However, MPPI is not yet widely available in India. But some lenders or insurers may offer similar coverage under different names or bundled products.

Note: This is different from Mortgage Life Insurance, which pays out the entire outstanding loan amount if the borrower passes away.

Buying a home is one of the biggest financial commitments most people make in their lifetime. While taking a mortgage allows you to own your dream home, it also comes with the responsibility of making regular monthly payments, or EMIs. But what happens if an unexpected event like sudden unemployment, illness, or injury, affects your ability to earn? This is where Mortgage Payment Protection Insurance (MPPI) comes in.

In this blog, we’ll explain:

- What MPPI is,

- How it works,

- Its inclusions and exclusions,

- Pros and cons,

- Alternatives available in India.

Mortgage Payment Protection Insurance in India: How It Differs

In India, the concept of MPPI exists in a more limited form. The most common products are Home Loan Protection Plans (HLPPs) or Mortgage Reducing Term Assurance (MRTA), credit-linked life insurance offered by banks or NBFCs when you take a home loan. Instead of replacing your EMIs during a job loss or illness, these plans repay the entire outstanding loan amount directly to the lender in the event of the borrower’s death.

Some HLPP or MRTA products come with optional riders for critical illness or total permanent disability, which can help settle the loan if you are unable to work again. A few insurers also offer limited “EMI protection” or “job-loss cover” add-ons, but these are not true MPPIs. They usually cover only 3 to 6 months of EMIs under strict conditions such as involuntary job loss (non-disciplinary) and continuous full-time employment.

Overall, while Western MPPI products are designed to protect the borrower’s income, the Indian versions focus more on protecting the lender’s loan exposure.

Examples of MPPI products globally:

- UK: Payment shield Mortgage Protection Insurance is a standalone policy that you can buy directly from a retailer. It offers options for accident, sickness, and/or unemployment coverage, and pays a monthly benefit linked to your mortgage after a waiting period.

- Australia: Zurich Home Loan Protection is a retail policy that provides coverage if you are temporarily unable to work due to illness, injury, or involuntary unemployment. It also pays off the outstanding mortgage balance in the event of death or terminal illness, with coverage decreasing in line with the loan balance.

- Canada: Scotiabank Mortgage Protection offers coverage of up to CA$3,500 per month for up to six months per job loss, with a total maximum of 12 months per mortgage. The policy also includes a 60-day waiting period before benefits begin.

Can’t decide which health or term insurance plan is right for you? Don’t worry! Book a free call with Ditto, and our IRDAI-certified advisors will help you choose the perfect fit.

What Are the Inclusions and Exclusions of a Mortgage Payment Protection Insurance?

| Inclusions | Exclusions |

|---|---|

| Involuntary Redundancy: You lose your job through no fault of your own (e.g., company closure, downsizing). | Voluntary Redundancy: You choose to leave your job or accept a severance package. |

| Accidental Injury: An injury that prevents you from performing your job duties, certified by a doctor. | Pre-existing Medical Conditions: Illnesses or injuries you had before you took out the policy. |

| Sickness/Illness: A diagnosed illness that makes you medically unfit to work for a sustained period. | Self-Employment/Contract Work: Policies may not cover loss of income for self-employed individuals unless specifically stated. |

| Temporary EMI Support: Pays your monthly home loan instalments for a pre-defined period. | Claim Waiting Period: You need to cover your mortgage EMIs yourself before the policy starts paying out. |

| Some Policies: May also include a small amount for associated costs like property insurance premiums. | Misconduct or Poor Performance: Losing your job due to disciplinary action. |

| — | Retirement: Loss of income due to planned retirement. |

It’s important that you read your policy document carefully. Most claims fail because of exclusions, so knowing what your mortgage payment protection insurance won’t cover is just as important as understanding what it will.

How Does Mortgage Protection Insurance Work?

Mortgage payment protection insurance is quite straightforward. It’s a mechanism that transfers your mortgage payment risk to an insurer for a defined period if a major life event occurs.

Here is a step-by-step breakdown of how it functions:

- Policy Purchase: You purchase the policy, either when you take out your home loan or at a later date. The premium is calculated based on factors like your age, the size of your mortgage, and the benefit amount you want to receive.

- The Event: You experience an insurable event, such as a serious injury from an accident or an involuntary job loss (redundancy).

- The Deferral Period: Almost every mortgage payment protection insurance policy has a "deferral period," also known as a waiting period. This is the time between the event (e.g., job loss) and when the insurer starts paying out. This period can range from 30 days to 60 days. You must be able to cover your mortgage EMI yourself during this time.

- Filing a Claim: You file a claim with your insurer, providing proof of the event (e.g., a letter of redundancy from your employer, or a medical certificate from your doctor).

- The Payout: Once the deferral period ends and the claim is approved, the insurer starts paying your monthly benefit amount. This payment is typically made directly to you, not the lender. The payment is designed to cover your mortgage EMI and sometimes an extra percentage for related expenses.

- The Duration: Payments will continue until one of three things happens: you return to work, you reach the policy’s maximum payout period, or the mortgage is fully paid off.

The entire process is designed to be a temporary bridge. It ensures your largest financial commitment, i.e., your home loan, is managed while you focus on getting back on your feet.

Note: Mortgage payment protection insurance is beneficial for people who have minimal emergency savings but have a stable employment history.

Alternatives to Mortgage Payment Protection Insurance in India

- Critical Illness Cover and accidental disability cover pays a lump sum upon diagnosis of a serious illness or a total and permanent disability, which can be used to pay EMIs or other expenses. Can be opted as a standalone policy or riders with you health or term life plan.

- Term Life Insurance provides a lump sum to your family if you pass away, which can be used to clear the mortgage or support them financially.

- Mortgage Life Insurance (credit life) is similar to Term Life Insurance but is specifically designed to pay off the mortgage upon death. For most borrowers, pairing a home loan with a term insurance policy is a smarter alternative to mortgage life insurance as it offers broader coverage, useful add-ons (riders), and the flexibility to use the payout for multiple financial needs.

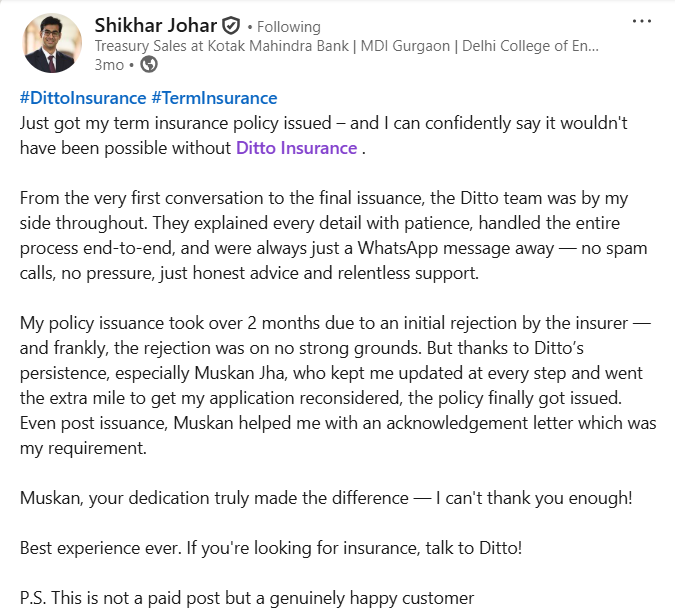

Why Choose Ditto for Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Srinivas below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Mortgage Payment Protection Insurance (MPPI) can provide temporary relief by covering mortgage payments during short-term disruptions like illness, injury, or job loss. While this type of protection is widely available as flexible, stand-alone policies in countries such as the UK, Australia, and Canada, in India, similar solutions are limited.

The common offerings here are Home Loan Protection Plans (HLPPs) or Mortgage Reducing Term Assurance (MRTA). These primarily repay the outstanding loan in case of death and occasionally include riders for critical illness or permanent disability. True income-replacement coverage for borrowers is rare and often bundled with home loans under strict conditions.

Given these limitations, MPPI should be seen as a short-term safety net rather than a comprehensive solution. For stronger, long-term protection of both your home and family, a Term Life Insurance policy with suitable riders provides greater flexibility and financial security, ensuring that your obligations are met even under unforeseen circumstances.

FAQs

How long do you need mortgage protection insurance?

You generally need mortgage payment protection insurance for as long as you have the outstanding mortgage loan and you are reliant on your regular income to pay the EMI. As you pay off your loan and your outstanding principal reduces, you can choose to reassess or cancel the policy.

What is the difference between MPPI and Life Insurance?

Life insurance (Term Insurance) pays out a lump sum benefit to your family upon your death. It is designed to pay off the entire outstanding mortgage (or other debts) and provide financial security to your dependents. MPPI, or mortgage payment protection insurance, on the other hand, pays out a monthly benefit to you while you are alive but unable to work due to job loss, illness, or injury.

Can you cancel your mortgage protection insurance policy?

Yes, you can cancel your mortgage payment protection insurance policy at any time. If you decide to cancel, you typically stop paying the premiums, and the coverage immediately ceases. There are usually no financial penalties for cancelling, but you will not get a refund for the period you have already paid for.

Is mortgage payment protection insurance mandatory?

No, neither home loan insurance nor mortgage payment protection insurance is mandatory in India by the IRDAI Or RBI. Lenders may offer it as an add-on, but you can refuse it. The decision to purchase it is a personal one, based entirely on your level of financial stability and risk tolerance.

Last updated on: