What Is The Maximum Age Limit for Health Insurance in India?

Until recently, most health insurance providers in India capped the age limit for purchasing a new policy at 65, with senior citizen plans available for those aged 60 and above.

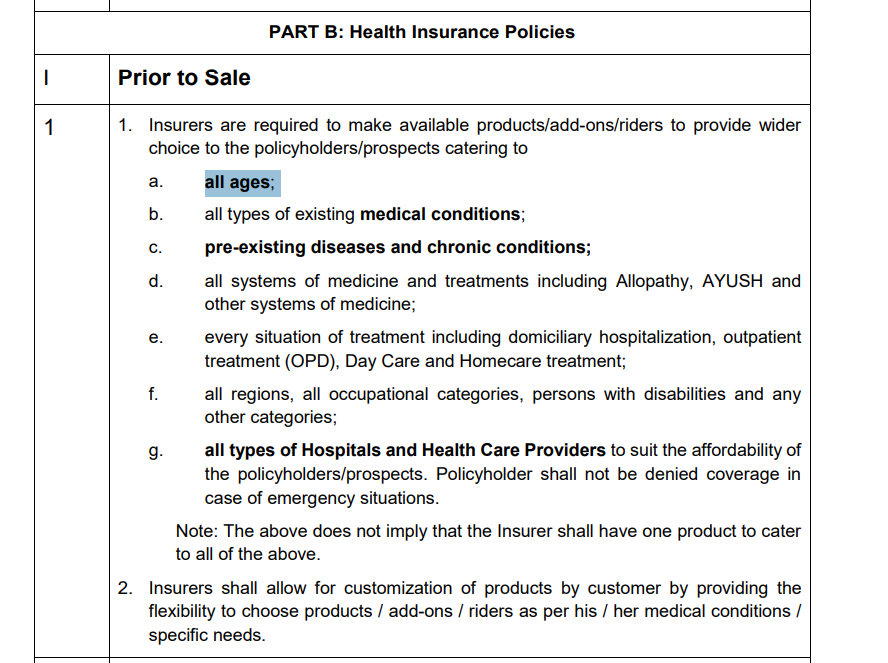

But from April 1, 2024, the Insurance Regulatory and Development Authority of India (IRDAI) removed the maximum age limit for entry into health insurance plans. It issued a directive mandating insurers to launch or modify products to cater to all age groups. Following this, popular insurers such as HDFC Ergo and Niva Bupa modified their flagship plans to remove entry age restrictions.

Introduction

Imagine reaching your golden years and realizing that getting health insurance is no longer an option due to age restrictions. Unfortunately, this was the reality for many seniors in India until recently. To combat this issue, the IRDAI has eliminated the maximum age limit for purchasing health insurance in India. But what does this mean for you, your parents, or your loved ones?

In this blog, we’ll break down the new rules, explore top health insurance plans for senior citizens, and share expert tips on why securing health coverage early still matters. Let’s dive in.

Want help picking the right health plan for your parents? Book a free consultation with Ditto’s advisors. No spam, no hidden charges.

Note: This is from the IRDAI Master Circular on Protection of Policyholders’ Interests.

Can You Buy Health Insurance for Senior Parents?

Absolutely! Thanks to IRDAI's directive, you can now buy comprehensive health insurance for senior parents, regardless of their age. Many insurers already offer specialized health plans, such as Optima Secure, Care Supreme, and Niva Bupa Reassure 2.0, for those aged 60 or 65. These senior citizen plans are designed to cover age-related health issues, such as heart disease, diabetes, or arthritis.

However, a key point to note is that these plans come with stricter underwriting (due to their comprehensive nature), so there’s a high chance of rejection or permanent exclusion for specific diseases if the insurer perceives them as high risk.

Alternatively, some plans with restrictions include Activ Care Standard, Elder Care, Red Carpet Senior Citizens, and Senior Health Advantage.

Did You Know?

While premiums for senior citizens are higher due to increased health risks, they can be reduced through options like wellness discounts. Voluntary deductibles and copayments can also reduce the burden, but opt for them only if you are willing to pay out of pocket for a portion of future treatments.

Best Health Insurance Policies for Senior Citizens in India (2025)

Before we discuss the list, here’s how we decide what plans to feature.

At Ditto, every health plan goes through our six-point evaluation framework. It doesn’t mean these are the only good plans, but that they stand out after being scored across all six pillars.

You can learn more about how we evaluate health insurance plans here.

Factors to Consider Before Buying Health Insurance for Senior Citizens in India

Choosing the right health insurance for senior citizens can be tricky, especially with so many plans, premiums, and conditions to compare. Here are some key things to keep in mind:

1) Coverage for Pre-Existing Conditions

Most senior citizens have ongoing health issues like diabetes, hypertension, or heart disease, which makes pre-existing condition coverage a must. Look for a plan that covers these conditions with minimal waiting periods, or offers add-ons that reduce them.

For example, Aditya Birla Activ One Max has an add-on called chronic care, which covers pre-existing Asthma, Hypertension, Cholesterol, Diabetes mellitus, Chronic Obstructive Pulmonary Disease (COPD), Obesity, or Coronary Artery Disease (PTCA done before 1 year) from Day 1.

2) Choose a Higher Sum Insured

Medical inflation is higher than standard inflation, and medical expenses increase with age, so even a short hospital stay can be expensive.

Opt for a higher sum insured to ensure you’re financially protected against large medical bills. A ₹10-20 lakh cover is a good starting point for most senior citizens, as it’ll also help you with your peace of mind, and you wouldn’t have to worry if you’re admitted.

3) Balance Premium Costs and Benefits

Compare plans carefully and look for options that balance affordability with good benefits. Some insurers also offer voluntary deductibles to make premiums more affordable.

However, at Ditto, we do not actively recommend going for it. The deductible only makes sense if the premium savings are significant and you’re okay with bearing the deductible out of pocket for the year.

Why Should You Avoid Buying Health Insurance Later?

Here’s why buying health insurance early is always the better move:

1) Premiums Increase with Age

Health insurance premiums rise with age, as the risk of medical complications and hospitalization grows. Someone purchasing a policy in their 60s or 70s will likely pay significantly higher premiums compared to someone buying the same coverage in their 20s or 30s. Moreover, loading charges are also probable for senior citizens.

2) Waiting Periods

Most health insurance policies have a waiting period (usually 1-3 years) for pre-existing diseases. Buying early means you complete this period while you’re still healthy, so when you do need to make a claim later, your coverage is already active and unrestricted.

3) Limited Coverage Options

Younger buyers have access to more plan options and useful add-ons, such as maternity coverage, critical illness riders, and wellness benefits. These features can be more complex to get or more expensive if you wait until later in life.

4) Higher Chances of Rejection

Medical underwriting applies to all ages, particularly risk-prone senior citizens, so you should expect medical checks. That means if you wait until health issues develop, insurers can charge higher premiums or even reject your application. Buying young ensures a smooth approval process.

In short, buying health insurance early is about securing lifelong, hassle-free coverage. The earlier you start, the easier it is to get comprehensive protection, affordable premiums, and peace of mind.

If you’d like to learn more about this in detail, you can check out our comprehensive guide on How Much Does Health Insurance Cost?

Why Choose Ditto for Health Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Abhinav below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

The IRDAI’s decision to remove the maximum age limit for health insurance in India is a progressive step toward inclusive healthcare. Today, individuals of any age can purchase health insurance for lifelong protection and financial security.

Frequently Asked Questions

Is it possible for a 75-year-old to get health insurance?

Yes, it is. With the IRDAI’s new rule, there is no upper age limit for buying health insurance. However, insurers may evaluate the applicant’s medical history and may charge higher premiums or impose specific conditions.

What should you consider while buying a health insurance policy for senior citizens?

Look for coverage for pre-existing conditions, a high sum insured, and a reasonable balance between premium cost and benefits. Check for shorter waiting periods and cashless hospital network availability.

Can an 80-year-old get a life insurance policy?

While health insurance is now open to all ages, life insurance policies still have age limits, typically 18 to 65. However, a few specialized senior life insurance plans may accept applicants aged 70 or older (pension and annuity-based plans), depending on the insurer.

Who is eligible for Ayushman Bharat over 70 years?

Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) covers economically weaker sections of society and individuals aged 70 and above. Therefore, they can avail of coverage under this scheme if they meet the eligibility criteria.

Will my policy get cancelled if the insurer withdraws its product?

No, on product withdrawal, your insurer must offer suitable migration to a similar product and clearly justify withdrawal reasons to IRDAI. If you want to change insurers, portability preserves credits like BONUS, waiting, and moratorium periods.

Last updated on: