Is it Possible to Increase a Term Insurance Cover?

Many people buy their first term insurance policy early in life, only to realise later that their responsibilities have doubled while their cover has stayed the same. If basic expenses can double in 10 to 15 years, a ₹1 crore cover that once felt huge may not be enough 20–30 years from now.

So if your current cover feels small, here’s the simple question to ask: Can you increase it, and what’s the smartest way to do that? This guide helps you understand how to get the right coverage for your family without overpaying or relying on features that might be declined later.

Can I Increase My Term Insurance Cover?

In many cases, yes. Most people don't rely on just one method. You might start with a basic term plan when you begin working, use the life-stage increase option after marriage or having children, or later buy an extra policy as your income, lifestyle, loans, or financial goals grow. In simple terms, you can increase your term cover in four ways:

1) Purchase a New Term Plan

If your existing policy doesn't offer useful in-built increases or life-stage options, or feels rigid or expensive, the most straightforward fix is often to buy a new term plan for the extra cover you need.

You keep your old policy as it is and buy a fresh policy based on your current income, loans, and dependents. You choose the insurer, decide the cover and tenure, and keep the two policies separate.

One rule is non-negotiable: when you apply for a new term plan, you must declare all existing life insurance policies. IRDAI requires this and helps avoid claim issues later.

Considering buying an additional term plan already?

Some of the best options are HDFC Life’s Click 2 Protect Supreme, Axis Maxlife Smart Term Plan Plus, ICICI Prudential iProtect Smart Plus, and Bajaj Life E-touch II.

2) In-built Increasing Cover

Some modern term plans are designed so that your cover automatically grows over time. You choose this option when you buy the policy. After that, the sum assured increases in a fixed pattern. Here’s an overview:

Example: HDFC Life - Click 2 Protect Supreme (Life option) Option A: 100% sum insured till first 5 years, then 10% increase every 5 years

Option B: 100% sum insured for first year, then 5% increase every year

In both cases, the maximum increase till total sum insured reaches 200%.

As you can see, your cover steadily climbs as your expenses and responsibilities rise, without a new policy or fresh paperwork each time. The trade-off is that premiums are higher at the start because the cost of future increases is already built in.

This in-built increase suits someone who expects their responsibilities to grow and prefers a “set it and forget it” approach, rather than manually changing the cover later.

3) Life Stage Benefit

Life stage benefits don't increase your cover each year by default. Instead, the policy lets you increase your sum assured upon certain life events.

Typical events include marriage, the birth or adoption of children, or taking a home loan. At each of these points, the insurer may let you add extra cover (usually up to a specific amount) if you request it within a fixed time window and before a certain age.

The insurer usually reviews your health and income for the extra cover and sets the extra premium based on your age at that time. Still, the process is easier than buying a completely new policy. In simple terms, your cover "steps up" when your responsibilities jump, without paying for a very high cover from day one.

For example, ICICI Pru iProtect Smart Plus lets you increase your cover by 50% at marriage, 25% at the birth or adoption of the first child, another 25% at the birth or adoption of the second child, and up to 100% at home loan disbursement.

This is allowed only if you are under 50 when the event happens, you use the option within 180 days, you pay the extra premium on the increased cover, and you clear the medical underwriting (financial underwriting skipped) for the higher sum assured.

4) Voluntary Top-ups (Manual Enhancement)

Voluntary top-ups let you ask the insurer to raise the sum assured on an existing policy. The catch: the insurer can say yes, restrict the amount, or say no.

They usually reassess your risk with fresh health declarations, possible medical tests, and updated financial documents. The extra premium is based on your current age and health, so it almost always costs more than if you had taken that higher cover earlier.

It offers flexibility on paper, but in practice, it is not always the easiest or most cost-effective way to increase cover. Because of this, voluntary top-ups are best seen as a good backup, not something you can entirely rely on for all future increases.

For example, in Axis Max Life SSP, the Voluntary Sum Assured Top Up lets you increase your cover later in the policy only if you opted for this feature at the start and your original death benefit was at least ₹50 lakh.

You use the option once after the first policy year, while you are under 50 and have at least 10 years of term left, and the policy is in force with no prior claims or a Premium Break used.

The top-up can be up to 100% of the original base cover, in multiples of ₹10 lakh, and is subject to complete medical and financial underwriting, with the extra premium based on your current age, remaining term, and total sum assured band.

Why Should You Consider Increasing Your Term Insurance Cover?

As life progresses, your financial responsibilities change. Imagine you bought your first policy when you were single and renting. A few years later, you're married, have a child, a home loan, and parents who depend on you more.

Each of these increases the amount your family would need if your income stopped suddenly. At the same time, inflation pushes costs up, so a cover that feels big today can feel small later.

The whole point of term insurance is simple: your cover should match your current life, not how things looked when you first bought the policy. There’s a risk in waiting. If you develop:

- Diabetes

- Hypertension

- Thyroid issues

- Sleep apnea

- Depression/anxiety (on medication)

- Start smoking regularly

Any new enhancement or fresh policy can become much more expensive or even be declined. So don't delay getting the right cover because it might cost more or not be possible.

Things to Consider Before Increasing Your Term Cover

Does Your Current Policy Allow an Increase at All?

Look for terms like "increasing cover", "life stage benefit", "sum assured top up", or "step up option". If you find none of these, you'll usually need a new policy instead of hoping for a voluntary top-up.

Time Windows, Age Limits, and Caps

Check if these options are allowed only in the first few years, only up to a certain age, and what the maximum total cover limit is, based on your income.

Will You Need Fresh Medicals or Underwriting?

Expect some level of fresh risk check: updated health declarations, tests, and income proof before the higher cover is approved.

Premium Impact and Affordability

Look at your total premium across all term policies after the increase. The extra cover should plug a real gap, like a big loan or new dependents.

Riders and Policy Features

If you increase coverage inside the same policy, see what happens to riders like critical illness or accidental disability. Some move with the sum assured, others don’t. If it looks messy, it may be simpler to keep the old plan as is and buy a clean second policy with the latest benefits.

How Much Term Cover Do You Actually Need?

In simple terms, your term cover should do three things: replace your income for several years, clear big loans, and support key goals like children’s education, after adjusting for your savings and other life insurance.

If you want help turning this into an actual number, you can use Ditto’s Term Insurance Cover Calculator. It uses your income, age, expenses, loans, and dependents to suggest a realistic range.

Why Choose Ditto for Term Insurance?

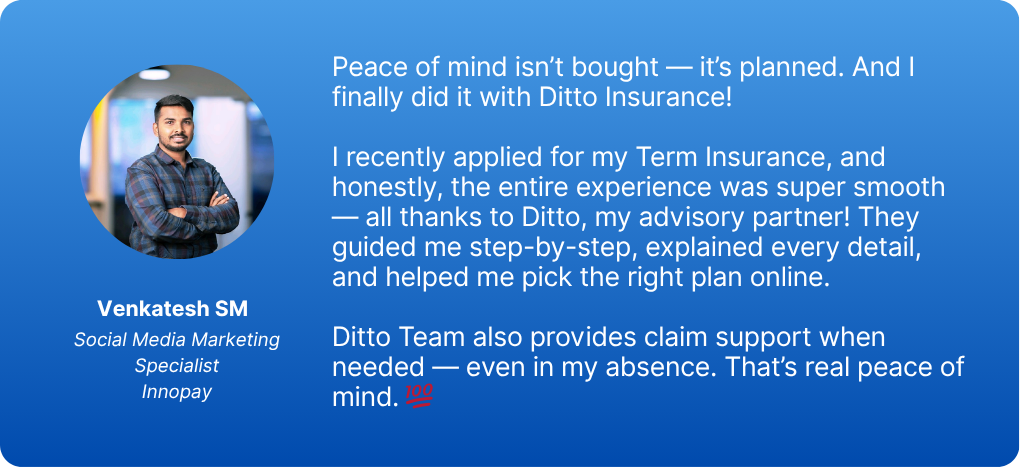

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Venkatesh below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right term insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Ditto’s Take on Term Insurance Covers

- Get as close as possible to the right cover from day one. That way, you lock in a higher cover at a lower cost for future needs, instead of assuming you can always increase it later. Upgrades depend on underwriting and are never guaranteed.

- As a thumb rule, choose a term that runs till around age 60 or 65, till when your family truly depends on your income. If you pick a term that's too short just to save on premiums, you might outlive the policy and struggle to buy a new one later.

- If you stretch it till 80 or 85, you may keep paying high premiums long after your kids are independent and most big responsibilities are over.

- In many cases, it can be simpler and cheaper to compare newer term plans and buy an additional policy with better pricing or riders, instead of forcing an old policy to stretch.

- A simple way to think about it is this: match your cover and tenure to the years when someone truly relies on your income, and review that decision every 5 to 10 years or whenever you hit a major life event.

- Don’t just chase the lowest premium or the longest tenure. Choose a structure that genuinely protects your family in the years that matter most.

Frequently Asked Questions

Last updated on: