SBI General Health Insurance: Overview

SBI General Health Insurance is a general insurance company that also sells health insurance products. There are multiple plans for cashless and reimbursement facilities, starting from basic coverage at just ₹50,000 to comprehensive policies going up to ₹2 crore. SBI General Health Insurance has tie-ups with over 16,000 network hospitals nationwide and insured 24 crore+ customers with an average claim settlement ratio (CSR) of 96% over 2022-25.

Introduction

Unlike other insurers, SBI General Health Insurance democratised health coverage reaching tier-3 cities in India. The brand name brought credibility and the plans are equally affordable for individuals, families, and senior citizens.

But is the public sector backing enough to make SBI General the best health insurance?

At Ditto, we've analyzed SBI General Health Insurance plans extensively to find the pros and cons and help you decide.

In this guide, you will learn :

- Who should buy SBI General Health Insurance?

- What are the key features of SBI General Health Insurance plans?

- What Are The Different Types Of SBI General Health Insurance plans?

- Is it worth buying SBI General Health Insurance in 2025?

Can’t decide what features you should have in your health plan? Fret not! Book your free call with Ditto and together we will design your perfect health cover.

Who Should Buy SBI General Health Insurance?

Existing SBI Customers

Tier-2 & Tier-3 City Residents

Senior Citizens (60+)

Health-conscious Individuals

SBI General Health Insurance: Key Metrics

Backed by India's largest public sector bank, SBI General is a trusted, government-owned insurer with robust metrics for safety and reliability.

Smart Add-On Options When Buying SBI General Health Insurance:

- Unlimited restoration/refill

- OPD cover (₹5K-₹10K annual limit)

- Maternity/ newborn cover: (₹25K-₹2L, depending on the plan)

- Global treatment cover: (for specified illnesses diagnosed in India with 24-36 month waiting period)

Note: Benefits, limits, and waiting periods are plan-specific and updated periodically. Always refer to the latest brochure/policy wording before purchase.

Things to Consider when Buying a Health Plan

Exceeding room rent caps triggers proportionate deductions

Verify caps to save out-of-pocket expenses on the total bill.

“Unlimited restoration” is not really “unlimited”

The limit typically resets for new or unrelated claims while caps, co-payments, and sub-limits remain.

Add-ons like claim shields are good to buy

It protects against hospitals charging extra for non-medical items (consumables).

Hospital network numbers mean nothing if there aren’t any in your city

Always search your preferred hospital online before buying.

What Are The Different Types Of SBI General Health Insurance Plans?

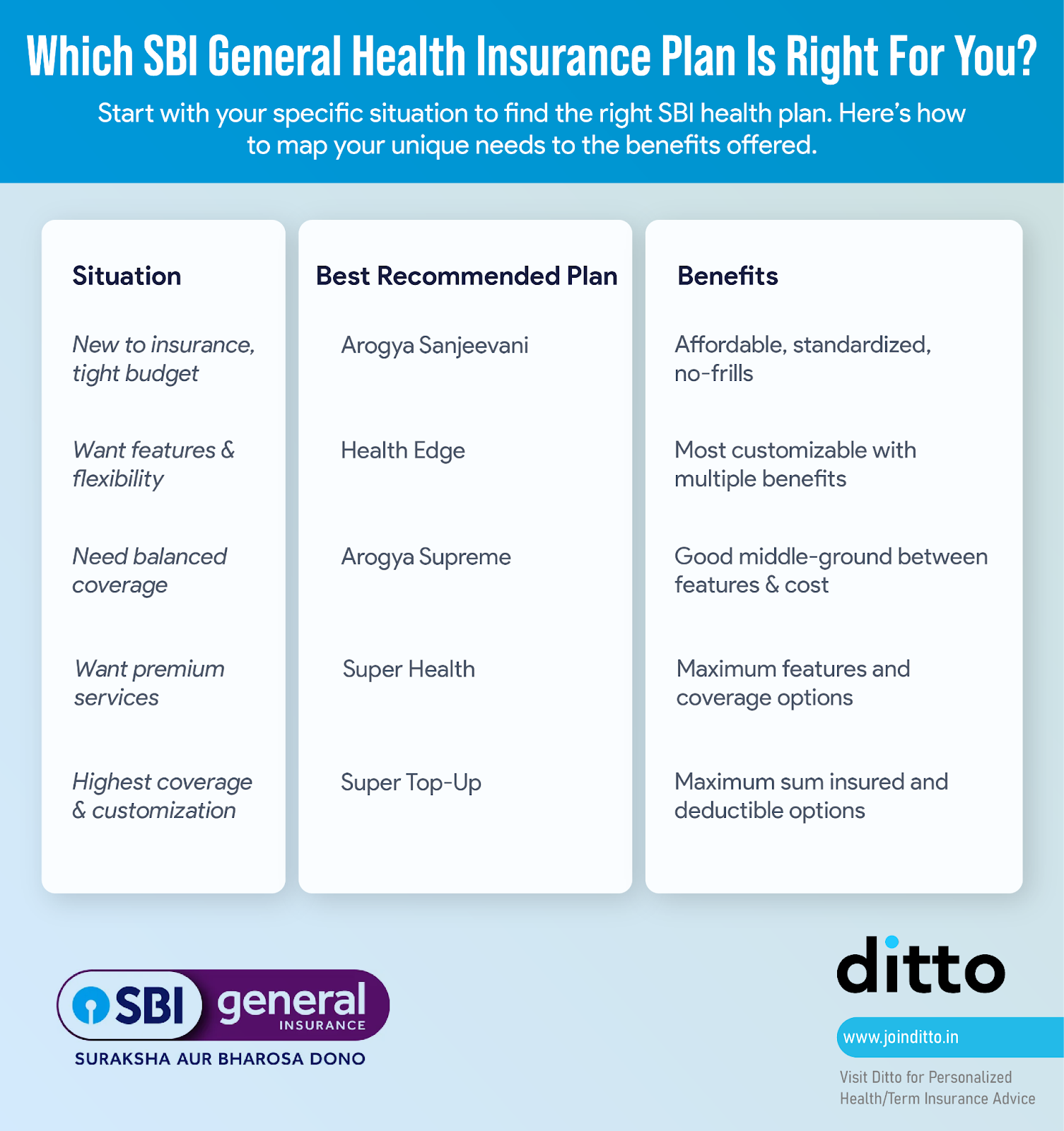

Which SBI General Health Insurance Plan Is Right For You?

What Are The Inclusions and Exclusions In SBI General Health Insurance?

SBI General plans cover a wide range of medical expenses, but some services are excluded. Let’s have a closer look.

Common inclusions:

- In-patient hospitalization and day-care procedures

- Pre and post-hospitalization expenses

- Ambulance and organ donor expenses

- AYUSH treatments (Ayurveda, Yoga, Unani, Siddha, Homeopathy)

- Wellness check-ups, consumables cover (Claims Shield) on select plans

- OPD, maternity/newborn care, and specified global treatment add-ons

- Waiting periods apply (initial, listed illnesses, pre-existing conditions)

Common exclusions:

- Self-inflicted injury, war-related injuries, and breach of law

- Cosmetic treatments, weight management, infertility, surrogacy unless covered

- Experimental or unproven treatments

- Other permanent exclusions listed in the policy

Is It Worth Buying SBI General Health Insurance in 2025: Ditto’s Take

For millions of Indians seeking affordable and reliable health insurance in 2025, SBI General is a fairly good option. But despite decent metrics and helpful inhouse claims team, the complaint volume is on the higher side and TPA assigning varies by the location.

That’s where Ditto’s 7-point checklist can guide you to buy the right health plan:

- Review the Customer Information Sheet (CIS), plan brochure, and policy details thoroughly.

- Avoid plans with strict room rent caps that trigger large out-of-pocket bills due to proportionate deductions.

- Prioritize checking room rent limits, sub-limits on specific diseases, waiting periods, and exclusions.

- Get consumables cover, restoration/refill, annual health checkups, if possible.

- Use SBI General’s cashless hospital search tool and call hospitals to verify current cashless policies in your city.

- Work with a trusted agent or advisor for post-sales support and seamless claims assistance. Individual experiences vary by location.

- Verify TPA details and in-house claims processes before purchasing a plan.

Important Disclosure:

All data and metrics in this article are sourced from SBI General's official website, policy documents, and public disclosures. SBI General is not a current partner of Ditto. Their retail presence is limited and most customers hold group plans through employers or banks.

Why Choose Ditto For Health Insurance?

At Ditto, we’ve helped 7,00,000+ customers become smart insurance buyers by matching their unique needs to the right health insurance policy. That’s why customers like Pramey trust Ditto and recommend us to others.

✅ Honest advice – no sales pitches, no commission-driven recommendations

✅ 12,000+ 5-star reviews (Rated 4.9 on Google)

✅ Real claim experience – we've helped customers through actual claims

✅ Backed by Zerodha and other leading fintech companies

Final Thoughts

Credible and affordable, SBI General Health Insurance offers a wide range of plans with reliable coverage and strong claim settlement ratio. But don't just pick any plans on offer. Instead, get personalized advice to meet your real-life needs. Book a free call with Ditto’s expert advisors for end-to-end guidance.

FAQs

What is the SBI General Health Insurance claim settlement process?

For cashless, choose a network hospital, get pre-authorization via the insurer/TPA, and the hospital will raise the bill to the insurer. For reimbursement, submit the filled SBI claim form, discharge summary, bills, prescriptions, diagnostics and KYC documents within timelines.

How fast claims are settled?

Insurers must settle or reject a claim within 30 days of receiving all necessary documents. If there’s an ongoing investigation, it needs to be completed within 45 days. Any unexplained delay leads to a penalty.

Can I cancel my SBI General Health Insurance if I felt pressured at the bank?

Yes, health policies carry a 30-day free-look period. If the branch forces a sale on you, escalate the matter to the insurer’s GRO and, if needed, register a complaint on IRDAI’S Bima Bharosa (IGMS) portal.

Does cashless work at any hospital now?

Under Cashless Everywhere scheme, it may, but one must follow conditions like prior intimation. Sometimes, hospital adoption varies, so pre-check for planned procedures. In emergencies, notify within 48 hours.

How do I port from or into SBI General without losing my waiting-period credits?

To port SBI General Health Insurance or port into SBI General from another insurer, apply 45–60 days before renewal. All acquired credits will move to an equal or superior plan and a fresh waiting period will only apply if you increase your cover.

Last updated on: