Absolutely. Backed by India’s largest bank, State Bank of India (SBI), and regulated by IRDAI’s strict solvency and claim norms, SBI Life isn’t just safe, it has high financial stability and proven reliability. Think of it as the LIC of private insurers: large scale, strong public sector support, and years of trust behind it.

Sure, the best insurer depends on your needs, but if “safe” is the question, SBI Life is a solid choice. It is ideal for those who value both offline and online access, as well as long-term peace of mind.

Looking for the safest insurance plan?

Book a FREE consultation with Ditto and get unbiased advice on SBI Life and other top insurers.

No spam. No hidden fees. Just honest guidance.

Book Your Free Call Now

SBI Life Insurer Overview

Established in 2001, SBI Life Insurance is built on strong financial foundations. Its majority shareholder and promoter is SBI, which holds over a 55% stake in the company. This backing, combined with IRDAI’s regulation, enables it to blend rock-solid public sector credibility with the digital agility of a modern insurer.

According to SBI Life’s Annual Report, the insurer manages over ₹4 lakh crores in assets, 22.6 lakh+ new policies, and a nationwide, hybrid network of 1,040 offices + over 40,000 partner branches to serve every kind of policyholder. Nearly 99% of SBI Life’s policies are sourced digitally, yet it retains deep roots for those preferring in‑person service. Moreover, when it comes to new business premiums, SBI Life stands tall as the second-largest player in the market, trailing LIC and ahead of HDFC Life.

SBI Life: Financial Strength and Trust, with a Few Red Flags

SBI Life’s financial strength is further demonstrated by its CRISIL AAA/Stable rating, the highest credit rating, which signifies rock-solid solvency, profitability, and backing from SBI. On the customer front, Hansa Research’s CuES 2025 report notes that SBI Life has significantly improved its Net Promoter Score (NPS) and earns high marks for trust and affordability, even as ICICI Prudential and Max Life lead on overall experience.

That said, even giants stumble. In 2024, IRDAI fined SBI Life ₹1 crore for non-transparent aggregator tie-ups and flagged questionable claim denials. Moreover, mis-selling complaints surfaced in bank branches, and a few consumer court rulings went against the insurer. Some customers also note that SBI Life’s term insurance products tend to be costlier and less comprehensive than peers. But those are minor blemishes on an otherwise impeccable record. SBI Life remains one of India’s safest and most trusted life insurers.

SBI Life Insurer’s Insurance Plans

SBI Life offers a wide range of plans across categories like term insurance, savings, retirement, and ULIPs. Here are some of their flagship offerings that give insight into their scale and reliability:

- SBI Life – eShield Next (Term Plan)

- SBI Life – Smart Platina Plus (Guaranteed Savings)

- SBI Life – eWealth Plus (ULIP)

- SBI Life – Retire Smart Plus (Retirement)

- SBI Life – Smart Future Star (Child Plan)

- SBI Life – Smart Annuity Plus (Pension)

These plans reflect the insurer’s focus on long-term security, guaranteed returns, and flexibility.

Customer Reviews on SBI Life Insurance

Claim & Amount Settlement Ratios of SBI Life Insurance

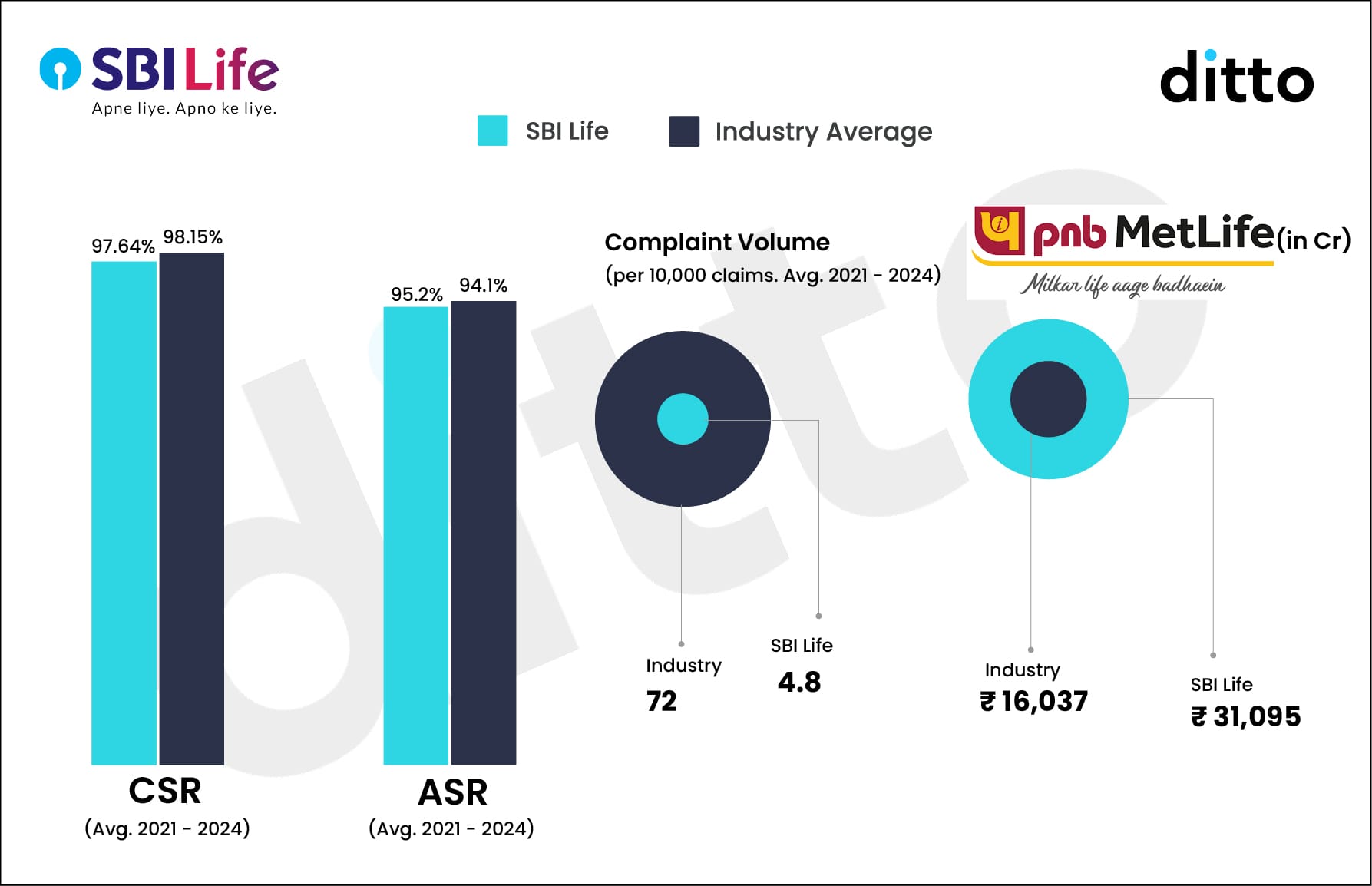

SBI Life shows strong performance in both key claim metrics. Its Claim Settlement Ratio (CSR) for FY 2024-25 is 98.83%, which is a slight improvement over FY 2023-24’s 98.62%. If we take the average over the period of FY 2022 to FY 2025, the insurer’s CSR stands at 98.24%, only slightly below the industry’s 98.66%, with nearly 99% of claims settled within 30 days. For further analysis, you can refer to this list of the top 10 term insurers ranked by their CSR.

Equally important, its Amount Settlement Ratio (ASR), the proportion of the claim amount actually paid, stands at a 3-year average of 95.2% from 2021 to 2024, higher than the industry average of 94.1%.

Ditto’s Verdict: While SBI Life’s CSR is just below the industry average, its higher ASR shows that it not only approves claims but also pays them fairly, offering policyholders both reliability and value.

Complaint Volume of SBI Life Insurance

SBI Life has consistently outperformed the industry, maintaining a remarkably low average of just 5.6 complaints per 10,000 claims between FY 2022 and FY 2025, far below the industry average of 17.67.

Ditto’s Verdict: While SBI Life's large scale and product mix (especially group claims) may somewhat dilute the complaint volume, the consistent outperformance vs the industry average, including in years where the overall industry improved, indicates a genuine service strength, not just a statistical illusion.

Also, the decline in SBI Life’s complaint volume is no coincidence; it reflects focused investments in service quality, streamlined grievance redressal, and institutional discipline shaped by its large scale, government-backed social security mandate, and vigilant IRDAI oversight.

Solvency Ratio of SBI Life

With a 3-year average solvency ratio of 2.0, well above the regulatory minimum of 1.5, SBI Life demonstrates sound financial resilience and disciplined capital deployment. While it trails the industry average slightly, this reflects a more efficient capital strategy, ensuring safety without underutilizing resources, a hallmark of a well-run insurer.

Here’s the comparison:

Ditto’s Verdict: That "too-big-to-fail" perception and state backing instill confidence in customers, especially in the retail and institutional segments. In the unlikely event of severe stress, SBI’s ability and the government’s willingness to infuse capital offer a robust safety net, dramatically reducing the risk of default or business disruption.

Note - All the metrics discussed above have been taken from SBI Life’s public disclosures, IRDAI Annual reports, and Statistics handbook.

Ditto’s Take on SBI Life Insurance

From a trust and stability standpoint, SBI Life checks all the right boxes: India’s largest bank backs it, has massive scale, and boasts over two decades of consistent performance. As of today, SBI Life doesn’t have any debt obligation on its balance sheet.

Profit after tax (PAT) was Rs 2,413 crore in the fiscal year 2025 (Rs 1,894 crore in the fiscal year 2024). This 500 crore jump in PAT is mainly due to the sale of more traditional (insurance and investment-based) policies and increased revenue from existing customers renewing their plans.

Its investments also earned better returns, and it kept costs under control. The performance of potent agents and improved customer retention also contributed. As of March 31, 2025, its net worth was Rs 16,793 crore, indicating humongous financial reserves. So, if you're looking for credibility, size, and a legacy of trust, SBI Life is undoubtedly a safe bet.

However, when it comes to term insurance, the insurer has room for improvement. To begin with, the insurer should consider introducing more competitive riders, such as a critical illness benefit that provides a lump sum payout on diagnosis, waiver of premiums on critical illness and total permanent disability, zero-cost options that allow special exit value, and instant payouts upon claim intimation.

Additionally, SBI Life’s premiums need to be more competitive, as paying extra simply for the backing of a government-owned insurer is not justified, mainly since all insurers in India are regulated and safeguarded by the IRDAI.

Here’s a table comparing premiums of top term insurers in July 2025. Clearly, SBI Life’s flagship term plan, E-Shield Next, cannot justify its pricing when pitted against equally effective products.

Premiums for a Salaried, Non-smoker (With GST, without 1st year discounts)

Note: These are for illustrative purposes only; final premiums are subject to underwriting by the insurer and periodic price adjustments.

Why Talk to Ditto for Term Insurance Plans?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

SBI Life Insurance stands tall as a trusted titan in the Indian insurance space, backed by the legacy of SBI, high CRISIL ratings, and solid financials (debt-free). Its consistent claim settlement record, fast turnaround times, and low complaint volume reflect operational strength, while its expansive presence ensures accessibility across the country.

That said, not all that glitters is gold; product design, especially in term plans, lacks the flexibility and transparency offered by newer-age insurers. So while SBI Life scores big on trust, reach, and scale, it might not always offer the most customer-friendly or customizable solutions. In short, it's reliable, but not revolutionary. Choose it if you value institutional safety, but know that if you’re seeking modern-day product finesse, you’ll be better served elsewhere.

Last updated on: