Quick Overview

TATA AIG General Insurance has been a familiar name in the Indian insurance industry since 2001. It was established as a joint venture between the TATA Group and American International Group (AIG).

Over time, it has built a strong presence in health, motor, and travel insurance. Many customers feel comfortable starting their health insurance search with a known name like TATA.

But a big brand name is not enough when it comes to health insurance. What really matters is what happens at the time of a claim.

When a family member is in the hospital, and the bill is rising, you want an insurer that responds quickly, pays fairly, and keeps the paperwork stress to a minimum.

That is where one number becomes very important: the claim settlement ratio.

In this article, we will look at TATA AIG’s claim settlement ratio, how it is calculated, how it has moved over time, and whether its claim track record matches the trust that the brand enjoys.

TATA AIG Claim Settlement Ratio Average FY 2022-2025

Note: The figures below are sourced from the insurer’s public disclosures (Form NL 37):

TATA AIG’s three-year average CSR of 88.72% is slightly below the industry average of 91.22%. So it may not be among the very top insurers on this metric, but it still settles a large share of the claims it receives.

How to Calculate TATA AIG’s Claim Settlement Ratio?

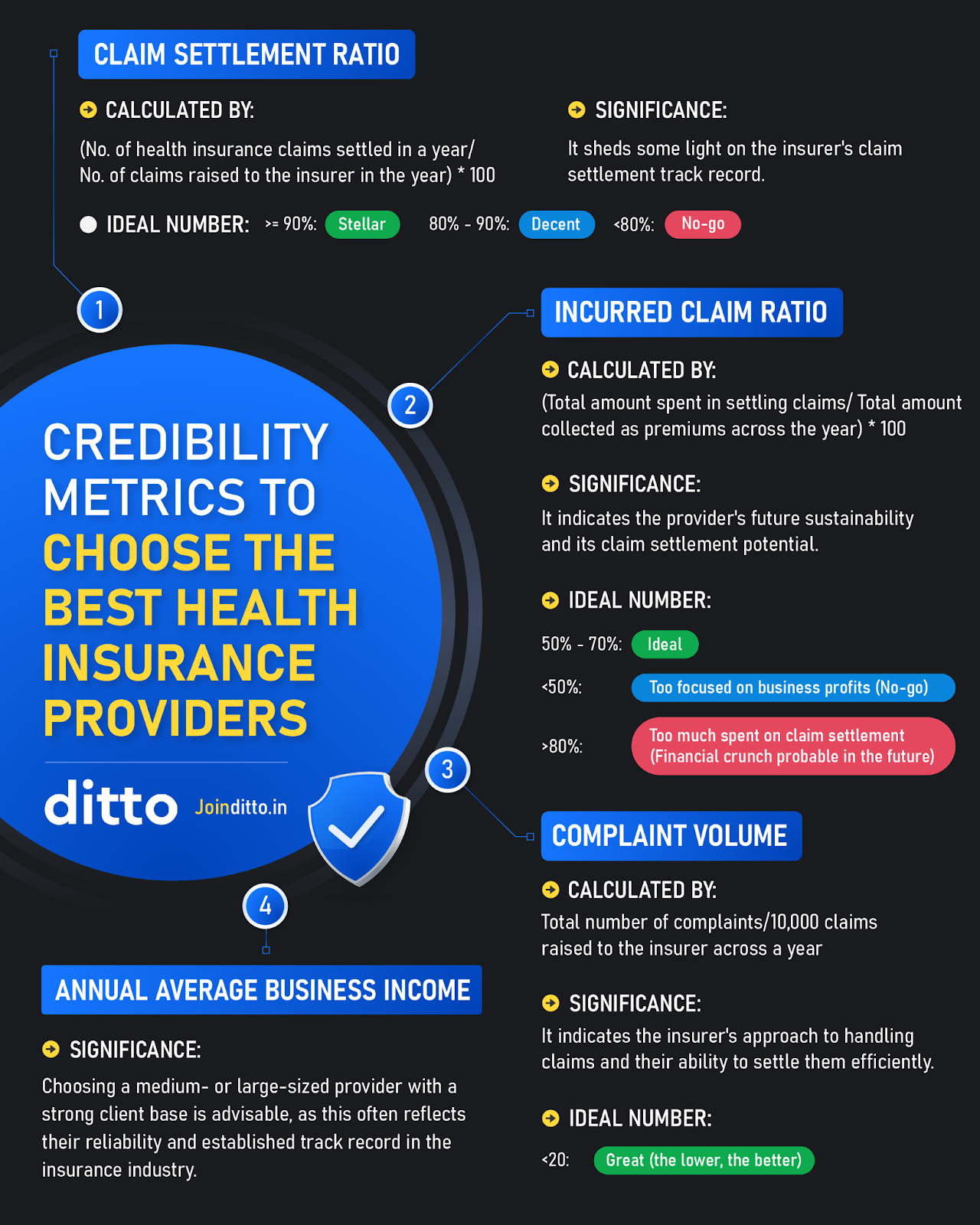

The claim settlement ratio (CSR) is one of the key numbers we look at when we judge how credible an insurer is during the claim settlement process. In simple words, a CSR tells you how many claims an insurer paid out of all the claims it handled in a year.

At Ditto, we use a clear and consistent method:

CSR = (Claims settled ÷ Total claims that required a decision) × 100

“Total claims that required a decision” means all old and new claims the insurer worked on that year, after removing the ones closed without payment and the ones still pending.

To assess an insurer more accurately, we rely on a 3-year average instead of a single year’s number. This avoids unusual spikes or dips and reflects the insurer’s true long-term reliability.

As a broad thumb rule, it is safer to pick insurers that have a CSR of 90% or higher. If an insurer has a CSR consistently below 80%, it implies a higher chance of rejections or delays.

On the other hand, a CSR that is unusually high, close to or above 100%, can also be a red flag because it suggests the numbers may not be reported clearly.

Other Operational Metrics of TATA AIG

Though TATA AIG is not one of the top 10 health insurance companies by CSR in India, CSR alone shouldn’t decide which insurer or policy you pick. Make sure you’re considering other metrics, along with the plan’s features, benefits, claim experience, and real customer reviews, to get a complete picture before choosing it.

Metrics To Consider

Incurred Claim Ratio (ICR)

With an average ICR of 80.93% (2021-24), TATA AIG stays around the ideal range. This suggests that it pays a healthy proportion of claims while keeping the business financially sound.

Average Complaints per 10,000 Claims

In FY 2022–25, TATA AIG recorded an average of just 10.65 complaints. This relatively low number points to a fairly smooth customer experience and reasonably efficient claim support.

Annual Business / Gross Written Premium (GWP)

TATA AIG’s Gross Written Premium (GWP) has grown steadily from ₹1,930 crore in FY 2021–22 to ₹3,592 crore in FY 2024–25. This suggests that the company is underwriting more policies, reaching more customers, and strengthening its position in the health insurance market.

Network Hospitals

TATA AIG offers access to 11,000+ network hospitals, giving policyholders wider cashless treatment options across the country. If you get treated at a non-network hospital, you can still file a reimbursement claim, where you pay the bill first, and the insurer pays you back as per policy terms.

Why Choose Ditto for Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call now, slots fill up fast!

Ditto’s Take on TATA AIG’s CSR

TATA AIG stands between the top performers and the weaker players. On one hand, its business has grown steadily, and complaint volumes are quite low, which suggests that most customers get through the claim process without too much friction.

On the other hand, its claim settlement ratio is a bit lower than what we usually like to see. Many of its popular health plans are also on the expensive side and come with conditions that can make claims tricky if you are not careful.

While TATA AIG is not a write-off from a claims point of view, it is also not among our first picks when we look at the overall package of pricing, benefits, and how comfortable we feel with its claim handling over the long run.

If you are considering a TATA AIG plan, it is worth comparing it closely with a few stronger, all-rounder options in the market, like HDFC Ergo and Aditya Birla, before you decide.

Quick Note

Frequently Asked Questions

Last updated on: