Proportionate deduction in health insurance is a clause that reduces claim payout if the policyholder stays at an expensive hospital room than what’s allowed in the policy. The deduction, however, doesn’t apply to the hospital room rent alone.

It reduces the claim payment for all related medical expenses (like doctor’s fees, surgery charges, etc). Cost of ICU charges, medicines, implants, consumables and diagnostics are left out from this calculation as per IRDAI’s rules.

Introduction

There’s a clause in most health insurance policies that's widely misunderstood-one that can cost you lakhs even when your claim should be 100% covered. It's called room rent capping, the main trigger behind the penalty known as “proportionate deduction”.

At Ditto, we’ve seen firsthand how room rent violations lead to proportionate deductions, reducing approved claim amounts by 20–65%, and increasing out-of-pocket medical expenses. So, it makes sense to understand how proportionate deduction works.In the next few minutes, you’ll learn:

- What is proportionate deduction in health insurance?

- How room-rent limits trigger proportionate deductions?

- How to calculate proportionate deduction ?

- The IRDAI rules on proportionate deduction: what’s included and excluded

- Ways to avoid or reduce proportionate deduction (room eligibility, riders, top-ups)

What is Proportionate Deduction in Health Insurance?

Proportionate deduction is a penalty imposed on final claim payout when you choose a hospital room exceeding your policy's daily room rent limit. Let’s say,your health plan allows a ₹4,000 per day hospital but you pick a ₹8,000 room instead. In such a case, your claim payout can be reduced by 50%, leaving you to pay the rest on your own.

Remember: The term "proportionate deduction" is used specifically for room rent breaches. It directly establishes that a policyholder has to pay a portion of all costs incurred and not just the rent difference.

Don’t let clauses like proportional deduction impact your claim payout. Register for Ditto’s Free Health Insurance 101 Webinar and be a smart health insurance buyer.

How Do Room Rent Limits Trigger Proportionate Deductions?

If you exceed a hospital room rent by ₹1,500, you pay ₹1,500 extra, right? Well, not really!

When one exceeds the room cap, insurers don't just charge for the difference. They assume all related hospital services (like doctor fees, nursing charges, surgeries) were billed at premium rates. The room capping can be either an amount-wise capping like 5K a day or 1-2% of the sum insured, along with category-wise capping for a single private room only. This is primarily because hospitals themselves link several charges to one room and tier-price everything by room category. Insurers use the same logic to justify reducing the final claim amount "proportionately".

Proportionate Deduction in Health Insurance: Inclusions and Exclusions

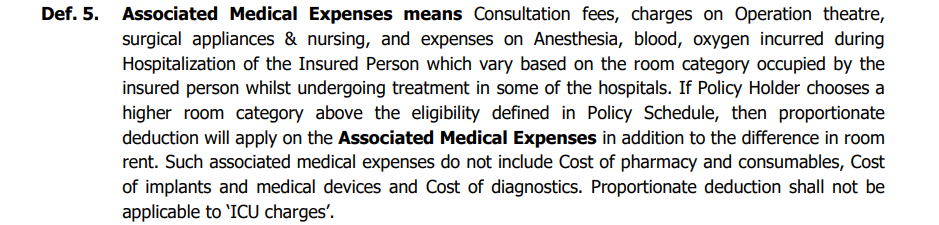

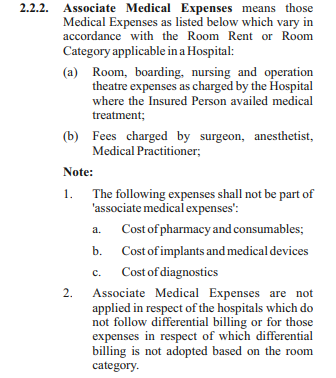

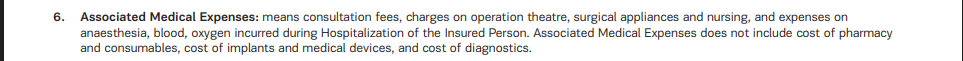

IRDAI requires insurers to classify hospital costs as Associated medical expenses (AME) and Non-associated medical expenses (Non-AME). All non-associated expenses, including ICU charges, are not subjected to any proportionate deductions since hospitals don’t charge differentially for them.

Here are some snapshots of “Associated Medical Expenses” explanations extracted from policy wordings of flagship plans from popular insurers (HDFC ERGO, Care, and Aditya Birla).

As per the IRDAI's Master Circular of 2020, here’s what’s included and excluded for proportional deduction, i.e., associated and non-associated medical expenses.

It’s good to know: IRDAI says proportionate deduction only works if hospitals follow tiered pricing (i.e., different prices of rooms where the cost of services like doctor fees or OT charges changes with the type of room).

However, some charitable/small hospitals in India charge flat rates where treatment costs remain the same regardless of room category. So, if your hospital is one of them, your insurer won’t be able to apply the clause of proportional deduction.

How to Calculate Proportionate Deduction in Health Insurance?

Here’s the formula to calculate proportionate deduction:

Claim Payable = (Eligible Room Rent ÷ Actual Room Rent) × Total Bill

Let’s calculate the claim payable amount for a ₹5 Lakh Policy that allows up to ₹5,000/day as hospital room rent (1% of ₹5 lakh sum insured).But if one stays in a ₹8,000/day room, the coverage Ratio drops to 62.5%.

If the total hospital bill is ₹2,00,000, the insurer pays ₹2,00,000 × 62.5% = ₹1,25,000.

That means, your out-of-pocket expense is ₹75,000!Note: The example has been simplified for illustration. Other factors like copay, disease wise limit, consumables are also applicable.

Ways to Avoid or Reduce Proportionate Deduction

Here’s how to avoid or reduce proportionate deduction by picking the right strategy for different situations.

From getting a critical illness cover to opting for hospicash, there are multiple ways to offset things for a health plan with room rent limits. Talk to Ditto’s IRDAI-certified advisors to plan your new health insurance or modify an existing plan.

How To Avoid Proportional Deduction On Your Mediclaim Payout: Ditto's Take

Reduce your out-of-pocket expenses and protect your mediclaim payout from proportional deductions. Here’s what you need to know and do.

- Proportionate deduction applies when you choose a hospital room above your eligible rent limit.

- Medicines, diagnostics, implants, and ICU charges are exempt from proportional deduction as per IRDAI guidelines.

- A small room upgrade can reduce your claim by 20–40%.

- Always check your policy's room rent clause before hospitalization.

- Proportionate deduction doesn't apply if the hospital uses flat pricing for all rooms.

- You can raise a dispute about wrong deductions with IRDAI or raise a case through the Insurance Ombudsman.

- Upgrading your sum insured increases room eligibility and reduces risk of proportional deduction.

- Prefer policies with "No room rent limit" or at least "Any room up to single private" option.

- Request for a proportionate-deduction worksheet showing eligible vs. actual room rent, the ratio used, and line items (treated as AME vs. non-AME). If ICU is involved, point to the IRDAI bar on proportionating ICU charges.

- Consulting with Ditto's IRDAI-certified experts for buying health insurance can save your mediclaim payout from proportional deductions.

Why Choose Ditto For Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

The Bottom Line

Proportionate deduction can dramatically reduce your claim payout leaving you in shock. So, plan smart and choose a full-proof health plan that protects your coverage.

Book your free call with Ditto where our IRDAI-certified advisors can guide you to find the best health insurance plan without room rent caps and unwanted clauses.

FAQs:

Which expenses are affected and which usually aren’t?

Under IRDAI’s 2020 guidelines, proportionate deduction applies only to specific expenses linked to room category, like room rent, ICU charges, doctor consultation, nursing, and operation theatre costs. Essential medical costs such as medicines, diagnostic tests, implants, and devices are excluded from proportionate deduction as per IRDAI’s revised norms. Pharmacy bills, diagnostic reports, and implant costs are also fully reimbursed.

How does proportionate deduction work with surgical packages?

If you choose a room above your limit, the insurer usually splits the package into three parts; room rent, associated medical costs (surgeon/OT/anesthesia/nursing), and non-associated costs (medicines/consumables/implants/diagnostics). Only the associated costs are reduced based on your room eligibility. Non-associated costs and ICU charges are paid in full.

What about day-care procedures?

If your treatment doesn’t use room categories or differential billing, proportionate deduction usually doesn’t apply. Always check how the hospital bills such procedures.

Do cashless claims avoid proportionate deduction?

No. Even in cashless setups, if you choose a room above the allowed limit, your claim will be reduced proportionally.

Can I challenge proportionate deduction?

Yes, you can, especially if deductions are made on items IRDAI says should be exempt. Start with the insurer's grievance cell and escalate to the Insurance Ombudsman if needed.

Is a higher sum insured enough to avoid proportional deduction?

Not always. Even a ₹20 lakh cover can have a ₹4,000/day room rent limit. So, check the room clause, not just the coverage amount. If you’re unsure, you can always reach out to Ditto’s IRDAI-certified advisors for end-to-end guidance.

Does Proportionate Deduction Apply to Cashless Claims?

Yes, proportionate deduction applies to cashless and reimbursement claims equally.

Last updated on: