| What is an Insurance Ombudsman? The Insurance Ombudsman is an independent authority established under the Insurance Ombudsman Rules, 2017, by the Government of India, with the approval of the Insurance Regulatory and Development Authority of India (IRDAI). Its primary role is to provide policyholders with an affordable, impartial, and accessible mechanism to resolve complaints against insurers. Instead of going through lengthy and costly court procedures, the Ombudsman offers a quick and free grievance redressal system. |

What is the Role of the Insurance Ombudsman?

According to the official IRDAI consumer complaints portal, the Ombudsman addresses disputes between insurers and policyholders in a fair and timely manner. The role of the Insurance Ombudsman is to act as a mediator between the insured and the insurer for resolving disputes. Some of its key responsibilities include:

- Providing a free, impartial platform for policyholders to raise unresolved complaints.

- Hearing disputes related to claims, delays, or service deficiencies by insurers.

- Issuing reasoned decisions that are binding on the insurer.

- Offering an alternative redressal mechanism before policyholders consider courts or consumer forums.

The Ombudsman’s jurisdiction ensures that complaints are resolved fairly, efficiently, and within a defined timeframe, without unnecessary escalation.

Facing claim delays or unfair rejection? Book a free call with Ditto to get expert help with insurer complaints, IRDAI Bima Bharosa, and Insurance Ombudsman cases.

Types of Complaints You Can File with the Insurance Ombudsman

As per IRDAI guidelines and the Ombudsman Rules, a policyholder may approach the Ombudsman for complaints such as:

- Delay in claim settlement or partial/total repudiation of claims.

- Disputes regarding premium payment or incorrect policy terms and conditions.

- Policy servicing-related grievances, like delays in issuing documents.

- Non-receipt of policy documents after purchase.

- Disputes related to misrepresentation of policy features at the time of sale.

- Other insurer services deficiencies, where resolution from the insurer is unsatisfactory.

Internal Insurance Ombudsman – Draft IRDAI Guidelines 2025b

Documents Required to Lodge a Complaint with the Insurance Ombudsman

To lodge a complaint, you need the following documents (as per IRDAI’s complaint registration form):

- A written complaint copy submitted to the insurer along with their response (if any).

- Policy document copy.

- Claim form and correspondence related to the dispute.

- Any supporting evidence, such as bills, receipts, and medical reports (in case of health insurance claims).

- Completed Complaint Registration Form provided by IRDAI. (available on the CIO website)

Note: Only policyholders or claimants can file a complaint. Complaints filed by advocates, agents, or third parties will not be entertained.

Complaint Redressal Framework in India

Before approaching the Insurance Ombudsman, a structured grievance redressal hierarchy is established by the Insurance Regulatory and Development Authority of India (IRDAI) and the Council for Insurance Ombudsmen (CIO).

Step 1: Approach the Insurer’s Grievance Redressal Officer (GRO)

- Every insurance company is mandated by IRDAI to have a Grievance Redressal Officer (GRO).

- Lodge your complaint directly with your insurer by:

- Post

- Visiting their office in person

- Always request a written acknowledgment with the date.

- Insurers are required to resolve complaints within 15 days (2 weeks) as per IRDAI guidelines.

- You can access the complete list of GROs for all insurers on IRDAI’s official consumer complaints page: IRDAI – Consumer Affairs & Complaints Page

Step 2: Approach IRDAI (if unresolved by the Insurer)

If the insurer does not respond within 30 days, or if you are not satisfied with their resolution, you can escalate your grievance to IRDAI through the Bima Bharosa System.

IRDAI Complaint Channels:

- Online: Bima Bharosa Portal

- Email: complaints@irdai.gov.in

- Toll-Free Numbers: 155255 or 1800 4254 732 (available 8 AM – 8 PM, Monday to Saturday)

- Post: General Manager, Policyholder’s Protection & Grievance Redressal Department, Insurance Regulatory and Development Authority of India (IRDAI), Sy. No.115/1, Financial District, Nanakramguda, Gachibowli, Hyderabad – 500032

Note: You can use this link for the format that you may need to follow to approach the IRDAI Complaints offline.

Once registered, the Bima Bharosa system issues a unique token number for tracking. IRDAI forwards the complaint to the concerned insurer and monitors its progress until resolution.

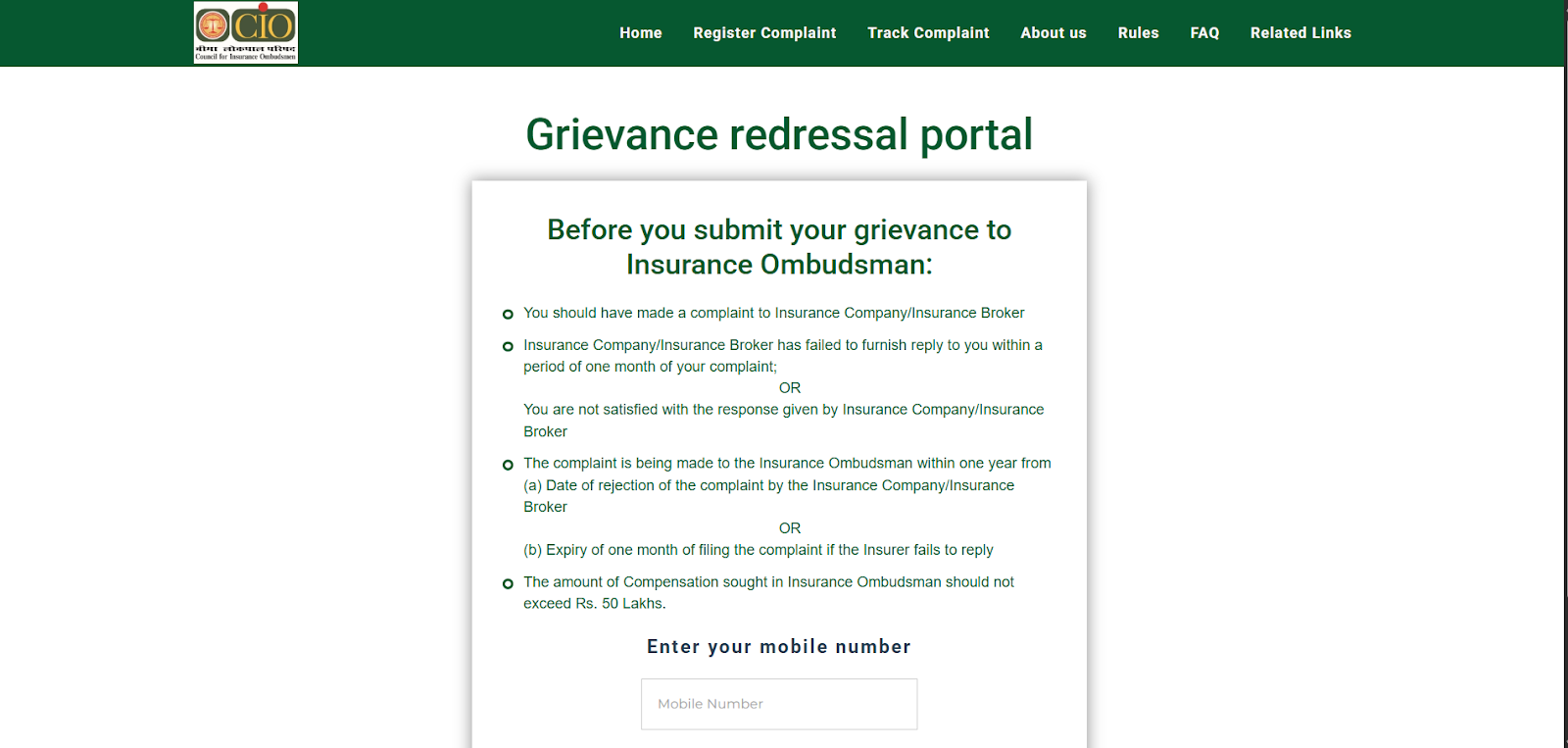

Step 3: Approach the Insurance Ombudsman (CIO)

If your grievance remains unresolved even after taking it up with the insurer and IRDAI, you can escalate it to the Insurance Ombudsman under the Council for Insurance Ombudsmen (CIO).

- This is an alternate dispute redressal mechanism designed to be free, impartial, and speedy.

- You can file a complaint online via the CIO portal: 🔗 CIO – Insurance Ombudsman Complaint Registration

- You may also submit a complaint offline via:

- Post

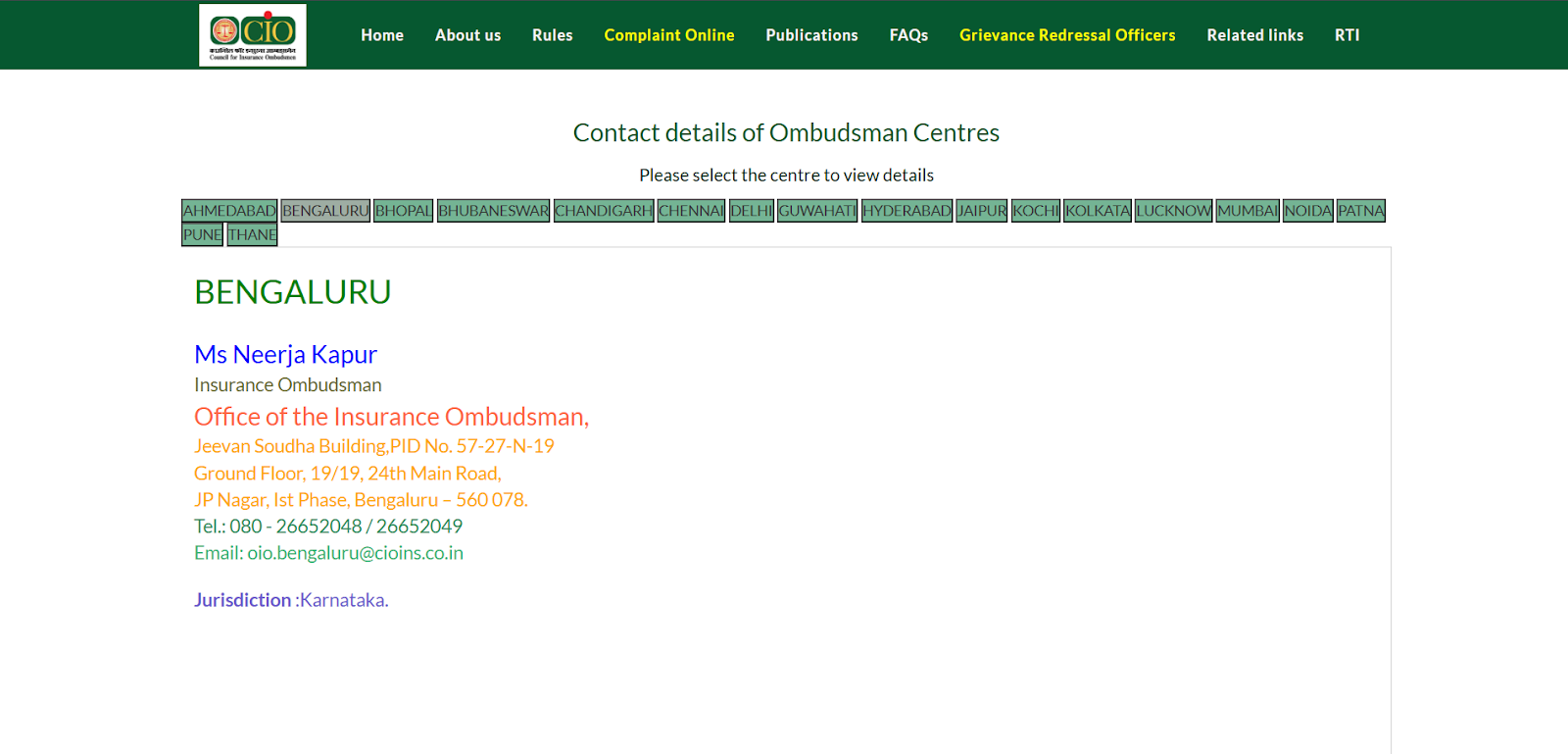

- Walk in at the nearest Ombudsman office (list available here: Insurance Ombudsman Offices & Jurisdictions)

Note: This is a specimen complaint form. You can use this to gauge how you may need to file a complaint offline.

Conditions for approaching the Insurance Ombudsman:

You must first lodge a complaint with your insurer.

- Either the insurer failed to respond within 30 days, or you are not satisfied with the response.

- You must approach the Ombudsman within 1 year of:

- The date of rejection of your complaint, OR

- Expiry of 30 days from filing with the insurer.

- The amount of compensation sought should not exceed ₹50 lakhs.

Step 4: Consumer Courts (if still unresolved)

If you are not satisfied with the Ombudsman’s award, or if your claim exceeds ₹50 lakhs (the Ombudsman’s jurisdictional cap), you can escalate the matter further to Consumer Courts under the Consumer Protection Act, 2019.

- Consumer Courts are judicial bodies that provide a legal remedy for consumer disputes, including insurance-related complaints.

- Unlike the Ombudsman, their decisions are legally binding and enforceable.

Consumer Disputes Redressal Commissions:

- District Commission – For claims up to ₹50 lakh

- State Commission – For claims above ₹50 lakh and up to ₹2 crore

- National Commission (NCDRC) – For claims above ₹2 crore

National Consumer Disputes Redressal Commission (NCDRC)

This step ensures that policyholders always retain their legal right to pursue further remedies, even after using the Ombudsman route.

Facing claim delays or unfair rejection? At Ditto, we help you not just choose the right insurance but also guide you through grievance redressal — from insurer GRO to IRDAI Bima Bharosa, and finally the Insurance Ombudsman. Book a free call with us.

How to Contact the Insurance Ombudsman?

Unlike IRDAI’s grievance cell, the Ombudsman system is managed by the Council for Insurance Ombudsmen (CIO).

Contact Options:

- Online: CIO Complaint Registration Portal

- Email/Post: Submit the complaint form and documents to your jurisdictional Ombudsman office.

Walk-in: Visit the nearest Ombudsman office. A full list of offices with addresses and contact details is available here.

Complaints must be filed within one year from either the date of the insurer’s rejection or expiry of 30 days from the complaint date if no reply is received.

What is the Time Limit for Approaching the Ombudsman?

- Within one year of the insurer’s rejection of the complaint OR

- After 30 days of no response from the insurer.

Additionally, the Ombudsman can only handle complaints where the compensation sought is up to ₹50 lakh.

How to File an Insurance Ombudsman Complaint Online?

To directly approach the Ombudsman, you must use the CIO portal, not IRDAI’s Bima Bharosa.

Steps:

1) Visit the CIO Complaint Page.

2) Fill in personal, insurer, and complaint details.

3) Upload supporting documents.

4) Submit the form.

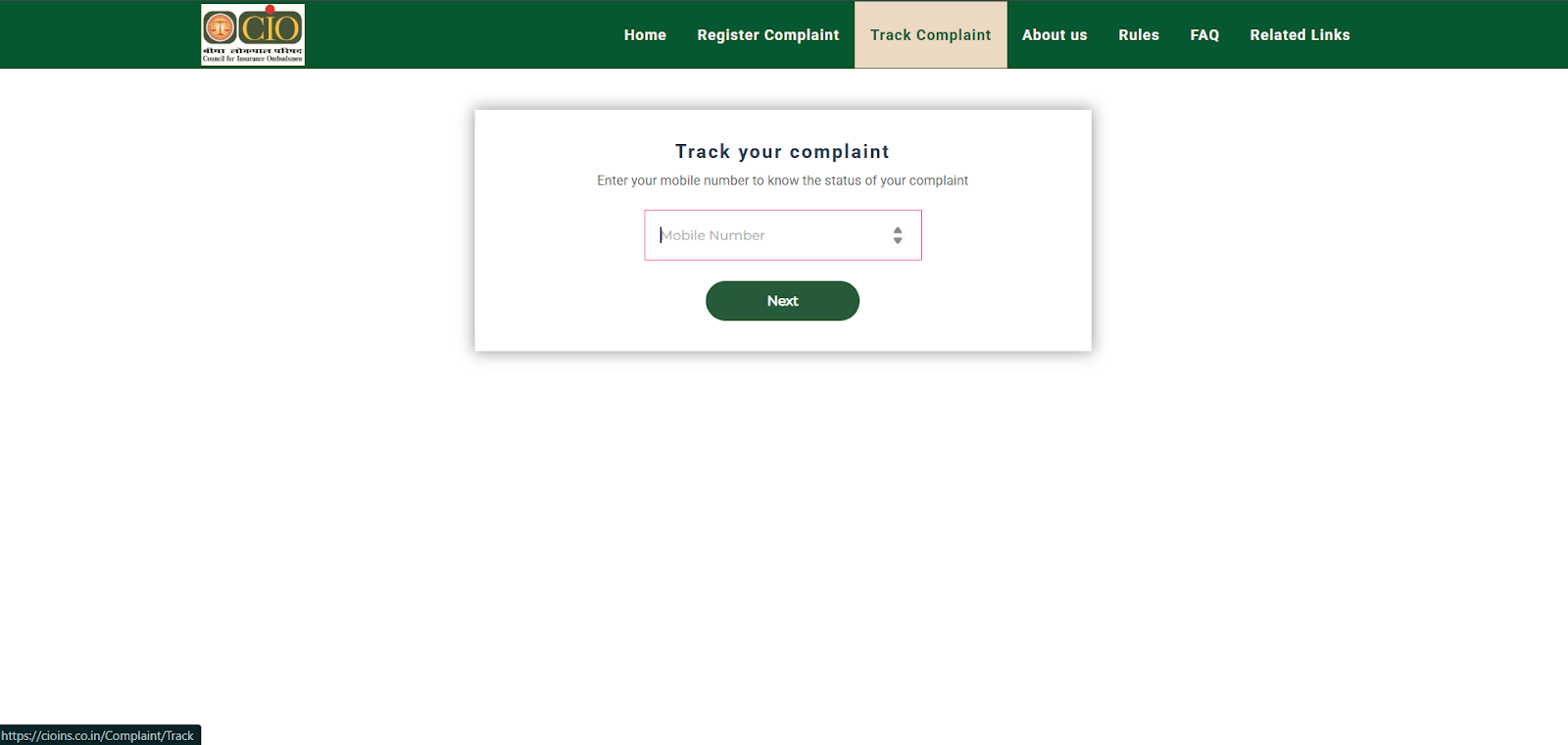

5) Track your complaint status via the CIO portal.

Did You Know?

How Long Does It Take for the Insurance Ombudsman to Resolve a Complaint?

According to CIO guidelines, complaints are typically resolved within three months of receiving all necessary documents.

The Ombudsman must issue a reasoned decision in each case, and it is binding on the insurer. If dissatisfied, a complainant can appeal within 30 days to the Ombudsman under the Insurance Ombudsman Rules, 2017.

Did You Know?

Why Talk to Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

The Insurance Ombudsman is a vital safeguard for policyholders in India, ensuring quick, impartial, and cost-free resolution of disputes. Alongside Insurer GROs and IRDAI’s Bima Bharosa, it forms a strong multi-layered grievance redressal system under the Council for Insurance Ombudsmen (CIO).

However, the Ombudsman’s own annual report notes that awareness remains low, particularly in rural and semi-urban areas. To bridge this gap, IRDAI and insurers are running awareness campaigns to improve access.

Importantly, the Ombudsman’s decision is binding on insurers but not on complainants. This asymmetry means customers can still approach consumer courts or civil courts if dissatisfied, while insurers must comply with awards in favour of policyholders. This makes the framework consumer-friendly, though it also leaves insurers exposed to prolonged litigation risks.

FAQs

How can I reach the Insurance Ombudsman Office?

You can file complaints via the CIO portal, email/post, or visit the nearest office listed here.

When should you approach the Insurance Ombudsman?

Only after first contacting your insurer, then the IRDAI (if the issue remains unresolved within 30 days), and finally the Ombudsman within one year.

What is the compensation limit under the Insurance Ombudsman?

The Ombudsman can award compensation of up to ₹50 lakh.

Is there a fee to file a complaint?

No. Filing a complaint with the Ombudsman is completely free of cost.

Where can I find the official FAQs of the Insurance Ombudsman?

You can find the official FAQs of the Insurance Ombudsman here.

Last updated on: