Quick Overview

Insurance is as much about trust as it is about managing risk. Policyholders need confidence that their insurer will step in when they need support the most. This trust is often strongest in the case of government-owned health insurers like New India, Oriental, National Insurance, and United India. These companies have been around for over 70 years, are among the largest players in the market, and report some of the highest claim settlement ratios in the industry.

However, their products have not always evolved at the same pace as those offered by private insurers, especially when it comes to coverage depth and overall value for money. There are also some financial concerns that prospective buyers may want to consider.

In this article, we’ll take a deeper look into government health insurance companies, their performance, premiums, pros and cons, and whether they are a good choice for you.

Top Government Health Insurance Companies In India

In the above table, CSR signifies Claim Settlement Ratio, ICR signifies Incurred Claims Ratio, and GWP means Gross Written Premium.

Overview of Government Health Insurance Companies

New India Assurance

Overview:

New India is the largest general insurer in India in terms of annual business volume. It operates in over 25 countries and has a long-standing presence in the market. With CSR consistently above 98% and complaint volumes low, it reflects stable operational performance.

However, its ICR suggests that the insurer pays out more than what it earns, which can be a point of concern. In addition, several of its plans include restrictions and sub-limits. For instance, the Yuva Bharat Health Platinum plan has disease-wise sub-limits for conditions like cataract and certain modern treatments.

United India General Insurance

Overview:

United India has a wide physical presence, with over 1,500 offices across India. Its CSR has consistently remained above 90%, which is considered a decent figure in the industry. Its plans also come with several restrictions and sub-limits. For example, the Individual Platinum plan has a room rent limit of 1% of the sum insured per day or actual expenses, whichever is lower.

National Insurance

Overview:

National Insurance, the oldest insurer in the country, has consistently reported a CSR of over 93%. It also records the highest complaint volumes among the four government-owned insurers. Its plans follow a similar structure, with certain coverage limits and caps. For example, the National Mediclaim Plus policy includes a room rent limit of 1% of the sum insured for specific coverage slabs, among other restrictions.

Oriental Insurance

Overview:

Oriental Insurance is the insurer with the lowest CSR among the four companies at 93.55%. It also follows the same theme of restrictive policy benefits e.g. the Happy Family Floater plan has a room rent restriction of 1% of sum insured per day even in the highest platinum variant.

Benefits of Government Health Insurance Companies In India

1) Established Legacy

With over 70 years of experience, these insurers bring deep industry knowledge and long-standing trust.

2) Government Backing

Being government-owned adds a sense of stability, security, and long-term reliability.

3) Strong Regulatory Oversight

They operate under strict government norms, which helps ensure transparency and better policyholder protection.

4) High Claim Settlement Ratios

Public sector insurers have consistently shown strong claim settlement performance, reflecting their commitment to honoring claims.

5) Low Complaints Volume

Despite serving a massive customer base, they receive relatively fewer complaints, which points to dependable service and effective grievance handling.

Drawbacks of Government Health Insurance Companies In India

Very High ICR

ICR shows how much of the premium collected is used to pay claims. While 50–80% is considered healthy, consistent 100%+ ICR levels suggest that all four insurers are paying out more than they earn. This raises concerns about long-term stability, especially since many PSU insurers need frequent government recapitalisation, which also reflects in their solvency ratios.

Plan Benefit Considerations

Many plans offered by government health insurance companies come with restrictions that we usually do not recommend, like room rent caps, disease-wise sub-limits, and co-payment. Such restrictions increase the risk of high out-of-pocket expenses.

Solvency Risks

As per the IRDAI Annual Report 2024-25, apart from New India, all the other government health insurance companies had a negative solvency ratio. While government support has always been implicit, this raises concerns over the insurer’s ability to pay claims in case of financial stress.

Limited Network Hospitals

A smaller hospital network reduces access to cashless treatment. This can delay care and increase out-of-pocket expenses. Ideally, insurers should offer 7,500-10,000+ network hospitals, but government insurers typically fall far short of this.

TPA Involvement

Public sector insurers often rely on TPAs to manage claims. While this is a widely used model, it can sometimes introduce additional coordination steps. Insurers with in-house claims teams may offer more direct control over the process.

Pricing Considerations

Many government health insurance plans are priced high for the benefits they offer. They often miss modern features like strong restoration benefits, meaningful bonuses, and still include limits like room rent caps, disease sub-limits, and co-payment.

Why Choose Ditto for Health Insurance?

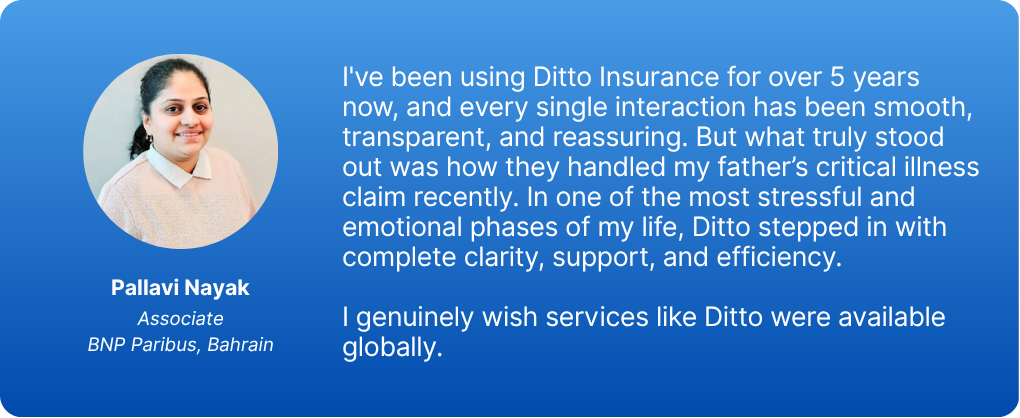

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now or chat over WhatsApp, slots fill up fast!

Ditto’s Take on Government Health Insurance Companies

Before choosing a government health insurance company, take a moment to assess your needs. While the companies have a strong track record and CSR figures, premiums for their plans tend to be on the higher side for the not-so-comprehensive benefits. Also, make sure that there are network hospitals nearby that you like.

Compare all your options, and make sure you consider the best plans from good private insurers as well. And as always, check the policy wordings carefully to avoid any surprises in a time of need.

Note

Frequently Asked Questions

Last updated on: