| What is a Survival Period in Health Insurance? The survival period in health insurance is the minimum time you must live (usually 14-30 days) after being diagnosed with a critical illness before the insurer pays the lump‑sum benefit. Survival period doesn’t apply to regular health insurance plans, since these policies mainly reimburse hospitalization & treatment costs. It’s only relevant in critical illness policies usually offered as a rider or a standalone plan where a defined payout is made after diagnosis only if the insured survives the specified period. |

When buying health or critical illness insurance, most people focus on premiums, coverage, and claim processes. But there’s one lesser-known detail that could make a big difference when it matters most: the survival period.

Understanding benefit-based vs. indemnity-based policies makes the concept of a survival period much clearer. Let’s take a quick look:

| Aspect | Indemnity-Based Policies | Benefit-Based Policies |

|---|---|---|

| How they work | Reimburse actual hospitalization/treatment costs | Pay a fixed lump sum on the occurrence of an event (e.g., diagnosis of a listed critical illness, accidental death, hospital cash). |

| Examples | Comprehensive health insurance, motor insurance | Critical illness cover, personal accident cover, hospital cash plans |

| Relevance to survival period | No survival period, because payment depends on bills and treatment expenses, not on survival after diagnosis. | Survival period applies here, since the lump sum is triggered by diagnosis/incident, but only if the insured survives a minimum number of days. |

In this guide, we’ll explain precisely what the survival period is, how it works, and how it differs from standard waiting periods. By the end, you’ll be better prepared to choose a health plan that truly meets your needs, without any last-minute surprises.

Still unsure how to choose the right survival period in health insurance? Book a free call with us and let our experts guide you in making the correct decision.

Why Does Critical Illness Insurance Have a Survival Period?

You might wonder, “Why must I survive 30 days to get a payout?”

Here’s why: critical illness (CI) insurance is meant to support your recovery, not serve as a death benefit. If the illness is fatal early on, your term life insurance covers your family financially. But if you survive, the CI plan helps you manage non-medical costs like lost income, daily expenses, or home adjustments.

Remember, each insurance product plays a unique role:

- Term life protects your family

- Health insurance covers hospital bills

- Critical illness protects you during recovery

That’s why the survival period exists.

How Long Is the Typical Survival Period in Health Insurance Plans?

There's no survival period in standard health insurance plans, since these policies focus on covering medical treatment costs rather than offering lump-sum payouts after a diagnosis.

However, if you’ve added critical illness coverage to your health or term insurance, or have a standalone critical illness policy, a survival period of 14 to 30 days usually applies. This means you must survive for that duration after being diagnosed with a covered illness or undergoing a covered surgery for the insurer to approve the claim. It helps ensure the benefit is paid only for severe, life-impacting conditions.

That’s why it’s wise to choose one with the shortest survival period available when selecting a critical illness rider.

A shorter survival period, say, 14 days instead of 30, reduces the risk of your claim being rejected if the illness proves rapidly fatal. It ensures your family is more likely to benefit, even in severe cases where recovery is uncertain.

| Simply put: The shorter the survival period, the greater the chances of your payout being honored, providing timely financial support when needed most. |

Let’s go through some examples of Survival period:

| Type | Policy | Details |

|---|---|---|

| Term Insurance Rider | HDFC Life C2P Supreme + Health Plus (CI) Rider | 60 specified CIs covered for 15 years maximum Survival period - 15 days Waiting period - 90 days |

| Health Insurance Rider | Aditya Birla Activ One Max + Critical Illness Rider (Page 35) | 20 specified CIs (renewable as needed) Survival period - 15 days Waiting period - 60 days |

| Standalone Critical Illness Insurance | HDFC Critical Illness Platinum | 15 specified CIs (renewable as needed) Survival period - 15 or 30 days (Choice) days Waiting period - 90 days |

| Did You Know? Personal accident insurance typically doesn’t include waiting or survival periods since accidents happen suddenly, unlike illnesses that develop gradually. Instead, they usually apply a 365-day rule: the death or disability must occur within one year of the accident for a valid claim. This ensures a direct link to the accident while providing immediate coverage from day one. |

Difference Between Waiting Period and Survival Period in Health Insurance

Understanding the difference between waiting and survival periods in health insurance is essential for making informed coverage choices. Let's take a quick look at the comparison table:

| Feature | Waiting Period | Survival Period |

|---|---|---|

| What it means | Time during which certain benefits/diseases are not covered (e.g. pre‑existing disease, maternity, specific illnesses). | Time you must survive post diagnosis to be eligible for the benefit payout. |

| When it starts | Usually from the policy start/revival date | Begins after the insured has been diagnosed with a critical illness. |

| Duration | Pre-existing Diseases up to 36 months Specific Illnesses - 24 months Maternity - 9 to 48 months Term Insurance Riders (CI/ATPD) - 30 to 180 days |

Usually short: 14‑30 days |

| Applicability | all health insurance policies, riders attached to term or health plans | primarily to critical illness covering policies or riders |

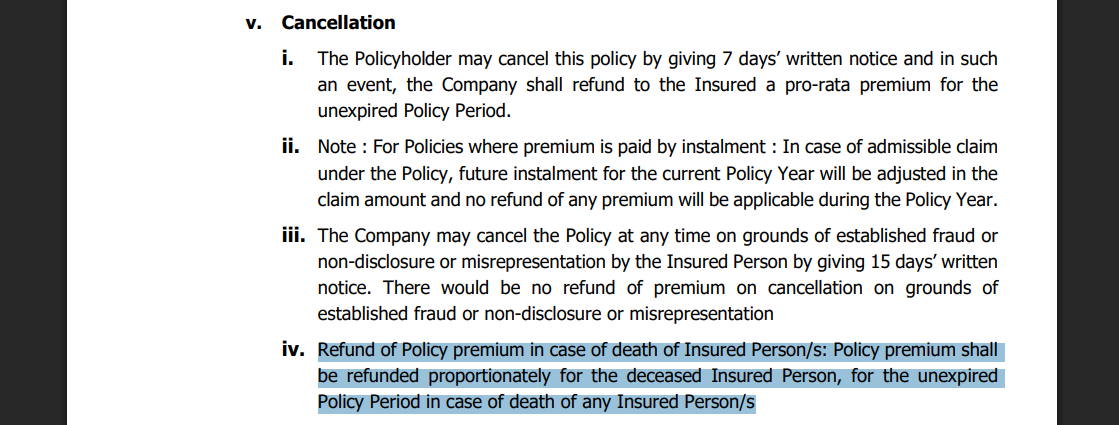

Do You Get Return on Premium if You Do Not Survive the Survival Period?

In most cases, you won’t get a return on premium if the insured person doesn’t survive the required survival period under a critical illness rider.

However, in case of a standalone policy ( such as HDFC ERGO Standalone CI policy), proportionate premiums may be refunded if no prior claim is made, only for that particular year.)

Here’s a snippet from the policy wording stating such premium returns:

Critical illness and other riders are structured to pay a lump sum benefit only if the insured survives a set number of days (usually 14 to 30) after being diagnosed with a covered illness or suffering a serious injury.

If the person passes away before completing that period, the claim becomes invalid and no payout is made, regardless of how much premium was paid. That’s why it’s essential to clearly understand these terms before adding such riders to your policy.

| Did You Know? ICICI Lombard's standalone critical illness plan (Critishield) covers 92 Critical Illness (CIs) segregated into Major and Minor categories and has a unique ZERO Survival period and a standard 90-day waiting period (ie. only illnesses diagnosed 90 days post policy purchase are eligible for claim under the policy). |

How to Choose the Right Survival Period in Health Insurance? (Ditto’s Take)

First, ensure the plan or rider fits your needs, check the number of illnesses covered, their severity, and the insurer’s track record (claim settlement ratio, complaints, financial stability). Once that aligns, secondary factors like the survival period and other policy conditions should be evaluated.

The survival period may seem like a small detail, but it can make a big difference when you make a claim, especially with a critical illness rider. Here's how to make the right choice:

- Go for the shortest survival period available (usually 14 days). It lowers the risk of your claim being denied if the illness is rapidly fatal.

- The cost difference is often negligible, so there's little downside to choosing a shorter period.

- It increases the chances your family receives the payout, even in severe health emergencies.

- Read policy terms carefully: some riders may come with more extended periods by default, or differ across insurers.

Ditto's take: When in doubt, always opt for the shortest survival period offered. It's a smart way to protect your claim eligibility.

Why Talk to Ditto for Your Health Insurance?

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Arun below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

Key Takeaways

Understanding the survival period is essential when adding a critical illness rider to your insurance. It can significantly impact your claim and financial protection. Here's some final thoughts:

- The survival period applies to riders, and regular health insurance does not cover treatment costs.

- Typically, you must survive 14 to 30 days after diagnosis or injury for a claim to be valid.

- Choosing a shorter survival period reduces the risk of claim denial and improves payout chances.

- If you don’t survive the period, no lump sum is paid, and premiums are usually non-refundable.

- Always check the survival period terms carefully before finalizing your policy.

Still unsure how to choose the right survival period in health insurance? Book a free call with us and let our experts guide you in making the correct decision.

FAQs

Can the survival period be customized or reduced?

In most cases, the survival period for critical illness coverage cannot be customized or reduced, as the insurer sets it.A rare exception is the Standalone CI policy from HDFC ERGO, which allows you to choose between a survival period of 15 or 30 days. The 15-day variant (lower S.P) costs more.

How does the survival period affect claim eligibility?

If you don’t live through the survival period after being diagnosed with the critical illness, you are not eligible for the lump‑sum payout. Surviving that period is a condition for the claim.

Is the survival period the same for all illnesses?

Yes, the survival period is set at a policy level, so there would be one applicable survival period for all the critical illnesses mentioned in one critical illness policy.

Does IRDAI regulate survival periods in health insurance?

IRDAI doesn’t explicitly set standard survival periods for all critical illness policies, but regulates health/term insurance products broadly, including riders,definitions, waiting periods, moratoriums, etc.

Does the survival period still apply if you’re diagnosed during the waiting period?

Yes. The survival period still applies if the diagnosis is made after the waiting periods. But if a diagnosis occurs during the waiting period, you may not be entitled to claim for that illness if that illness is under the waiting period restriction.

Last updated on: