Quick Overview

If you’re looking for the LIC e-Term Insurance Plan today, it can be confusing. You’re either trying to buy the policy, only to realise it’s no longer available. Or you already own the plan and are worried about what its withdrawal means for your coverage, premiums, or claims.

At Ditto, we’ve seen this confusion often. To give you accurate, reliable answers, we’ve reviewed the IRDAI guidelines, studied LIC’s official policy documents, and analysed how withdrawn insurance products are treated under Indian insurance regulations.

In this blog, we’ll clarify what a withdrawn plan actually means and help existing customers understand the nitty-gritty details of their policy. Let’s dive in.

How LIC e-Term Insurance Plan Works

The LIC e-Term plan was a pure term insurance policy with no survival or maturity benefits. If the life insured died during the policy term while the policy was in force, the sum assured was paid to the nominee.

Features and Benefits of LIC e-Term Insurance Plan

Premium:

There were 2 categories of premiums. Aggregate (default/standard rates set using the combined data from the overall population) and non-smoker rates (lower rates but only if you qualify as a non-smoker via the urinary cotinine test).

Tax Benefits:

Premiums paid were eligible for tax deduction under Section 80C (of the old regime), and the payout was (and still is) tax-free under Section 10(10D).

Discounts:

8% discount on the first premium, and the renewal discounts were 6% (2nd year), 4% (3rd year), 2% (4th and 5th year). However, the amount of discount was limited to ₹3000 per policy per year.

Eligibility Criteria for LIC e-Term Insurance Plan

Premium Details of LIC e-Term Insurance Plan

As the plan is no longer live in the market, we won’t be able to share the latest quotes. However, here are the sample rates taken from the policy brochure.

So if a 30-year-old non-smoker is buying 1cr cover for 30 years, the cost is 1.46₹ x (1,00,00,000 / 1000) = ₹14,600 P.A.

Note: Unlike more modern term plans, monthly, quarterly, or half-yearly premium payment modes were not available under this policy. Therefore, premiums under the plan were payable annually only and collected via the online payment system.

Riders Available With LIC e-Term Insurance Plan

The LIC e-Term plan did not offer any optional riders such as critical illness cover, waiver of premium, or accidental benefit riders. It was a basic term plan focused solely on death risk coverage.

Limitations of LIC e-Term Insurance Plan

- Limited Flexibility in Payment Modes

- No Rider Options

- In-Built Features (Life Stage Benefit, Terminal Illness Cover, and Instant Payout) are Missing.

- Can No Longer be Purchased

How to Buy LIC e-Term Insurance Plan Online?

As the LIC e-Term plan has been withdrawn, it cannot be purchased anymore.

For new buyers, you don’t need to worry. Even though the LIC e-Term plan is no longer available, there are still several reliable and well-priced term insurance plans in the market. If you’re looking particularly for a plan from LIC, you can check out our detailed review of LIC Term Plans.

Other than that, at Ditto, we typically recommend a curated set of top-rated term plans that offer better flexibility, rider options, and claim support.

You can explore them by checking out our detailed guide on Best Term Insurance Plans in India.

Claim Process for LIC e-Term Insurance Plan

For existing policyholders, the claim process remains the same as with other insurers’ term plans:

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call or chat on WhatsApp now!

Conclusion

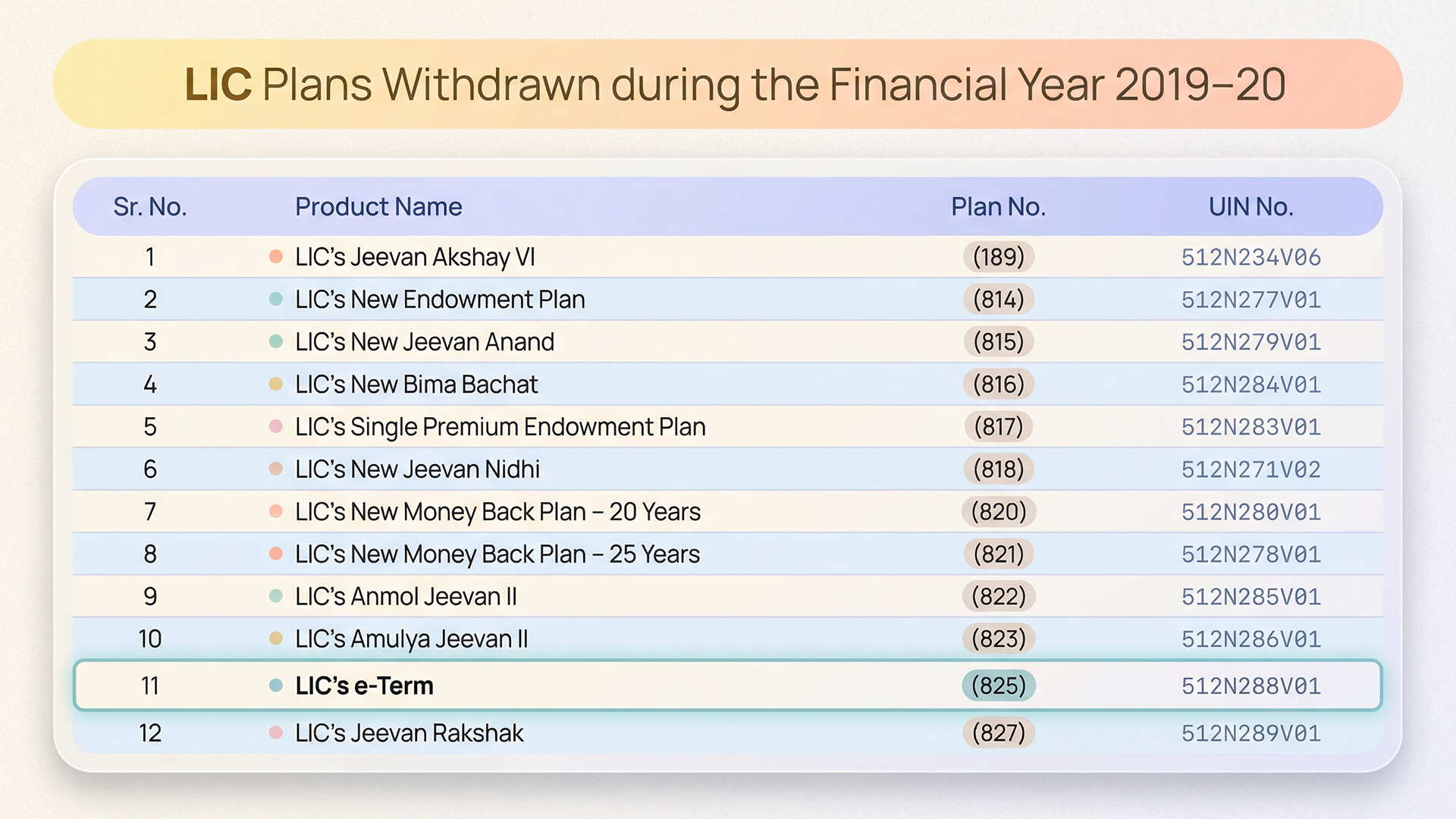

The LIC e-Term Insurance Plan (Plan No. 825) was a simple online term cover that offered basic life insurance protection. Though it is no longer available for new buyers, existing policyholders continue to be covered under the terms they originally purchased. Its withdrawal from sale does not affect the validity or benefits for those who already hold the policy.

Full Disclosure: LIC is not a partner insurer of Ditto. The above information has been taken from the insurer’s website and publicly available sources.

Frequently Asked Questions

Last updated on: