| What is a Life Insurance Premium? A life insurance premium is the amount one pays (monthly, quarterly, half-yearly, or annually) to keep the policy active. It ensures that the nominee receives the sum assured in case of the policyholder’s untimely demise. Factors that affect your life insurance premium include age, health, lifestyle, sum assured, and term. In case the medical or lifestyle risk for an individual is high, an underwriter may add a loading charge, which increases the premium. |

Buying life insurance is an investment for tomorrow. The life insurance premium you pay today works as a security for your children (or nominee) when you’re not around.

In India, insurers operate under IRDAI (Insurance Regulatory and Development Authority), which means all insurance products are designed and priced on actuarial grounds. Disclosures and consumer protections (like free-look, moratorium, and grace period as per policy terms) also affect what you pay, whether your cover stays continuous, and how claims are decided.

We’ve curated this guide to help you learn about the factors that affect your life insurance premiums and how things work behind the scenes (like actuarial risk, underwriting, loading charges).In a few minutes, this article will help you better understand :

- What is a life insurance premium?

- What are the factors that affect your life insurance premium?

- How are life insurance premiums calculated?

- How to pay life insurance premiums

- How gender affects the life insurance premium

- Tips to reduce your life insurance premium

Quick clarity: When we say “life insurance premium,” we primarily mean “term premium”. However, most people get mixed up between “life insurance” and “term insurance.” Term insurance is the most pure form of life insurance, essentially an after-life protection with no savings component. On the other hand, life insurance is a blanket term covering term plans, ULIPs (market-linked investment and insurance), endowment plans (guaranteed savings and insurance), and whole-life policies (lifetime cover that may come with bonuses).

Book a free 30-minute call with Ditto. IRDAI-certified advice, zero spam, and clarity on your policy details before it’s too late.

What Is A Life Insurance Premium?

A life insurance premium is the price you pay to keep your plan active. If you don’t make the payment by the renewal due date and miss the grace period, the policy will lapse.

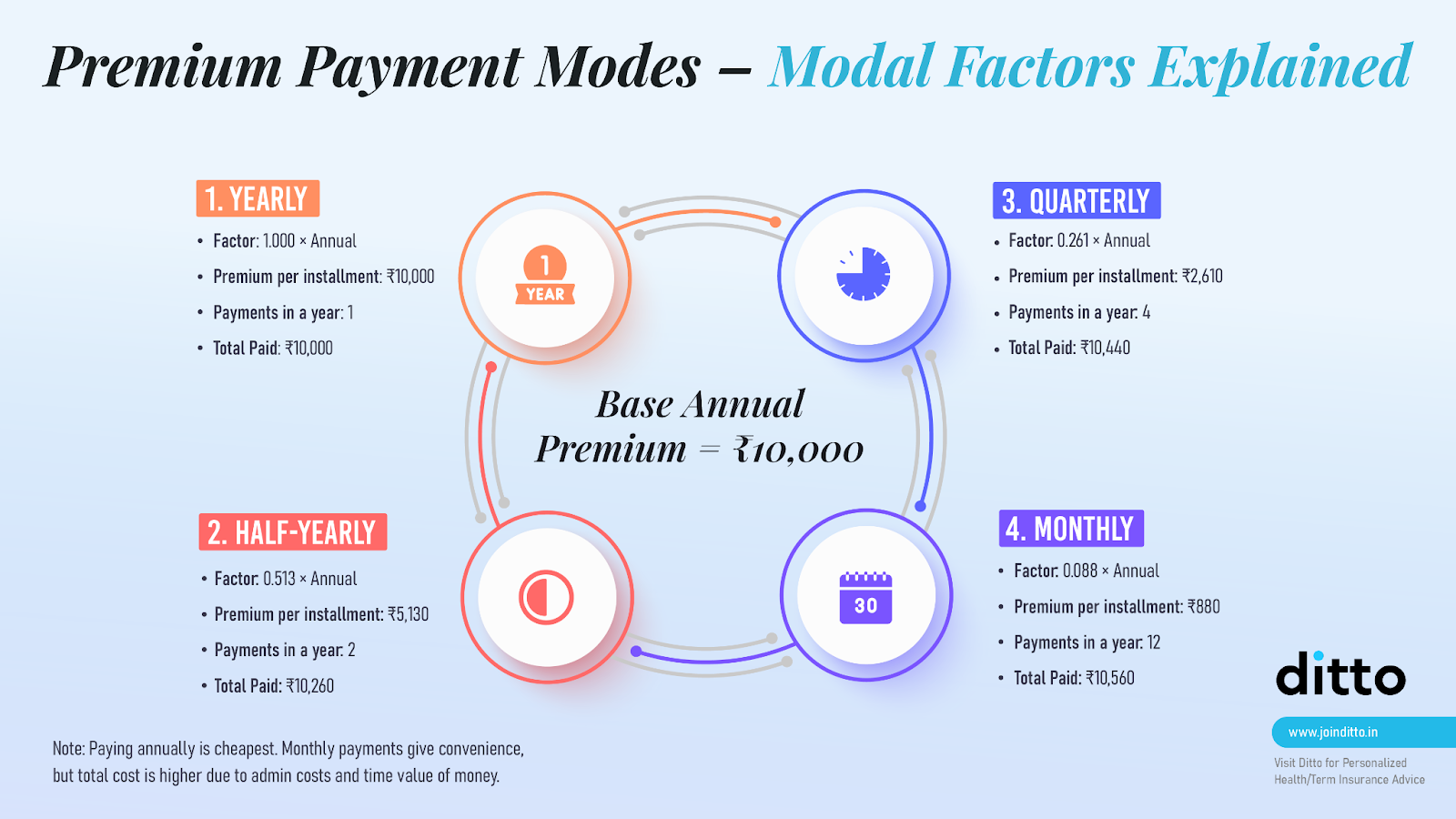

You can pay a life insurance premium either monthly, quarterly, half-yearly, or annually. Annual mode of payment is comparatively cheaper (2-5%) than other instalments because it avoids small frequency loadings.

So, even though you’re paying in smaller installments, the total over the year gets slightly higher than the annual amount due to time value of money and admin costs.

You are free to switch payment modes (say from annual to monthly), but the changes will take place from the next annual policy renewal date.

Pro tip: Plan and buy your term policy early in life for a lower premium. To avoid due date and grace period drama, set up autopay and calendar reminders.

What Are The Factors That Affect Your Life Insurance Premium?

Insurers evaluate risks before they send you a quotation. Anything that increases the chance of a claim or keeps you covered into older, riskier years pushes the premium higher.

The table below lists the essential factors, what it means, how it affects premium, and what you should do.

| Factor | What it means | How it affects premium | What to do |

|---|---|---|---|

| The cover (Sum Assured) | The payout your family receives. | Higher cover = higher premium (but not directly proportional). | Calculate your needs sensibly (income, loans, goals). Don’t over-insure. |

| Policy Term/Duration | How long the policy stays active (e.g., 10–40 years or till age 60/65). | Longer term = higher annual premium; shorter term = lower annual premium. | Pick a term that covers your earning years and major liabilities (till retirement or until loans/kids’ dependency ends). |

| Age | Your current age at the time of policy purchase. | Older age = higher mortality = higher premium. | Buy life insurance early in life to lock lower premiums. |

| Medical issues | Declared medical conditions & underwriting results. | Can trigger loading charges (price add-on) or restrictions on riders, coverage amount. | Disclose honestly and manage controllables (like quitting tobacco or minimising alcohol consumption). |

While these are the most pressing factors for life insurance premiums, there are other factors that affect life insurance costs in India.

Together, these things can be too much to consider for any first time life insurance buyer. That’s why we recommend checking out our detailed guide on what all to consider when buying life insurance and keep things nice and easy!

| Did You Know? The quotation from two insurers for the same individual can vary by 10-20% due to mortality tables, underwriting cut-offs, and plan choice. Moreover, the impact of loading charges is only known after the underwriting process. So, always compare quotes and ask about potential loadings in your case before buying life insurance. |

How Are Life Insurance Premiums Calculated?

Calculating life insurance premium is actuarial work. Insurers set a base premium using mortality tables (probability of death by age/term), expenses, margins/solvency buffers, and expected investment returns.

Thereafter, an IRDAI-approved actuary certifies pricing assumptions and product filings, ensuring rates are risk-based and justifiable. Knowing how the term insurance premium is calculated will help you plan better and save on premiums.

How To Pay Life Insurance Premiums

Paying your life insurance premium is simple. Pick the mode that suits you and set autopay to avoid lapse. Here’s how it goes with different payment modes.

| Mode | Method | How | Best for | Instructions |

|---|---|---|---|---|

| Online | Insurer website/app (Quick Pay) | • Open site/app • Select Pay Premium/Quick Pay • Enter policy no. & DOB • Pay & download receipt |

• First-time payments • Fast renewals • Instant receipts |

• Verify due amount/status before paying • Save the receipt PDF/SMS • Use only the official website/app |

| Online | Auto-debit (e-mandate / card) | • Set the mandate once • Payments run automatically on the due date |

• Zero missed due dates • Policies where lapses are costly |

• Maintain a balance/limit buffer • Update the mandate if your card/account changes • Set a reminder for mandate expiry |

| Online | Net banking | • Add insurer as a biller • Pay from the dashboard on schedule |

• People who manage bills in their bank portal | • Turn on biller alerts • Check bank cut-off for same-day credit • Enter the policy number exactly as on the policy |

| Online | UPI (push payment) | • Pay via any UPI app using VPA or scan insurer QR | • Instant pay with a clear audit trail | • Confirm payee name before approving • For large annual premiums, check per-transaction limits (split if needed) • Keep the UPI confirmation as proof |

| Online | Digital wallets | • Pay via a supported wallets like Amazon Pay, SBI Yono | • Quick renewals if wallet is funded | • Check wallet limits/fees • Ensure the receipt shows your policy number • Avoid wallets that don’t display the insurer as merchant |

| Online | BBPS (Bharat Bill Payment System) | • Use BBPS via your bank app or approved third-party apps | • Standardised payments & unified receipts | • Select Insurance category •Pick your insurer • Note the BBPS reference ID • Reconcile in |

Whichever mode you choose, always enable reminders (via calendar or insurer SMS and app notifications) and save receipts for tax proofs and quick dispute resolutions.

| Quick checklist to avoid lapses: a) Turn on autopay and keep a small balance buffer. (Usually, it’s set to 5–10% higher than your premium to cover penalties, bank charges, or tax changes). b) Keep your policy number handy and verify the receipt after payment. c) If you change banks/cards/UPI id, update the mandate before your next due date. d) Prefer annual payments if possible (usually cheaper than monthly/quarterly pay). |

Does Gender Affect Life Insurance Premium?

Women usually pay less for term life insurance in India—not due to bias, but because women live longer than men on average. Longer life expectancy means fewer expected claims during the policy term, so insurers price the base rates lower. In short, a lower mortality curve leads to cheaper premiums.

The pricing logic reflects in rate cards too. For example, ICICI Prudential’s iProtect Smart Plus offers a 15% lifetime discount for women with an extra first-year concession for salaried women. Tata AIA and HDFC Life Click 2 Protect Supreme also have similar plans.

So, as a woman living in India, expect materially lower premiums (often up to 15%) for the same cover and term, subject to your health and disclosures.

| Things to watch out for : Risk still exists: A female smoker or someone with adverse medical conditions is liable to pay more than a healthy male non-smoker. Insurers can apply underwriting loadings or exclusions regardless of gender, as long as pricing is actuarially justified. Product differences: The discounts on premiums are most visible on term insurance plans (pure protection options). Savings/investment-led products (e.g., ULIPs) are priced differently due to various investment features. |

Tips to Reduce Your Life Insurance Premium: Ditto’s Take

How much you pay for life insurance premiums can never be a random choice. At the backend, it's all about making the right choices, like when you buy, how much cover you take, the payment mode, and your add ons. This will help you lock in lower costs for years, without affecting your claim.

Here are a few expert tips to lower your life insurance premium:

- Buy a term plan early in life.

- Don’t overstretch the term period, instead match it to your real responsibilities.

- Right-size your cover using the (10–15× income + loans + key goals) formula or use Ditto’s calculator.

- Don’t buy a term insurance before checking the second year prices (which are always higher compared to first-year premiums due to discounts)

- Always review your term plan after major life events (marriage, death, childbirth)

- Don’t choose the default “till 99” term length option. Match target retirement age or your last big EMI to keep costs down.

- Skip unnecessary term riders. Choose functional ones like CI (Critical Illness), WOP (Waiver of Premium), or disability.

- Pay annually if your cash flow allows (less expensive to monthly/quarterly payments)

- Always set autopay to avoid lapses.

- Follow a healthy lifestyle and disclose honestly.

- Compare quotes from 2-3 insurers and understand underwriting philosophies as they may differ.

Note: Choose regular-pay over limited-pay if you need a lower annual outgo (even if the lifetime total is higher). Skipping the return-of-premium also fetches a lower premium.

Why Choose Ditto For Term Insurance

More than 50% of Indian families ignore term insurance without realising its value. To make matters worse, customers are often misguided into investing in plans that don’t do any justice to their life goals. That’s where Ditto comes in.

Ours is always a guidance-first approach to make you a confident and informed insurance buyer. We are called “Ditto” for a reason as we never recommend a product that we won't buy ourselves.

Our IRDAI-certified advisors acknowledge your unique needs and budget matching it to right term plans. That’s why we are trusted by 7,00,000+ customers and are highly recommended.

✅No-Spam & No Salesmen

✅Rated 4.9/5 on Google Reviews by 15,000+ happy customers

✅Backed by Zerodha

✅100% Free Consultation

✅Personalized recommendations

✅Real-time claim support

The Bottom Line

Paying for life insurance shouldn't be difficult. Once you know the factors that affect your life insurance premium, you start buying with a purpose. Start by sizing the right cover for your life needs, pick a term that matches your working years, disclose honestly, and set autopay to avoid lapse.

If you’re stuck or feel unsure, talk to a Ditto advisor. It’s a free, no obligation call to help you make the right decision.

FAQs

What is the age limit for life insurance?

The common entry age limit for life insurance plans is from 18 and up to 60/65 (varies across insurers). Coverage can run up to 85 years or the whole life “till 99/100” depending on the product. It's always recommended that you buy younger to get lower premiums.

How to make a life insurance premium affordable?

To make a life insurance premium affordable, buy early in life, choose the right sum assured (not the biggest), skip unnecessary riders, opt for annual mode, and disclose honestly.

Do premiums increase every year?

Term plans keep your premium locked for the entire policy term.

What happens if I miss a premium?

There’s always a grace period if you miss the premium due date (15 days for monthly payment and 30 days for yearly plans). However, if you miss payment during the grace window, your policy will lapse. In some cases, policy revival may be possible but it requires payment of arrears with additional interest and fresh underwriting.

Can I get a discount if I buy directly from the insurance company website?

Some insurers promote discounts on products bought directly from their website. However, it's not much as life insurance premiums are decided by IRDAI norms and they're almost the same across all channels. The real savings come from annual/limited payment and buying early.

Last updated on: