Quick Overview

LIC feels like the safe, familiar choice for most families. So when people look for an LIC health plan, they’re really trying to carry that same trust into their hospital expenses.

But here’s the key update: LIC isn’t selling health insurance anymore. All LIC health insurance plans have been withdrawn, which means you cannot buy a new LIC health insurance policy today.

In this article, we’ll break down why LIC discontinued its health insurance plans, provide an overview of the older withdrawn LIC health plans, which plan alternatives are worth considering today, and our honest advice on what to do next.

Why did LIC Discontinue its Health Insurance Plans?

LIC hasn’t provided a public explanation for withdrawing these products. That said, industry dynamics in health insurance can help explain why insurers take such calls.

1) Health insurance is Operationally Heavy

Health insurance is not only about issuing a policy. It also requires strong on ground execution like cashless approvals, smooth claims processing, and hospital coordination at the exact moment a customer needs help.

2) Older Plans were Not Comprehensive

Most LIC health plans were designed as fixed benefit products, not as full reimbursement covers for your actual hospital bill. For instance, LIC Jeevan Arogya clearly states that it pays a lump sum benefit irrespective of actual medical costs, which is a big limitation compared to comprehensive plans today.

3) Customers Expectations have Changed

Most buyers now want one main health policy that can handle large hospital bills with minimal limits and fewer caps. Older benefit style products do not align with how people buy health insurance today.

4) Where LIC Stands Right Now

If you check LICs Health Plans page, there are no active health insurance products listed. What is available today is mostly critical illness riders that can be added to LIC life insurance policies and these are fixed benefit riders, not hospitalization covers.

5) Could LIC Come Back to Health Insurance

LIC has said it is in advanced discussions to enter health insurance by taking a stake in a standalone health insurer. However, it has also clarified that there is no binding agreement yet. While LIC has not named the insurer, multiple media reports suggest it could be ManipalCigna.

List of LIC Health Insurance Plans

What Plans to Consider Instead of LIC Health Insurance Plans?

When people look for LIC health insurance plans, they’re often looking for one thing: a reliable, government-backed name that feels stable in a claim situation. Since LIC isn’t offering health policies anymore, the closest option is to look at public sector (government-backed) insurers that sell health insurance.

Below are some government-backed insurers worth considering.

That said, reliability isn’t only about who owns the insurer. What matters just as much is how the product works when you actually file a claim, things like clear coverage rules, fewer unpleasant limits, and smooth claims support.

So after reviewing a wider set of insurers and how their policies behave in real claim scenarios, the table lists our overall top options across the market.

Why Choose Ditto for Health Insurance?

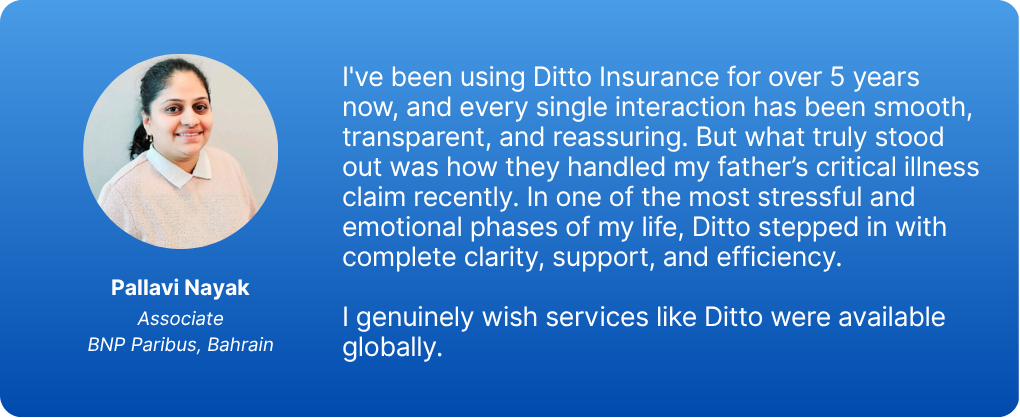

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Pallavi below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- Dedicated Claim Support Team

- 100% Free Consultation

Confused about the right insurance? Speak to Ditto’s certified advisors for free, unbiased guidance. Book your call or chat on WhatsApp with us now!

Ditto’s Take on LIC Health Insurance Plans

LIC health insurance plans are withdrawn, so they are not an option for new buyers today. If you already have LIC’s Arogya Rakshak / Jeevan Arogya / Health Plus or any other health policy, don’t cancel it in a hurry. Use it as a secondary fixed-benefit layer, but buy a proper indemnity policy as your primary cover.

What we recommend:

- Buy a comprehensive health policy with strong claim service and lower complaint rates.

- Compare plans on room rent limits, copay, waiting periods, and restoration.

- If LIC returns to health insurance, wait until the plans are live and the claim experience is proven.

Frequently Asked Questions

Last updated on: