| Time Limit for Filing a Health Insurance Claim The time limit for filing a health insurance claim varies based on the type of claim. For planned cashless treatment, it’s best to inform the insurer 3–5 days before hospitalization. In emergency cashless cases, notify the insurer’s desk or TPA at the hospital within 24 hours of admission, if possible. For reimbursement claims, submit them within a week of discharge, though the formal time limit is 30 days for hospitalization and 15 days for post-hospitalization expenses. OPD expenses can be claimed weekly, fortnightly, or monthly for convenience. Filing your claim early helps ensure a faster and smoother process. |

Filing a health insurance claim can be overwhelming, especially during a medical emergency or after hospitalization. To make the process smoother and ensure your expenses are reimbursed, it’s essential to understand the time limit for filing a health insurance claim.

This guide explains the deadlines for different types of claims such as planned and emergency cashless, reimbursement, post-hospitalization, and OPD expenses, along with the basic documentation required during claim settlement. Knowing these key timelines helps you avoid delays, reduce stress, and get your rightful benefits faster.

Book a FREE insurance consultation with Ditto today. Get expert help in choosing the right policy and filing claims hassle-free. Slots are limited—book now!

Time Limits in Cashless Claims

Every health insurance policy has a set of prescribed timelines you must follow before the insurer is obligated to pay your claim. These rules help the insurer verify your case properly. Understanding and following the time limit for filing a health insurance claim enables you to avoid claim rejections and ensures a smoother claim process. When availing of cashless hospitalization treatment, it’s essential to notify the insurer immediately.

1) Planned Hospitalization (Cashless)

Ideally, inform the insurer 3–5 days before admission. This gives them enough time to verify the policy, check eligibility, and issue a pre-authorization letter, which is usually valid for 15 days.

In practice, you can notify the insurer 24 to 48 hours before admission, but doing it earlier helps prevent last-minute delays and document problems. Waiting until the last moment or informing too late may result in slower processing or additional document requests, complicating the cashless process.

2) Emergency Hospitalization (Cashless)

You should notify the insurance company within 24 hours of admission or before discharge (if treatment lasts less than 24 hours, i.e., daycare treatments), whichever comes first. Prompt notification allows the insurer to coordinate directly with the hospital, minimizing your out-of-pocket expenses and ensuring a faster, hassle-free settlement.

Ditto’s Advice: Although insurers don’t strictly enforce rigid deadlines, earlier intimation is strongly recommended for smooth processing. Delayed notification may complicate document collection and delay claim settlement. The insurer’s medical team may inspect medical records to verify the validity of the claim before approving cashless treatment.

| Did You Know? According to the IRDAI Master circular on protection of policyholders' interest, health insurers must follow strict timelines for providing cashless authorization in hospitals: Approval for Cashless Facility: 1)Insurers must decide on cashless requests within 1 hour of receiving them. 2)Insurers may set up help desks in hospitals to assist with cashless approvals. 3)Policyholders must also get digital pre-authorization confirmation. Final Authorization for Discharge: 1) Insurers must give final discharge approval within 3 hours of receiving the hospital’s request. 2) Policyholders cannot be made to wait for discharge due to insurer delays. 3) If there’s a delay beyond 3 hours, any extra charges billed by the hospital must be paid by the insurer (from the shareholder’s funds), not the policyholder. |

Time Limits in Reimbursement Claims

If you opt for reimbursement of hospitalization expenses, the following time limit for filing a health insurance claim applies:

- Hospitalization, Day Care Treatment, or Pre-Hospitalization Expenses: File your claim within a week of discharge, but the formal limit is within 30 days from discharge.

- Post-Hospitalization Expenses: Submit the claim within 15 to 30 days of completing the post-hospitalization coverage period.

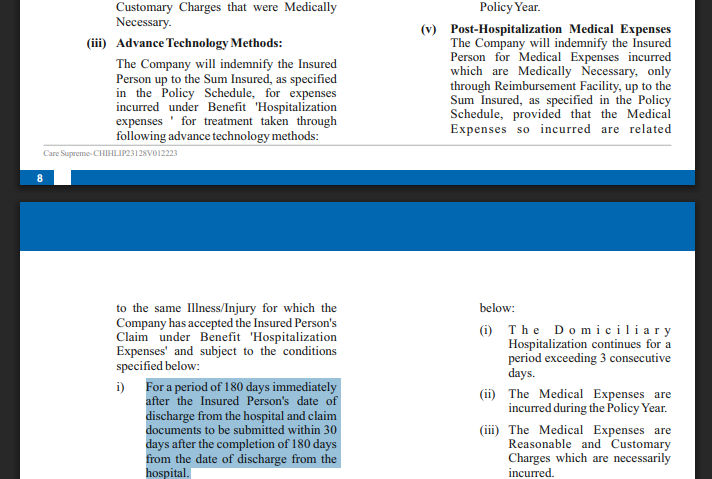

Here’s a snippet from the policy wording of a popular insurer:

In practice, we haven’t seen any insurer impose a strict deadline for reimbursement claims. If there are unavoidable reasons for the delay, insurers usually accept the claim. However, filing the claim as early as possible is strongly recommended, as it simplifies the process of collecting documents from hospitals and doctors.

| Quick Note: Health insurers must settle claims quickly: 1)Claims must be settled/rejected within 15-30 days (as specified in the policy wording) of receiving all necessary documents. 2) If an investigation is needed, it must finish in 30 days, with claim settlement within 45 days. 3) Delays beyond this attract interest at 2% above the RBI’s bank rate. |

Filing health insurance claims on time and with the right documents can feel complicated, especially when dealing with medical emergencies or unfamiliar policy terms. If you’re unsure about the process or need help choosing the right policy, our experts at Ditto are here to guide you every step of the way.

Time Limits in OPD Claims

The time limit to file OPD (Outpatient Department) claims is within 15-30 days after completing the post-hospitalization treatment. OPD expenses can be bundled and submitted weekly, fortnightly, or monthly for convenience, making it easier to manage documents and claims.

Although insurers don’t enforce strict deadlines for OPD claims, filing as early as possible simplifies the process and helps avoid complications during claim settlement.

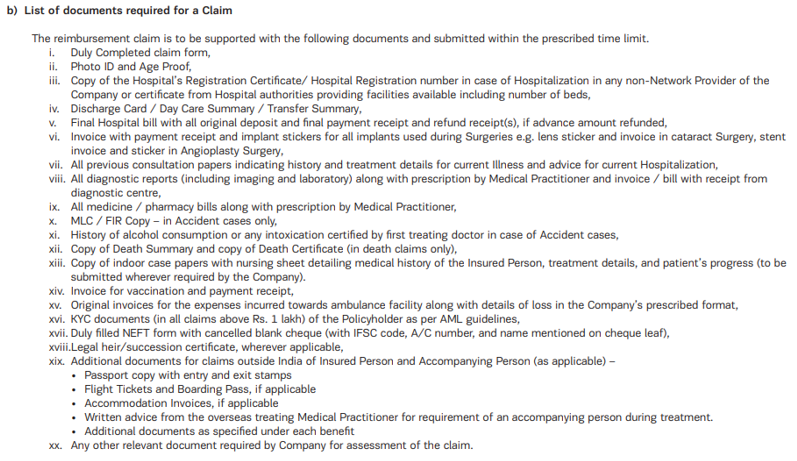

Basic Documentation during Claim Settlement

To ensure smooth claim settlement, make sure you provide any required documents from the following:

- Duly filled and signed Claim Form.

- Copy of Photo ID and address proof of the insured.

- Medical Practitioner’s first consultation paper and referral letter advising hospitalization.

- Medical Practitioner’s prescription with advised diagnostic tests or consultations.

- Original numbered hospital bills, receipts, and discharge summary.

- Original numbered pharmacy bills from licensed chemists.

- Original pathological and radiological test reports and payment receipts.

- Operation Theatre Notes (if applicable).

- Emergency Notes, Initial Assessment Sheets, and Indoor Case Papers (if applicable).

- Original investigation test reports and receipts supported by the doctor’s reference slip.

- MLC/FIR report and Post Mortem Report (if applicable).

- Ambulance Receipt.

- Any additional documents required by the insurer to assess the claim or detect fraud.

Here’s a snippet of the required basic documentation during claim settlement from a reliable insurer:

Why Talk to Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Piyush love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Final Thoughts

Filing your health insurance claim on time and providing the right documents are essential for a smooth and hassle-free claim process. Understanding the time limit for filing a health insurance claim and preparing your paperwork in advance helps you avoid delays and ensures quicker reimbursement when you need it most.

Key Takeaways:

- Intimate emergency cashless claims within 24–48 hours of hospitalization or injury, and planned cashless claims ideally 3–5 days before admission.

- Submit reimbursement claims within a week of discharge, with a formal limit of 30 days for hospitalization and 15–30 days for post-hospitalization expenses.

- OPD expenses can be claimed weekly or monthly for easier management.

- Always submit original, numbered documents as early as possible, and provide a valid written explanation if there’s any delay.

FAQs

What is the time limit for filing reimbursement claims?

Ideally, file your reimbursement claim within a week of discharge. The formal limit is within 30 days from discharge for hospitalization and within 15-30 days after post-hospitalization treatment.

What is the general time limit for filing a health insurance claim?

Intimation should be done within 48 hours of hospitalization or injury and preferably 3–5 days prior to planned hospitalization. Claims should be filed as early as possible, ideally within a week of discharge.

Can OPD expenses be claimed separately?

Yes, OPD expenses related to the ailment can be claimed weekly, fortnightly, or monthly, giving you flexibility and easier document management.

What happens if I miss the time limit for filing a claim?

While no insurer strictly enforces a hard deadline in practice, delays complicate the process. The insurer may reject the claim unless a valid reason is provided in writing and accepted.

What basic documentation during claim settlement is required by the insurer?

Key documents include the filled claim form, photo ID, address proof, doctor’s referral, prescriptions, hospital bills, discharge summary, pharmacy receipts, diagnostic test reports, and ambulance receipts.

Last updated on: