Even for India’s wealthiest individuals, life insurance is a cornerstone of prudent financial planning. High Net-Worth Individuals (HNIs) have substantial assets and incomes, but they often shoulder equally substantial responsibilities and risks.

This is why a well-chosen term insurance plan can protect an HNI’s family and business interests, ensuring that wealth is preserved and obligations are met even if the unexpected happens.

In simple terms, term insurance offers a large cover amount for a relatively low cost, which makes it particularly attractive to those with a lot to lose.

Who are High Net-Worth Individuals (HNIs) in India?

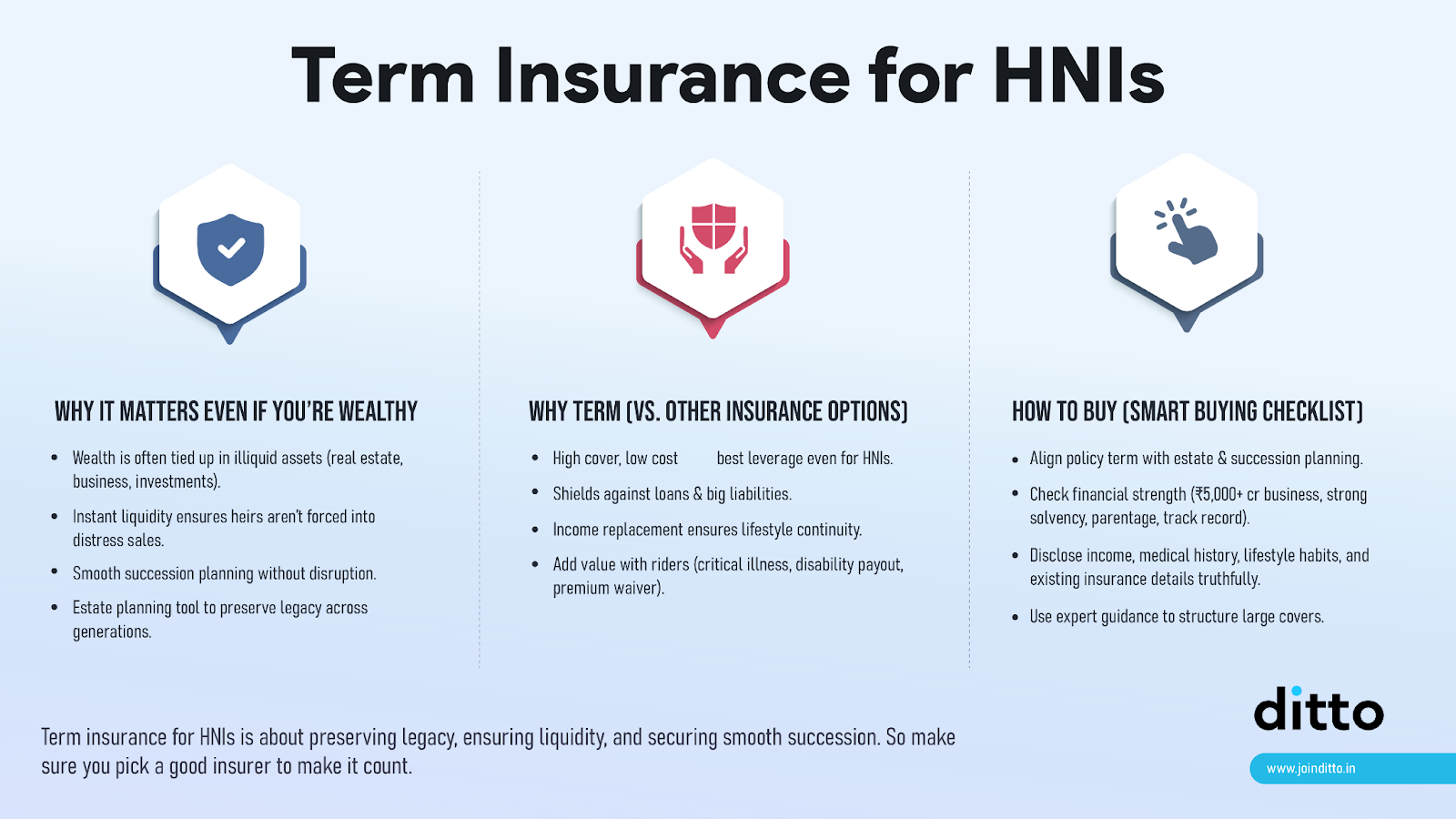

Why Should HNIs Consider Term Insurance

It’s a common misconception that if you’re wealthy, you don’t “need” insurance. Many high-net-worth individuals assume their wealth alone will cover any eventuality. In reality, it’s quite the opposite.

Here are the primary reasons why HNIs should seriously consider a term plan:

Financial Liability Coverage

Wealthy individuals often carry large loans or debts, such as sizable home loans, commercial property loans, or business loans. If an HNI were to pass away unexpectedly, these liabilities could become a burden on their family or business partners.

A term insurance payout acts as a safety net to clear such debts. It ensures that your loved ones won’t be forced to sell assets or take distress loans (usually at very high interest) to pay off outstanding liabilities.

In essence, the insurance cover can shoulder the repayment of big-ticket loans (which can easily run into crores for HNIs) so that your family’s financial stability isn’t shaken during an already difficult time.

What makes this even more attractive is the tax component. Death benefits from life insurance remain completely tax-free under Section 10(10D) of the Income Tax Act, helping the family receive the full payout without deductions.

There are also legal safeguards to ensure timely and protected claims:

- IRDAI now mandates that simple death claims must be settled within 15 days, and investigated claims within 45 days. If not, the insurer must pay interest.

- Section 45 of the Insurance Act protects older policies. After 3 years, the insurer can’t deny claims except in proven cases of fraud. And the onus is on the insurer to prove it.

- Under Section 39, naming your spouse, children, or parents as beneficial nominees ensures they get the proceeds directly, even if other heirs contest it.

- For married men, a policy bought under the MWP Act becomes a trust for the wife and kids. Creditors or extended family can’t touch the money even if your estate has outstanding liabilities.

Estate Planning and Wealth Transfer

HNIs often have significant estates and might be concerned about a smooth wealth transfer to the next generation.

Term insurance can provide liquidity to cover any estate taxes or settlement/legal costs that may arise.

While India currently doesn’t levy an inheritance tax, there can still be costs associated with transferring assets (like property registration or capital gains on certain asset sales).

Moreover, if a large portion of wealth is tied up in businesses or real estate (often illiquid), a term insurance payout gives heirs immediate funds to handle urgent expenses or taxes without liquidating those assets.

This helps in preserving the core wealth; your family can inherit your assets intact, using insurance money for interim needs.

In short, term insurance complements estate planning by ensuring heirs get a tax-free lump sum that can cover formalities and safeguard the family’s long-term wealth.

Business Continuity

Many HNIs are business owners or key partners in enterprises. Their sudden absence could disrupt business operations or finances.

Think about obligations like employee salaries, outstanding invoices, or even the cost of finding a suitable successor.

A term plan with a high sum assured can inject much-needed capital into the business in the event of the owner’s demise. This money can keep the business running, paying off business loans, stabilizing the company during transition, or buying out the deceased owner’s equity stake if needed.

Essentially, term insurance can act as a business continuity plan, ensuring that your enterprise and partners aren’t left in the lurch. In fact, insurance experts emphasize that for HNIs who are entrepreneurs, a high-cover term plan is essential to mitigate such risks.

Note

Income Replacement for Dependents

One might wonder, “If someone is very wealthy, do their dependents really need income replacement?” The answer is often yes.

High-net-worth families may have lifestyles and future goals (children’s education abroad, upkeep of multiple properties, philanthropic commitments, etc.) that assume the continued income or oversight of the HNI.

If that primary earner is gone, even a large asset pool might not immediately produce equivalent income due to market fluctuations or liquidity issues.

A term insurance payout provides a guaranteed lump sum that can be invested or structured to generate income, ensuring the family’s day-to-day needs and long-term plans stay on track.

Our Takeaway: It's worth noting that term insurance brings peace of mind. Knowing that a robust financial safety net is in place allows HNIs to make bold decisions in business or investments, without the constant worry of “what if something happens to me.”

As an expert from Ditto Insurance puts it,

“Term insurance is important for anyone with dependents, but even more so for HNIs,” simply because the scale of their responsibilities (and potential risks) is larger.

What Our Advisors Say

List of Term Life Insurance Plans for HNIs in India

HNIs don’t necessarily need a special “HNI-only” policy because most regular term plans can cater to a high cover amount, provided you meet the insurer’s criteria.

However, certain term insurance plans are particularly popular among HNIs in India due to their high coverage limits, flexible options, and strong claim records.

Below, we list some of the top term life insurance plans (offered by reputable insurers) that are well-suited for HNIs seeking substantial coverage.

Axis Max Life Smart Term Plan Plus

HDFC Life Click 2 Protect Supreme

ICICI Prudential iProtect Smart Plus

Bajaj Life eTouch II

TATA AIA Maha Raksha Supreme Select (MRSS)

Remember

Talk to an expert

today and

find

the right

insurance for you.

Benefits of Term Insurance for HNIs

Term insurance is often recommended as the go-to life cover for most people, and HNIs are no exception. In fact, given the scale of coverage HNIs need, term plans emerge as the most efficient option. Here are the benefits of term insurance for high-net-worth individuals:

Affordability (High Cover at Low Cost)

Term plans offer a large sum assured at a relatively low premium, as they are pure protection products with no investment components. By keeping insurance costs low, HNIs can free up more money to invest elsewhere for higher returns. For them, term insurance is “the most cost-effective form of life insurance” because it doesn’t bundle in savings or endowments.

For example, a healthy individual in their 30s might secure ₹1 crore cover for around ₹10,000-15,000 per year.

Even after scaling that to ₹5 or ₹10 crore, the premiums remain a small percentage of an HNI’s annual income.

In short, term insurance maximizes coverage per rupee of premium, which appeals to anyone who understands value, and HNIs, being financially savvy, certainly do.

Assumptions: 30-year-old non diabetic male, non-smoker, salaried, and no pre-existing diseases from a tier 1 city, seeking cover until 65 years.

Customizable Coverage

HNIs often have needs that evolve over time, and term plans offer the flexibility to adapt. You can customize the policy with riders and options to tailor the coverage to your specific needs.

Many term plans also let you choose how the payout is received (lump sum, monthly income, or a combination), which can be helpful in estate planning or providing a steady family income.

HNIs may prefer limited pay options (pay premiums for, say, 10 years instead of the entire term) to get the payment out of the way during high-earning years.

All these tweaks mean a term policy can be molded to fit an HNI’s life perfectly, rather than being a one-size-fits-all.

In fact, high-income individuals often “like customizing their term plan cover amount and adding relevant riders as per their needs.”

Wealth Preservation

One often-overlooked benefit of term insurance for the wealthy is how it helps preserve accumulated wealth.

Imagine a scenario without insurance: if someone passes away, their family might have to tap into savings, sell stocks (possibly at the wrong time), or liquidate property to cover immediate expenses, pay off loans, or keep a business afloat.

This can chip away at the wealth that was intended to be kept for the long term or for future generations.

Term insurance prevents forced asset liquidation by providing instant liquidity when it’s most needed.

The payout can cover hospital bills, funeral costs, debts, or any pressing financial needs without disturbing your investment portfolio or physical assets.

Because the insurance payout can be earmarked for specific purposes like your children’s education or your spouse’s retirement, it ensures that the rest of your wealth continues to grow or be used as intended.

What Type of Term Insurance is Suitable for HNIs?

Term insurance plans come in several forms, and it is important to choose the option that aligns best with your financial needs and long-term goals. You might also hear about other life insurance types, such as whole life plans or ULIPs.

Here, we outline the main types of term or term-related insurance that HNIs in India consider, and how each works:

Regular Level Term Insurance

What is it: This is the classic term plan where you decide on a sum assured (coverage amount) and a policy term (say 10, 20, or 30 years, or up to a certain age). The coverage remains constant throughout the term, and premiums are fixed for the entire duration.

How it Works: For HNIs, a level term plan is often used to cover a long-term obligation or to secure the family’s future generally. Its simplicity is its strength. For example, a ₹20 crore cover means that if anything happens to you during the term, ₹20 crore is paid out.

Ideal For: This type is suitable when you want straightforward protection and expect your insurance needs (the amount required) to remain high until a certain point (like until retirement or until children are independent). Most of the plans listed in the previous section offer level coverage by default.

Decreasing Term Plans

What is it? In a decreasing term insurance plan, the coverage amount reduces over time (usually annually) at a predetermined rate.

How it Works: These plans are designed to match declining liabilities, a prime example being a loan that you’re paying down. The big advantage is cost: because the cover amount keeps dropping, the premiums for decreasing term plans are lower than for an equivalent level cover.

Ideal For: People who have large debts that will gradually reduce (like an amortizing business loan or a mortgage on a property) sometimes use decreasing term insurance to cover that specific risk.

Ditto's Advice

Increasing Cover Term Plan

What is it: In an increasing cover term insurance plan, the coverage amount increases over time at a predetermined rate.

How it Works: These plans are designed to match the increasing responsibilities of an adult, as well as inflation.

However, do not get this confused with life-stage benefits, which increase your cover amount by a predetermined percentage after your marriage, purchase of your first house, and birth of a child.

Whole Life Insurance (Term to 99/100 years)

What is it? Some term plans or traditional life insurance plans offer coverage for the entire lifetime of the insured, often up to age 99 or 100. Technically, “whole life” plans can be of different types (some have cash value, etc.), but here we refer to term-like policies that one can keep for the duration of their life.

How it Works: Whole Life Term coverage means there is no fixed end date. The policy will pay out whenever death occurs, regardless of age at the time of death, from 50 to 100 years old.

HNIs sometimes opt for whole life insurance to ensure an inheritance or facilitate an estate transfer. Since the policy will inevitably pay out (assuming premiums are paid), it can act as a guaranteed legacy for beneficiaries, for example, providing estate liquidity or equalizing inheritance.

Ideal for: Whole-life plans are great for peace of mind and estate planning, but not everyone needs insurance at age 90 if, by then, their wealth can cover the expenses.

Unit-Linked Insurance Plans (ULIPs) and Other Investment-Linked Policies

What is it? ULIPs are life insurance plans that double as investment vehicles. A portion of your premium goes towards life cover, and the rest is invested in funds (equity, debt, etc.) of your choice. They are often pitched to HNIs as a two-in-one product: “market returns plus insurance.”

How it Works: ULIPs often come with higher charges and complexities, especially in the initial years. The life cover in ULIPs is usually a multiple of the annual premium (for example, 10x the premium), and an HNI might need to pay a very hefty premium to get a truly large cover, which isn’t cost-effective purely for insurance purposes.

Takeaway:

We generally recommend keeping insurance and investments separate at Ditto. And the reason is simple:

Term insurance gives you maximum cover for minimum cost. At the same time, your investments can be made in instruments with far greater flexibility and potentially higher returns than a ULIP, such as mutual funds, NPS, and FDs.

ULIPs also have lock-in periods and can be subject to market volatility, which might defeat the purpose of having a guaranteed risk cover.

Why Do We Recommend Only Term Plans at Ditto?

Primary Purpose

The rationale is that pure term insurance focuses on what insurance is meant for: protection. And it does that job exceptionally and economically well.

Multitasking

The moment you mix insurance with investment (such as ULIPs or certain whole-life insurance plans with cash value), you start paying more, and the product tries to do multiple jobs at once.

Coverage

It’s better to let a term cover your life risk and invest your money elsewhere for growth, where it’s not tied into an insurance contract.

Additional Options

As an HNI, you may likely have access to top-notch investment avenues, such as AIFs, PMS, and hedge funds. You don’t need your life cover to invest in the stock market on your behalf (and charge management fees for it).

Recommendation

Instead, use term insurance as a shield for your wealth and family, and separately grow your wealth with the help of your financial advisors or market opportunities.

This clarity of purpose is why term insurance is our strong recommendation for both HNIs and others.

How to Choose the Best Term Policy for HNIs

Choosing a term insurance policy is an important decision, especially when the coverage amounts are substantial. Here are some guidelines and factors that HNIs should consider to ensure they pick the best term policy for their unique situation:

Assess Your Coverage Requirement

- Begin by figuring out how much life cover you actually need. This involves considering your current lifestyle expenses, outstanding liabilities (loans, mortgages, etc.), and future financial goals for your family (such as children’s education, marriage, or any dependents’ special needs).

- You can use Ditto’s free term cover calculator to get an estimate based on your income and expenditure. Remember, the goal is to ensure that if you’re not around, the sum assured can generate enough returns or provide enough capital to meet all the financial needs you have identified for your family while being invested in a simple risk-free instrument like FDs.

- It’s better to err on the side of a little extra coverage, because your income and responsibilities might grow over time. That said, avoid going overboard just for the sake of it; the premium should remain affordable and meaningful relative to your finances.

Choose the Appropriate Type of Plan

- As discussed in the previous section, decide what type of term plan suits your needs. Do you need a level term plan that stays constant, or does an increasing term (to counter inflation) make sense?

- If you have a large loan, would a decreasing term plan be beneficial to cover just that liability? Also, consider the policy term.

- Many people opt for coverage till 60-65 (covering them until retirement) if the goal is income replacement for dependents.

- Others may opt for a longer term or whole-life cover if the goal is estate creation or if they have dependent spouses/kids, even in later life.

- Decide on features like limited pay vs regular pay: limited pay can be great if you want to finish premium payments early (say, pay for 10 years for a 30-year cover). It’s often preferred by HNIs who have high cash flows now but want to avoid the hassle of paying premiums at an older age.

- Essentially, map the plan options to your needs chart. For example, if ensuring something for heirs no matter when you die is the goal, a plan that covers till 99 or whole life might be the choice.

- Note that a higher cover duration also leads to higher premiums due to a higher mortality risk for the insurer (especially beyond the age of 70).

Here's What Experts Say

Examine Insurer Credibility and Claim Stats

- When the sum assured is very high, you want to be sure that the insurer can and will pay out if needed.

- Look at the insurer’s claim settlement ratio (CSR), amount settlement ratio (ASR), complaint volume, and, more importantly, their track record with high-value claims.

- Many insurers publish the amount of claims settled in crores. For instance, LIC paid out over ₹18,000 crore in a year, while ICICI Prudential paid out approximately ₹1,950 crore, as seen in industry data.

- A high volume (relative to their revenue) indicates experience with big claims. In a nutshell, here are the benchmarks we follow:

- Additionally, read reviews or ask around about the claim experience. Some insurers are known for smoother, quicker claim processing.

- It’s wise to prefer insurers who have been around for a while and have a stable reputation.

- While price is important, do not choose a provider solely because they offer a slightly lower premium if their credibility is questionable. You need the company to be rock-solid when a claim arises.

Compare Features and Flexibility

- Once you shortlist a few plans from reputable insurers for the coverage amount and term you want, compare their features side by side.

- Review the available riders (critical illness, accidental death/disability, waiver of premium, etc.) and determine which ones you would actually want.

- For instance, if a plan offers an inbuilt waiver of premium on disability or critical illness, that’s very valuable. It means if something happens to you (short of death) that affects income, you won’t have to pay further premiums, and the cover still continues.

- Some plans might have a premium return option at the end or a “special exit benefit”, so examine the cost versus benefit of those.

- If you are an NRI or may become one, ensure the policy offers coverage in the country where you plan to live, as most insurers provide global cover with some exclusions for high-risk regions.

- If you are buying the policy as an NRI, check if the insurer requires additional steps such as medical tests in India or submitting attested documents. Your premiums can also be paid through international cards or NRE/NRO accounts.

- If you travel a lot or might relocate, ensure there’s no geographic exclusion within India, but if you travel abroad, intimation to the insurer becomes necessary, especially for longer duration stays.

- If you plan to take out new loans, an increasing coverage option may be useful.

- Doing a feature-by-feature comparison will illuminate which plan aligns best with your preferences (or you can just book a call with an expert at Ditto Insurance).

Consider Premium Costs and Payment Convenience

- While we don’t recommend choosing a term plan purely based on price, affordability still matters.

- You need to sustain the premiums over 20–30 years, so it’s worth comparing quotes for your desired sum assured across insurers.

- If one plan is significantly more expensive than another, without a clear feature or service quality benefit, it might not be worth the extra cost.

- Now, most people don’t realize that insurers offer implicit discounts for larger covers. As your sum assured increases, the insurer’s fixed costs (like medical underwriting, admin, and distribution) are spread over a larger cover amount. Reinsurers also price bulk risk more efficiently.

Here's a Real Example to Illustrate

Note: Premiums are subject to change on a case-by-case basis.

Medical and Financial Underwriting Requirements

- Be prepared for the fact that large covers will involve thorough medical check-ups and financial underwriting.

- When choosing a plan, understand the process. Some insurers might require more exhaustive medical tests than others, or foreign travel/residency info if applicable. This isn’t necessarily a criterion to choose the policy, but being aware helps.

- Disclose all information truthfully during the application because high-value policies will likely go through financial documents and background checks.

- It’s better to be transparent (declare all existing policies, health conditions, lifestyle habits) to avoid any chance of claim denial.

- Choosing a cover amount that you qualify for without hassle is part of the process. This is because insurers have limits on sum assured based on income multiples, especially for higher cover amounts.

- You will need to submit proper documentation, such as your payslips, offer letters, bank statements, ITRs, GST returns, audited P&L statements, etc.

- Insurers usually provide 20-30x annual income as max insurance cover, and this multiple is lower for older folks (36+).

- Apart from the financial requirements, be prepared for medical tests, not only home-based but also centre-based, like treadmill tests, Chest X-rays, lung function tests, USG, ECG, and anything else that insurers prescribe. This is done especially for larger covers (₹2 crore plus).

Practical Tip: Buy term insurance at a younger age. As you grow older, health issues can arise, leading to an increase in premiums. This may complicate the approval process. Sometimes, HNIs also procrastinate on insurance, thinking their wealth suffices, but starting early locks in your insurability.

Review and Update Nominee Details

- Once you’re zeroing in on a policy, make sure you appoint the correct nominee(s) who will claim the money if something happens to you. For HNIs with complex family structures or business partners, this is crucial.

- You might want to specify multiple nominees (e.g., spouse and children) with percentages, or even consider a trust as a nominee if you have an estate plan in place.

- We normally recommend that you choose a beneficial nominee, i.e., spouse, parents, or children, so that the benefits pass on naturally, and not merely as a collectible for the estate. Keep will and nominations consistent.

- If you want the payout to go to someone other than the beneficial nominee, consider mentioning it in the will and assigning the policy to them (charity, other relatives). Assignment overrides all nominations.

- Choose a policy that allows the flexibility you need in nomination. Most will, but ensure you complete the nomination form carefully.

- Keep your nominees informed about the policy, where it’s stored, the policy number, and the insurer’s contact, so they know what to do.

Pro Tip

By following these steps, assessing needs, picking the right type, comparing insurers, examining features, weighing costs, fulfilling underwriting, and setting up nominees, you can easily choose an ideal term insurance policy.

Why Choose Ditto for Term Life Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Vijay below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right term insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Conclusion

For High Net-Worth Individuals in India, term insurance should not be an afterthought or a box to tick, but a tool to safeguard your empire and loved ones. Despite abundant wealth, HNIs face unique challenges: large debts, business risks, estate distribution concerns, and the volatility of markets.

A well-chosen term insurance plan addresses these concerns head-on by providing a massive safety cushion at a relatively tiny cost. It ensures that your passing does not create a financial crisis for your family or business. Instead, it can turn a precarious situation into a well-managed one.

We encourage every HNI and high-income professional to evaluate their life insurance needs objectively. If you haven’t already, consider this your cue to look at the top term insurance plans.

For personalized assistance, remember that Ditto is just a call away!

Quick Note

Frequently Asked Questions

Why People Trust Ditto

Last updated on: