Quick Overview

LIC’s online term plans have historically focused on simplicity and trust, rather than innovation. LIC Bima Kavach continues that legacy by delivering the core promise of term insurance: financial protection on death without investment elements or maturity benefits.

However, buyers today look beyond just “death cover” and expect built-in benefits such as terminal illness payouts, premium protection during disability, faster claim processing, and value-added health services. This LIC Bima Kavach plan review examines whether the plan in question meets those expectations.

Eligibility Criteria for LIC Bima Kavach

Key Features of LIC Bima Kavach Plan

- Pure Death Benefit Only

LIC Bima Kavach is a pure term insurance plan. If the life insured dies during the policy term while the policy is active, the death benefit is paid to the nominee, and the policy terminates. There is no maturity or survival benefit. - Cover Options

At policy inception, the life assured must choose one of the following cover options. This choice is irreversible.

Level Sum Assured: The sum assured remains constant throughout the entire policy term.

Increasing Sum Assured: It is designed to partially offset inflation and growing responsibilities:

- First 5 policy years: Sum assured remains flat

- Policy years 6 to 15: Sum assured increases by 10% per year (simple interest)

- Maximum increase capped at 2× the initial sum assured

- From policy year 16 onwards: Cover remains fixed at 2× the initial sum assured until the end of the policy term.

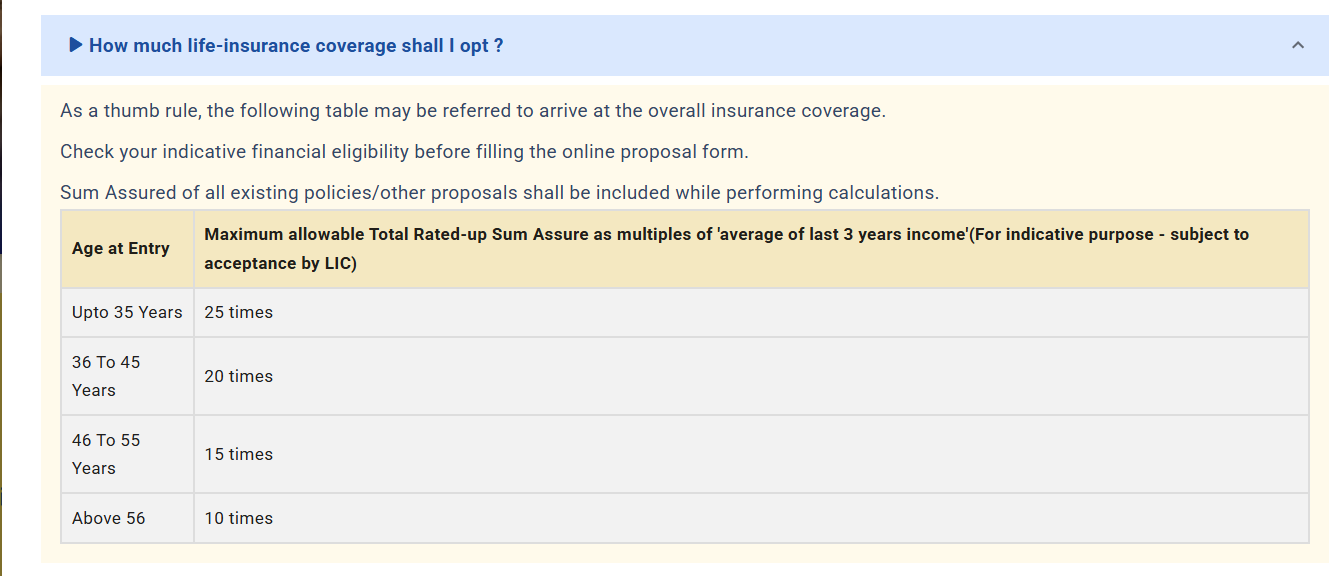

If you’re in two minds about the kind of cover to choose, the following image taken from LIC’s official website might help you ascertain which type and amount of cover you may need/ be eligible for:

- Death Benefit Payout Structure

By default, the death benefit is paid as a lump sum. However, the life assured may opt to receive the death benefit (fully or partially) in instalments.

Available options:

- Payout period: 5, 10, or 15 years

- Frequency: Monthly, Quarterly, Half-yearly, or Yearly

Minimum instalment amounts:

- ₹5,000 (monthly)

- ₹15,000 (quarterly)

- ₹25,000 (half-yearly)

- ₹50,000 (yearly)

The instalment option must be chosen by the life assured during their lifetime. The nominee cannot modify or override this choice at the time of claim.

- Life Stage Cover Enhancement Option

The Life Stage option allows an increase in sum assured on key life events, subject to strict conditions.

Eligibility Conditions

- Available only with a level sum assured.

- Regular pay must be chosen at inception.

- Entry age must be 40 years or below.

- The option must be selected at policy inception.

- A written request must be submitted within 6 months of the life event.

Permitted Cover Increases

- Marriage: Increase by 50% of the sum assured, capped at ₹2 crore

- Birth of first child: Increase by 25%, capped at ₹1 crore

- Birth of second child: Increase by 25%, capped at ₹1 crore

Once exercised, the increased cover continues for the remaining policy term with a corresponding premium increase.

Riders Available with LIC Bima Kavach

The accidental benefit rider is the only optional add-on offered by LIC Bima Kavach. It pays an additional lump sum if the life assured dies due to an accident, over and above the base term plan’s death benefit. The maximum aggregate accidental death cover across all LIC policies is capped at ₹1 crore.

It is available only with regular pay and limited pay options.

While this rider may appear useful for families facing sudden financial disruption due to accidental death, we generally don’t recommend it at Ditto.

Accidental deaths are already covered under the base term insurance policy, and adding an accident-specific rider only narrows the scope of protection.

In most cases, increasing the base sum assured provides broader, all-cause coverage.

Note

What are the Exclusions in the LIC Bima Kavach Term Plan?

Like most term insurance policies, the LIC Bima Kavach comes with a set of standard exclusions, such as suicide within the first year and certain claim-related limitations as defined in the policy wording. These exclusions are in line with industry norms and regulatory guidelines.

To understand in detail, read more about the types of deaths not covered under a term insurance plan.

LIC Bima Kavach vs Popular Term Plans: Premium Comparison

The profile considered is a non-smoker male, opting for a ₹2 crore sum assured, with policy coverage up to age 70, and without any first-year discounts.

Actual premiums may vary based on underwriting outcomes, health disclosures, and insurer-specific pricing factors.

Premium Comparison for the Term Plans

Key Insights: LIC Bima Kavach is consistently the most expensive option across ages 25 to 40, with premiums over 50% higher than the cheapest private insurer at every age point.

It is also noticeably costlier than HDFC’s plan, which is otherwise among the most expensive offerings within the private insurer segment.

Metrics of LIC Bima Kavach

Key Insights: LIC pays out far larger claim amounts and handles significantly higher business volumes than the industry median, while maintaining a strong claim settlement record. Its complaint rate is also substantially lower than the industry average.

That said, with services like a 30-day claim settlement, LIC is broadly in line but not meaningfully ahead of the industry.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

LIC Bima Kavach plays to LIC’s biggest strengths: scale, stability, and institutional trust. It is a sturdy term plan for buyers seeking high cover amounts of ₹2 crore and above from India’s largest life insurer.

However, you must be willing to pay a higher premium. While it lacks modern features and broader rider options, the plan still delivers reliable core protection backed by LIC’s claim-paying capacity.

For lower cover needs with better features at a lower cost, LIC Digi Term may work better. However, in the ₹2 crore+ segment, Bima Kavach remains LIC’s most robust offering.

Disclaimer

Frequently Asked Questions

Last updated on: