| What Is the Role of an Underwriter in Insurance? An insurance underwriter (an individual/team) is a specialist who evaluates and decides whether an insurer should accept a particular risk, and if so, under what terms, premiums, and conditions. The underwriter’s job is to strike a careful balance between business growth (issuing more policies) and profitability (ensuring premiums are adequate to cover expected claims and expenses). In essence, underwriters are the gatekeepers of an insurer’s risk portfolio. They interpret data, analyze risk exposure, and ensure that every policy aligns with the insurer’s overall risk appetite and regulatory requirements. |

When you apply for insurance, you're not just filling out forms; you’re asking an insurer to take on a financial risk. But how do they decide whether you’re a good fit for their coverage, and what will it cost you? That’s where underwriting comes in.

In this post, we'll break down:

- What factors insurance underwriters consider when evaluating your risk

- How underwriting affects your premiums and policy terms

- The key differences between an insurance agent and an underwriter

- How the Insurance Regulatory and Development Authority of India (IRDAI) influences underwriting practices

If you want to learn more about underwriting, you can book a free consultation with us anytime, and we’ll help you out.

| Key Takeaways: 1. Role of Underwriters: Underwriters evaluate risks and determine policy terms based on factors like health, occupation, and claims history, ensuring the insurer offers fair and sustainable coverage. 2. Insurance Agents vs. Underwriters: While agents sell policies and interact with customers, underwriters assess the risk associated with each policy, influencing premiums and coverage terms. 3. Improving Underwriting Outcomes: By maintaining a healthy lifestyle, being honest in your application, and seeking expert guidance, you can improve your chances of securing better premiums and coverage. |

What Does an Insurance Underwriter Do?

Let’s look at the core functions of an underwriter:

1) Risk Assessment:

Review the applicant’s profile, nature of risk, and exposure. This may include medical reports (life/health), vehicle or property details (motor/property), or financial statements (commercial lines).

2) Decision-Making:

Determine whether to accept, modify, postpone, or decline the risk. Underwriters also decide on applicable loadings, exclusions, or deductibles when the risk is higher than average.

3) Pricing and Terms:

Recommend or approve premiums, coverage limits, and policy wording consistent with internal underwriting guidelines and regulatory standards.

4)Portfolio Management:

Monitor the mix of accepted risks, loss ratios, and exposure concentration. They collaborate with reinsurance and actuarial teams to ensure sustainable underwriting performance.

Here’s a table below with the different responsibilities of underwriters according to their domains:

| Product Line | Key Responsibilities of Underwriters |

|---|---|

| 1. Life Insurance | • Evaluate medical and financial risks. • Review medical history, lifestyle factors (smoking, alcohol), age, and lab results. • Assess income and financial justification for the sum assured. • Apply extra mortality loadings for higher-risk lives or refer complex cases to reinsurers. • For group term, analyze demographic experience, participation ratios, and claim trends. |

| 2. Health Insurance | • Review pre-existing diseases, chronic conditions, and hospitalization history. • Ensure compliance with IRDAI’s rules & circulars on turn around time for policy issuance/porting. • Decide on acceptance, disease-specific loadings, or waiting periods within a Board-Approved Underwriting Policy (BAUP) framework. |

| 3. Motor Insurance | • Assess vehicle make/model, usage (private/commercial), location, and prior claims. • For own damage, determine suitable premium rates and apply loadings or discounts. • For third-party, ensure regulatory compliance and monitor claims trends to manage portfolio profitability. |

| 4. Property & Engineering | • Conduct technical risk surveys to evaluate fire protection, construction type, occupancy, and exposure. • Recommend deductibles, warranties, or reinsurance for high-value risks.• Collaborate with risk engineers for on-site assessments and catastrophe (NATCAT) modeling. |

| 5. Marine Insurance | • Review cargo type, packaging, route, and mode of transit. • Apply relevant Institute Cargo Clauses (A/B/C). • Underwrite based on loss experience, theft exposure, and seasonality. |

| 6. Liability & Specialty Lines | • Analyze contracts, business operations, and loss history to quantify third-party exposure. • Underwrite specialized covers such as D&O, cyber liability, and professional indemnity. • Evaluate policy limits, retroactive dates, and exclusions to manage aggregation and legal risks. |

| 7. Reinsurance Underwriting | • Evaluate risks ceded by primary insurers. • Assess treaty terms and decide on facultative acceptances. • Manage capacity, retention, and accumulation within global underwriting limits. |

What Is The Difference Between an Insurance Agent and an Underwriter?

Both the insurance agent and the underwriter play essential roles in the insurance process, but their roles differ.

1) Insurance Agent:

The agent is the person who interacts directly with customers. They help individuals or businesses understand different insurance products, compare options, and choose a policy that suits their needs. Agents also assist with completing and submitting applications and act as a liaison between the customer and the insurance company throughout the buying process.

Compensation: Insurance agents typically earn through commissions: a percentage of the premium from every policy they sell or renew. Depending on the insurer and product type, they may also receive bonuses, incentives, or persistency rewards for maintaining a high rate of renewals and customer relationships.

2) Underwriter:

The underwriter works within the insurance company, evaluating the applications submitted by agents. Their primary responsibility is to assess the risk of insuring individuals, properties, or businesses.

They analyze factors such as age, health, occupation, financial standing, claims history, and risk exposure to determine whether to approve, modify, or decline an application. They also determine the premium rate and terms under which the policy can be issued.

Compensation: Underwriters are usually salaried employees of the insurance company. Their pay structure may include a fixed salary, performance-based bonuses, and occasionally profit-sharing or portfolio performance incentives, but they do not earn commissions on individual sales.

In simple terms, the agent sells you the policy, and the underwriter decides how much it costs based on the level of risk you represent.

What Is The Difference Between An Underwriter And An Insurance Company?

Both the underwriter and the insurance company are integral to the insurance process, but they serve different functions:

1) Insurance Company:

The insurance company is the overall organization that designs, markets, and manages insurance products. It sets policy terms, handles customer service, manages claims, and bears the financial risk associated with providing coverage. In short, the insurer is the provider that assumes responsibility for paying out claims and ensuring compliance with regulatory and business requirements.

2) Underwriter:

An underwriter works within an insurance company, focusing on evaluating individual risks and determining the associated premiums. Their goal is to ensure the insurer only takes on risks that align with its financial capacity and risk appetite.

Think of the insurance company as the “provider,” and the underwriter as the “gatekeeper” who makes sure that the right customers are offered the right policies.

IRDAI’s Role in Insurance Underwriting

The Insurance Regulatory and Development Authority of India (IRDAI) plays a crucial role in ensuring that the underwriting practices followed by insurance companies are fair, transparent, and consistent across the industry.

Let’s break down how this works.

- IRDAI doesn’t license individual underwriters. Instead, it holds the insurer accountable through a Board-approved underwriting policy (BAUP) and governance checks.

- For life insurers, the BAUP must spell out risk assessment standards, risk appetite/tolerance, how underwriting aligns with pricing and reinsurance, reporting of UW performance to the Board, and a clear delegation of authority (“who can approve what”); insurers must also maintain an internal audit mechanism to test quality and compliance with the BAUP.

- In health insurance, IRDAI’s Master Circular requires a board-approved policy framework. It enforces consumer protections that directly constrain underwriting (e.g., standardized permanent exclusions and the 60-month moratorium after which non-fraud claims can’t be contested), which anchors UW decisions in fair-treatment rules.

- Beyond product line specifics, IRDAI’s corporate governance regime makes the Board responsible for robust policies and oversight (with committees like the Product Management Committee). It allows for supervisory action in response to non-compliance identified through filings or inspections.

IRDAI’s Protection of Policyholders’ Interests framework also underpins underwriting by mandating the clarity, timeliness, and defensibility of decisions (including the rejection of applications and loadings, which must be justified); breaches can trigger regulatory action against the insurer and responsible officers.

What You Can Do to Improve Your Underwriting Outcome: Ditto’s Take

While much of the underwriting process depends on factors beyond your control, there are several steps you can take to improve your chances of getting approved and securing better premiums.

For starters, did you know that larger insurers generally have a slightly more lenient underwriting because of being established. However, please note that this isn’t a rule of thumb, just the general observation.

Now, let’s look at steps you can take to improve your underwriting outcome:

1) Maintain a Healthy Lifestyle

- Limit alcohol consumption and avoid recreational drugs.

- Maintain a healthy weight and stay physically active by following a balanced diet and engaging in regular exercise.

2) Be Honest in Your Application

- Fully disclose your medical history, lifestyle habits, and any risky activities. Omissions or misrepresentations can lead to policy denial or claim denial later.

- Provide accurate information about your family’s health history.

3) Know Your Financial Needs

Apply for an appropriate amount of coverage that aligns with your specific needs and requirements. If you want to learn more, you can check our article on How Much Term Insurance Do I Need? Or How Much Health Insurance Do I Need?

4) Take Help

Insurance forms can be tricky, and even minor errors can delay approval. That’s where we come in. Our advisors at Ditto can guide you through every step, help you complete forms accurately, and clarify the meaning of each question.

Note on appeals and reconsideration: A decline isn’t always final, and new evidence (fresh labs, specialist note, corrected financials), along with a reinsurer's opinion, can change outcomes.

Let’s say you apply for life insurance with Insurer A, and they conduct a blood test. The test shows that your blood sugar is high, which leads them to decline your policy.

But then, you decide to get a second opinion. You have another blood test done at a different lab, and you consult with your doctor. It turns out that the original test was inaccurate, maybe it was a lab error or a temporary fluctuation in your blood sugar levels.

Now, you go back to Insurer A with this new evidence: a clean test result and your doctor’s note explaining the situation. Insurer A will then consult their reinsurer (the company that helps Insurer A assess risk). If the reinsurer agrees that the second test is accurate (or they insist on another test at an independent facility) and see that your health is fine, they might reverse their decision and approve your policy.

If you’d like to learn more you can read about it in our detailed guide on What is Reinsurance?

By following these steps, you can present yourself as a lower risk to insurers, which can help you qualify for better coverage at more affordable rates.

Why Choose Ditto for Insurance?

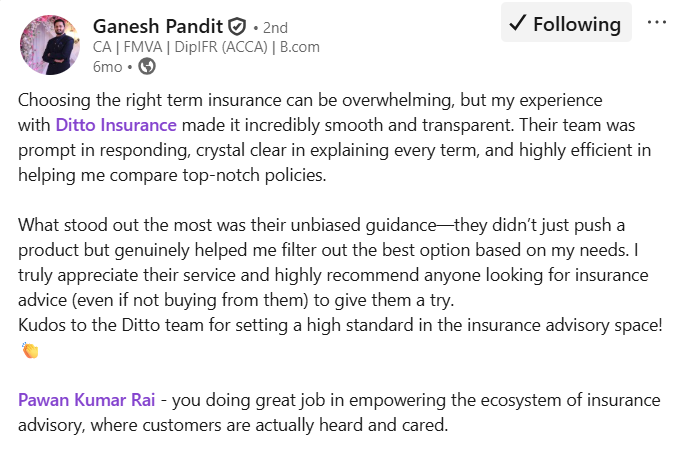

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Ganesh below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

In insurance, underwriters play a crucial role in assessing risk and determining the terms, premiums, and coverage of policies. By carefully evaluating factors like health, occupation, and history, they ensure that insurers maintain a balanced risk portfolio while offering fair and sustainable coverage.

Understanding their role helps individuals make informed decisions when applying for insurance, and with expert guidance, it’s possible to improve underwriting outcomes and secure better, more affordable policies. Ultimately, underwriting safeguards both the insurer’s financial stability and the policyholder’s needs.

Frequently Asked Questions

How Much Do Insurance Underwriters Make?

Insurance underwriters' salaries can vary depending on their experience, location, and the size of the insurance company for which they work. On average, an insurance underwriter in the U.S. can earn anywhere from $50,000 to $100,000 annually. In India, underwriters typically earn between ₹4-10 lakhs per year, although this amount depends on their experience and expertise.

What is the role of an underwriter?

The role of an underwriter is to evaluate the risks associated with a potential policyholder and determine whether they should be approved for coverage. They assess various factors, such as age, health, occupation, and lifestyle, to determine risk. Their goal is to strike a balance between offering affordable coverage and protecting the insurer's financial stability.

What is the purpose of underwriting in insurance?

Underwriting in insurance serves to assess and manage the risk associated with issuing a policy. By evaluating an applicant’s risk factors, underwriters help insurance companies offer appropriate policies and premiums, which ensures fairness for both the insurer and the policyholder. It also protects the insurer from excessive financial risk and helps ensure that policyholders are adequately covered according to their unique circumstances.

How to become an insurance underwriter?

Many successful insurance underwriters come from backgrounds such as actuarial science, finance, economics, statistics, or life sciences, and some even begin their careers preparing for or clearing actuarial examinations.

Actuarial exams provide a strong foundation in probability, financial mathematics, and risk modeling. These are skills that closely align with modern underwriting, particularly in pricing and portfolio analysis. While a specific degree isn’t mandatory, professional certifications greatly enhance an underwriter’s credibility.

- In India, underwriters often pursue the Insurance Institute of India (III) qualifications, including Licentiate, Associate, and Fellowship, which incorporate underwriting modules.

- Globally, recognized credentials include the CII (UK) ACII, The Institutes (US) AU™ or CPCU®, LOMA’s FLMI® for life and health products, and the Academy of Life Underwriting’s AALU/FALU designations.

These credentials demonstrate advanced knowledge of risk assessment, product design, and regulatory compliance, helping underwriters progress to senior technical or managerial roles worldwide.

What are the three types of underwriting in insurance?

There are three primary types of underwriting in insurance:

- Manual Underwriting: The underwriter manually reviews the application, medical history, and other relevant details to assess the risk and decide on the policy terms.

- Automated Underwriting: This is often used in life insurance and is based on algorithms that assess the risk factors from the applicant's data. It speeds up the process but can still involve manual intervention if the algorithm flags a complex case.

- Automatic/Simplified Underwriting: Typically used for policies with lower coverage amounts or less complexity, automatic underwriting involves no manual review but instead relies on preset rules and guidelines to approve or deny applications.

What tools and data do underwriters use?

Underwriters rely on a combination of documents, data, and analytical tools to accurately assess risk. These include proposal forms and KYC documents, medical reports and lab results (for life and health cases), and financial statements or income proofs (to verify affordability). They also use credit bureau data, fraud databases, and risk-engineering or survey reports for property and industrial risks. For large or complex cases, underwriters refer to reinsurer guidelines. In catastrophe-prone areas, they may use geospatial or NATCAT (natural catastrophe) models to estimate potential losses.

What Decisions Do Underwriters Make?

Underwriters make the final call on whether and how an insurance policy can be issued — essentially deciding if the company should take on a particular risk and under what terms. Their day-to-day decisions generally fall into four categories:

- Accept as Standard: The risk is normal and fits the insurer’s pricing assumptions, so the policy is issued at regular rates.

Example: A healthy 30-year-old non-smoker applying for ₹50 lakh term life cover is accepted at standard premium rates.

- Accept with Terms: The risk is slightly higher than average, so the policy is approved but with adjustments like higher premiums, deductibles, or specific exclusions.

Example (Life): A 45-year-old smoker with borderline diabetes may be offered cover at a 50% extra premium.

Example (Health): A 58-year-old with controlled hypertension might get a small loading and a 3-year waiting period for heart-related claims.

Example (Property): A factory with outdated fire safety systems could be insured, but only after adding a higher deductible and a requirement to upgrade the equipment.

- Postpone or Decline: When the risk is too high or uncertain, underwriting may be deferred or rejected. Example: An applicant recently hospitalized for an ailment may be asked to reapply after recovery, or the proposal may be declined if the risk exceeds the limits.

- Refer for Approval: Large or complex risks beyond an underwriter’s authority are sent to a senior underwriter or reinsurer for review. Example: A ₹10 crore term cover request that exceeds the company’s internal retention is referred to the reinsurer for final acceptance and pricing.

In short, underwriters ensure each policy issued aligns with the insurer’s risk appetite, pricing strategy, and regulatory guidelines — protecting both the customer’s interests and the company’s financial health.

Does IIB fit into underwriting?

The Insurance Information Bureau of India (IIB) is IRDAI’s industry data hub that collects and analyses transaction-level data across motor, health, and life insurance. Insurers (and IRDAI) use IIB’s datasets to price and underwrite more accurately, benchmark loss ratios, and detect fraud patterns. For example, IRDAI’s annual motor third-party premium revisions rely on claims and premium data compiled by IIB, and insurers are required to upload TP data to the IIB portal for this purpose. IIB also runs consumer/insurer utilities like V-Seva for checking vehicle insurance/claim history, which supports risk selection in motor. In short, IIB provides the shared, validated market data that underwriters and actuaries use to set terms, monitor experience, and keep pricing fair and consistent.

Last updated on: