About HDFC Life Term Insurance Calculator

The HDFC Life Term Insurance Calculator is a simple online tool that helps you estimate your term insurance premium in minutes. By entering details like age, income, occupation, tobacco use, and lifestyle, it gives an instant premium quote and suggests a suitable cover based on your financial profile.

You can compare plans, check affordability, and make informed choices. Note that premiums shown on site are indicative and may change after medical and underwriting reviews. It’s a quick, transparent way to plan your cover.

Introduction

Before buying a term insurance plan, it’s important to know exactly how much cover you need and how much it’ll cost you. And what better way to find out than by using the HDFC Life Term Insurance Calculator? This simple online tool helps you estimate your premium and understand what truly affects your pricing.

In this guide, we will walk you through how to use the HDFC Life Term Insurance Calculator, what details you’ll need along the way, and a few important things to keep in mind while using it.

Choosing a term plan can be tricky. Book a free call with Ditto’s advisors and get expert guidance on coverage, policy terms, and the plan that suits your lifestyle and budget.

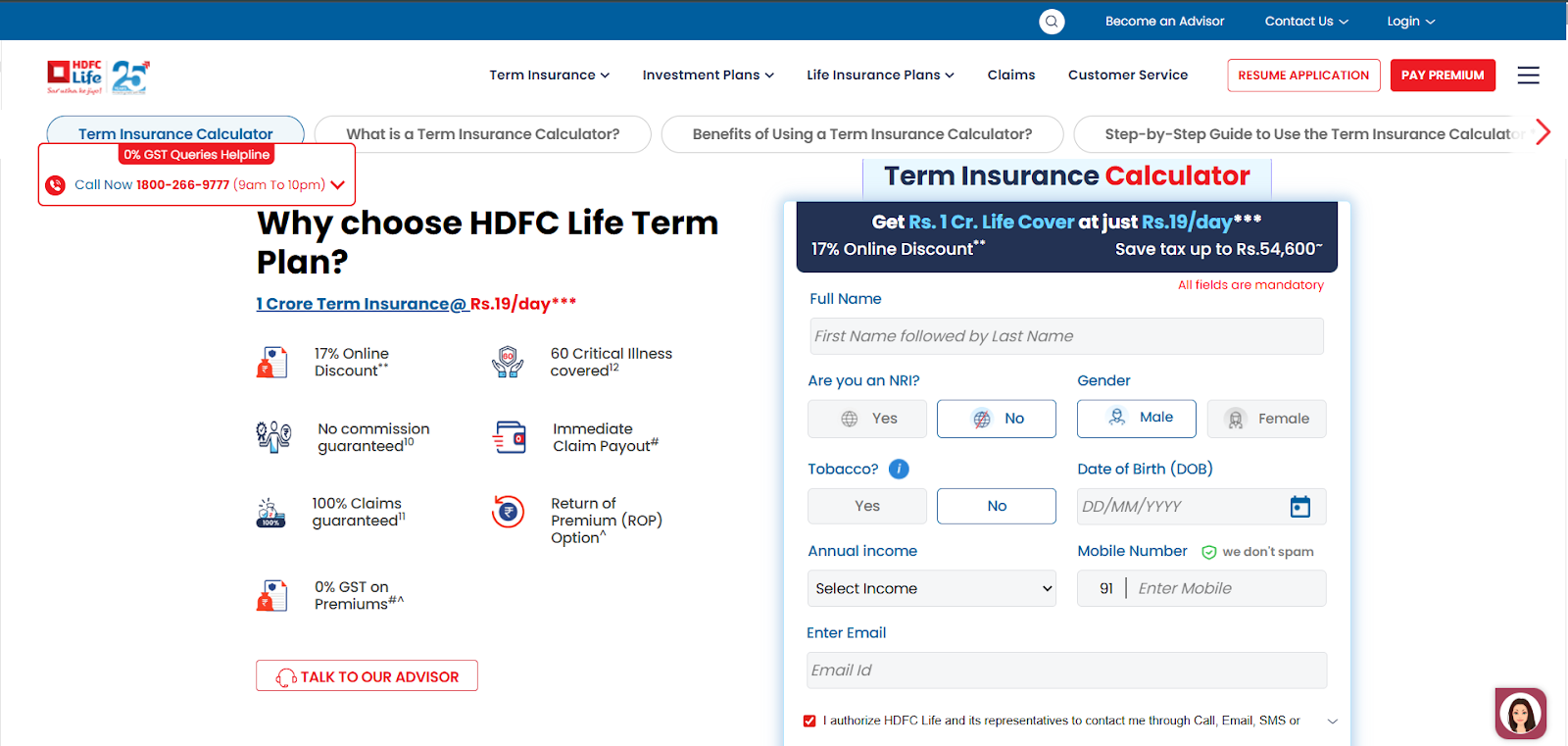

How to Use the HDFC Life Term Insurance Calculator

Using the HDFC Life Term Insurance Calculator is straightforward. Follow these steps:

1) Head to the “Term Insurance Calculator” page on the HDFC Life website.

2) Fill in your basic details:

- Full name (as per official ID)

- Residential status (select “Yes” if you are an NRI, otherwise “No”)

- Gender

- Tobacco usage: choose “Yes” if you’ve used tobacco in the last 2 years, else “No”

- Date of Birth

- Annual Income

- Occupation (salaried/self employed or business/housewife)

- Mobile number and Email ID

3) Once all mandatory fields are filled, click the button such as “Calculate Premium” (or similar) to get your estimated premium.

4) The tool will then display an estimated premium amount for a recommended sum assured and may also suggest term-plan options matching your profile.

What are the Benefits of Using HDFC Life Term Insurance Calculator?

Saves time

Instead of manually estimating or calling up the insurer, you can instantly see premium estimates online.

Helps compare plan options

With the estimated premium and cover suggestion at hand, you can compare different plans/cover levels side by side.

Check affordability

You can see whether the suggested premium fits your budget before committing.

Assists in choosing the right cover (sum assured)

Based on your income and age, it suggests a cover level, so your family is adequately protected.

Free and accessible online

You don’t have to pay or visit an office, just use it anytime from anywhere.

Supports informed decisions

Using the tool gives you better insight into how factors such as age, tobacco use, income, etc., affect your premium, so you can pick a plan that truly fits your needs.

If you want a clearer idea of how your age, income, and dependents impact your term insurance cover, explore the Ditto Term Insurance Cover Calculator. It’s a quick way to learn what influences your cover amount and why choosing the right term plan matters.

Things to Keep in Mind While Using the HDFC Life Term Insurance Calculator

While the HDFC Life Term Insurance Calculator is a quick and reliable tool to estimate your premium, there are a few important points to remember before finalizing your plan:

- Premiums shown are indicative and may change after underwriting, which reviews medical history and risk profile.

- Younger age results in lower premiums; buying early locks in affordable rates.

- Be honest about medical history; pre-existing conditions affect premiums and eligibility.

- Smokers pay higher premiums; HDFC Life rates for smokers may be higher than some competitors. In such cases, you may also consider other insurers like ICICI Prudential Life or Bajaj Allianz Life, which sometimes provide more favorable premium options for tobacco users.

- HDFC Life’s premiums are generally higher, which reflects their strong claim settlement record, brand reliability, financial stability and customer service performance.

- Your income decides your cover amount (typically 10–15× your annual income). Opt for higher cover if you have dependents or liabilities.

- Medical tests may be mandatory based on age, coverage, and health disclosures.

- Longer terms cost slightly more but offer extended protection. Choose one that covers your working years or until dependents are self-reliant.

- Optional riders such as Accidental Death Benefit, Critical Illness Cover, or Waiver of Premium enhance protection but increase your overall cost. Pick riders that fit your needs.

- Even if HDFC Life is your preferred or partner insurer, it’s smart to compare premiums, benefits, and features across insurers.

Why Talk to Ditto for Your Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right health insurance policy. Here’s why customers like Akshay love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

Conclusion

The HDFC Life Term Insurance Calculator is a simple and effective tool to help you understand how much life cover you really need and what it might cost you.

Instead of guessing or relying on rough estimates, it lets you see exactly how your age, income, and lifestyle affect your premium within minutes. It’s a great first step before buying a policy that helps you plan smartly, compare options, and make well-informed decisions about protecting your family’s financial future.

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

FAQs

Which HDFC term plans are supported by the calculator?

The HDFC life term insurance calculator supports a variety of HDFC Life term plans: HDFC Life Click 2 Protect Super, Click 2 Protect Elite Plus, Click 2 Protect Life, Click 2 Protect Ultimate, Click 2 Protect Supreme, HDFC Term with Return of Premium Plan, HDFC Life Smart Term Pro, and HDFC Life Quick Protect.

Does the calculator show GST, loading, and payment modes?

The HDFC Life term insurance calculator does not show GST separately, as retail term plans are currently exempt. It provides an approximate premium estimate, though any loading due to health or lifestyle risks is applied during underwriting and isn’t displayed.

The calculator also allows selection of premium paying terms (regular, limited pay, or single pay) but payment mode options aren’t shown. These are available when purchasing the policy online via net banking, cards, or other electronic methods.

What factors impact life insurance premiums?

Life insurance premiums depend on factors like your age, health, lifestyle habits, occupation, and coverage amount.

Younger and healthier individuals usually pay lower premiums, while smoking, medical conditions, or risky jobs can increase costs. The policy term, add-ons, and income level also influence pricing, as insurers assess your overall risk before finalizing the premium.

Can a person with a disability get term insurance?

Yes, people with disabilities can buy term insurance but it depends on the insurer’s underwriting assessment. The company will review your medical records, disability certificate, income stability, and the type and severity of the disability before offering coverage. If the disability significantly increases health or mortality risk, the insurer may decline the proposal.

How can self-employed individuals get term insurance in India?

Self-employed people can absolutely get term insurance, though the approval process is a bit more detailed than for salaried applicants. Insurers usually ask for proof of consistent income such as ITR filings, GST returns, audited financials, or bank statements.

Your cover amount is typically based on a multiple of your declared income. Keeping your finances transparent and your filings regular helps improve approval chances and ensures you get the right coverage.

Which HDFC Life term plan is suitable for a housewife?

The HDFC Life Click 2 Protect Supreme plan is a great fit for homemakers looking to protect their family’s financial future. It offers affordable premiums, flexible payout options, and a Premium Break Benefit (up to 12 months) to help manage household finances without pressure.

Last updated on: