh is paid. This benefit is not available if the sum assured is below ₹1 crore.

- Premium Break Benefit allows for a one-year premium deferment after five policy years, provided coverage continues.

- Smart Exit allows you to surrender the policy and recover all premiums after 25 years, subject to certain conditions and a minimum 31-year term.

Add-ons You Can Opt For:

- Critical Illness Rider: Covers 60 specified critical illnesses for up to 15 years. Provides a lump-sum payout on diagnosis to help with treatment and income loss.

- Accidental Income Benefit: Pays 1% of the rider sum assured every month for 10 years in case of total and permanent disability due to an accident.

- Spouse Cover Option: Offers an additional death benefit (up to 50% of base sum assured) to the spouse after the life assured’s death. Comes with strict eligibility rules and is generally not recommended if the spouse is working.

Besides these, the plan also offers an ROP option, parent protect care and the option to renew your plan at maturity. You can also opt for waiver of premium rider.

Annual Premiums Across Ages

Note: The listed premiums are for a non-smoker profile, with a sum assured of ₹ 2 crore (Coverage till age 70, without first-year discounts).

2. HDFC Life Click 2 Protect Elite Plus: The Elite Plus term plan is a reasonable choice for affordable, high-cover term insurance. It offers essential protection features, but falls short in some areas, such as the absence of an in-built terminal illness benefit and limited options to increase cover over time. It offers a sum assured of ₹2 cr to ₹5 cr.

Some of its Features Are:

- Death claim intimation, ₹5 lakh is paid within one working day after document submission. Once the claim is approved after the 1-year waiting period, the balance is paid. If rejected, the ₹5 lakh is recovered.

- Smart Exit Benefit and option to defer premiums for 12 months while coverage continues.

- Key add-ons include a Critical Illness rider covering 60 illnesses for up to 15 years, Waiver of Premium on CI/disability, and an Accidental Income benefit paying 1% monthly for 10 years. Accidental death and ROP riders are also available.

Annual Premiums Across Ages

Note: The listed premiums are for a non-smoker profile, with a sum assured of ₹ 2 crore (Coverage till age 65, without first-year discounts).

3. HDFC Life Click 2 Protect Ultimate: The policy offers solid protection; it comes with several limitations, like higher premiums and lacks essential riders. It offers a sum assured of ₹1 cr to ₹3 cr, which mostly caters to the salaried people.

Some of its Features Are:

- Smart Exit Benefit allows policyholders to surrender their policy and get back all premiums paid, with similar t&c as for the other 2 plans.

- Terminal Illness Benefit provides coverage up to ₹2 crore with a waiting period of 6 months from policy issuance.

- The plan offers a 100% claim guarantee, except in specific cases. Claims are not payable if death occurs due to suicide within the first policy year or as a result of intoxication, and as per other t&c.

Annual Premiums Across Ages

Note: The listed premiums are for a non-smoker profile, with a sum assured of ₹ 2 crore (Coverage till age 65, without first-year discounts).

Besides the plans discussed above, HDFC Life’s older Click 2 Protect Life has limited availability in 2026 and is largely being phased out, with renewals continuing. Click 2 Protect Supreme Plus is its enhanced successor due for launch soon, offering wider features, flexible cover increases, exit options, and stronger long-term protection.

To know more about it, watch this:

HDFC Life Click 2 Protect Supreme Across Term Policies

Note: The listed premiums are for a non-smoker profile, male with a sum assured of ₹2 crore (Coverage till age 70, without first year discounts).

Key Insight: Despite higher premiums, C2P Supreme stands out for HDFC Life’s strong brand, scale, reliable post-sales service, rich feature set, and improved discounts, making it a dependable and well-rounded term insurance option.

Inclusions and Exclusions of HDFC Term Insurance

Note: As per IRDAI rules, if the policyholder dies by suicide within the first year of buying or reviving the policy, the insurer will reject the claim and refund around 80% of the total premiums. Exclusions may vary from plan to plan.

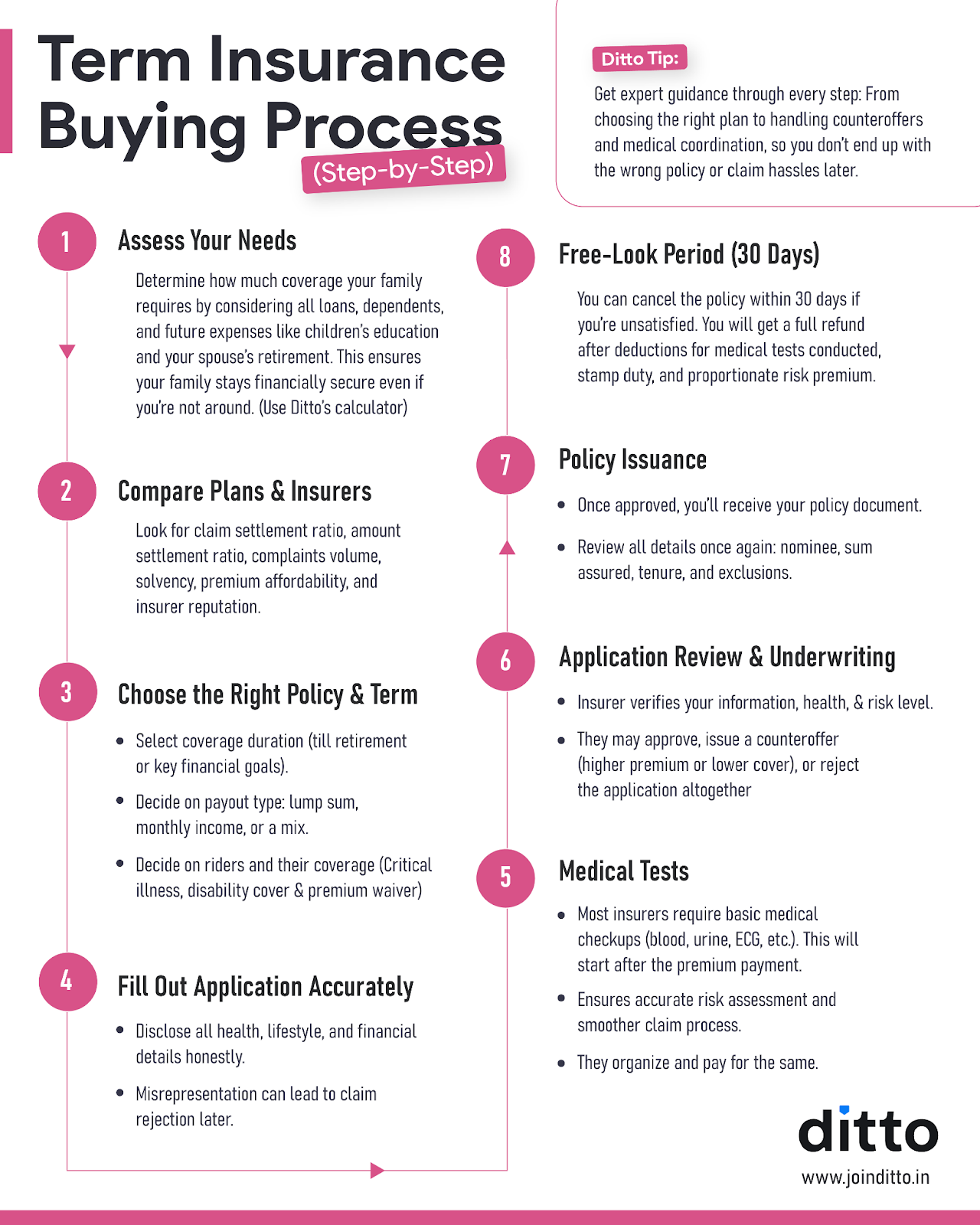

How To Buy HDFC Life Term Plans Online in 2026?

What are the Documents Required To Buy HDFC Life Term Insurance Plan?

- Identity proof like Pan card or a Passport

- Address proof like Aadhaar card or a utility bill

- Age proof, like a birth certificate

- Income proof like Salary slips, Form 16 or bank statements

- Recent passport-size photo

- Medical tests, if required, based on age or cover amount

What are the Things To Consider Before Buying HDFC Term Plan?

Before buying an HDFC term plan, you must assess the right sum assured, policy term, and premium affordability. Review the insurer’s metrics, rider options, and long-term features to ensure the plan aligns with your family’s financial needs.

Learn more about what to consider when purchasing a term plan.

Note: It is important to estimate the correct term cover you require. To get a better understanding, use this online calculator to find the ideal cover for you.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why do customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now or chat with us on WhatsApp!

Ditto’s Take on HDFC Term Insurance

In 2026, HDFC Term Insurance is a preferred choice for individuals seeking reliable and flexible life coverage. For most people, we recommend choosing the current feature-rich flagship plan, C2P Supreme, as it offers greater flexibility, multiple rider combinations, and broader overall coverage.

HDFC Life is our partner. If you’d like expert advice on whether HDFC Term plans fit your long-term needs, book a call with us. At Ditto, we recommend comprehensive plans, which align with your long-term goals. Explore more about how our experts evaluate term plans through Ditto’s cut.

Frequently Asked Questions

Last updated on: