The SBI term insurance calculator is a free online tool provided by SBI Life Insurance that enables you to estimate your term insurance premium instantly. By entering basic details such as age, gender, lifestyle, and coverage amount, the calculator provides a personalized quote for your chosen plan, eliminating the need for paperwork or sales calls.

Introduction

Imagine being able to know precisely how much your term insurance will cost before you even speak to an agent. That’s the power of the SBI Term Insurance Calculator. For an industry giant like SBI Life, which offers multiple term plan options, this tool eliminates the guesswork from the process and provides instant, transparent premium estimates directly on their website.

At Ditto, we’ve seen how tools like these empower people towards better financial preparation but we also know that every individual’s insurance need is unique. That’s why we’ve helped over 8,00,000 Indians understand and choose the right policy.

Want to compare SBI’s plans with other recommendations from Ditto before you take the plunge? Talk to Ditto’s expert advisors; we’ll help you understand your options, find the right coverage, and buy with zero spam or hidden charges.

Why Should You Use the SBI Term Insurance Calculator?

Instant Premium Estimate

Know your premium within seconds without agent intervention.

Transparency

Clearly see how each input affects your premium amount.

Comparison-Friendly

Adjust parameters to compare costs across plan variants.

Budget Planning

Helps align your insurance premium with your financial goals.

Time-Saving

No need for physical documentation or manual calculations.

Pro Tip: Experiment with different options (like riders or payment modes) before purchase.

What is the Information Required for Using the SBI Term Insurance Calculator?

To get a premium quote using the SBI Life term insurance calculator, you’ll need to enter the following details:

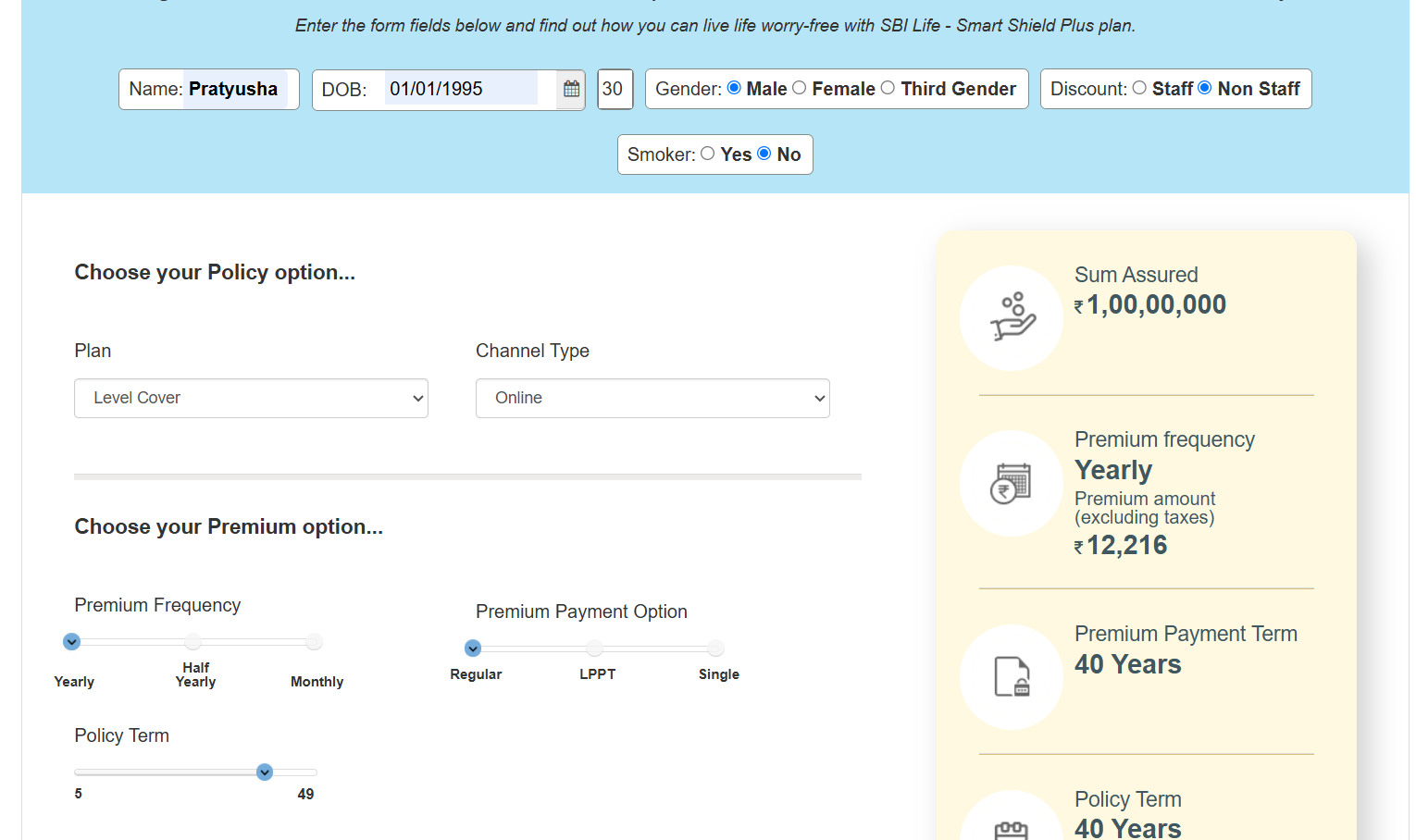

- Name – To personalize your policy quote.

- Date of Birth (DOB) – Determines your age, which directly impacts the premium amount.

- Gender – Male, Female, or Third Gender, as premium rates can vary based on gender. If one

- Discount Category – Choose whether you are a Staff or Non-Staff member (Employees usually get discounted premiums).

- Smoking Habit – Indicate whether you are a Smoker or Non-Smoker, since smokers/tobacco consumers are charged higher premiums.

- Channel Type – Select the purchase mode (Online).

- Premium Frequency – Choose how you wish to pay: Yearly, Half-Yearly, or Monthly.

- Premium Payment Option – Pick between Regular Pay, Limited Pay (LPPT), or Single Pay.

- Policy Term – Select the number of years you want the coverage for (e.g., 5 to 67 years).

- Sum Assured – Enter the desired coverage amount (minimum ₹25 lakh, no upper limit).

- Better Half Benefit – Opt Yes or No for this feature that provides coverage for your spouse after your death.

- Accident Benefit Rider (Optional) –

- Option A: Accidental Death Benefit (ADB) — specify rider term (5–57 years) and rider sum assured (₹50,000–₹75 lakh).

- Option B: Accidental Partial Permanent Disability Benefit (APPD) — specify rider term (5–57 years) and rider sum assured (₹50,000–₹25 lakh).

These details enable the calculator to estimate your premium amount and generate a customized plan summary.

Note: For illustration purposes, we have curated the documentation required and computed the premiums of the SBI Life Smart Shield Plus term plan.

How to Use the SBI Term Insurance Calculator?

Here’s a quick step-by-step guide to using the SBI term insurance calculator:

1) Go to SBI Life’s official website.

Open the SBI Life Insurance homepage.

2) Navigate to the Product Section.

Hover over the ‘Products’ tab and click on ‘Protection Plans’ under Individual Life Insurance Plans.

3) Choose your plan. Select SBI Life – Smart Shield Plus (or any term plan of your choice).

4) Click on ‘Calculate Premiums’. Scroll down to find this button on the plan page.

5) Enter your details.

Input personal details like DOB, gender, smoking status, and sum assured.

6) Select your options.

Choose premium frequency, payment term, plan type, and any optional riders.

7) View your premium quote.

The calculator instantly displays your estimated premium amount on the right-hand side of the screen.

8) Modify if needed.

You can adjust your coverage or term to see how it affects your premium.

Note: The final premiums will be decided after underwriting. If you have a medical condition or if your medical tests have adverse findings, loading charges can be applied.

What are the Benefits of SBI Term Insurance?

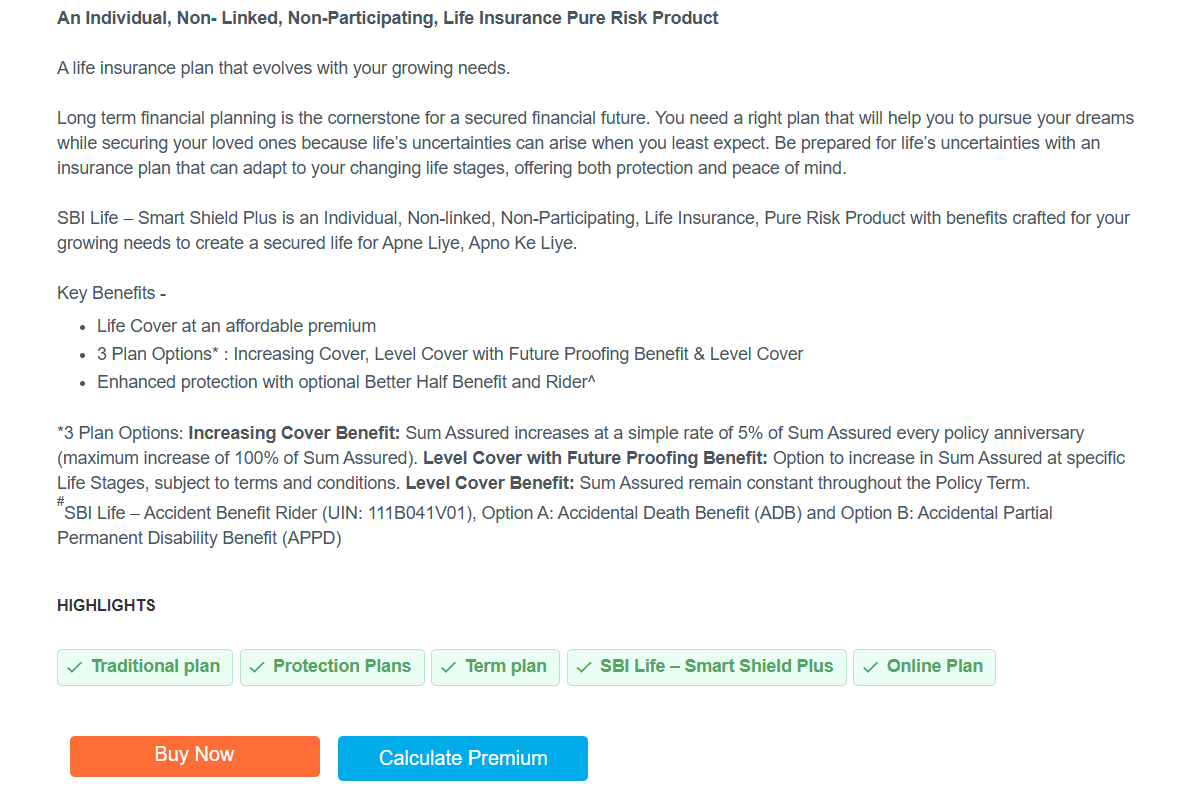

SBI Life’s term plans, especially Smart Shield Plus, offer a range of benefits designed for flexibility and protection:

- Customizable Coverage: Choose from Level Cover, Increasing Cover, or Future Proofing (with the Life Stage Benefit ) options.

- High Sum Assured Options: Minimum ₹25 lakh, with no upper cap on coverage.

- Optional Add-ons: Enhance protection with the Better Half Benefit, Accidental Death Benefit Rider, and Accidental Partial Permanent Disability Rider. However, the Critical Illness Rider & the Waiver of Premium Benefit, which we at Ditto strongly suggest, are missing.

- Long-Term Protection: Coverage available up to 100 years (Whole Life option).

- Flexible Premium Payments: Choose to pay once, for a limited period, or throughout the policy term.

- Affordable Premiums: Designed to fit your budget while ensuring maximum coverage.

- Tax Benefits: Premiums qualify for deductions under Section 80C (Old Regime) and 10(10D) of the Income Tax Act.

Why Talk to Ditto for Your Term Insurance?

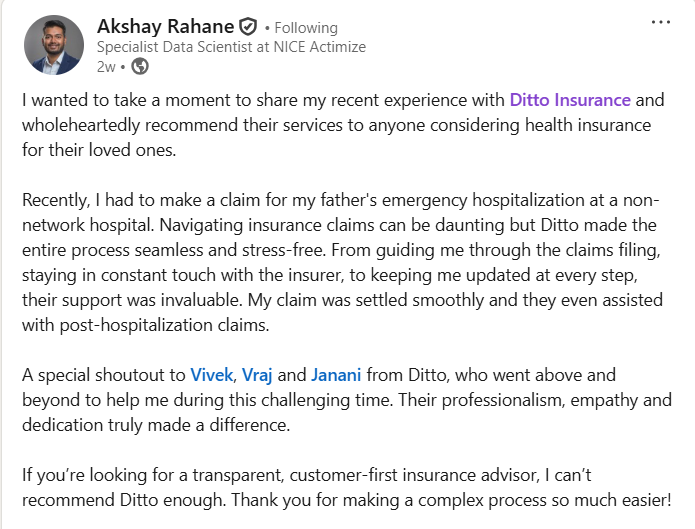

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right health insurance policy. Here’s why customers like Akshay love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

If you’re planning to buy SBI Life Smart Shield Plus or any other term plan like SBI Life Smart Shield Premier, using the SBI Term Insurance Calculator ensures you make an informed, budget-friendly decision, one that truly protects your loved ones.

FAQs

What are the features of the SBI term insurance calculator?

It’s an online tool that gives instant premium quotes, allows plan comparisons, and shows the impact of different coverage and payment options on your premium.

Can I use the SBI term insurance calculator for all plans?

Yes. The calculator supports all major SBI Life term plans, including Smart Shield Plus and Smart Shield Premier. For more details on term plans offered - SBI Life Insurance Policy Product Brochure Downloads

Does the calculator show GST-inclusive premiums?

No. The calculator typically displays premiums excluding taxes as per the new rules that waive GST on retail term insurance products.

Can I buy the plan directly after using the calculator?

Yes. After viewing your premium estimate, you can proceed to buy the policy online through SBI Life’s portal.

Is it necessary to add riders while calculating the premium?

No, riders are optional. However, including them in your calculation provides a more accurate estimate of the final premium.

Last updated on: