| Copay vs Coinsurance: What is the Difference? A copay is a fixed amount (in the U.S.) or a percentage (in India) you pay for each medical service, making costs predictable. Coinsurance, on the other hand, is the percentage of a medical bill you share with your insurer after meeting your deductible. In India, only copay applies as coinsurance isn’t part of health insurance policies here. |

When you buy health insurance, the fine print often includes terms like copay and coinsurance. Both are forms of cost-sharing with the insurer, but they impact your medical bills in very different ways.

A copay (short for "copayment") makes costs predictable for routine care, while coinsurance can mean paying a significant share of large hospital bills.

And here’s the key difference for Indian readers: coinsurance isn’t used in India, only copay is. Let’s break down how both work, with examples from the U.S. and India, so you know exactly what to expect when the bill arrives.

Compare health insurance plans with or without copay today. Talk to Ditto experts for free advice!

| Key Takeaways 1) If you value predictability and lower out-of-pocket surprises, a copay is easier to manage. 2) Coinsurance may reduce premiums, but it exposes you to higher risk during emergencies. 3) Understanding the distinction helps you choose a plan that matches your budget and healthcare needs. |

What is Copay in Health Insurance?

In India, a copay refers to the percentage of the admissible claim amount that the insured person must pay for hospitalization or treatment. Unlike the fixed amounts seen in other countries, the copay in India is typically a percentage, meaning the amount varies depending on the actual treatment cost.

Examples:

- 20% copay: You pay 20% of the bill, and the insurer covers the remaining 80%.

- Condition-based copay: For instance, a 30% copay might apply for treatment received outside your city of residence. This is the case if you’re availing treatment in a higher zone/tier than where you originally live.

Features:

- A copay helps reduce the insurer’s liability and ensures that their share of the cost is proportionally lower, which in turn controls healthcare expenses. While the insured bears a portion of the bills, they typically benefit from lower premiums.

- The copay does not affect the total coverage amount; it simply determines how costs are divided between the insurer and the policyholder.

- Government schemes, such as Arogya Sanjeevani and private insurance policies like the Care Freedom Plan, have mandatory copays. The copay serves to encourage more responsible healthcare consumption and reduce unnecessary claims, helping insurers manage costs while maintaining affordable premiums for policyholders.

Purpose:

The primary purpose of a copay in India is to lower the premium costs by having policyholders share part of the treatment expenses. It also encourages responsible use of medical services.

Now, let's compare this with the model in the U.S.

In the U.S., a copay is a fixed dollar amount that a policyholder pays at the time of service. It’s a straightforward, predictable payment that’s often required for things like doctor’s visits, prescriptions, and outpatient care.

Examples:

- $20 copay for a doctor's office visit.

- $10 copay for a generic prescription.

Features:

- Since the amount is fixed, it’s simple to know precisely how much you need to pay upfront.

- Copays are typically paid even if you haven’t met your deductible yet.

- It primarily applies to non-hospital care, including routine doctor visits and medications.

Purpose:

In the U.S., the copay system ensures that patients contribute to the costs of routine care, making healthcare spending more predictable and manageable for both patients and insurers.

How Does Copay in Health Insurance Work?

Whether you’re in the U.S. or India, the basic idea of copay remains the same: it’s a cost-sharing mechanism between the insurer and the insured. However, how it’s implemented can vary significantly based on the system in place.

In the U.S., copays are a way to make routine medical services affordable and predictable. This ensures patients don't face surprise bills every time they go for a check-up. In India, copay helps keep health insurance premiums more affordable, but they also mean you’ll always have to pay a percentage of each claim, .

While copays can make healthcare more manageable financially, they can also leave many policyholders feeling like the purpose of health insurance is lost. Especially when the out-of-pocket costs start to feel overwhelming, and they aren't receiving the full benefit of having insurance in the first place.

What is Co-insurance in Terms of Health Insurance?

Co-insurance is often confused with copay, but it works differently.

In the U.S., co-insurance refers to the percentage of a medical bill that you, the insured, must pay after meeting your deductible. For example, if you have a 20% co-insurance, you pay 20% of your medical bills, and the insurer pays the remaining 80%.

But here’s the thing:

Co-insurance is NOT recognized in India.

Despite what you may read in articles or even in AI-generated summaries, India's health insurance system doesn’t use coinsurance. The Insurance Regulatory and Development Authority of India (IRDAI) has no mention of co-insurance in its guidelines for standard health insurance products. If you’re looking for an actual coinsurance setup, you won’t find it in Indian health plans.

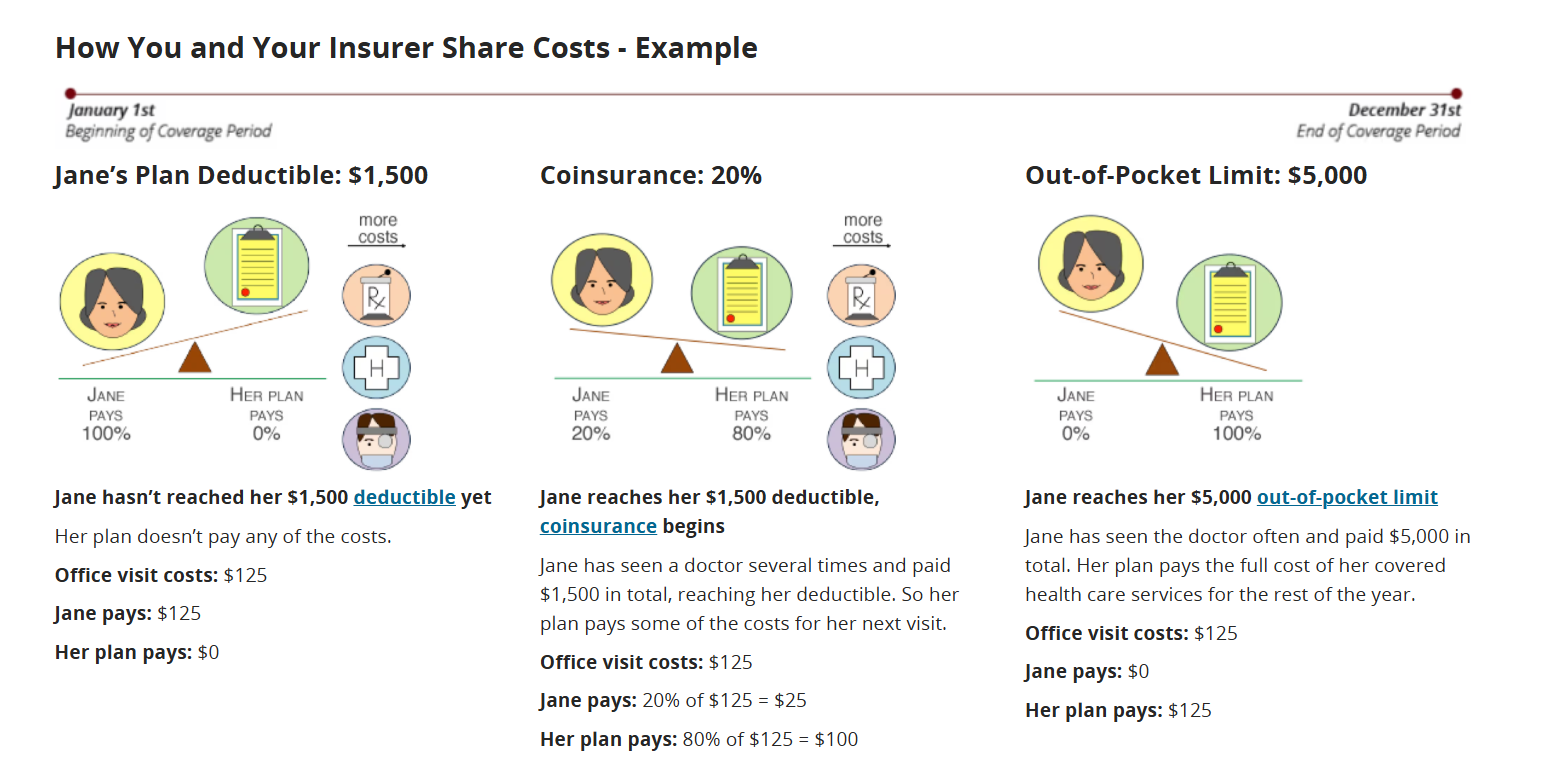

How Does Co-insurance Work?

In countries like the U.S., co-insurance comes into play after the deductible is met. Here's an example of how it works:

- Your annual aggregate deductible: $2,000.

- The total bill: $10,000.

- After your deductible is paid, you’re left with $8,000 in eligible medical costs.

- If you have a 20% coinsurance, you’ll pay $1,600 (20% of $8,000), and the insurer covers the remaining $6,400.

Let’s break these costs down. First, you’ll pay a $2,000 deductible, and then you’ll have to pay $1,600 as coinsurance for the remaining $8,000 of the bill. So, your total out-of-pocket cost would be $3,600.

Note: They look at it from an aggregate basis, depending on what’s spent in a year so the coinsurance can start from the same visit as well.

It’s a way of sharing larger bills, especially for expensive treatments, between you and your insurer.

Source: US Healthcare Department

What is the Difference Between a Copay and a Deductible?

While both copays and deductibles are forms of cost-sharing in health insurance, they serve very different purposes, and understanding the difference can help you avoid unexpected expenses.

Deductible:

A deductible is the total amount you must pay out of pocket each year before your insurance policy starts covering major medical expenses.

Example: If your deductible is ₹25,000, you’ll need to pay that full amount toward eligible hospital bills or treatments before your insurer starts to pay its share.

| Feature | Copay | Deductible |

|---|---|---|

| What it is | Fixed percentage | Total amount paid before coverage |

| When it applies | Every time you use certain services | Once per year, on an aggregate basis, usually for hospitalization |

| Amount | Small and predictable (eg, ₹500) | Larger and varies by policy (eg, ₹25,000) |

| Applies to | Doctor visits, prescriptions | Hospital bills, surgeries, and major treatments |

| Paid when? | Right away, regardless of the deductible | Before the insurer starts primary cost coverage |

How the US Health Insurance System Uses Deductibles, Copays, and Coinsurance

The U.S. health insurance system is known for its complex structure, and here's how cost-sharing elements fit in:

1) Deductible: The First Hurdle

Before insurance starts picking up the tab, you must first pay your annual deductible amount. Once you’ve paid it, your insurer will start covering the majority of your medical bills.

2) Copay: Predictable Fixed Costs

For certain services, such as doctor's visits or prescription refills, you’ll pay a copayment. This is a set amount that makes your day-to-day medical costs predictable and manageable.

3) Coinsurance: Sharing Larger Bills

For more expensive medical treatments (like surgeries or extended hospital stays), after meeting your deductible, you’ll pay a percentage of the remaining costs as coinsurance.

Why Does Cost Sharing Exist in the US?

The United States has some of the highest healthcare costs globally. To manage these costs and ensure insurance remains financially viable, the U.S. system uses a mix of deductibles, copays, and coinsurance. These mechanisms ensure that consumers share in the cost of their care, reducing unnecessary overuse while keeping premiums somewhat manageable.

The layered approach, created by deductibles, copays, and coinsurance, creates a balance between cost control for insurers and protecting individuals from catastrophic healthcare expenses.

Should You Opt for a Copay or Co-insurance? Ditto’s Take

The choice between copay and coinsurance comes down to your financial preferences, healthcare usage patterns, and location. If you prefer predictability in your medical expenses, especially if you visit doctors frequently or manage chronic conditions, copay-based plans can offer peace of mind.

You’ll know upfront how much you’re paying each time, which helps with monthly budgeting. This is especially helpful for seniors or anyone with ongoing treatment needs, as the financial impact per visit remains relatively small.

Co-insurance, on the other hand, can work better for people who are generally healthy and unlikely to need expensive care often. You might pay nothing most of the year, but when large medical bills arise (like hospitalization or surgery), you’ll share a significant portion of the cost. This model can be risky if you're caught off guard by a critical health issue, especially if your deductible hasn't been met yet.

Key Tip: If you’re risk-averse or want cost certainty, lean towards copay. Suppose you’re okay with the occasional high bill in exchange for lower premiums. In that case, coinsurance might be worth considering, but only if you're in a market like the U.S. where coinsurance exists.

Important for Indian Readers:

Co-insurance is not applicable in India. Health insurance policies here typically use a copay for cost-sharing. So if you're evaluating Indian plans, your choice is usually between no copay (100% coverage) or a copay clause (partial sharing), depending on your age, medical history, or plan eligibility.

We’ll always recommend opting for a plan without a copayment, even if it means spending a few thousand rupees extra. In our experience, percentage-based copays can lead to significant out-of-pocket expenses and unlike the US we do not have the concept of out-of-pocket maximums to take care of it.

Why Choose Ditto for Health Insurance

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Here’s look at why customers like Abhinav below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅Dedicated Claim Support Team

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Conclusion

Copay and coinsurance both exist to split healthcare costs between you and your insurer, but they work differently. In the U.S., you’ll often see both: copay for predictable doctor visits and prescriptions, coinsurance for big-ticket hospital bills. In India, only copay applies, typically as a percentage of the treatment cost. Understanding how both of these work can help you make more informed choices when selecting a health insurance plan.

FAQs

Do co-pay and coinsurance count toward out-of-pocket maximums?

In the U.S., both co-pays and co-insurance contribute toward your out-of-pocket maximum, meaning once you’ve reached your cap, the insurer pays 100% of the costs. However, this concept isn’t applicable in India, as out-of-pocket maximums aren’t a standard feature in Indian health insurance.

Is it better to have copay or coinsurance?

It depends on your healthcare needs and how much financial risk you’re willing to take.

- Copay offers predictable, fixed costs per visit, making it ideal for people who need frequent care or prefer consistent expenses.

- Coinsurance means you share a percentage of larger bills, which can be cost-effective if you rarely use healthcare, but riskier if unexpected expenses arise.

In India, coinsurance isn’t a standard offering as most plans only use copay for cost-sharing.

What is an example of a copay?

A copay is a fixed fee you pay for a medical service. For example:

- ₹500 for a general physician consultation

- ₹300 for a prescribed generic medicine

The amount is pre-defined by your insurance plan and applies each time you use that service.

What's the difference between copay and deductible?

- A copay is a small, fixed fee you pay for each service (e.g., doctor visit, medicine).

- A deductible is the total amount you must pay out of pocket in a year before your insurance starts covering major expenses.

Think of copay as your cost for day-to-day care, and deductible as the hurdle you cross before insurance kicks in fully.

What is an example of a coinsurance?

Let’s say your plan includes 20% coinsurance after meeting a deductible: If your hospital bill is ₹1,00,000 and you’ve already paid your deductible, you’ll pay ₹20,000 (20%), and the insurer will cover ₹80,000 (80%).

Note: This model is used in the U.S., but not in India, where such cost-sharing is typically handled via copays.

Last updated on: