| Term vs Permanent Life Insurance – Which One Should You Choose? Term insurance offers coverage for a fixed period (say 20–40 years). If you pass away during this time, your nominee gets the payout; if you survive, the policy ends. It’s affordable and best for income protection. Permanent life insurance (whole life), on the other hand, covers you till age 99/100 and often includes a savings or investment component. In India, these include traditional whole life plans, endowments, and ULIPs. Some term plans also extend till 99 years. |

When it comes to protecting your loved ones, life insurance is one of the most important decisions you’ll make, but it can also feel overwhelming. There are many questions to consider, and one we’ll tackle today is: What kind of life insurance is the right fit for me? More specifically, should I choose term life insurance, as the name suggests, or permanent life insurance that promises coverage for life? However, they work very differently. Let’s break it down and see which fits you best.

Secure your family’s future today – Compare Term & Permanent Life Insurance Plans with Ditto!

Term Insurance vs Permanent Life Insurance: How Do They Work?

Term insurance is the simplest form of life insurance. You pay a fixed premium for coverage during a specific period, say 20, 30, or 40 years. If you pass away during this time, your nominee gets the payout (sum assured). If you survive the term, the policy ends and you get nothing back (unless you’ve chosen a return-of-premium variant, which is not worthwhile). The biggest advantage? It’s extremely affordable for the amount of coverage you get.

Permanent life insurance, also called whole life insurance, works differently. These plans cover you for your entire life, typically up to age 99 or 100. They also have a savings component, called cash value, that grows over time. Depending on the type of plan, you may also get a maturity benefit if you survive till the policy’s maximum age. In India, permanent plans come in three broad forms:

- Traditional whole life plans like ICICI Pru Gold, which offer guaranteed benefits and, in some cases, bonuses.

- Endowment plans like Aditya Birla Vision Life Income Plus that blend insurance and savings.

- Unit-Linked Insurance Plans (ULIPs) like HDFC Life Click 2 Wealth, which combine life cover with market-linked investments.

There’s also a middle path: whole-life term insurance. These are term plans that extend coverage till 99/100 years of age. They don’t offer maturity benefits but guarantee a payout if you die. They’ve become popular recently, but as we’ll see, they’re not always the best choice. (Read Ditto’s take here).

Term Insurance vs Permanent Life Insurance: Pros and Cons

The biggest strength of term insurance is its affordability. For a few thousand rupees a year, you can secure crores worth of coverage. This is why term plans are the backbone of financial protection for most families. They allow you to cover big liabilities like home loans, children’s education, or dependent parents.

But there are limitations. Term plans don’t build savings, and if you survive the policy term, you don’t get anything back. Extending the cover beyond your working years can also become expensive.

Here’s a real example for a 25-year-old male, non-smoker, buying a ₹1 crore ICICI Iprotect Smart Plus term plan (without first-year discounts):

| Policy Term | Annual Premium (₹) |

|---|---|

| Till 65 | 10,273 |

| Till 85 | 14,344 |

| Till 99 | 23,823 |

Notice the problem? Extending the policy to 99 doesn’t just mean you pay 130% extra every year; you also pay it for an extra 34 years! And by the time you’re 99, that ₹1 crore won’t even hold the same value; inflation will have eroded its purchasing power dramatically.

That’s why we recommend opting for higher coverage for the years your family really depends on you. The need for a large corpus is most significant in the next 10–20 years, not at 99.

That’s why most people use term insurance as pure protection, a safety net until retirement, when financial dependency usually reduces.

Permanent Life Insurance: Advantages and Disadvantages

Permanent plans promise lifetime protection. Unlike term insurance, there’s usually a payout at some point: either when you die or when the policy matures at age 99/100. This makes it appealing if you want to leave a legacy or if you have a lifelong dependent, like a child with special needs.

They also come with a savings component. Traditional plans may offer guaranteed returns and bonuses, while ULIPs let you invest in equity or debt funds with the potential for higher growth. Plus, you can often borrow against the policy’s cash value in emergencies.

The trade-off is cost. Premiums are far higher than term plans, and for the same premium outgo, the life cover you get is much smaller. They’re also less flexible — once you’re in, exiting early can mean surrender charges or penalties. And while returns are guaranteed in some products, inflation can eat away at the real value over decades.

Term Insurance and Permanent Life Insurance: Key Differences

Here’s a simple way to see the contrast:

| Feature | Term Insurance | Permanent (Whole Life) Insurance |

|---|---|---|

| Duration | Fixed term (e.g., 20–40 years, or till 99) | Lifetime (till 99/100) |

| Premiums | Low | High |

| Payout | Only if death occurs during the term | On death (anytime) or on maturity |

| Savings | None | Cash value + possible bonuses/fund value |

| Flexibility | High; invest premium difference elsewhere | Low; funds are locked inside the plan |

| Best for | Income replacement, liability coverage during working years | Legacy, lifelong dependents, guaranteed savings |

Term Insurance vs Permanent Life Insurance: Which Is Right For Me?

Here’s Ditto’s honest take:

- If your goal is pure protection, term insurance is unbeatable. Cover your working years, when your family depends on your income, and invest the money you save on premiums elsewhere.

- If you have a lifelong dependent or want to leave a guaranteed inheritance, permanent life insurance can be a sensible option. However, it should be considered after you’ve already secured an adequate term plan.

- Whole-life term insurance (cover till 99) sounds attractive because it guarantees a payout someday, but for most people, it’s an expensive way to achieve this. A higher cover till retirement plus disciplined investing often delivers better outcomes.

The rule of thumb: secure your risks with term insurance first, then use savings and investments to build wealth.

Why Choose Ditto for Term Insurance?

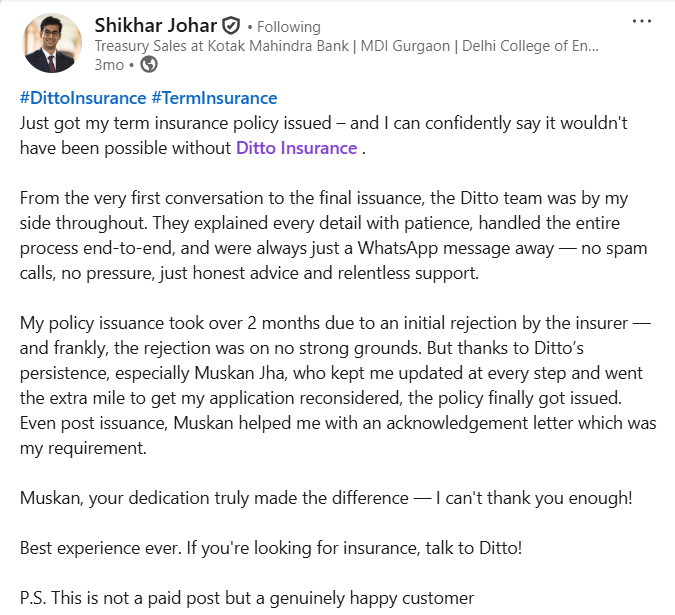

At Ditto, we’ve assisted over 7,00,000 customers with choosing the right insurance policy. Why customers like Shikhar below love us:

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 5000+ to 9000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call now!

Term Insurance and Permanent Life Insurance: Final Thoughts

Both term and permanent life insurance protect your family, but they do it in very different ways. Term insurance is lean, cost-effective, and covers the years that matter most. Permanent life insurance adds savings and lifelong cover, but at a much higher cost. For most people, term insurance is the foundation. Permanent insurance is optional and suitable only in specific situations, such as caring for lifelong dependents or estate planning.

If you are looking for comprehensive term coverage that align your medical needs, we recommend the best term insurance companies for 2026. Explore more about how our experts evaluate term plans through Ditto’s cut.

FAQs

Can I convert a term insurance policy into a permanent life insurance plan later?

Many insurers offer a conversion option, allowing policyholders to switch from a term plan to a permanent plan without fresh medical tests. This can be useful if your needs change, but premiums will be higher based on your age at conversion.

How does inflation impact permanent life insurance?

While permanent life insurance offers lifelong cover, inflation erodes the real value of the sum assured over decades. This means a fixed payout in the future might have significantly less purchasing power unless you choose a plan with increasing cover options.

Are there tax benefits for both term and permanent life insurance?

Yes. In India, premiums paid for both term and permanent life insurance are eligible for deduction under Section 80C of the Income Tax Act, and death benefits are generally tax-free under Section 10(10D).

Do whole life insurance plans have a maturity benefit?

Yes, many whole life, endowment, and ULIP-based permanent plans pay a maturity benefit if you survive till 99 or 100. In contrast, whole-life term plans do not.

Last updated on: